You'll be able to work with msp102 online form instantly by using our online PDF tool. Our tool is consistently evolving to present the best user experience possible, and that's due to our dedication to continuous improvement and listening closely to customer comments. Getting underway is effortless! All that you should do is adhere to the next simple steps below:

Step 1: Press the "Get Form" button above. It's going to open up our tool so that you could begin filling out your form.

Step 2: When you open the tool, you will get the document all set to be filled in. Other than filling out various blanks, you could also do several other things with the Document, namely putting on your own textual content, changing the original text, adding images, signing the PDF, and more.

This PDF doc requires specific details; to ensure correctness, please be sure to consider the suggestions further on:

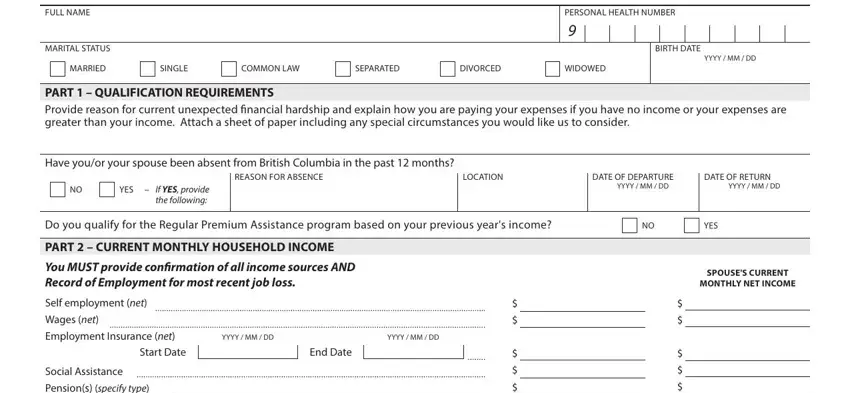

1. Complete your msp102 online form with a selection of necessary fields. Gather all of the necessary information and make sure there is nothing overlooked!

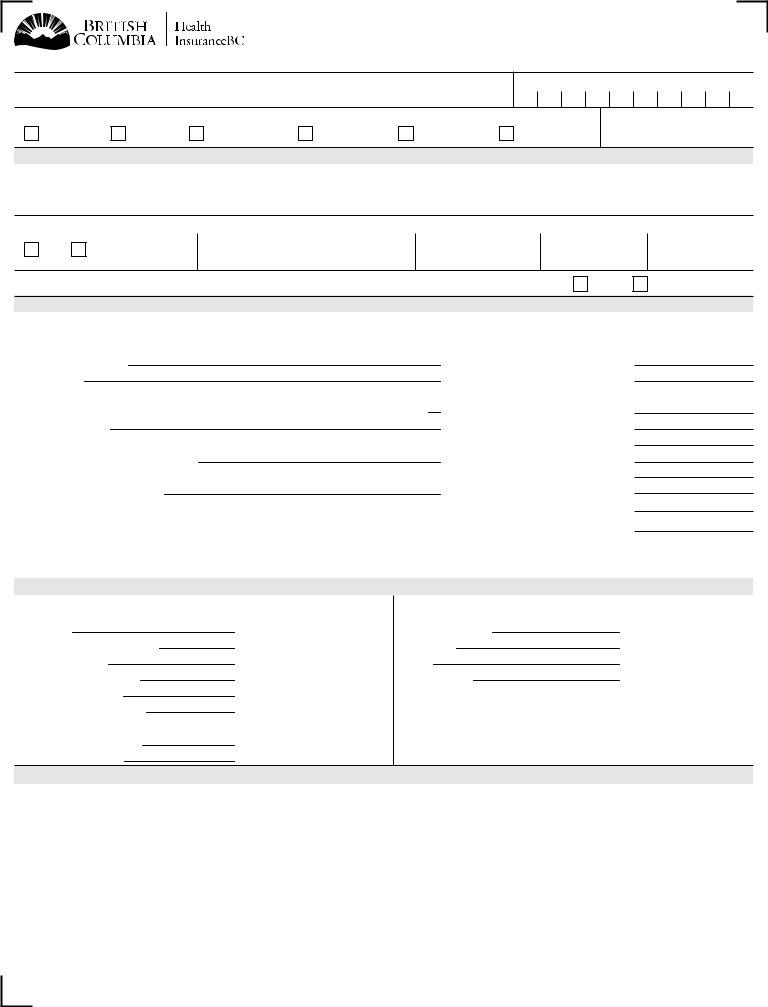

2. Once your current task is complete, take the next step – fill out all of these fields - FULL NAME, MARITAL STATUS, PERSONAL HEALTH NUMBER, BIRTH DATE, YYYY MM DD, MARRIED, SINGLE, COMMON LAW, SEPARATED, DIVORCED, WIDOWED, PART QUALIFICATION REQUIREMENTS, Have youor your spouse been absent, YES, and If YES provide the following with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

When it comes to MARITAL STATUS and WIDOWED, make sure you take a second look in this section. Those two are the most significant fields in this page.

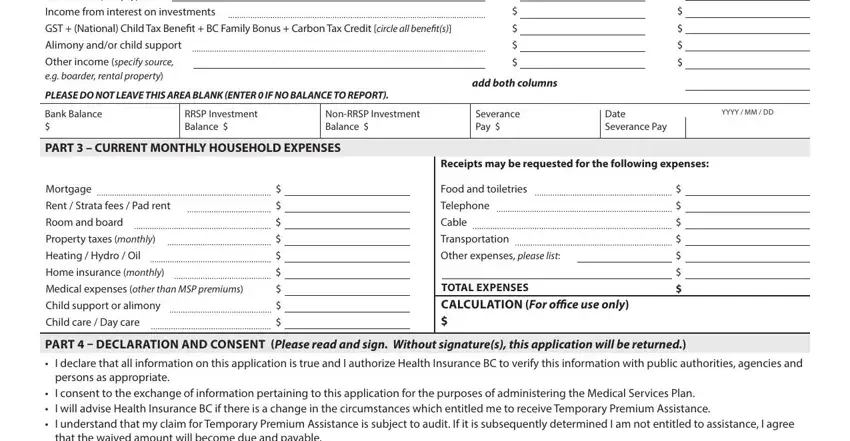

3. Within this part, take a look at Pensions specify type, Income from interest on investments, GST National Child Tax Benefit, Alimony andor child support, Other income specify source eg, add both columns, PLEASE DO NOT LEAVE THIS AREA, Bank Balance, RRSP Investment Balance, NonRRSP Investment Balance, Severance Pay, Date Severance Pay, YYYY MM DD, PART CURRENT MONTHLY HOUSEHOLD, and Mortgage. These must be taken care of with greatest precision.

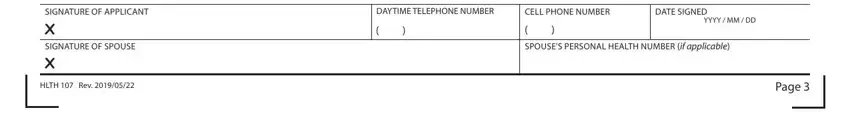

4. It is time to proceed to this next segment! In this case you have all of these SIGNATURE OF APPLICANT, SIGNATURE OF SPOUSE X, HLTH Rev, DAYTIME TELEPHONE NUMBER, CELL PHONE NUMBER, DATE SIGNED, YYYY MM DD, SPOUSES PERSONAL HEALTH NUMBER if, and Page fields to fill out.

Step 3: Confirm that the information is correct and simply click "Done" to finish the process. Obtain your msp102 online form as soon as you subscribe to a free trial. Immediately gain access to the pdf form in your FormsPal cabinet, along with any edits and adjustments being all kept! FormsPal provides safe document completion devoid of data record-keeping or distributing. Be assured that your information is in good hands here!