hlth 119 can be filled out online easily. Simply try FormsPal PDF editor to perform the job promptly. To retain our tool on the cutting edge of practicality, we strive to put into action user-oriented features and enhancements on a regular basis. We're at all times looking for suggestions - join us in reshaping the way you work with PDF docs. With some simple steps, you are able to start your PDF journey:

Step 1: Firstly, open the pdf tool by pressing the "Get Form Button" at the top of this webpage.

Step 2: Using our online PDF editor, you may accomplish more than simply fill out blanks. Express yourself and make your docs look professional with custom text added in, or modify the file's original input to perfection - all comes along with the capability to insert just about any photos and sign the document off.

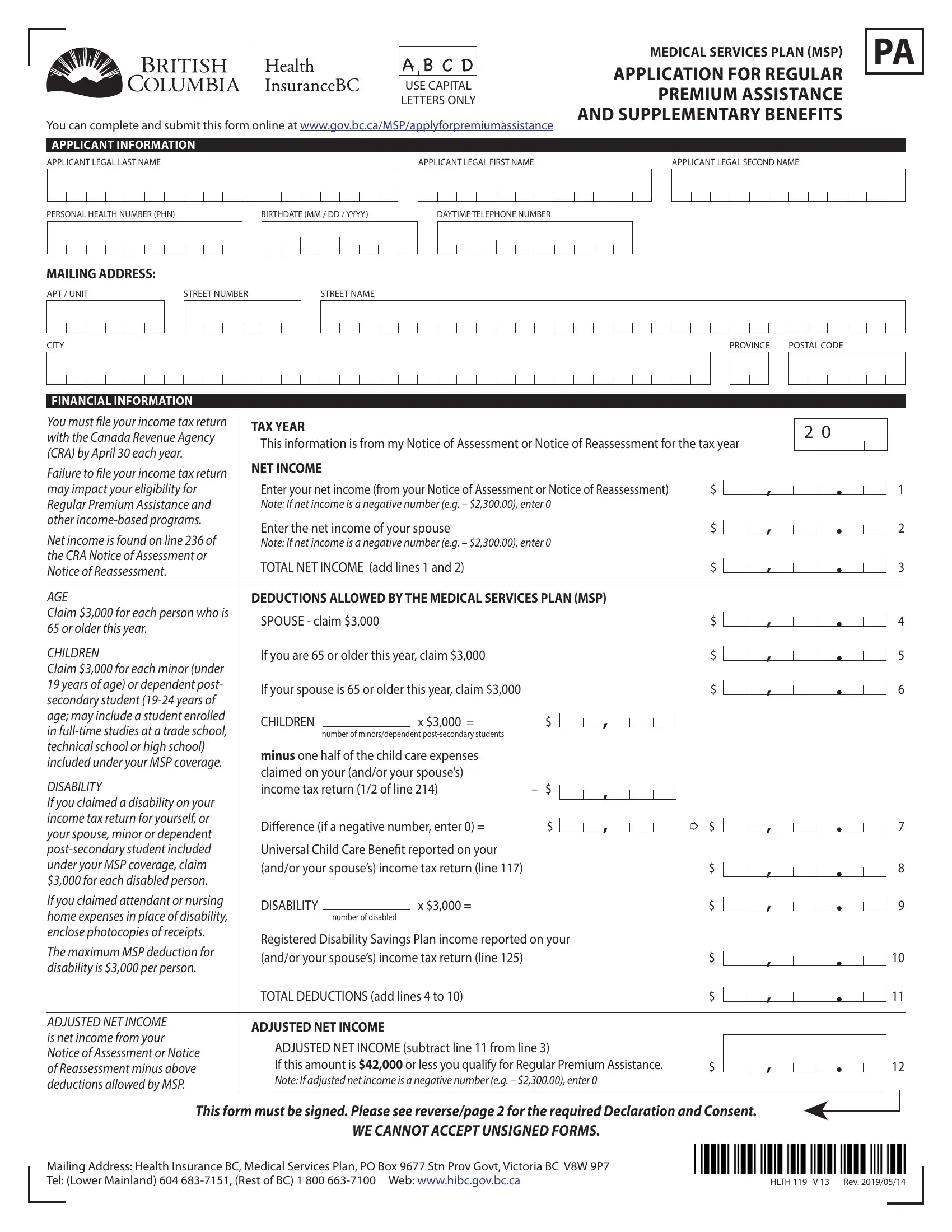

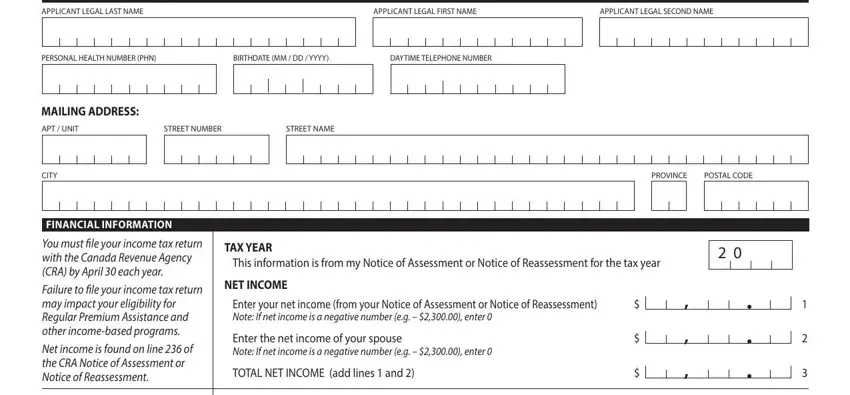

This form will require specific details to be typed in, hence be sure you take some time to provide exactly what is required:

1. The hlth 119 necessitates certain information to be inserted. Ensure that the next blank fields are complete:

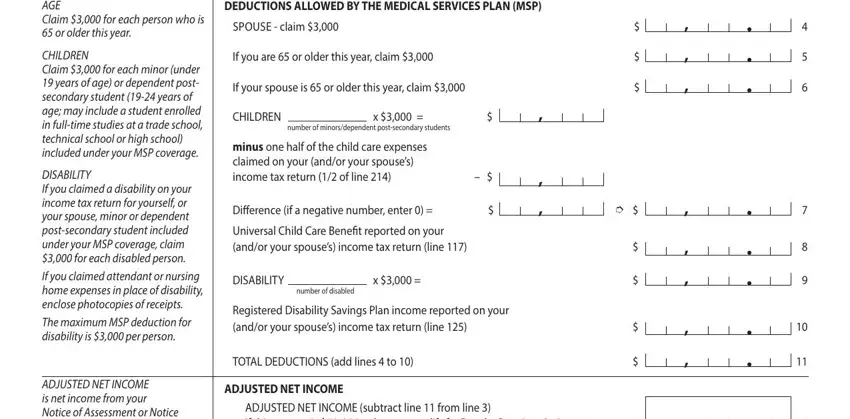

2. Once your current task is complete, take the next step – fill out all of these fields - AGE Claim for each person who is, CHILDREN Claim for each minor, DISABILITY If you claimed a, If you claimed attendant or, The maximum MSP deduction for, ADJUSTED NET INCOME is net income, DEDUCTIONS ALLOWED BY THE MEDICAL, SPOUSE claim, If you are or older this year, If your spouse is or older this, CHILDREN, number of minorsdependent, minus one half of the child care, Difference if a negative number, and Universal Child Care Benefit with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

As for The maximum MSP deduction for and If you claimed attendant or, be sure that you get them right here. Both of these are surely the most significant ones in this form.

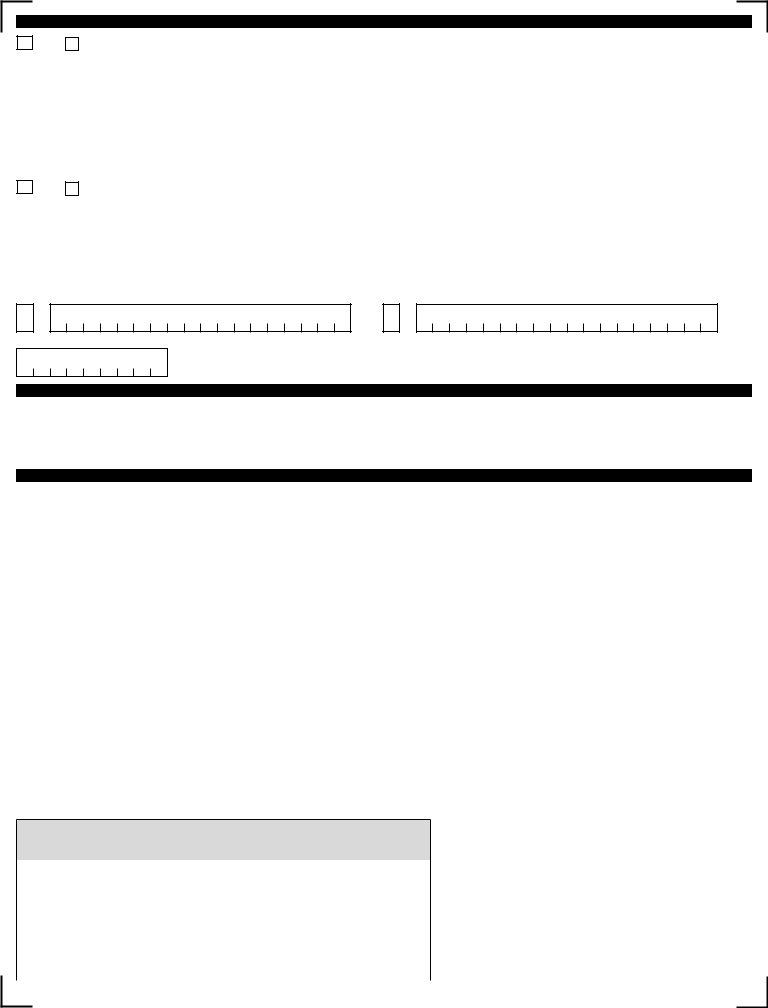

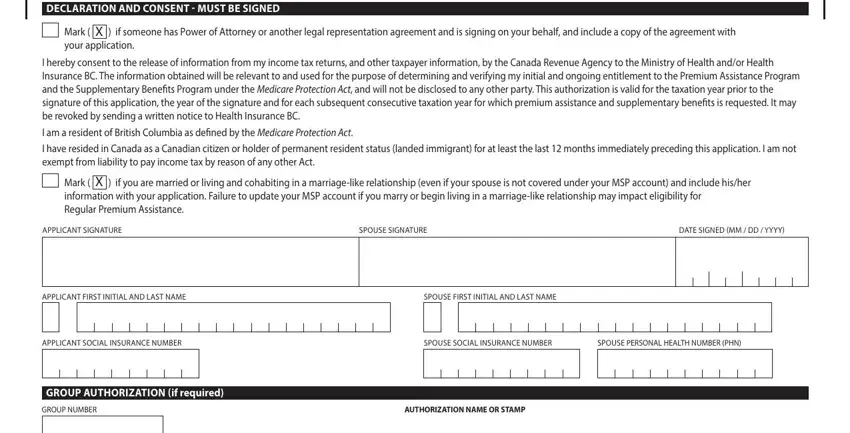

3. Completing DECLARATION AND CONSENT MUST BE, Mark X if someone has Power of, I hereby consent to the release of, I am a resident of British, I have resided in Canada as a, Mark X if you are married or, APPLICANT SIGNATURE, SPOUSE SIGNATURE, DATE SIGNED MM DD YYYY, APPLICANT FIRST INITIAL AND LAST, SPOUSE FIRST INITIAL AND LAST NAME, APPLICANT SOCIAL INSURANCE NUMBER, SPOUSE SOCIAL INSURANCE NUMBER, SPOUSE PERSONAL HEALTH NUMBER PHN, and GROUP AUTHORIZATION if required is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Step 3: After double-checking the filled out blanks, hit "Done" and you are done and dusted! Get your hlth 119 once you sign up at FormsPal for a free trial. Conveniently view the pdf form in your FormsPal cabinet, with any modifications and changes being automatically synced! We don't share or sell any information you type in when working with documents at our site.