mt903mn form can be completed very easily. Just try FormsPal PDF editing tool to complete the task quickly. To keep our editor on the leading edge of efficiency, we aim to put into practice user-oriented features and improvements regularly. We are always glad to receive suggestions - assist us with remolding PDF editing. Starting is easy! What you need to do is follow the next easy steps directly below:

Step 1: Simply click on the "Get Form Button" in the top section of this site to open our pdf editing tool. There you will find everything that is needed to fill out your document.

Step 2: After you open the editor, you will see the document prepared to be filled out. Apart from filling in different blank fields, you might also do some other things with the file, particularly writing custom words, changing the original textual content, inserting images, affixing your signature to the document, and a lot more.

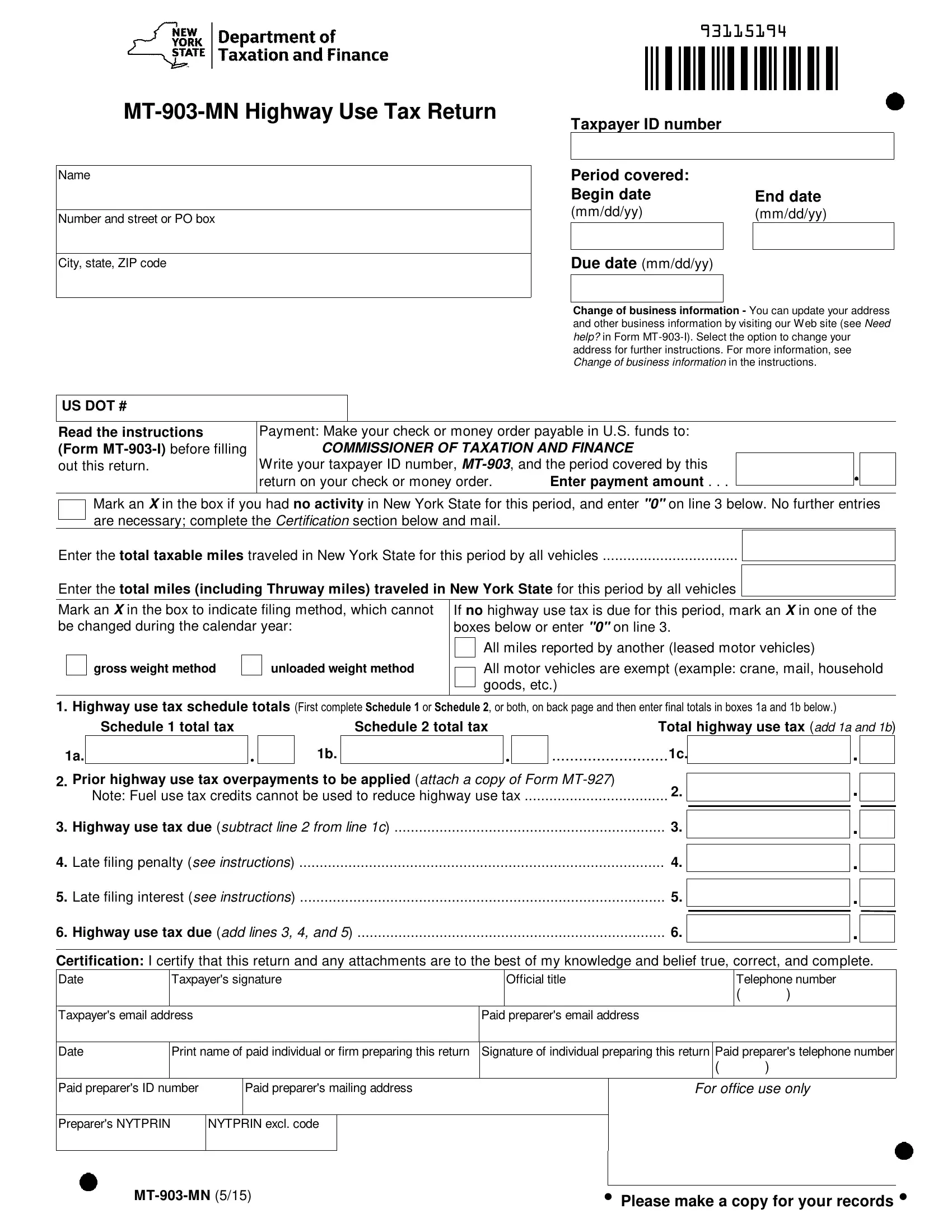

When it comes to blank fields of this specific document, this is what you should consider:

1. Complete the mt903mn form with a number of essential fields. Note all of the information you need and make sure not a single thing omitted!

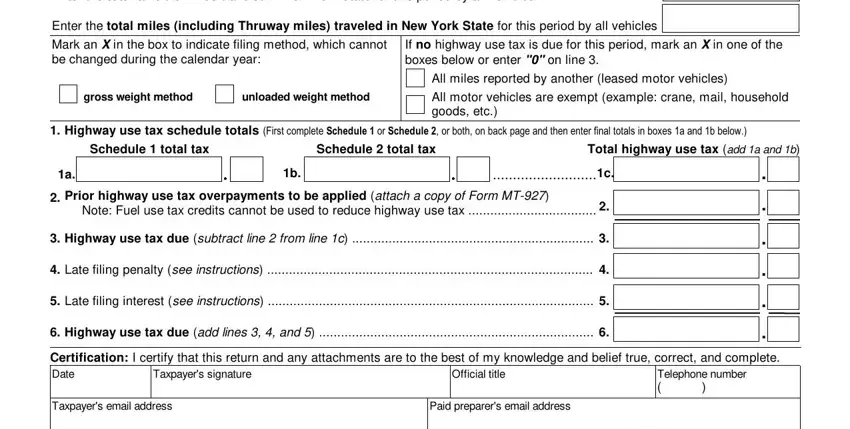

2. Soon after finishing the last section, go on to the subsequent stage and enter all required details in all these blanks - Enter the total taxable miles, Enter the total miles including, Mark an X in the box to indicate, If no highway use tax is due for, gross weight method, unloaded weight method, All miles reported by another, All motor vehicles are exempt, Highway use tax schedule totals, Schedule total tax, Schedule total tax, Total highway use tax add a and b, Prior highway use tax, Note Fuel use tax credits cannot, and Highway use tax due subtract line.

Lots of people generally get some things incorrect when filling out Schedule total tax in this area. Be sure to double-check everything you type in here.

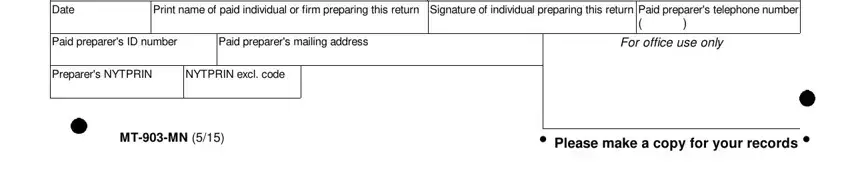

3. This part is going to be simple - fill out all of the fields in Date, Print name of paid individual or, Paid preparers ID number, Paid preparers mailing address, Preparers NYTPRIN, NYTPRIN excl code, For office use only, MTMN, and Please make a copy for your to complete the current step.

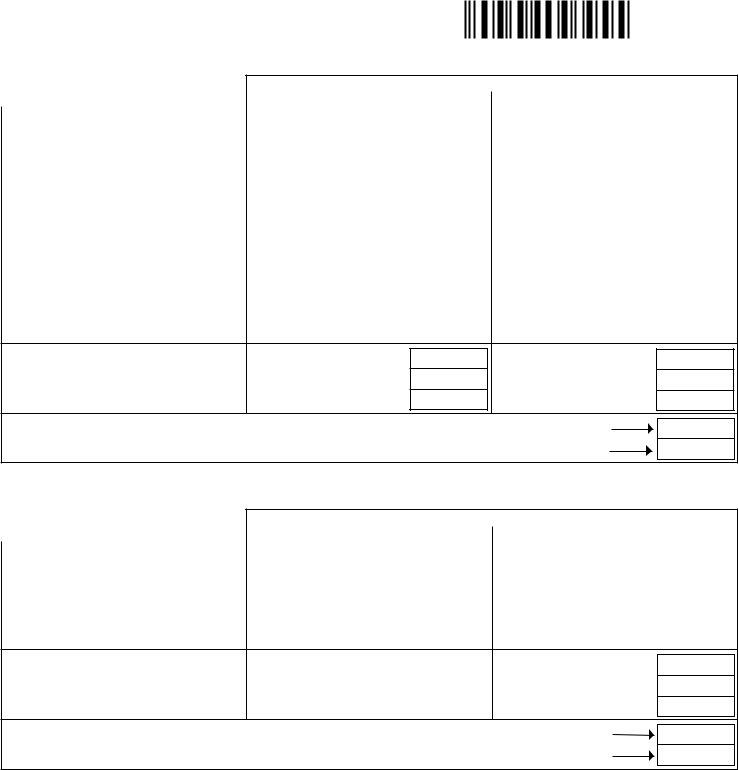

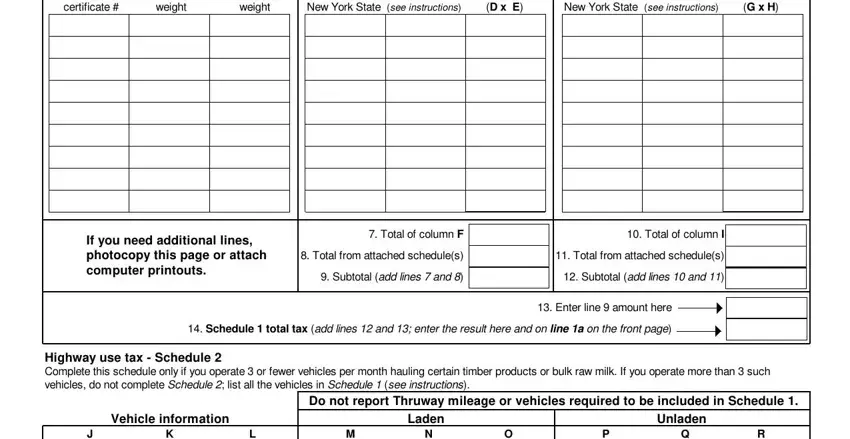

4. The following subsection requires your attention in the subsequent parts: Permit or certificate, Gross weight, Unloaded, weight, Taxable miles in New York State, Rate, F Tax, D x E, Taxable miles in New York State, Rate, Tax, G x H, If you need additional lines, Total of column F, and Total of column I. Make certain you give all of the required details to move onward.

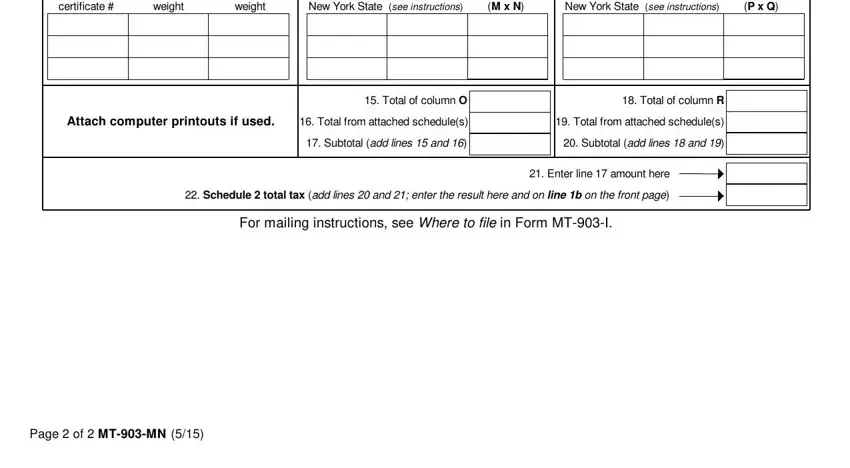

5. Since you near the finalization of the document, there are a couple extra requirements that must be met. Specifically, Permit or certificate, Gross weight, Unloaded, weight, Taxable miles in New York State, Rate, O Tax, M x N, Taxable miles in New York State, Rate, R Tax, P x Q, Attach computer printouts if used, Total from attached schedules, and Total from attached schedules must be filled in.

Step 3: Just after looking through the fields and details, press "Done" and you're good to go! Obtain the mt903mn form as soon as you subscribe to a 7-day free trial. Readily use the pdf file from your FormsPal account, together with any modifications and adjustments being conveniently saved! FormsPal offers safe form editor without personal data record-keeping or any sort of sharing. Be assured that your details are in good hands here!