Using PDF forms online is certainly quite easy using our PDF editor. Anyone can fill out 2019 hawaii application here in a matter of minutes. Our team is focused on giving you the perfect experience with our editor by continuously presenting new functions and upgrades. With all of these improvements, using our tool becomes better than ever before! With just several easy steps, you can begin your PDF journey:

Step 1: Hit the "Get Form" button above. It will open our tool so you can begin completing your form.

Step 2: Once you open the editor, you will see the document made ready to be completed. In addition to filling out different blanks, you could also do many other actions with the PDF, such as writing custom text, modifying the initial textual content, adding illustrations or photos, putting your signature on the PDF, and a lot more.

Completing this PDF demands attentiveness. Ensure every blank field is filled out correctly.

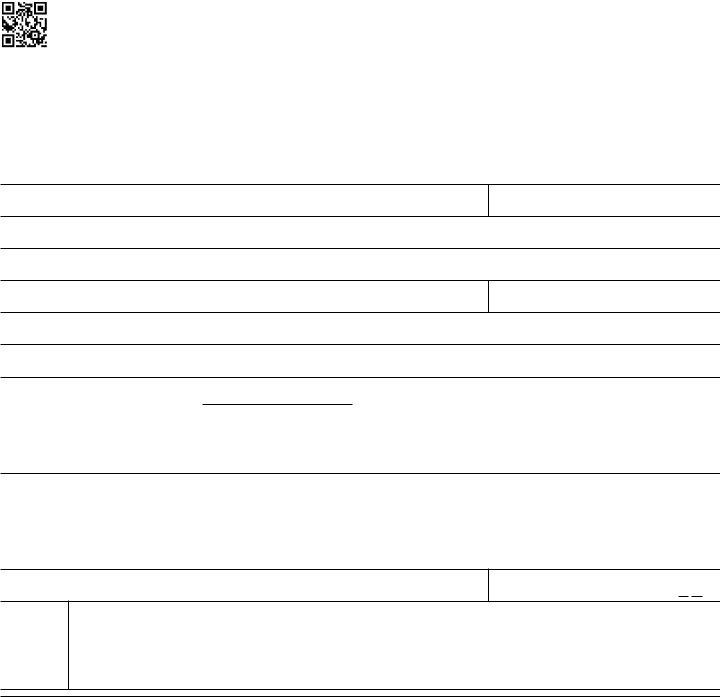

1. Begin filling out your 2019 hawaii application with a group of major fields. Consider all of the information you need and make sure nothing is neglected!

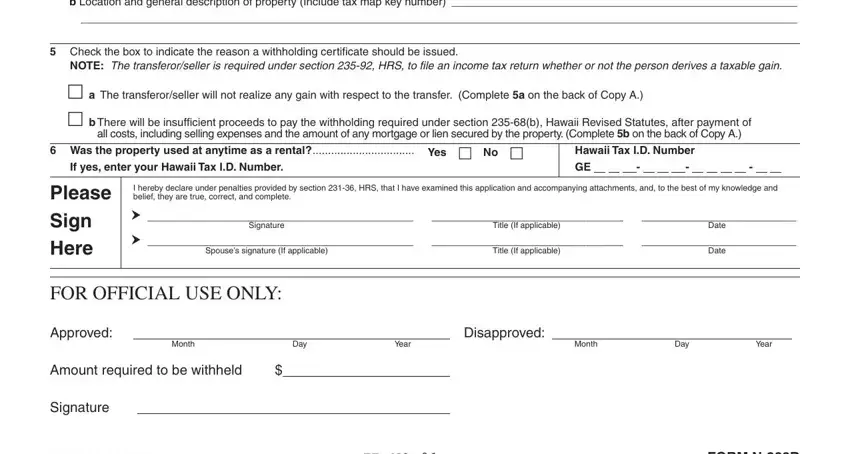

2. Soon after the last selection of blanks is done, go to enter the applicable details in all these: b Location and general description, Check the box to indicate the, NOTE The transferorseller is, a The transferorseller will not, all costs including selling, Was the property used at anytime, If yes enter your Hawaii Tax ID, Hawaii Tax ID Number, Please Sign Here, I hereby declare under penalties, Date, Spouses signature If applicable, Title If applicable, Date, and Signature.

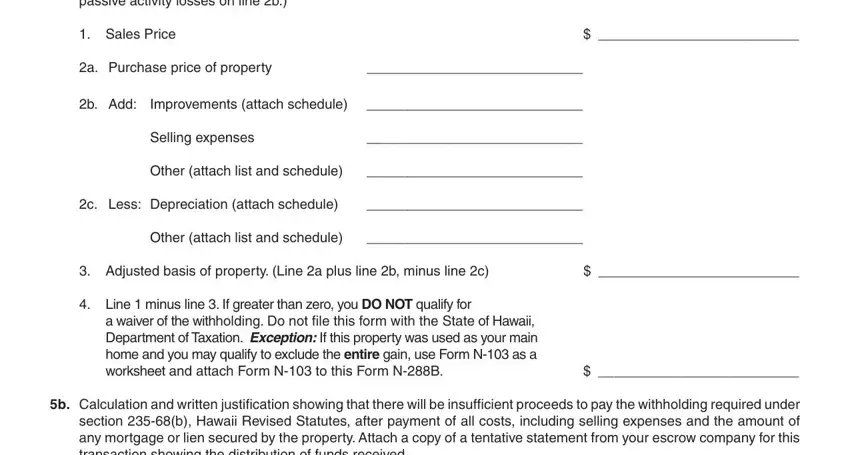

3. Completing a Calculation and written, Sales Price, a Purchase price of property, b Add, Improvements attach schedule, Selling expenses, Other attach list and schedule, c Less Depreciation attach schedule, Other attach list and schedule, Adjusted basis of property Line a, Line minus line If greater than, a waiver of the withholding Do not, and b Calculation and written is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

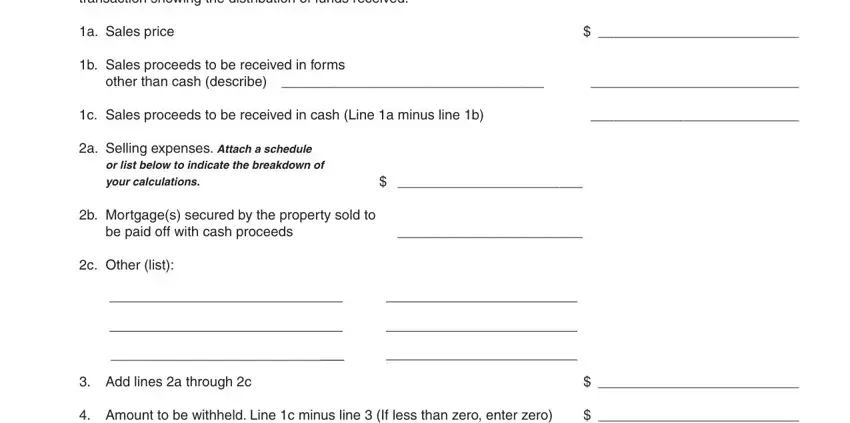

4. It is time to fill out this next part! In this case you will get all these b Calculation and written, a Sales price, b Sales proceeds to be received in, other than cash describe, c Sales proceeds to be received in, a Selling expenses Attach a, or list below to indicate the, b Mortgages secured by the, be paid off with cash proceeds, c Other list, Add lines a through c, and Amount to be withheld Line c blank fields to do.

Always be extremely mindful while completing a Selling expenses Attach a and other than cash describe, since this is where many people make errors.

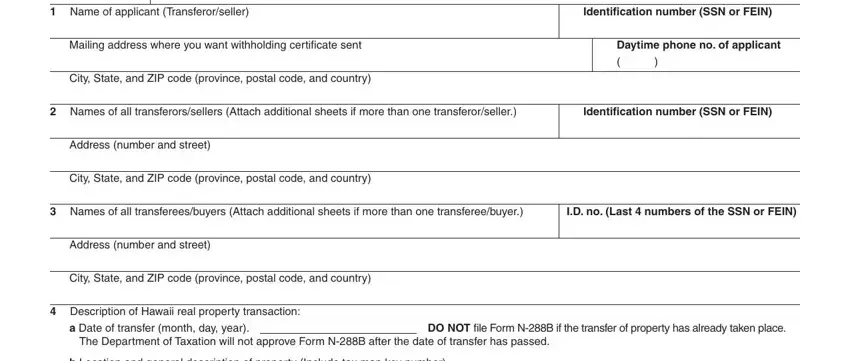

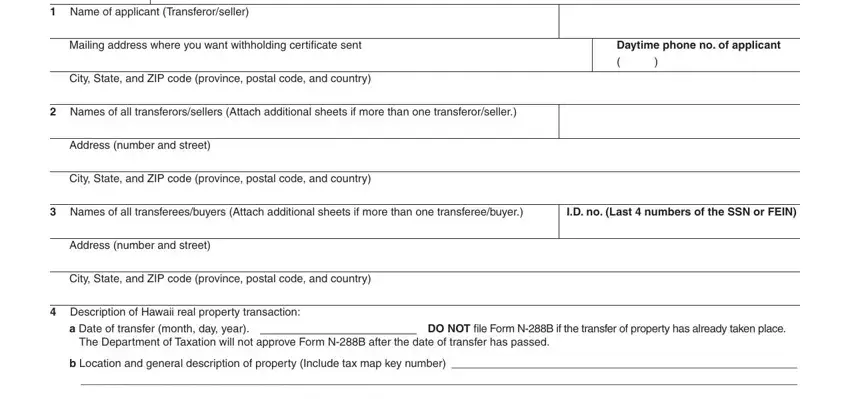

5. Now, the following last portion is what you should finish before finalizing the document. The blank fields in question are the next: Name of applicant Transferorseller, Mailing address where you want, City State and ZIP code province, Names of all transferorssellers, Address number and street, City State and ZIP code province, Daytime phone no of applicant, Names of all transfereesbuyers, ID no Last numbers of the SSN or, Address number and street, City State and ZIP code province, Description of Hawaii real, a Date of transfer month day year, DO NOT file Form NB if the transfer, and b Location and general description.

Step 3: Immediately after rereading your fields and details, click "Done" and you are all set! Right after setting up a7-day free trial account with us, you will be able to download 2019 hawaii application or send it via email right away. The PDF file will also be readily available in your personal account page with your every change. We do not sell or share the details that you type in when completing documents at FormsPal.