Handling PDF documents online is always easy using our PDF editor. Anyone can fill out nc5 online here and try out many other options we offer. Our tool is constantly evolving to deliver the best user experience achievable, and that's thanks to our dedication to continual development and listening closely to customer comments. Here is what you will want to do to start:

Step 1: Click on the "Get Form" button above. It will open up our tool so that you can start filling in your form.

Step 2: This editor enables you to change PDF documents in various ways. Enhance it by adding your own text, correct existing content, and add a signature - all doable in no time!

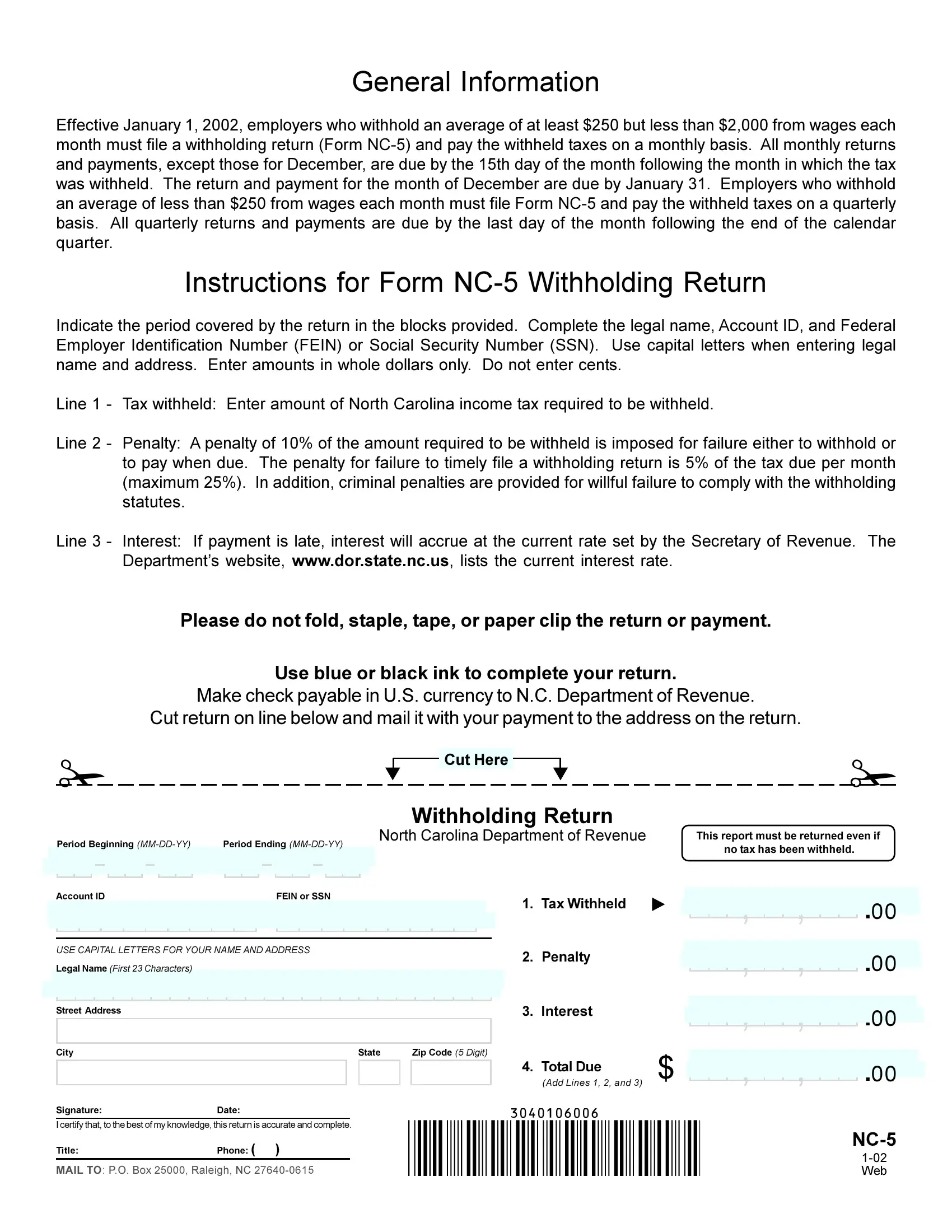

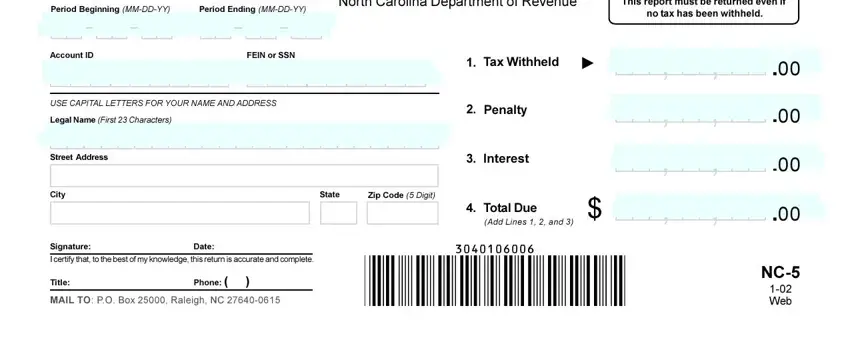

In order to complete this document, ensure that you provide the right details in each field:

1. You will want to fill out the nc5 online accurately, so pay close attention while working with the areas comprising all these fields:

Step 3: As soon as you've looked again at the information provided, just click "Done" to finalize your FormsPal process. After getting a7-day free trial account at FormsPal, you'll be able to download nc5 online or send it through email without delay. The form will also be easily accessible through your personal account menu with your every modification. With FormsPal, you'll be able to complete forms without the need to get worried about personal data leaks or entries being distributed. Our secure software helps to ensure that your personal details are stored safely.