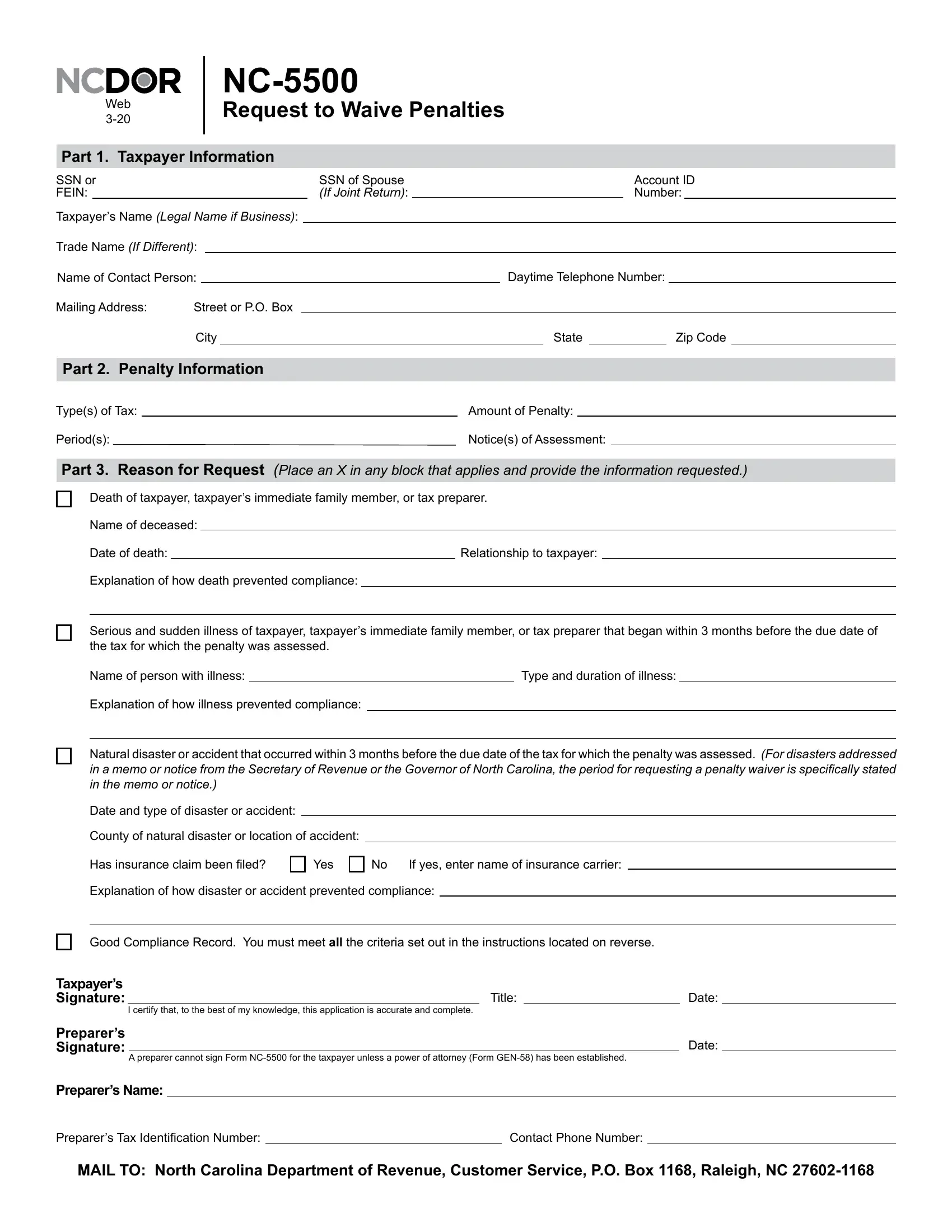

NC-5500

Request to Waive Penalties

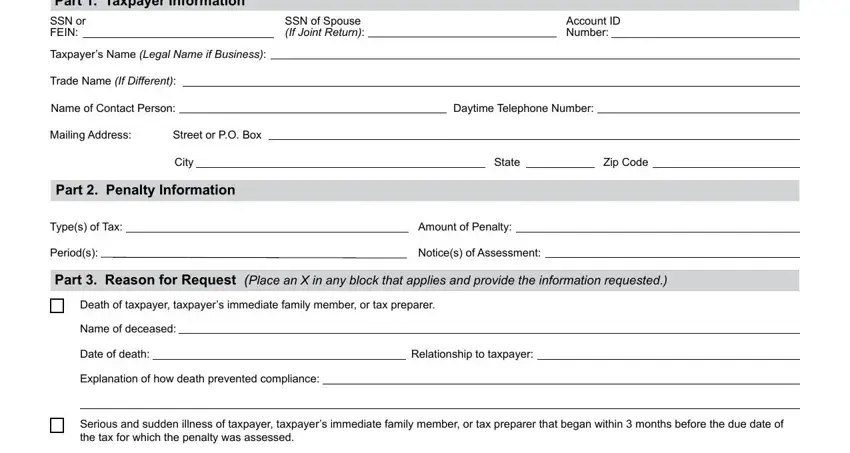

Part 1. |

Taxpayer Information |

|

|

|

|

|

|

|

|

|

|

|

SSN or |

|

|

|

|

|

|

|

|

SSN of Spouse |

|

|

|

|

|

|

Account ID |

FEIN: |

|

|

|

|

|

|

|

|

|

(If Joint Return): |

|

|

|

|

|

|

|

Number: |

|

Taxpayer’s Name (Legal Name if Business): |

|

|

|

|

|

|

|

|

|

|

|

|

Trade Name (If Different): |

|

|

|

|

|

|

|

|

|

|

|

|

Name of Contact Person: |

|

|

Daytime Telephone Number: |

|

Mailing Address: |

Street or P.O. Box |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

|

|

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 2. |

Penalty Information |

|

|

|

|

|

|

|

|

|

|

|

Type(s) of Tax: |

|

|

|

|

|

|

|

|

|

Amount of Penalty: |

|

|

|

|

|

|

|

Period(s): |

|

|

|

|

|

|

|

|

|

|

Notice(s) of Assessment: |

|

|

|

|

|

|

Part 3. Reason for Request (Place an X in any block that applies and provide the information requested.)

Death of taxpayer, taxpayer’s immediate family member, or tax preparer.

Name of deceased:

Date of death: |

|

Relationship to taxpayer: |

Explanation of how death prevented compliance:

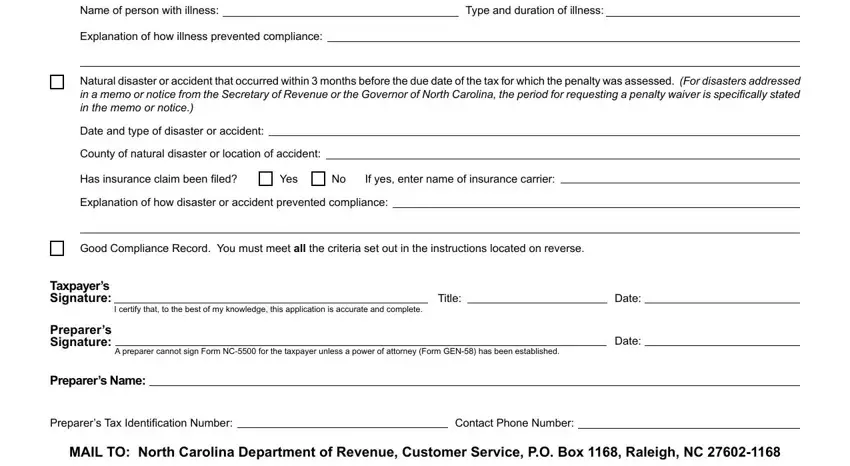

Serious and sudden illness of taxpayer, taxpayer’s immediate family member, or tax preparer that began within 3 months before the due date of the tax for which the penalty was assessed.

Name of person with illness: |

|

Type and duration of illness: |

Explanation of how illness prevented compliance:

Natural disaster or accident that occurred within 3 months before the due date of the tax for which the penalty was assessed. (For disasters addressed in a memo or notice from the Secretary of Revenue or the Governor of North Carolina, the period for requesting a penalty waiver is specifically stated

in the memo or notice.)

Date and type of disaster or accident:

County of natural disaster or location of accident:

Has insurance claim been filed?

No If yes, enter name of insurance carrier:

Explanation of how disaster or accident prevented compliance:

Good Compliance Record. You must meet all the criteria set out in the instructions located on reverse.

Taxpayer’s

I certify that, to the best of my knowledge, this application is accurate and complete.

Preparer’s |

|

Signature: |

Date: |

A preparer cannot sign Form NC-5500 for the taxpayer unless a power of attorney (Form GEN-58) has been established.

Preparer’s Name:

Preparer’s Tax Identification Number: |

|

Contact Phone Number: |

MAIL TO: North Carolina Department of Revenue, Customer Service, P.O. Box 1168, Raleigh, NC 27602-1168

Page 2

NC-5500

WebInstructions

3-20

Part 1. Taxpayer Information: Enter the identifying information of the taxpayer including the name, address, and applicable identification number(s) along with the name and phone number of a contact person (if

different from the taxpayer) on the appropriate lines.

Part 2. Penalty Information: List the type(s) of tax for which this request applies along with the amount of penalty and the tax period(s) covered. Important. For penalty waiver purposes, the following tax types are considered as one tax type:

•Corporate Income and Franchise taxes

•State, Local, and Transit Sales and Use taxes

In addition, all penalties imposed for the same filing period are treated as one request. Attach a copy of

each notice of tax assessment to this form or write each notice number in the space provided.

Part 3. Reason for Request: Indicate the reason for the penalty waiver request by placing an X in the space provided. Important. Your request will be denied if you do not provide all of the required information for the reason you specify.

Good Compliance Record. The Department recognizes that everyone makes mistakes and taxpayers

sometimes have difficulty complying with the tax laws. For this reason, each taxpayer is allowed one

100% penalty waiver for each tax type every three years based on the Department’s Penalty Policy ** at www.ncdor.gov.

The good compliance reason applies only if all of the following statements are true:

•All required tax returns and reports due have been filed.

•All tax, interest, and penalty that is not waivable for the tax period for which the penalty waiver is requested has been fully paid.

•Any amount due on a notice of collection received for a tax period that is different from the tax period for which the penalty waiver is requested has been fully paid.

•During the past three years, no penalty waiver based on a good compliance record for the tax type for which waiver is requested has been granted.

•The penalties at issue are not the result of the same or similar error or practice as those previously assessed by the Department.

•All documents, information, reports, and returns requested by the Department were timely provided.

**Exception: The 10% failure to pay penalty for trust taxes, such as sales tax and withholding tax, is not subject to the good compliance record reasons if the taxpayer collected but failed to remit trust taxes.