Understanding the intricacies of tax compliance can often seem daunting, especially when dealing with amended obligations. The Form NC-5PX stands at the heart of this process for semiweekly payers within North Carolina who find themselves navigating the correction of previously underpaid taxes. This particular form serves as a beacon, guiding semiweekly payers through the process of rectifying their tax payments for past periods. It is imperative for these payers to accurately report and pay any additional taxes along with interest accrued to avoid further complications. Specifically designed for adjustments, Form NC-5PX allows for the reduction of tax payments in instances where overpayment has occurred, provided the correction falls within the same quarter. The importance of detailed attention to entering correct dates of compensation, legal names, account IDs, and identification numbers cannot be overstressed. Furthermore, adhering to specific instructions regarding the physical submission of the voucher, such as the prohibition against folding and the preference for blue or black ink, ensures that the process moves forward without unnecessary delay. Preferred methods of payment and meticulous documentation processes underscore the primacy of accuracy and completeness in the pursuit of tax compliance. Through the lens of Form NC-5PX, semiweekly payers are afforded an essential tool in maintaining their fiscal responsibilities and contributing to the smooth operation of tax administration within North Carolina.

| Question | Answer |

|---|---|

| Form Name | Nc 5Px Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | nc 5 px form, nc 5px form, nc5px, nc 5px withholding |

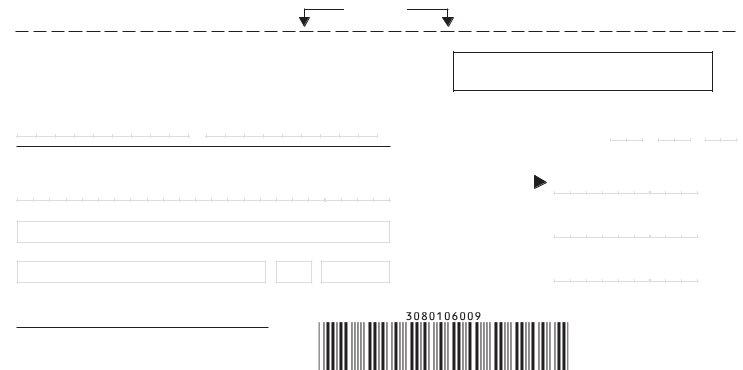

Instructions for Form

Amended Withholding Payment Voucher

For Semiweekly Payers

Form

Be sure to enter the date the compensation was paid. Also enter the legal name, account ID, and Federal Employer Identification Number (FEIN) or Social Security Number (SSN). Use capital letters when entering the legal name and address.

Please do not fold, staple, tape, or paper clip the voucher or payment.

Use blue or black ink to complete the voucher.

Make check payable in U.S. currency to N.C. Department of Revenue.

Cut return on line below and mail it with your payment to the address on the return.

! |

Cut Here |

! |

|

|

Amended Withholding Payment Voucher

North Carolina Department of Revenue

Account ID |

FEIN or SSN |

Use this form only if you owe additional tax. Use Form

Enter Date Compensation Paid

USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS

Legal Name (First 23 Characters)

1. Additional Tax

Street Address

2. Interest

City |

State |

Zip Code (5 Digit) |

3. Total Due

Signature:Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

Title: |

Phone: ( |

) |

MAIL TO: P.O. Box 25000, Raleigh, NC

(M M

|

, |

, |

.00 |

|

, |

, |

.00 |

$ |

, |

, |

00 |

|

. |