Every year, countless forms are filled out for tax purposes, but not all of them are as specific or as crucial for certain taxpayers as the NC K1 D 407 form. This form, dedicated to detailing the beneficiary's share of North Carolina income, adjustments, and credits, is a vital document for beneficiaries of estates or trusts. It serves as a clear record for both the North Carolina Department of Revenue and the beneficiary, outlining the income, losses, and any deductions or credits attributed to the beneficiary for a specific tax year. The NC K1 D 407 form follows strict guidelines for completion, including the use of blue or black ink and the submission of originals only, ensuring the information is accurately captured and processed. It links directly to other tax forms like the D-400, making it a key piece of paperwork for individuals navigating their tax responsibilities in relation to an inheritance or trust income. Furthermore, it distinguishes between residents and non-residents, indicating the different tax obligations based on the source of the income, effectively guiding beneficiaries through the process of reporting and paying their due taxes in North Carolina.

| Question | Answer |

|---|---|

| Form Name | Nc K1 D 407 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | www.ncdor.gov media 11655North Carolina Department of Revenue Third-Party ... - ncdor.gov |

Do Not Include This Page

Guidelines

::::==·

. •• ··=!!!:::!:•

Instructions

For Handwritten

Forms

NCD(i)• R

Before Sending

I NORTH CAROLINA DEPARTMENT OF REVENUE

Do not use red ink. Use blue or black ink.

®

Do not use dollar signs, commas, or other punctuation

marks.

, 1 t®I

Printing

Set page scaling to

"none." The

1�

ocopies of returns. Submit originals only.

,,___(8)

Do not mix form types.

Do not select "print on bothc;sides of paper."

;�1

WEB

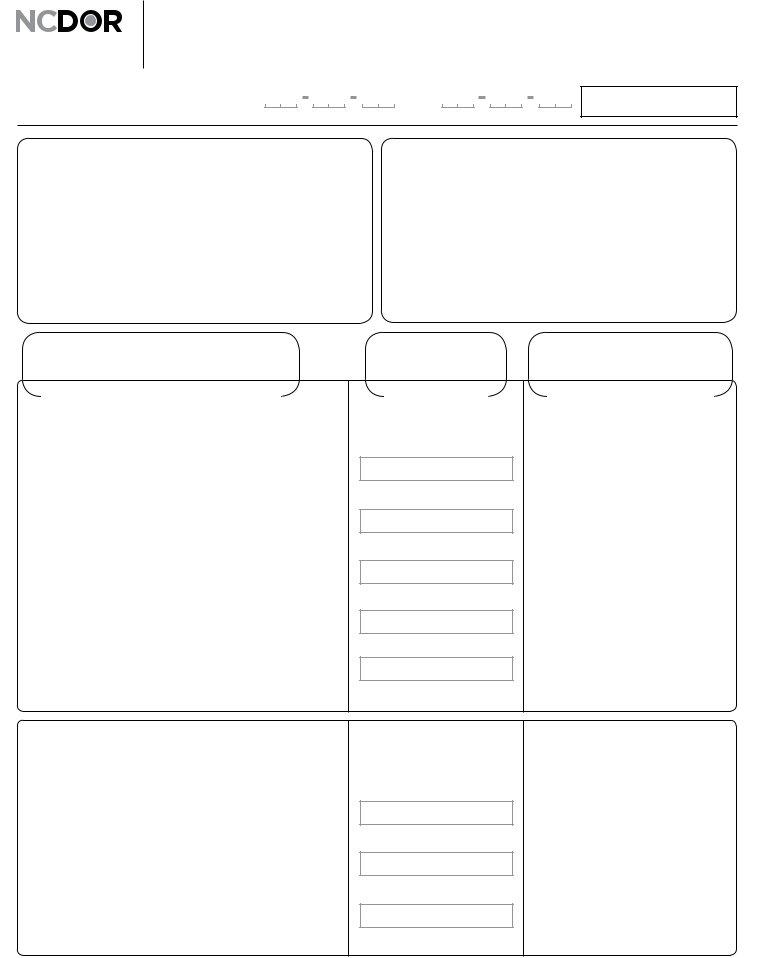

2020 Beneficiary’s Share of North Carolina Income, Adjustments, and Credits

For calendar year 2020, or fiscal year beginning

20 endingAND

DOR

Use

Only

|

Estate’s or Trust’s Federal Employer ID Number |

Beneficiary’s Identifying Number |

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estate’s or Trust’s Name, Address, and Zip Code |

Beneficiary’s Name, Address, and Zip Code |

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beneficiary’s Pro Rata Share Items |

Amount |

Individuals Filing Form |

|

|

|

||

|

|

|

|

|

|

|

All Beneficiaries

1.Beneficiary’s share of income (loss)

(Beneficiary’s share of amount from Federal Form 1041, Line 18)

2.Beneficiary’s share of additions to income (loss)

(From Form

3.Beneficiary’s share of deductions from income (loss)

(From Form

4.Share of tax paid to another state or country

(From Form

5.SHARE OF OTHER TAX CREDITS

Nonresidents Only

6.PORTION OF LINE 1 ABOVE THAT IS FROM N.C. SOURCES (Do not include intangible income from any source or business income from sources outside North Carolina)

7.Portion of Line 2 above that is attributable to N.C.

SOURCE INCOME

8.Portion of Line 3 above that is attributable to N.C.

SOURCE INCOME

(This amount should already be included in federal adjusted gross income)

(See Form

(See Form

FORM

FORM

Line 11, Column B

(See Form

(See Form