Through the online PDF tool by FormsPal, you can fill out or alter nc 5q fillable here. The editor is continually upgraded by our team, acquiring handy functions and turning out to be greater. For anyone who is seeking to get going, here's what you will need to do:

Step 1: Hit the "Get Form" button above on this page to get into our editor.

Step 2: The editor helps you customize your PDF document in a variety of ways. Change it by including customized text, correct what is originally in the file, and add a signature - all within a few clicks!

It really is simple to fill out the document using this helpful tutorial! This is what you must do:

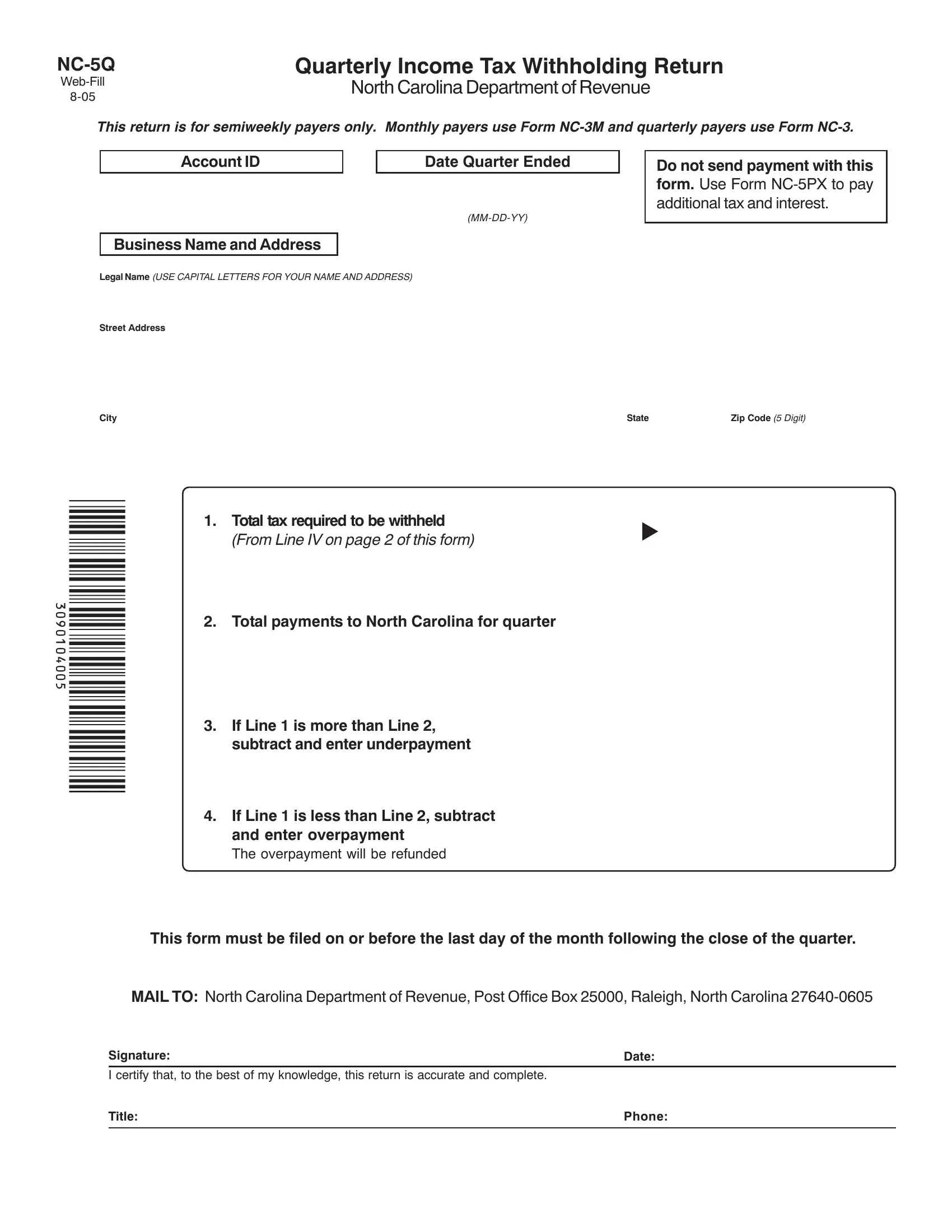

1. The nc 5q fillable will require particular details to be typed in. Ensure the next blank fields are filled out:

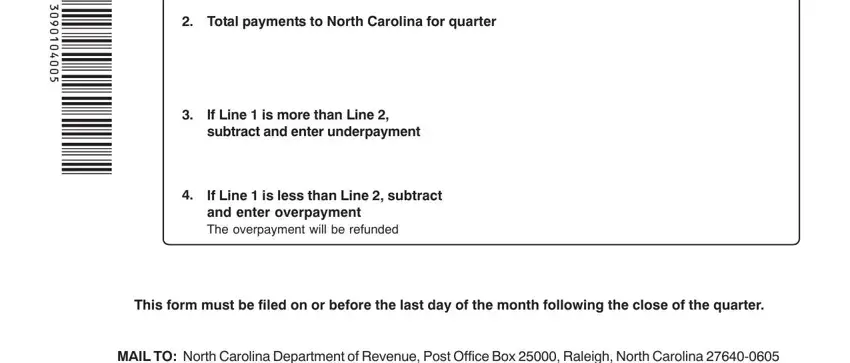

2. After the last section is finished, you need to put in the needed details in Total payments to North Carolina, If Line is more than Line, If Line is less than Line, This form must be filed on or, and MAIL TO North Carolina Department in order to move forward further.

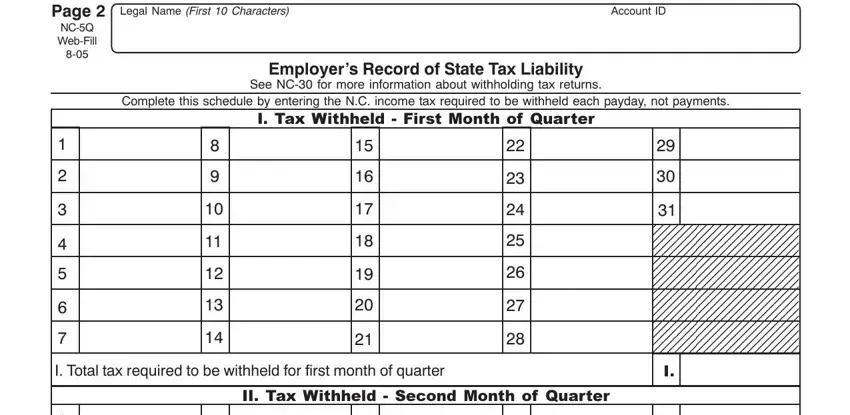

3. Completing Legal Name First Characters, Account ID, Employers Record of State Tax, See NC for more information about, Complete this schedule by entering, I Tax Withheld First Month of, Page, NCQ WebFill, I Total tax required to be, and II Tax Withheld Second Month of is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

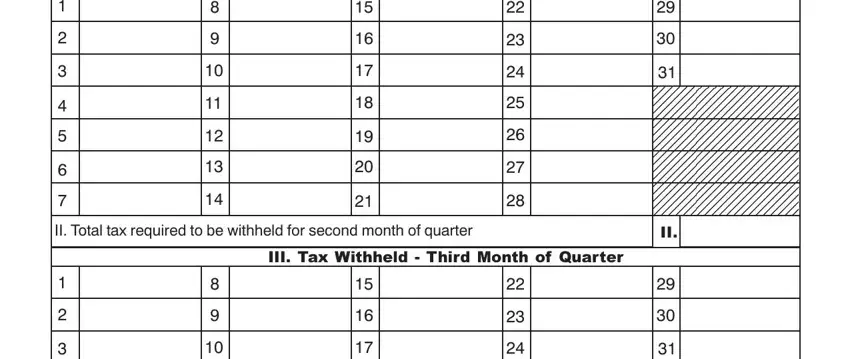

4. The next section will require your information in the subsequent parts: II Total tax required to be, and III Tax Withheld Third Month of. Remember to fill out all requested details to move onward.

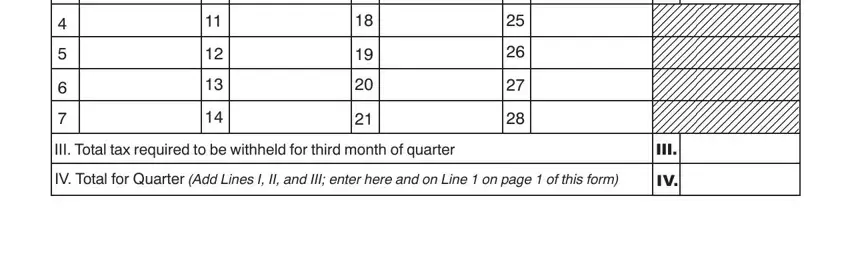

5. And finally, this last subsection is what you should finish prior to using the PDF. The blanks in question are the following: III Total tax required to be, IV Total for Quarter Add Lines I, and III.

It is easy to make an error when filling out your III, therefore you'll want to reread it before you send it in.

Step 3: Right after you have reviewed the information in the fields, press "Done" to finalize your form. Try a free trial account at FormsPal and gain instant access to nc 5q fillable - available from your personal account page. FormsPal offers secure document tools with no personal information recording or distributing. Feel at ease knowing that your details are safe here!