You can complete Ncdor Form D 400Tc easily in our online editor for PDFs. We are devoted to making sure you have the absolute best experience with our tool by consistently adding new functions and enhancements. Our tool is now even more intuitive as the result of the most recent updates! At this point, working with documents is easier and faster than ever. With a few easy steps, you are able to start your PDF editing:

Step 1: First of all, access the pdf editor by pressing the "Get Form Button" above on this webpage.

Step 2: The editor offers you the capability to work with your PDF in many different ways. Change it with any text, correct what is already in the document, and add a signature - all within several mouse clicks!

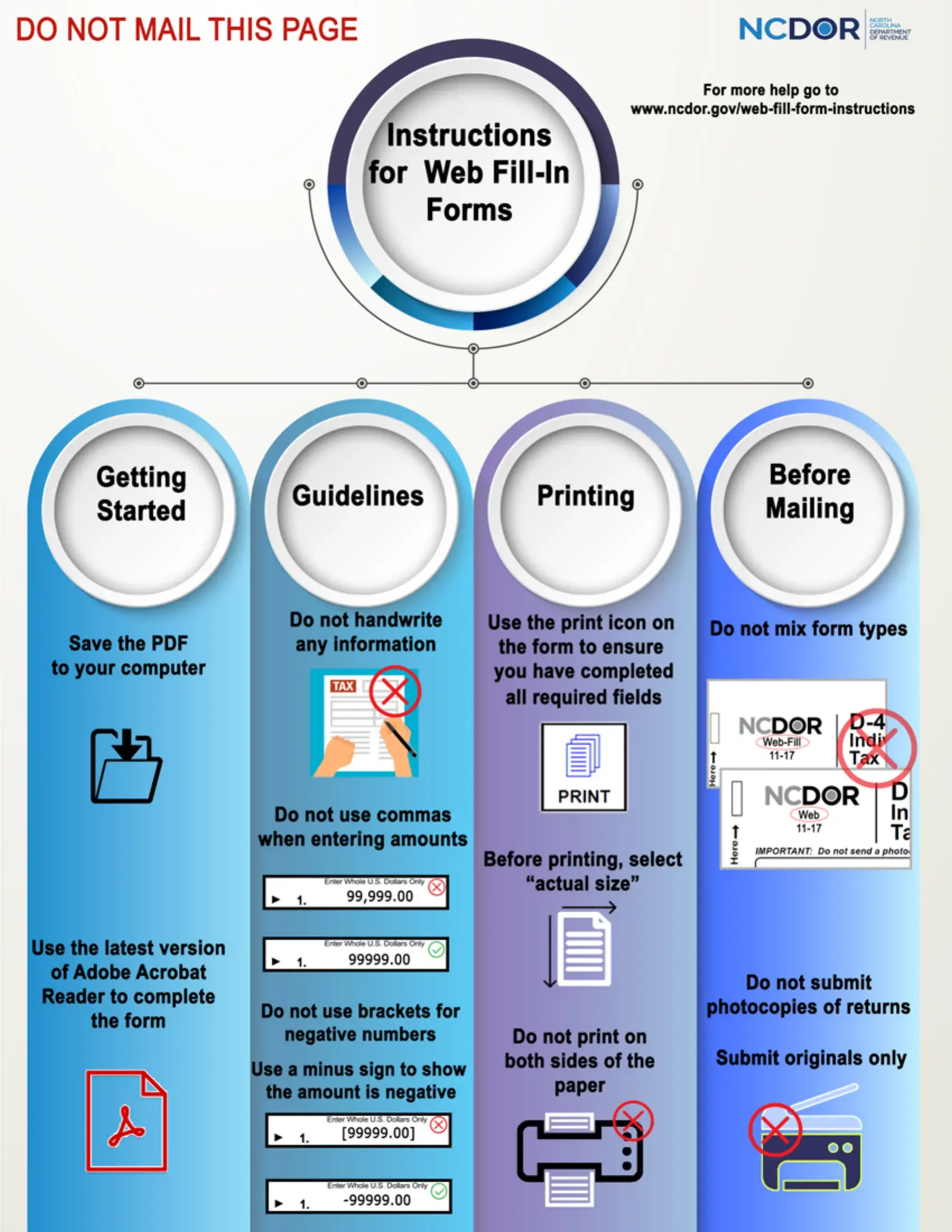

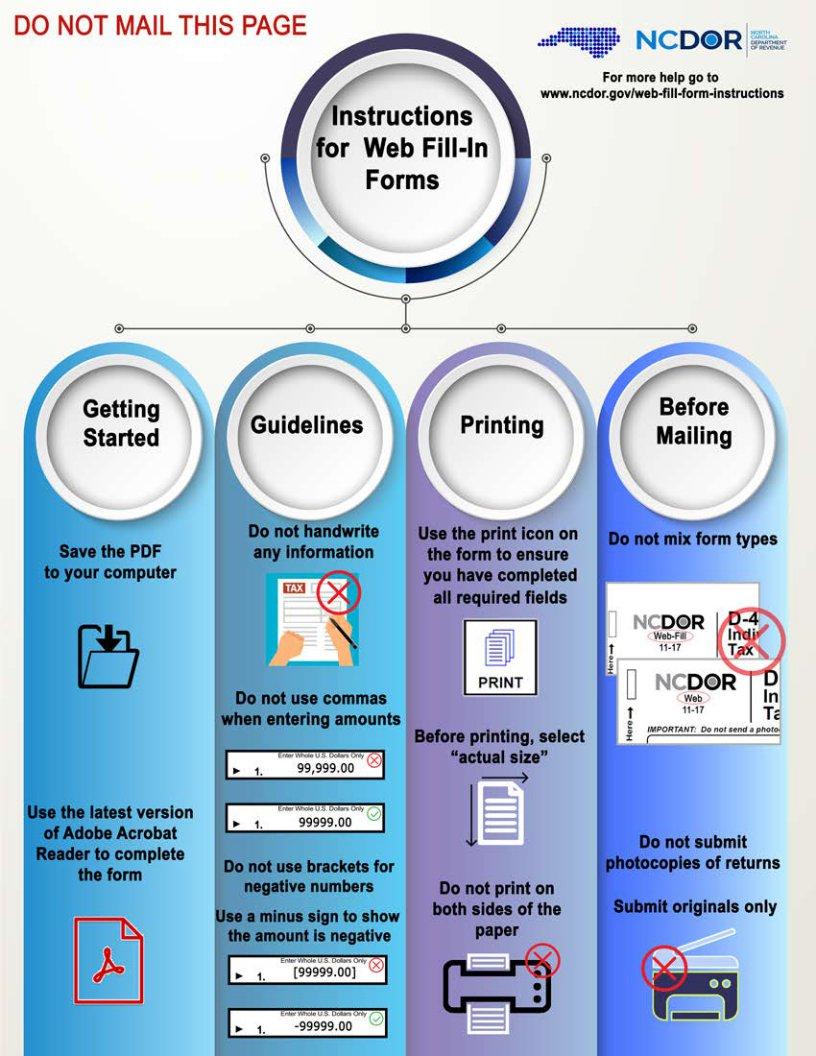

This PDF form requires specific info to be entered, so make sure you take whatever time to enter what's expected:

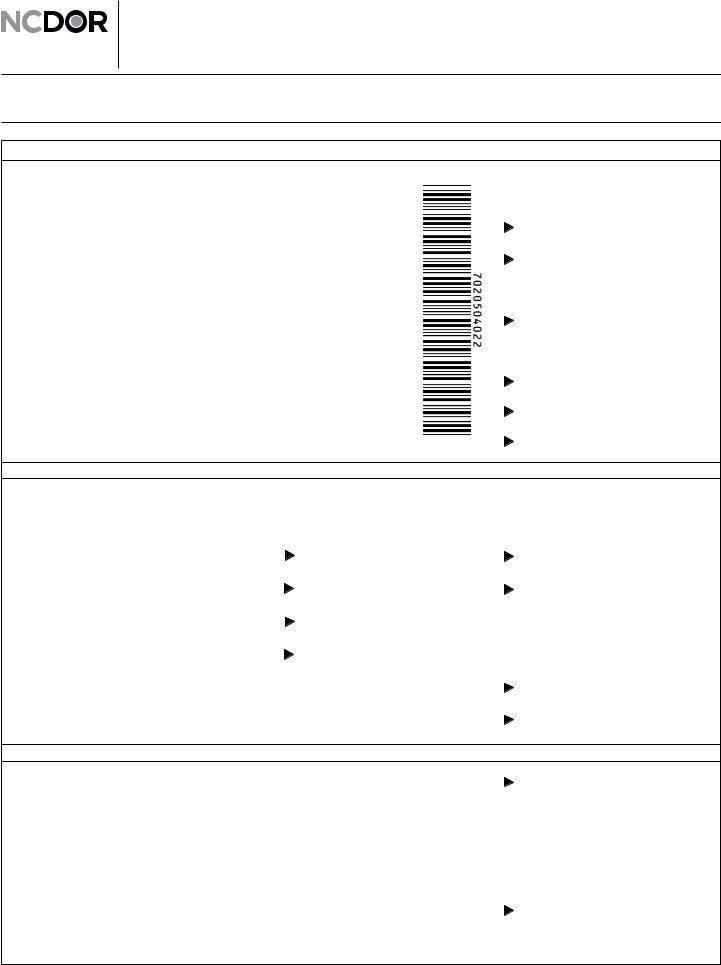

1. For starters, when filling out the Ncdor Form D 400Tc, start with the section that contains the subsequent fields:

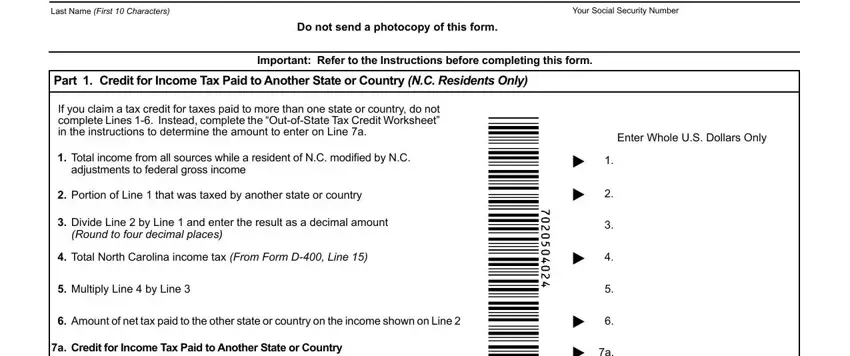

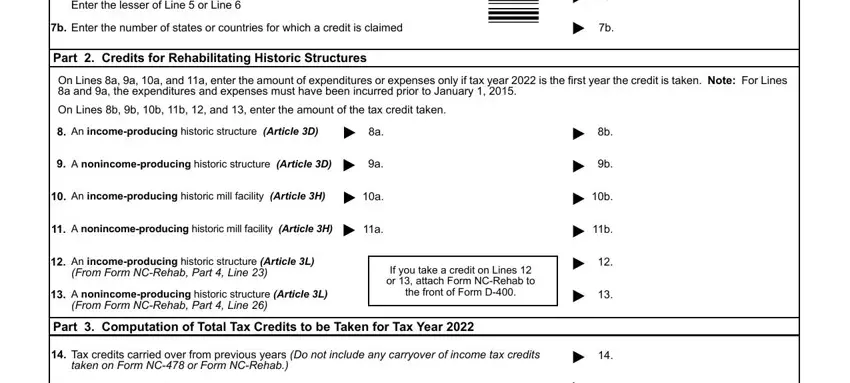

2. Once your current task is complete, take the next step – fill out all of these fields - Enter the lesser of Line or Line, b Enter the number of states or, Part Credits for Rehabilitating, On Lines a a a and a enter the, On Lines b b b b and enter the, An incomeproducing historic, A nonincomeproducing historic, An incomeproducing historic mill, A nonincomeproducing historic, An incomeproducing historic, From Form NCRehab Part Line, A nonincomeproducing historic, From Form NCRehab Part Line, If you take a credit on Lines or, and the front of Form D with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Many people generally make errors while filling out A nonincomeproducing historic in this part. You should definitely read again whatever you type in right here.

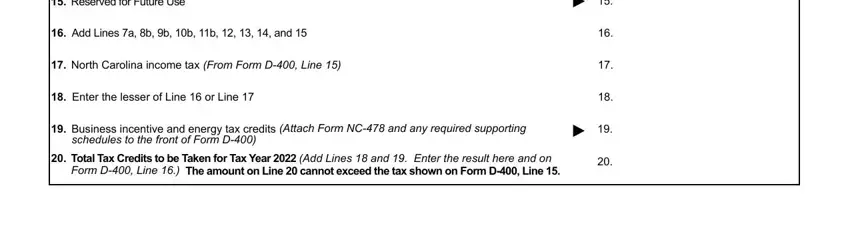

3. This third stage is going to be hassle-free - complete all of the blanks in Reserved for Future Use, Add Lines a b b b b and, North Carolina income tax From, Enter the lesser of Line or Line, Business incentive and energy tax, schedules to the front of Form D, and Total Tax Credits to be Taken for to complete the current step.

Step 3: Make certain your information is right and click on "Done" to finish the project. Right after setting up a7-day free trial account here, you will be able to download Ncdor Form D 400Tc or email it directly. The file will also be easily accessible from your personal account menu with all your edits. FormsPal ensures your information privacy via a secure method that in no way records or shares any private information involved in the process. Feel safe knowing your docs are kept safe when you work with our tools!