Embarking on the journey to resolve overwhelming tax liabilities through the North Carolina Department of Revenue's Offer In Compromise (OIC) program can provide a beacon of hope for financially distressed taxpayers seeking a fresh start. This detailed program is designed with the dual aim of bringing financial relief to taxpayers while ensuring the state's interests are protected, offering a structured pathway to settle tax debts by paying a lump sum that is less than the full amount owed. The OIC-101 Offer In Compromise Instruction Booklet is a comprehensive guide that arms taxpayers with the essential instructions, forms, and additional resources needed to navigate this complex process. Grounded in the statutory authority granted under NC General Statute 105-237.1, the program outlines specific criteria and documentation requirements to qualify for an offer, emphasizing the need for transparency and thoroughness in providing financial details. From determining the reasonable collection potential (RCP) to understanding the implications of submission, including the potential for continued accrual of interest and penalties, the booklet serves as an invaluable resource. Furthermore, it addresses the crucial steps following the submission, detailing what happens if an offer is accepted or denied, and setting realistic expectations for taxpayers. In articulating these procedures, the booklet also highlights the vital role of keeping copies of all submitted documents and underscores the financial commitment required upfront in the form of a non-refundable down payment. Through a blend of statutory guidelines, practical advice, and procedural clarity, the Offer In Compromise program presents a viable remedy for taxpayers aiming to reconcile their financial obligations with the State of North Carolina, fostering a process marked by fairness and the potential for financial rehabilitation.

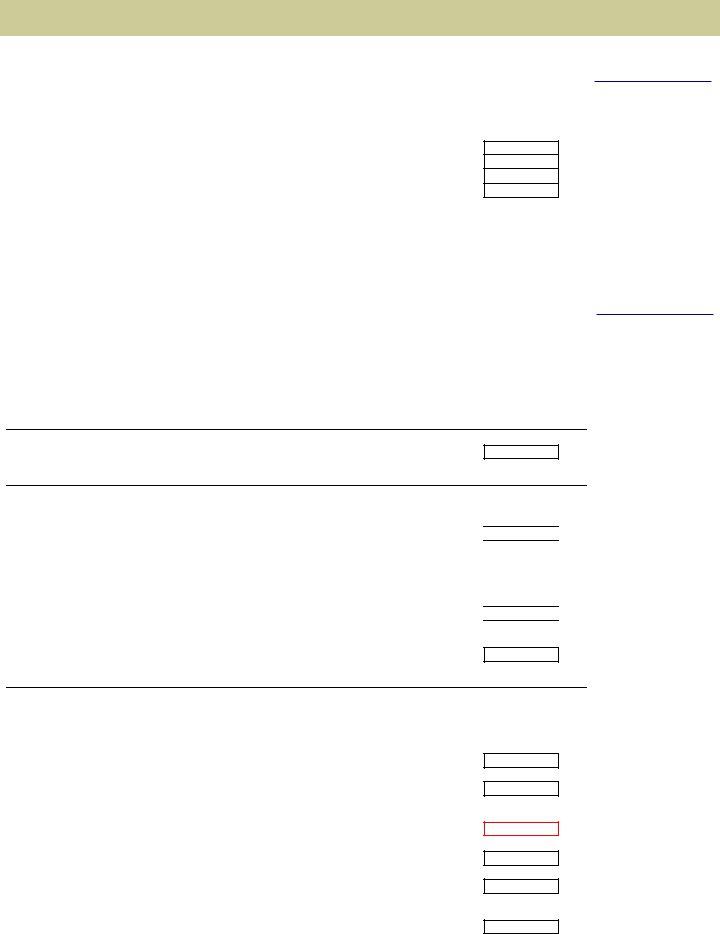

| Question | Answer |

|---|---|

| Form Name | Ncdor Offer In Compromise Form |

| Form Length | 13 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 3 min 15 sec |

| Other names | NCDOR: Offer In CompromiseNCDOR: Offer In CompromiseOffer in CompromiseInternal Revenue Service - IRS tax formsOffer in CompromiseInternal Revenue Service - IRS tax forms |

Offer In Compromise Instruction Booklet

State of North Carolina

Department of Revenue

Help Preparing an Offer In

What is an Offer in Compromise?

Compromise

This Booklet provides instructions for taxpay- ers preparing an Offer In Compromise.

Additional instructions and

Contact a Customer Service agent at

The North Carolina Offer In Compromise program allows qualifying, financially dis- tressed taxpayers the opportunity to put overwhelming tax liabilities behind them by paying a lump sum amount in exchange for the liability being settled in full. The law pro- vides specific requirements for accepting an offer. The goal of the Offer In Compromise program is to resolve a liability in a manner that is in the best interest of both the State and the taxpayer.

You are required to provide reasonable doc- umentation, as outlined below, with your request for an Offer In Compromise.

An offer will not be considered if it is determined that the offer was filed for the

purpose of delaying collection or otherwise jeopardizing the Department’s ability to

collect the tax debt.

Forced collection actions, such as garnish- ments, in effect at the time you submit your offer, will not automatically be suspended during the review period. Interest and penal- ty will continue to accrue on any unpaid tax debt while the offer is being considered.

This booklet provides the basic instructions, forms and other materials you will need to submit a request for an Offer In Compromise.

If you have questions, or need additional assistance, please contact the Department at

Contents

Statutory Basis for an Offer in Compromise and Basic Qualifications |

2 |

|

What Do I Send with My Offer? |

3 |

|

Determining the Amount of Your Offer & Required Down Payment |

4 |

|

How Does the Department Calculate the RCP? |

|

|

|

|

|

Does Offering the RCP GuaranteeAcceptance of My Offer? |

5 |

|

Will Offers for My Interest Only in a Joint Income TaxLiability Be Considered? |

|

|

|

|

|

What Happens After My Offer Is Submitted? |

|

|

Will Collection Actions Stop? |

6 |

|

If Your Offer Is Accepted |

|

|

|

|

|

If Your Offer Is Denied |

|

|

OIC Checklist |

7 |

|

Form |

8 - 9 |

|

Form OIC |

10 |

|

Form OIC |

11 |

|

Form OIC |

12 |

|

|

|

|

Form |

13 |

|

Page 2 |

|

(09/2021) |

|

|

|

Statutory Basis for an Offer in Compromise

NC General Statute

§

a)Authority. – The Secretary may compromise a taxpayer's liability for a tax that is collectible under NC G.S.

1)There is a reasonable doubt as to the amount of the liability of the taxpayer under the law and the facts.

2)The taxpayer is insolvent and the Secretary probably could not otherwise collect an amount equal to or in excess of the amount offered in compromise. A taxpayer is consid- ered insolvent only in one of the following circumstances:

a.It is plain and indisputable that the taxpayer is clearly insolvent and will remain so in the reasonable future.

b.The taxpayer has been determined to be insolvent in a judicial proceeding.

3)Collection of a greater amount than that offered in compromise is improbable, and the funds or a substantial portion of the funds offered in the settlement come from sources from which the Secretary could not otherwise collect.

4)A federal tax assessment arising out of the same facts has been compromised with the federal government on the same or a similar basis as that proposed to the State and the Secretary could probably not collect an amount equal to or in excess of that offered in compromise.

5)Collection of a greater amount than that offered in compromise would produce an unjust result under the circumstances.

6)The taxpayer is a retailer or a person under Article 5 of this Chapter; the assessment is for sales or use tax the retailer failed to collect or the person failed to pay on an item taxable under G.S.

7)The assessment is for sales tax the taxpayer failed to collect or use tax the taxpayer failed to pay as a result of the change in the definition of retailer or the sales tax base expansion to (i) service contracts, (ii) repair, maintenance, and installation services, or

(iii)sales transactions for a person in retail trade. The Secretary must determine that the taxpayer made a

b)Written Statement - When the Secretary compromises a tax liability under this section and the amount of the liability is at least one thousand dollars ($1,000), the Secretary must make a writ- ten statement that sets out the amount of the liability, the amount accepted under the compro- mise, a summary of the facts concerning the liability, and the findings on which the compromise is based. The Secretary must sign the statement and keep a record of the statement. If the com- promise settles a dispute that is in litigation, the Secretary must obtain the approval of the Attor- ney General before accepting the compromise, and the Attorney General must sign the statement describing the compromise.

Basic Qualifications

1.The period is collectible under NC G.S.

2.You have filed all tax returns and reports as required by statute.

3.You are not the subject of an open or active bankruptcy case.

4.You are not the subject of an open or active North Caro- lina Department of Revenue criminal investigation.

Page 3 |

|

(09/2021) |

|

|

|

What Do I Send with My Offer?

Keep

Copies!

You should

make copies

of all

documents

submitted to the Department for your records.

Do not send original copies with

your offer in

compromise

to the

Department

since they

will not be

returned.

1.If your statutory basis for compromise is anything other than reasonable doubt as to the amount of liability, a complete financial analysis will be completed on your account. Financial documentation must be submit- ted that reflects your financial situation for the three months immediately preceding the date you submit your Offer In Compromise.

Documentation Required (additional documentation may be requested after an initial review of the offer):

a.A completed and signed

b.A 20%,

Exceptions to this requirement are allowed if you submit a Form

c.A completed and signed NCDOR Financial Statement based upon your entity type:

d.Supporting Documentation:

If wage earner, last 3 months paystubs

Complete copies of last 3 bank statements for all accounts

Complete copies of last 2 federal income tax returns (if required to file)

If you claim to also owe the IRS, you must include a current federal account transcript for each outstanding period and tax schedule.

Substantiation for any claims of special circumstances made in section 8 of

A completed worksheet calculating your Reasonable Collection Potential based upon your entity type:

○OIC

○OIC

○OIC

e.Substantiation of claimed mortgages, vehicle liens and any other claimed judgments or liens.

2.If your basis for compromise is reasonable doubt as to the amount of liability, a financial analysis will not be conducted, however, you need to provide documents to support your claim.

Documentation Required:

a.A completed and signed

b.A 20%,

Exceptions to this requirement are allowed if you submit a Form

c.An explanation of the basis of reasonable doubt along with verifying documentation.

d.A computation of the claimed corrected tax due along with an explanation of how you arrived at that amount.

Offers should be submitted to: NC Department of Revenue, Attn: Offer In Compromise Unit, 1500 Pinecroft Rd., Suite 300, Greensboro, NC

Page 4 |

|

(09/2021) |

|

|

|

Determining the Amount of Your Offer & Required Down Payment

The Department will provide you an electronic template for completing the Collection Statement and RCP/down- payment calculations upon request.

All offer amounts must exceed zero.

Your offer amount must equal or exceed your Reasonable Collection Potential (RCP) amount. Your RCP should be calculated us- ing the OIC

The RCP equals the net equity of your assets plus the amount the Department projects it could collect from your future income.

If the Department’s financial analysis indicates that you have the ability to pay the tax liability in full, either immediately or through an installment payment agreement, or you can pay a greater amount than that offered in compromise, your offer will be denied.

The Department requires a 20% down payment of the offer amount. This will be applied towards your tax liability and will not be refunded. Pay- ment must be submitted in certified funds or by credit card. Offers received without the down payment will not be processed. If your gross in- come falls below the Federal Poverty Guidelines, or if you attach a Form

How Does the Department Calculate the RCP?

The OIC

Each form begins with the total of your liquid assets which includes cash on hand, average bank balance, invest- ment account balances and cash value of all insurance policies. You must in- clude your last 3 months statements for all accounts (checking and savings) and insurance policy statements with your offer.

The worksheets also assist in calculat- ing equity in all property owned by us- ing the Quick Sale Asset Value (QSV)

method. The QSV is calculated by mul- tiplying the asset’s value by a discount

factor. The Department allows you to discount property values to 80%. Real property asset value is calculated us- ing the county tax value multiplied by 80% QSV discount minus any out- standing mortgage balances. The most current mortgage statements must be submitted with the offer for the loan to be allowed.

Purchased vehicle and other licensed asset value is calculated using the NA- DA value multiplied by the 80% QSV discount minus any outstanding loan balance. The most current loan state- ments for each vehicle/ licensed asset owned must be submitted with the offer for the loan to be allowed.

Asset values minus any liens superior to the Department’s, such as those

arising from lRS or county tax debts, will equal your total equity in assets held.

Next, the worksheets assist in calculat- ing monthly disposable income by sub- tracting monthly allowable expenses from total monthly income. Calculate total monthly income using the aver- age of 3 months of paystubs, monthly pensions, social security, dividends, profit from business, alimony, child support, commissions or any other income sources.

Total allowable monthly expenses are calculated using Collection Financial

Standards provided by the IRS for housing and utilities, food, clothing & other items, vehicle operating costs, public transportation costs, vehicle loans, and medical costs as well as actual alimony, child support, day care expense, health and life Insurance expense, IRS and estimated tax pay- ments, and any

The calculated monthly disposable income is multiplied by 60 months and added to total equity in assets held to determine your RCP.

Each taxpayer is also allowed up to $2,000 in accounting/legal fees when documentation is provided. This allow- ance is solely for the preparation of the Offer In Compromise, and not for ac- counting fees accrued as a part of nor- mal personal and business filings. The accounting/legal fees are subtracted from the reasonable collection poten- tial in order to determine the net RCP.

Page 5 |

|

(09/2021) |

|

|

|

Does Offering the RCP Guarantee Acceptance of My Offer?

No. The Department performs an analysis of your financial condition during the review process. Failure to provide documentation to support

income, expenses, and loan balances can impact the Department’s calcula-

tion of the RCP and may result in the Department’s inability to process your

offer.

The following are factors used during the Department’s financial analysis

process when making a determination for an offer:

Omitted Items – If you omit income, assets, or other items of significance from your financial statement, your offer may be denied.

History of

Insufficient Documentation - If docu- mentation for outstanding mortgage and loan balances for real and per- sonal property is not provided, the loan balances will not be allowed. In addition, claimed expenses for alimo- ny, child support, day care, health and life insurance, IRS and estimated tax payments, and any

Property Valuation – The Department will assess the value of all property that you own. If the Department deter- mines value of the property is greater than shown on your RCP

Collected Taxes – If your debt is based on taxes that were collected from others, but not remitted, such as

sales or employee withholding taxes, the offer may not be accepted.

Earned Income – If an attachment of earned income will collect more over the statutory period of collection than the amount offered, your offer may be denied.

Installment Payment Agreement– If the current installment payment agreement will pay more over the stat- utory period of collection than the amount proposed in settlement, your offer may be denied.

Other – The law gives the Secretary the option to accept an offer but in no way requires it. In any instance where the Secretary determines that ac- ceptance is not in the best interest of the State, the offer will be denied.

Will Offers for My Interest Only in a Joint Income Tax Liability Be Considered?

In order to settle one

person’s interest in a joint

income tax liability, you must qualify for Innocent Spouse Relief.

You cannot be relieved of the liability through an Offer In Compromise.

No. If you have filed a joint income tax return for the year(s) in which you are requesting relief, you must submit an offer in compromise from both parties that includes financial information from and has been signed by both parties.

Pursuant to G.S. §

In order to receive relief for your

interest in a jointly filed income tax liability, you must qualify for Inno- cent Spouse Relief under N.C.G.S. §

If you request and qualify for Inno- cent Spouse Relief, you will be noti- fied by the Department of your per- centage of relief once your request has been processed.

If you do not qualify for Innocent Spouse Relief, you will remain jointly and severally liable for the balance of tax, penalty and interest due. You cannot request an offer in compro- mise to settle your interest in the outstanding liability.

Offer In CompromisePage6

Instruction Booklet

What Happens After My Offer Is Submitted?

A Certificate of Tax Liability may be filed at any time while your offer is

The Offer In Compromise (OIC) Unit conducts an initial review of the offer to determine if it meets the basic qualifications to be processed.

If the qualifications are met and the offer can be processed, then the completed OIC packet is reviewed and analyzed by the OIC Unit using the information provided. The OIC Unit also performs independent re-

search.

During the review of the OIC packet, the OIC Unit may deter- mine that more documentation is needed from you. If this is the case, then the OIC Unit will contact you.

If the additional documentation is not submitted as requested, then your offer will not be processed.

The OIC Unit makes a recom- mendation to the Secretary of Revenue and/or their designee, who has the final approval for all offer in compromise deci- sions.

The process can take up to 90 days. This timeframe can vary depending on the current vol- ume of submissions and the time of year.

being considered.

Will Collection Actions Stop?

Offer amounts must be paid in full with certified funds or by credit card when an offer

Not necessarily.

There are certain circumstanc- es when the Department will suspend collection activities while we consider your offer, but it is not a requirement.

After an offer is determined to be complete and submitted for

processing, we will not act to collect the tax liability while we consider and evaluate your offer.

We will also allow 14 days for you to respond after we send a

letter notifying you of the De- partment’s decision to deny

your offer.

It is important to note that the Department will not suspend collection if we determine that you submitted your offer to delay collection or cause a delay which will jeopardize our ability to collect the tax.

is accepted.

If Your Offer Is Accepted

Payment plans are not accepted for offer funds.

All Offer In Compromise forms and payments should be remitted to:

The Department will notify you and your designated repre- sentative if the offer is accept- ed, and direct you to remit pay- ment to: NC Department of Revenue, Attn.: Offer in Compro- mise Unit, at: 1500 Pinecroft Rd., Suite 300, Greensboro, NC

Payment of the accepted offer must be made in certified funds

or by credit card by the payment due date as indicated on the acceptance letter (usually 30 days from date of the ac- ceptance letter).

The total amount due will be the accepted offer amount less the 20% down payment.

Payments made toward the account while the offer is being considered will not decrease

the total offer amount due.

The Department does not accept payment plans on an offer in compromise.

A recorded Certificate of Tax Liability will be released when the Department receives pay- ment of the accepted offer amount in certified funds or by credit card.

If Your Offer Is Denied

NC Department of Revenue, Attn: OIC Unit, 1500 Pinecroft Rd., Suite 300, Greensboro, NC

The Department will notify you and your designated repre- sentative if the offer is denied.

As part of the review process, the Department calculates the RCP. If your RCP is less than the total liability due but more than the amount offered, in most cases, the Department will include the calculated RCP in the denial letter and give you the option to offer this amount.

Offering the calculated RCP does not necessarily guarantee the Department will accept the offer.

If you are unable to counter offer, you should immediately contact the Department to ar- range payment of the entire liability.

Appealing the Decision: North

Carolina statutes make no pro-

vision for appeal of a denied offer.

The Department may reconsid- er a denied offer if there is a

material change in the taxpay- er’s circumstances and docu-

mentation is provided prior to the due date on the denial let- ter. If it is after the due date on the denial letter, you will be required to submit a new offer.

Page 7 |

|

(09/2021) |

|

|

|

OIC Checklist Rev. 02/21

N.C. DEPARTMENT OF REVENUE

OFFER IN COMPROMISE CHECKLIST

This checklist lists all documents that may be needed with your Offer In Compromise submission. Ensure that you read the

Booklet in its entirety to determine what information is needed based upon your statutory basis for compromise.

ITEMS:

1.Form

2.20% Down Payment made by credit card or in certified funds payable to NCDOR. (Exceptions to this requirement are allowed if you submit a Form

Affirmation, or if your gross income is below the Federal Poverty Guidelines.)

3.Form

4.Form

5.Form

6.Worksheet for Offer In Compromise: OIC

7.Copy of last two (2) years Federal Income Tax returns, if required to file.

____• If not required to file, then attach a signed and dated, written explanation.

8.Copy of the federal account transcript for all periods if the taxpayer claims to also owe the IRS.

9.Copy of last three (3) months paycheck stubs, if applicable.

10.Copy of last three (3) months bank account statements for all accounts.

11.Verification of any claimed health issue or disability.

12.All documents or attachments listed under the signature line of the Collection Information Statements

13.Verification documents showing the computation of the claimed corrected tax due and documents supporting your claim. (If statutory basis of compromise is reasonable doubt.)

Additional information may be requested after the initial review of the Offer In Compromise.

Page 8 |

|

(09/2021) |

|

|

|

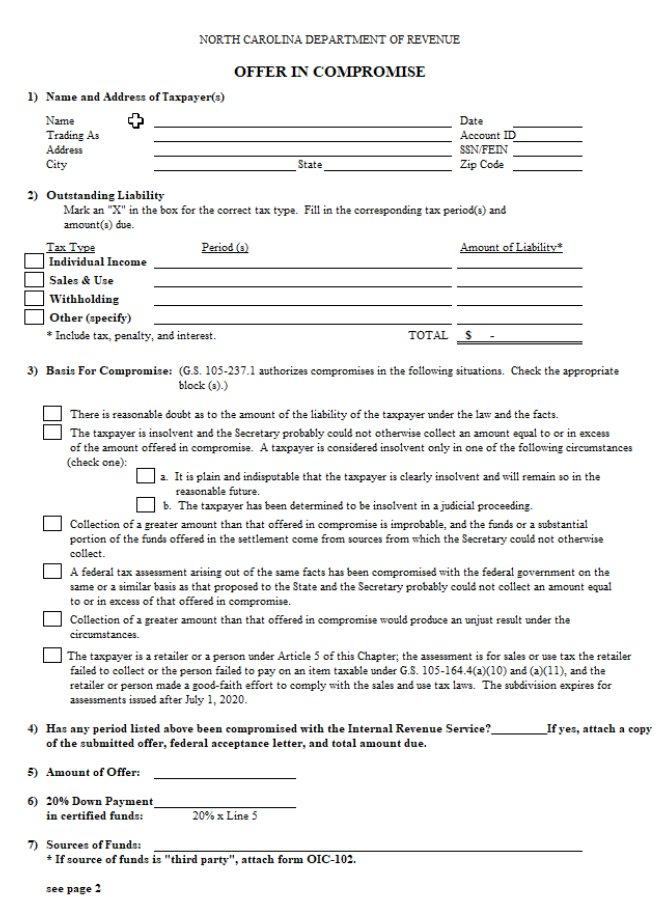

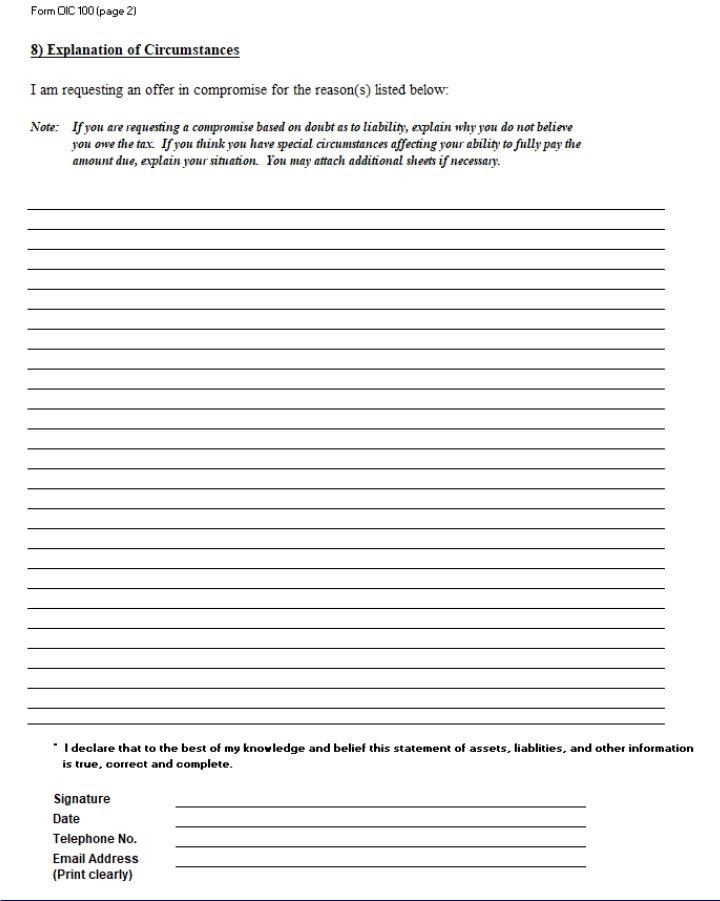

Form OIC 100

02/21

Page 9 |

|

(09/2021) |

|

|

|

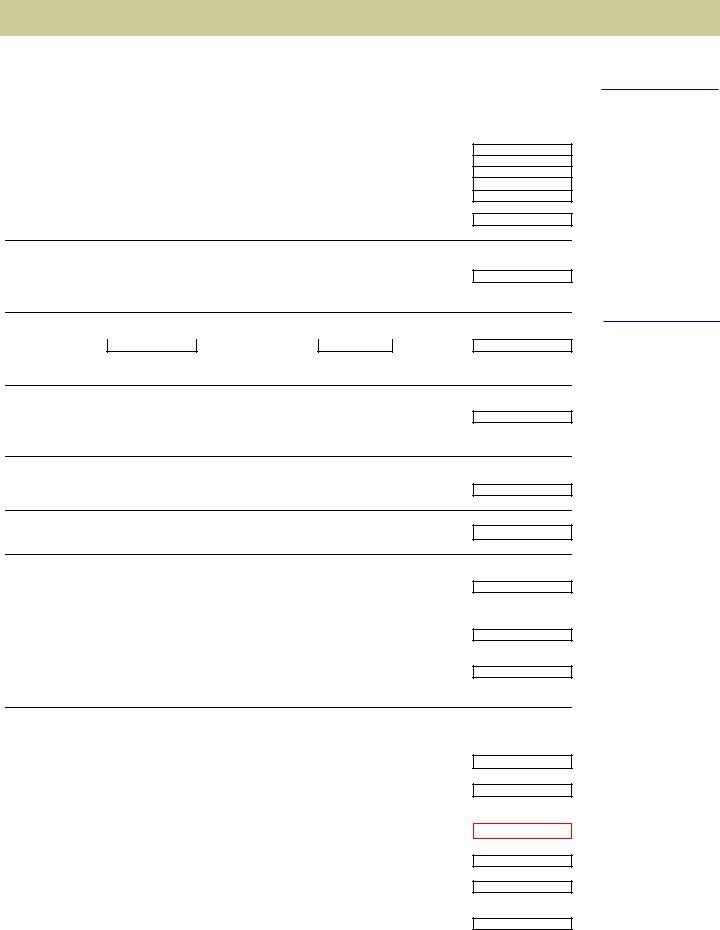

Calculating the RCP and Down Payment - Individuals

Worksheet for Offer in Compromise - Individual |

Form OIC |

Must complete

Step 1: Assessing Liquid Assets - Section 3

Cash on Hand - Line 12

Average Bank Balance- line 13e

Investment account balance (stocks, bonds, retirement, virtual currency) - Line 14e + Line 15d

Cash value of insurance policy - Line 16c

TOTAL LIQUID ASSETS |

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

Step 2: Real Property - Section 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

Fair Market Value |

|

x |

80% |

- |

Loan Balance |

|

= |

Asset Value |

|

|

|

Section 4 Line 17c |

|

QSV |

|

|

Section 4 Line 17d |

|

|

|

|

|

|

|

|

|

|

|||||

Step 3: Purchased Vehicle/ Other Licensed Asset |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

C |

||

Fair Market Value |

|

x |

80% |

- |

Loan Balance |

|

= |

Asset Value |

|

|

|

Section 5 Line 18c |

|

QSV |

|

|

Section 5 Line 18d |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Step 4: Subtracting Judgments/Liens |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Balance due |

|

D |

|

|

|

|

|

|

|

|

|

Section 7 Line 20d |

|

Step 5: Total Equity in Assets Held

E

Step 6: Disposable Income Analysis

Page 10

Refer to

The Department allows you to discount property values to 80%. This is referred to as Quick Sale (QSV) value

Total Monthly Income (line 36)

Wages, pensions, Social Security, dividends, profit from business, alimony, child support, commissions, other

Less

Total Monthly Expenses (line 48)

Housing and Utilities, Vehicle ownership & operating costs, food & clothing, health & life insurance,

Disposable Monthly Income:

F Section 10 Line 36

G Section 10 Line 48

H

Step 7: Proposed Offer Amount

**Do not enter amounts below $0.00. If equity in assets or disposable income calculations are less than $0.00, enter $0.00.

Equity in Assets Held (E)

Disposable Monthly Income (H) |

x |

60 (months) |

= |

Reasonable Collection Potential

Allowance for Accounting/Legal Fees (not to exceed

Proposed Amount Offered In Compromise (must be greater than 0)

20% Deposit (see instructions for exceptions)

I

J

H X 60

K

I + J = K

L

M

N

M x 20% = O

Calculating the RCP and Down Payment - Business Entities

Worksheet for Offer in Compromise - Business |

Form OIC |

Must complete

Step 1: Assessing Business Assets- Section 4

Cash on Hand - Line 15

Total Cash in Banks - Line 16d

Accounts/Notes Receivable - Line 18f

Total Investments (stocks, bonds, mutual funds, stock options, CDs, virtual currency) - Line 17c + Line 19c

Total Credit Available - Line 20c

Page 11

Refer to

Total Business Assets

Step 2: Real Property

Fair Market Value |

|

x |

80% |

- Loan Balance |

|

= Asset Value |

|

Section 4 Line 21e |

|

QSV |

|

Section 4 Line 21f |

|

Step 3: Vehicles, Leased and Purchased

A

B

completing this form

Fair Market Value |

|

x |

80% |

- Loan Balance |

|

= Asset Value |

C

The Department

Section 4 Line 22e |

QSV |

Section 4 Line 22f |

Step 4: Business Equipment - Section 4

Fair Market Value |

|

x |

80% |

- Loan Balance |

|

= Asset Value |

|

Section 4 Line 23e |

|

QSV |

|

Section 4 Line 23f |

|

Step 5: Business Liens, Judgments and Other Liabilities - Section 4

Balance due

Line 24d

Step 6: Total Equity in Assets Held

Step 7: Disposable Income Analysis

Total Monthly Income (Line 35)

Less

Total Monthly Expenses (Line 48)

Disposable Monthly Income:

Step 8: Proposed Amount Offered In Compromise (must be greater than 0).

**Do not enter amounts below 0. If equity in assets or disposable income calculations are less than 0, enter 0.

Equity in Assets Held (F)

Disposable Monthly Income (I) |

x |

60 (months) |

= |

I X 60

Reasonable Collection Potential (RCP)

J+K=L

Allowance for Accounting/Legal Fees (not to exceed

Proposed Amount Offered In Compromise (must be greater than $0.00)

20% Deposit (see instructions for exceptions)

N x 20% = O

allows you to discount property values to 80%.

DThis is referred to as Quick Sale (QSV) value

E

F

G

H

I

J

K

L

M

N

O

Page 12 |

|

|

|

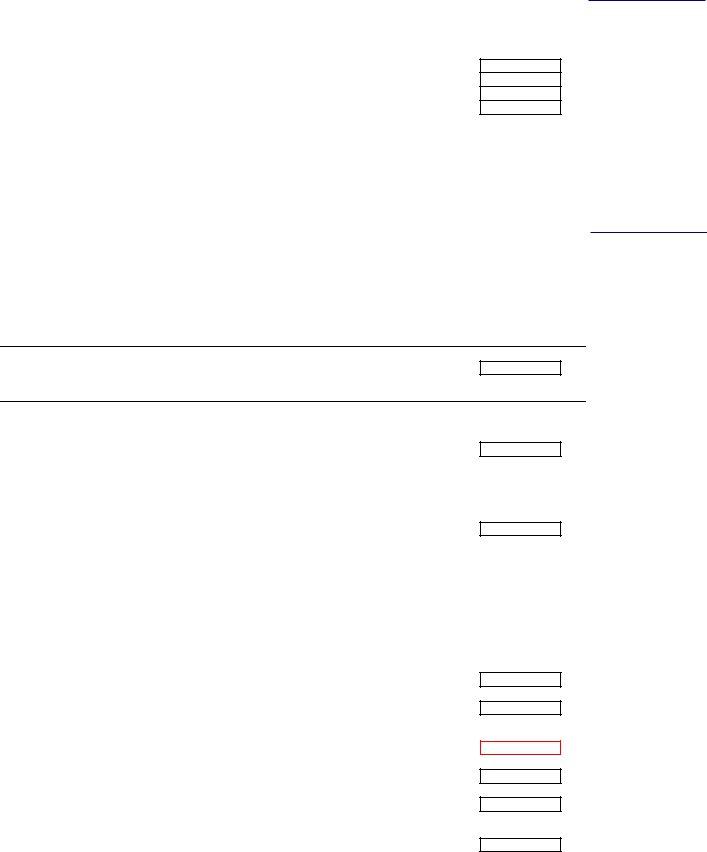

Calculating the RCP and Down Payment - Self Employed Individuals

Worksheet for Offer in Compromise - Self Employed Individuals |

Form OIC |

Must complete

Step 1: Assessing Liquid Assets - Section 3

Cash on Hand - Line 12 + Line 59

Average Bank Balance - Section 3 Line 13e + Section 11 Line 60c

Investment account balance (stocks, bonds, retirement, virtual currency) - Line 14e + Line 15d

Cash value of insurance policy - Line 16c

TOTAL LIQUID ASSETS |

|

|

|

|

|

|

|

|

A |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 2: Real Property - Section 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

||

Fair Market Value |

|

x |

80% |

- |

Loan Balance |

|

= |

Asset Value |

|

|

||

|

Section 4 Line 17c |

|

QSV |

|

|

Section 4 Line 17d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Step 3: Purchased Vehicle/ Other Licensed Asset |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

C |

|

|||

Fair Market Value |

|

x |

80% |

- |

Loan Balance |

|

= |

Asset Value |

|

|

||

|

Section 5 Line 18c |

|

QSV |

|

|

Section 5 Line 18d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Step 4: Subtracting Judgments/Liens |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Balance due |

|

D |

|

|

|

|

|

|

|

|

|

|

|

Section 7 Line 20d |

|

||

Step 5: Total Equity in Assets Held

E

Step 6: Disposable Income Analysis

Refer to

The Department allows you to discount property values to 80%. This is referred to as Quick Sale (QSV) value

Total Monthly Income (Line 36 + Line 72)

Wages, pensions, Social Security, dividends, profit from business, alimony, child support, commissions, other

Less

Total Monthly Expenses (Line 48 + Line 84)

Housing and Utilities, Vehicle ownership & operating costs, food & clothing, health & life insurance,

F

Section 10 Line 36 +

Section 12 Line 72

G

Section 10 Line 48 +

Section 12 Line 84

Disposable Monthly Income: |

|

H |

|

||

|

|

|

Step 7: Proposed Offer Amount |

|

|

**Do not enter amounts below $0.00. If equity in assets or disposable income calculations are less than $0.00, enter $0.00.

Equity in Assets Held (E)

Disposable Monthly Income (H) |

x |

60 (months) |

= |

Reasonable Collection Potential

Allowance for Accounting/Legal Fees (not to exceed

Proposed Amount Offered In Compromise (must be greater than 0)

20% Deposit (see instructions for exceptions)

I

J

H X 60

K

I + J = K

L

M

N

M x 20% = O

Form

NORTH CAROLINA DEPARTMENT OF REVENUE

Third Party Affirmation of Offered Amount

Taxpayer Name: ______________________________________

Taxpayer SSN/FEIN: __________________________________

Amount Offered: _____________________________________

I, ___________________________________________ (third party name), will provide $ ________________ (amount of offer) in certified

funds for ________________________________________ (taxpayer name) payable to the North Carolina Department of Revenue within

30 days after acceptance of the offer in compromise.

Printed Third Party Name: _____________________________________________________________________________________

Third Party Address: __________________________________________________________________________________________

Third Party Signature: ________________________________________________________________________________________

Date: ___________________________

_____________________ State

_____________________ County

“I, _________________________________________, a Notary Public for said County and State, do hereby certify

that _______________________________________ personally appeared before me this day and acknowledged the

due execution of the foregoing instrument.

Witness my hand and official seal, this the ________ day of

_____________________________, 20___.

________________________________

Notary Public

My commission expires ___________, 20 ___.