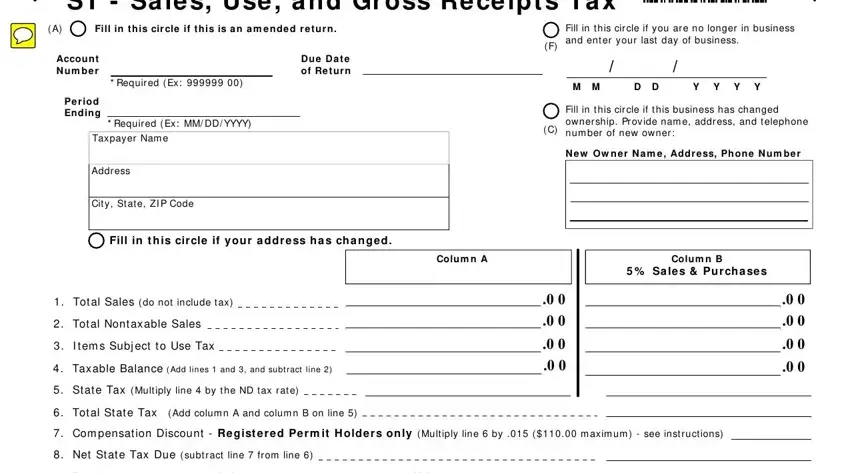

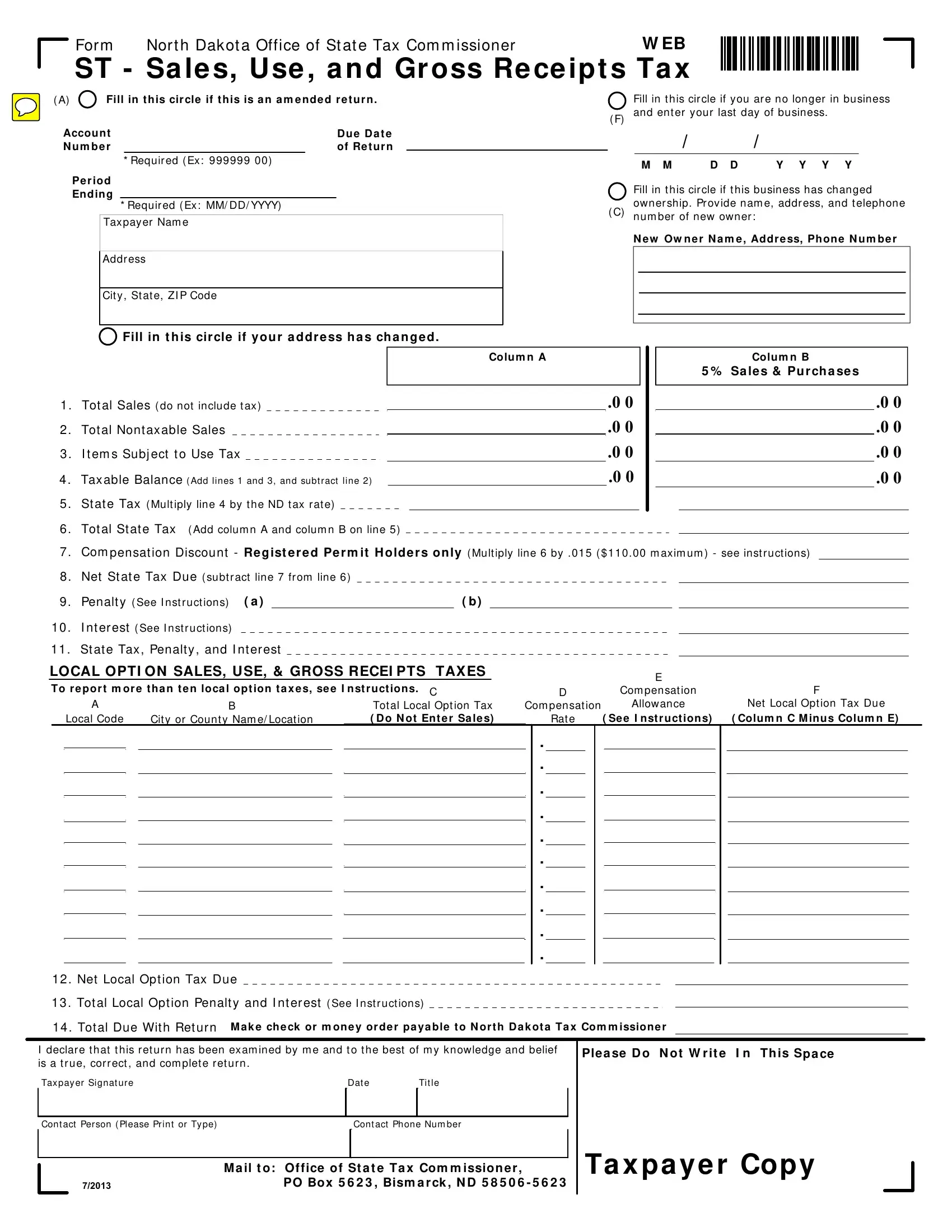

Ge ne r a l inst r uct ions

Eve r y pe r m it holde r m ust fi le a

r e t ur n for e a ch r e por t ing pe r iod e ve n if no sa le s w e r e m a de or no t a x is due .

A preprinted return, instructions, and return envelope are mailed in the final week of the reporting period to every registered permit holder that fi les a paper return. DO NOT mail a paper return if you

file electronically. For information about electronic filing see www.nd.gov/tax.

Please review the preprinted copy of your return before completing it. The original return has been preprinted specifically for your business.

All r e t ur ns a r e due t he la st da y of t he m ont h follow ing t he r e por t ing pe r iod .

To avoid penalty, the return must be postmarked by the US Postal Service on or before the due date and paid in full with a valid check or money order.

For be st r e sult s, com ple t e t he

or igina l cust om ize d for m a nd m a il it in t he r e t ur n e nve lope pr ovide d .

DO NOT send photocopies. Returns generated from a software package are acceptable if the Tax Commissioner has pre-approved the form and the required identifying information is provided.

I f you use a n a ppr ove d soft w a r e pa ck a ge t o pr e pa r e your r e t ur n it is e sse nt ia l t o e nt e r t he follow ing ide nt ifying infor m a t ion pr ope r ly:

• Account number. Enter the account number as shown on your preprinted form.

• Period ending. Enter the last day of the tax-reporting period.

• Name and Address. Enter the taxpayer name and address.

Line inst r uct ions - St a t e Ta x e s

Line 1 - Enter the total sales for the reporting period. Do not include the sales tax in this amount.

Line 2 - Enter the total nontaxable sales. Nontaxable sales include:

•Sales to federal, state, and local governments.

•Sales to nursing homes, hospitals, intermediate/basic care facilities, emergency medical services providers licensed by North Dakota Dept.

of Health, assisted living facilities licensed by the North Dakota Dept. of

For m ST

D o’s a nd D on’t s

Do

• Complete and return original forms provided by the Tax Commissioner.

• Print in blue or black ink.

• Print neatly within the designated spaces.

• Round all values in lines 1 through 4 to the nearest whole dollar.

• Enter dollars and cents in lines 5 through 14 and for all local tax data.

Don’t

• Don’t enter dollar signs ($), commas (,), or decimal points (.).

• Don’t use dashes or other symbols to indicate you do not have an entry.

• Don’t use pencil or light colored ink.

• Don’t use Column A unless reporting a state tax rate other than 5%.

Human Services, and voluntary health associations.

•Sales of food and food ingredients for humans excluding prepared food, candy, soft drinks, and dietary supplements.

•Sales of feed, seed, and chemicals used for agricultural purposes.

•Sales of used farm machinery and farm machinery repair parts used exclusively for agricultural purposes (applicable for Farm Machinery Gross Receipts Tax only); electricity; water; steam for ag processing; motor and heating fuel.

•Sales of oxygen, prescription drugs, durable medical equipment for home use, mobility-enhancing equipment, prosthetic devices, diabetic and bladder dysfunction supplies.

•Sales to Montana residents who complete a Certifi cate of Purchase on purchases of goods in excess of fifty dollars.

•Sales in interstate commerce (delivered outside North Dakota).

•Sales of nontaxable service.

•Sales for resale or processing.

•Trade-in allowance, bad debts, and returned merchandise.

Line 3 – Enter the cost of taxable goods and equipment consumed or used by you that was purchased without tax. For example, items removed from inventory and used by you.

Line 4 – Add lines 1 and 3, and subtract line 2. Enter the result on line 4.

Line 5 – Multiply line 4 by the applicable tax rate and enter the result on line 5.

Line 6 – Add column A and B on line 5 and enter a ount on line 6.

Line 7 – All registered permit holders regardless of fi ling frequency, will receive compensation on each properly filed return. The amount of compensation your company will receive is computed by multiplying the total state tax on line 6 times 1½ percent (.015) and enter the result on line 7. Effective with the

July 1, 2013 return, the compensation may not exceed $110.00 per return. Compensation may not be deducted if the return is fi led after the due date or is not paid in full. Penalty and interest will be assessed on tax due resulting from compensation deduction on a late filed or underpaid return. Please contact our offi ce if a return needs to be amended to ensure the proper vendor compensation rate is used.

Line 8 – Subtract total compensation on line 7 from line 6 and enter the result on line 8.

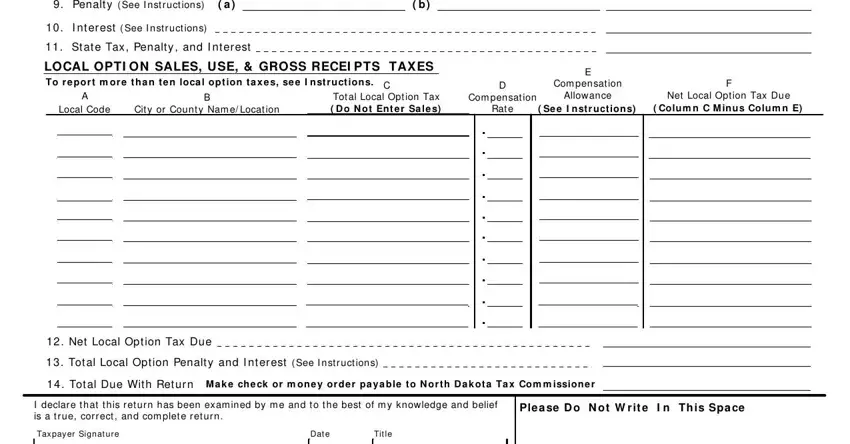

Line 9 – Calculate penalty if fi ling a late return.

•For the fi rst month the return is late, the penalty is 5 percent of the state tax on line 5 or $5, whichever is greater.

•For each additional month or fraction of a month the return is late, add an additional penalty of 5 percent of the state tax on line 5 up to a maximum of 25 percent.

If items (a) and (b) of line 9 are filled with XXXs, calculate penalty on the total state tax (line 6) and enter in line 9, column B. If items (a) and (b) are blank, calculate penalty on the state tax (line 5) separately for each column, enter the penalty amounts in items

(a)and (b), and enter the total penalty in line 9, column B.

Line 10 – If fi ling a late return, enter the amount of interest due. Interest does not apply to the fi rst month a return is late, but applies at a rate of 1 percent each month or fraction of a month the return remains late or unpaid.

Line 11 – Add lines 8, 9, and 10. Enter the result on line 11.