Any time you need to fill out form ndw r, you won't have to download any kind of software - just try using our online PDF editor. To make our editor better and more convenient to work with, we continuously implement new features, with our users' feedback in mind. All it takes is a few simple steps:

Step 1: First of all, access the tool by pressing the "Get Form Button" in the top section of this page.

Step 2: After you open the PDF editor, there'll be the form all set to be filled in. Other than filling out different blanks, you may as well perform many other things with the file, specifically putting on any words, changing the initial textual content, adding graphics, affixing your signature to the form, and much more.

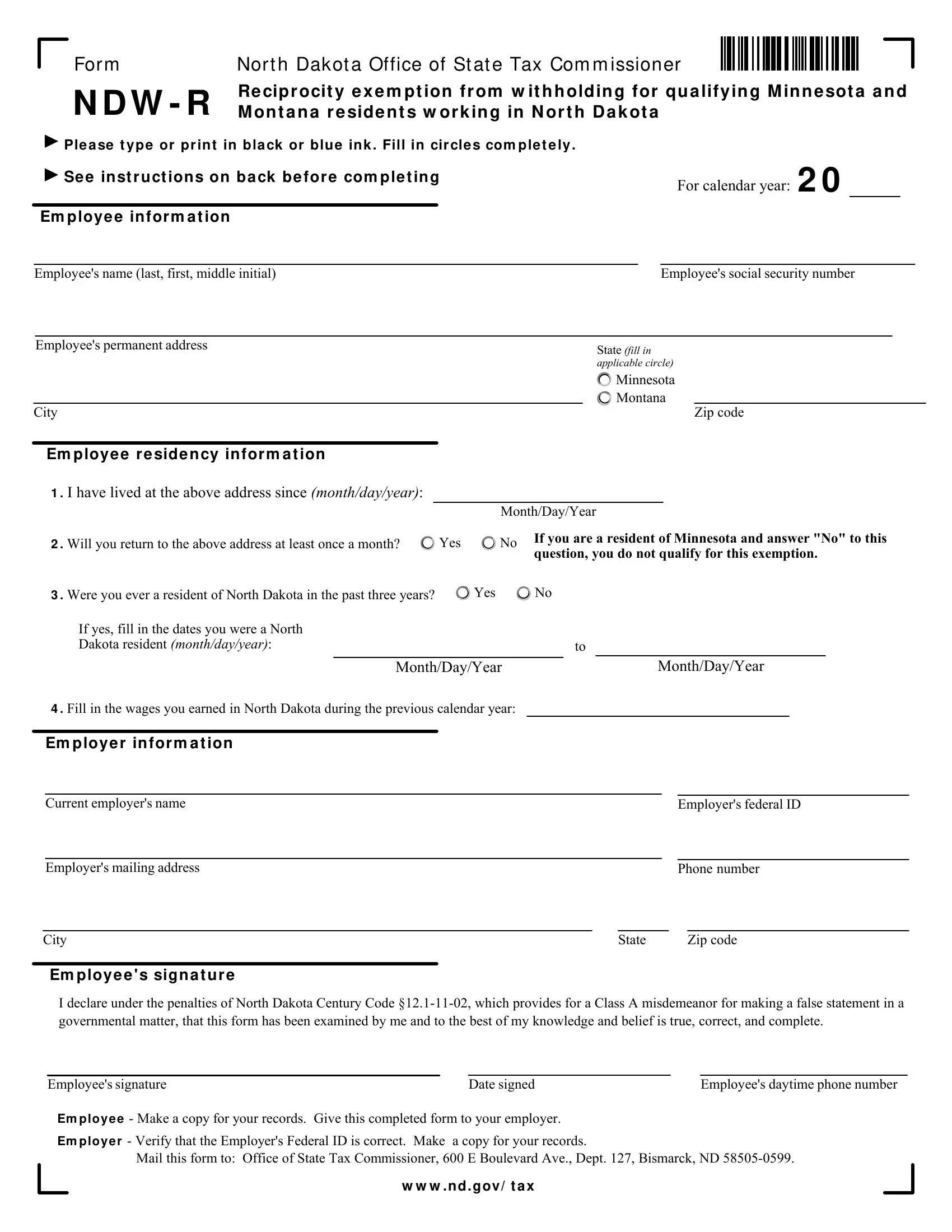

In order to fill out this PDF form, make certain you provide the right information in each and every blank field:

1. The form ndw r requires certain details to be entered. Be sure the following fields are finalized:

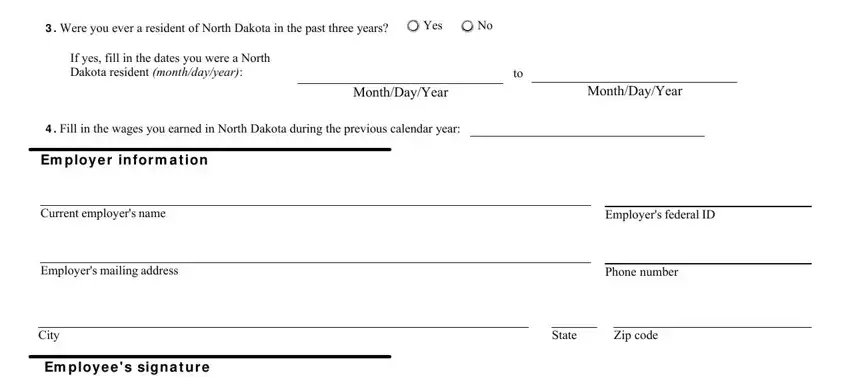

2. Soon after the previous array of blank fields is done, proceed to type in the relevant information in all these - Were you ever a resident of, Yes, If yes fill in the dates you were, MonthDayYear, MonthDayYear, Fill in the wages you earned in, Em ploye r infor m a t ion, Current employers name, Employers mailing address, City, Em ploye e s sign a t ur e, Employers federal ID, Phone number, State, and Zip code.

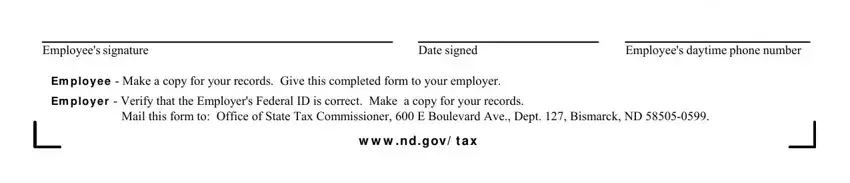

3. Completing I declare under the penalties of, Employees signature, Date signed, Employees daytime phone number, Em ploy e e Make a copy for your, Em ploy e r Verify that the, and w w w ndgov t a x is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Always be really careful when filling out Employees daytime phone number and w w w ndgov t a x, since this is the part in which many people make mistakes.

Step 3: Prior to finishing this document, it's a good idea to ensure that all form fields were filled out the right way. Once you’re satisfied with it, click on “Done." Make a 7-day free trial plan at FormsPal and obtain immediate access to form ndw r - download or edit in your FormsPal cabinet. If you use FormsPal, you can certainly complete forms without needing to worry about data breaches or data entries being shared. Our protected platform makes sure that your private information is maintained safe.