2013 can be filled in easily. Just use FormsPal PDF editing tool to get the job done in a timely fashion. The tool is consistently improved by us, acquiring new features and turning out to be much more convenient. For anyone who is looking to get started, here is what it requires:

Step 1: Access the PDF file inside our editor by clicking on the "Get Form Button" at the top of this page.

Step 2: This tool offers you the ability to modify PDF files in a range of ways. Modify it by adding customized text, correct what's already in the PDF, and place in a signature - all at your disposal!

This document will involve some specific details; in order to guarantee correctness, be sure to take into account the guidelines down below:

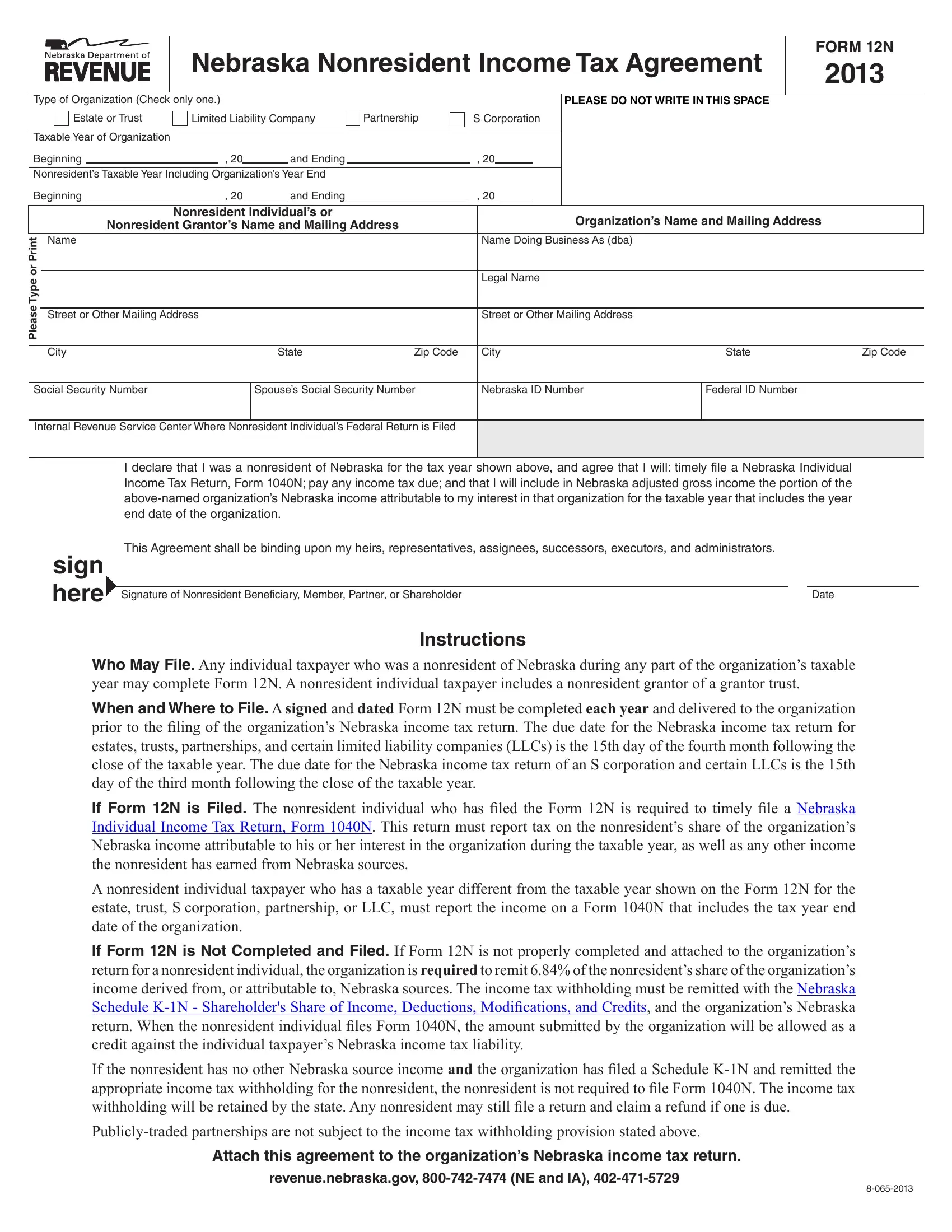

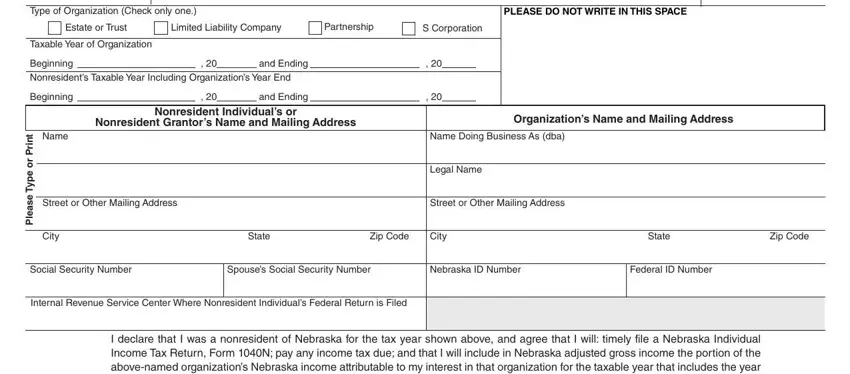

1. First of all, while completing the 2013, begin with the page that includes the subsequent blanks:

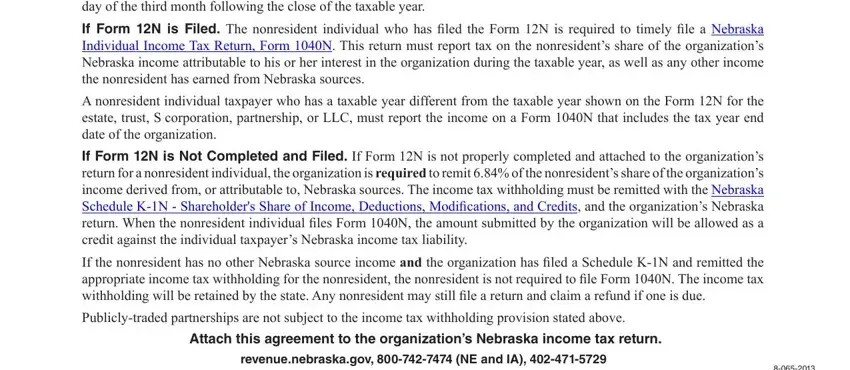

2. Now that this part is done, you're ready add the needed particulars in When and Where to File A signed, A nonresident individual taxpayer, If Form N is Not Completed and, Attach this agreement to the, and revenuenebraskagov NE and IA so you're able to proceed to the 3rd part.

As for revenuenebraskagov NE and IA and When and Where to File A signed, be certain you review things in this section. Both these are viewed as the most significant fields in this page.

Step 3: Prior to moving on, ensure that all form fields were filled out the proper way. The moment you believe it is all good, click “Done." Acquire your 2013 as soon as you sign up at FormsPal for a free trial. Easily use the form inside your personal cabinet, along with any edits and changes automatically saved! At FormsPal.com, we strive to make certain that all your details are kept protected.