Should you wish to fill out nebraska tax application form 20, there's no need to install any programs - just try our PDF tool. In order to make our editor better and less complicated to work with, we consistently come up with new features, with our users' feedback in mind. With a few basic steps, it is possible to begin your PDF journey:

Step 1: Hit the "Get Form" button above. It will open up our tool so that you could begin filling out your form.

Step 2: With our handy PDF editing tool, you can actually accomplish more than simply complete blank form fields. Edit away and make your docs appear high-quality with custom text added in, or modify the original content to excellence - all comes along with an ability to incorporate almost any pictures and sign the file off.

This PDF doc requires some specific details; in order to ensure consistency, please be sure to consider the suggestions further down:

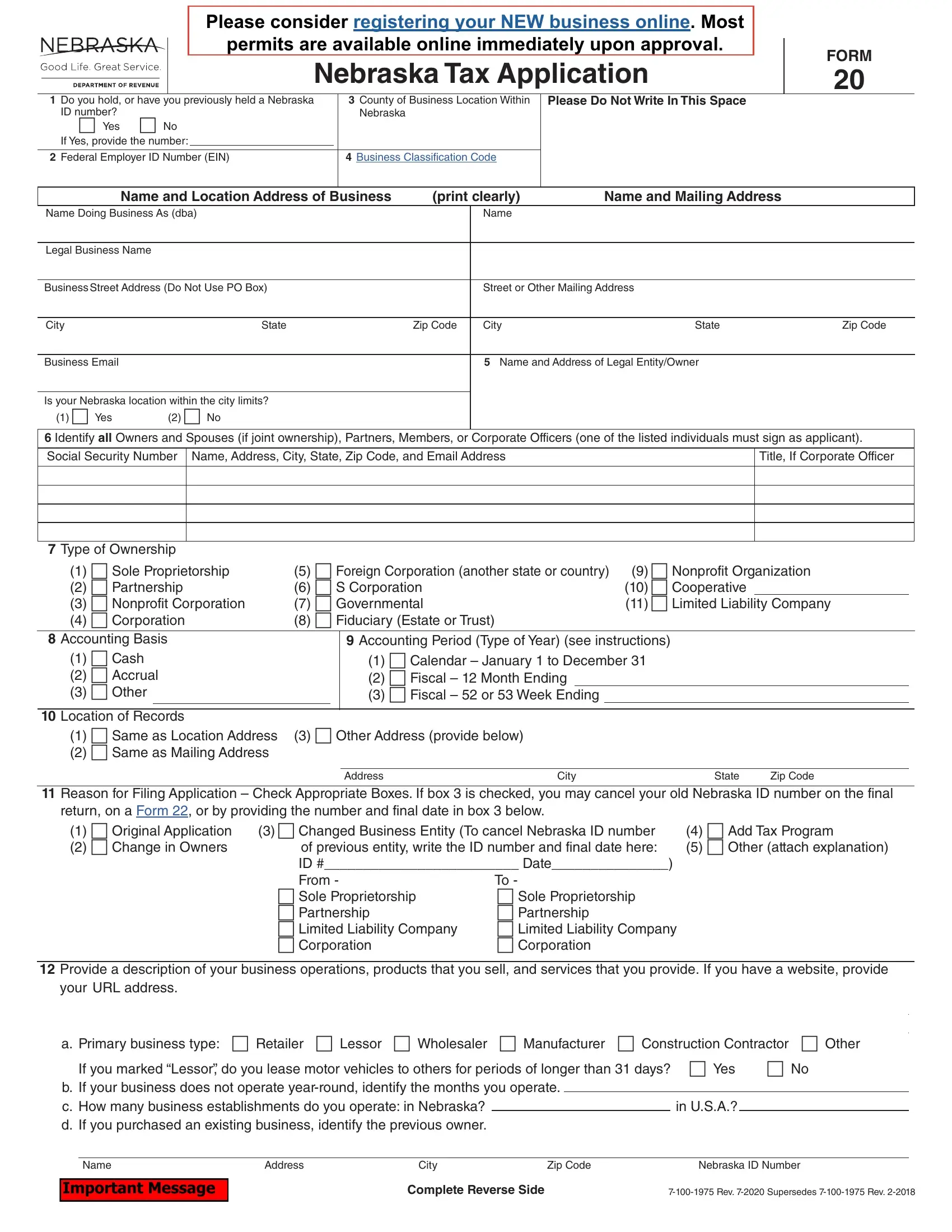

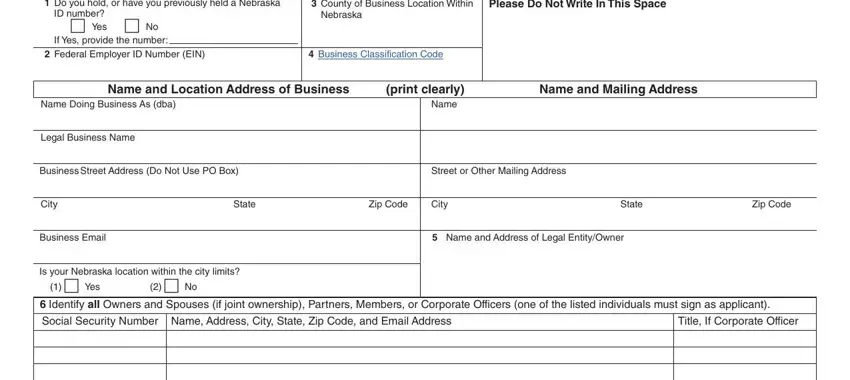

1. It is crucial to complete the nebraska tax application form 20 correctly, therefore be attentive while filling out the segments that contain these fields:

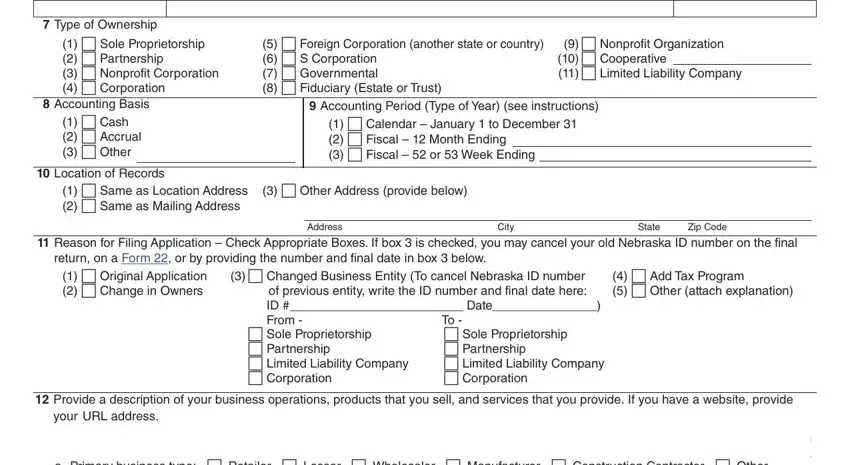

2. Once your current task is complete, take the next step – fill out all of these fields - Type of Ownership, c Sole Proprietorship c, c Foreign Corporation another, c Nonprofit Organization c, Accounting Basis, c Cash c Accrual c Other, Location of Records, Accounting Period Type of Year, c Calendar January to December, c Same as Location Address c, c Other Address provide below, Reason for Filing Application, return on a Form or by providing, Address, and City with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Always be very attentive while completing return on a Form or by providing and c Nonprofit Organization c, because this is where most people make some mistakes.

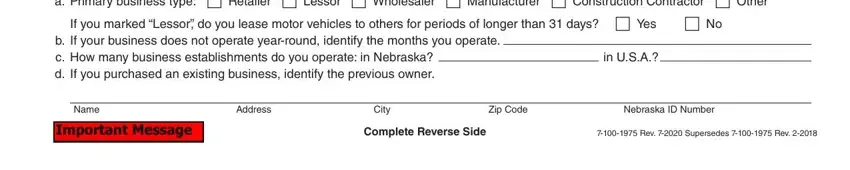

3. Within this stage, look at a Primary business type c Retailer, If you marked Lessor do you lease, b If your business does not, in USA, Name, Address, City, Zip Code, Nebraska ID Number, Important Message, Complete Reverse Side, and Rev Supersedes Rev. Each of these will need to be filled out with greatest precision.

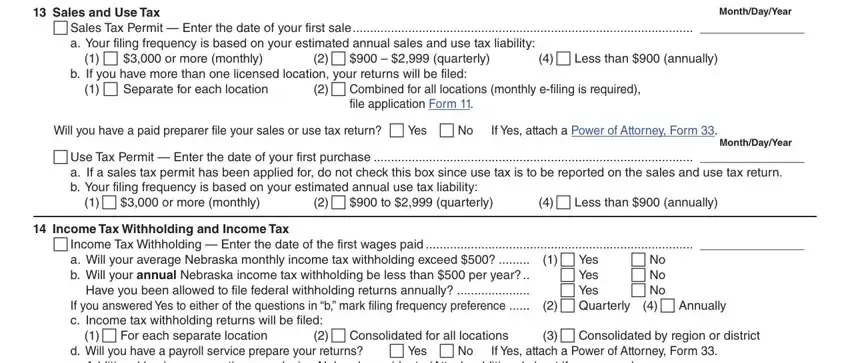

4. To go onward, the following step requires filling in several form blanks. Examples include Sales and Use Tax, MonthDayYear, c Sales Tax Permit Enter the date, a Your filing frequency is based, c or more monthly, c quarterly, c Less than annually, b If you have more than one, c Separate for each location, c Combined for all locations, file application Form, Will you have a paid preparer file, If Yes attach a Power of Attorney, c Use Tax Permit Enter the date, and a If a sales tax permit has been, which are vital to continuing with this form.

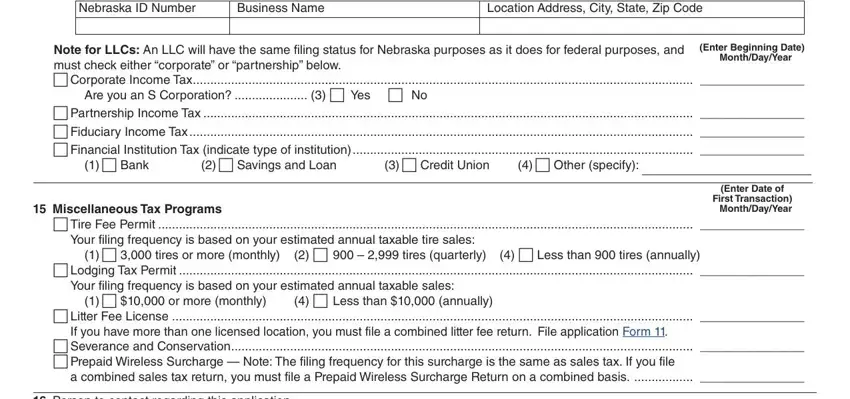

5. To finish your form, this last area has a couple of extra blanks. Typing in d Will you have a payroll service, Nebraska ID Number, Business Name, Location Address City State Zip, Note for LLCs An LLC will have the, MonthDayYear, Enter Beginning Date, c Bank, c Savings and Loan, c Credit Union, c Other specify, Miscellaneous Tax Programs c Tire, First Transaction MonthDayYear, Your filing frequency is based on, and c tires or more monthly will certainly wrap up everything and you're going to be done very quickly!

Step 3: Glance through the details you've inserted in the blanks and click the "Done" button. Go for a 7-day free trial account with us and acquire direct access to nebraska tax application form 20 - download or modify inside your FormsPal account. FormsPal ensures your information privacy via a secure method that never saves or distributes any kind of sensitive information involved. Rest assured knowing your paperwork are kept protected when you use our tools!