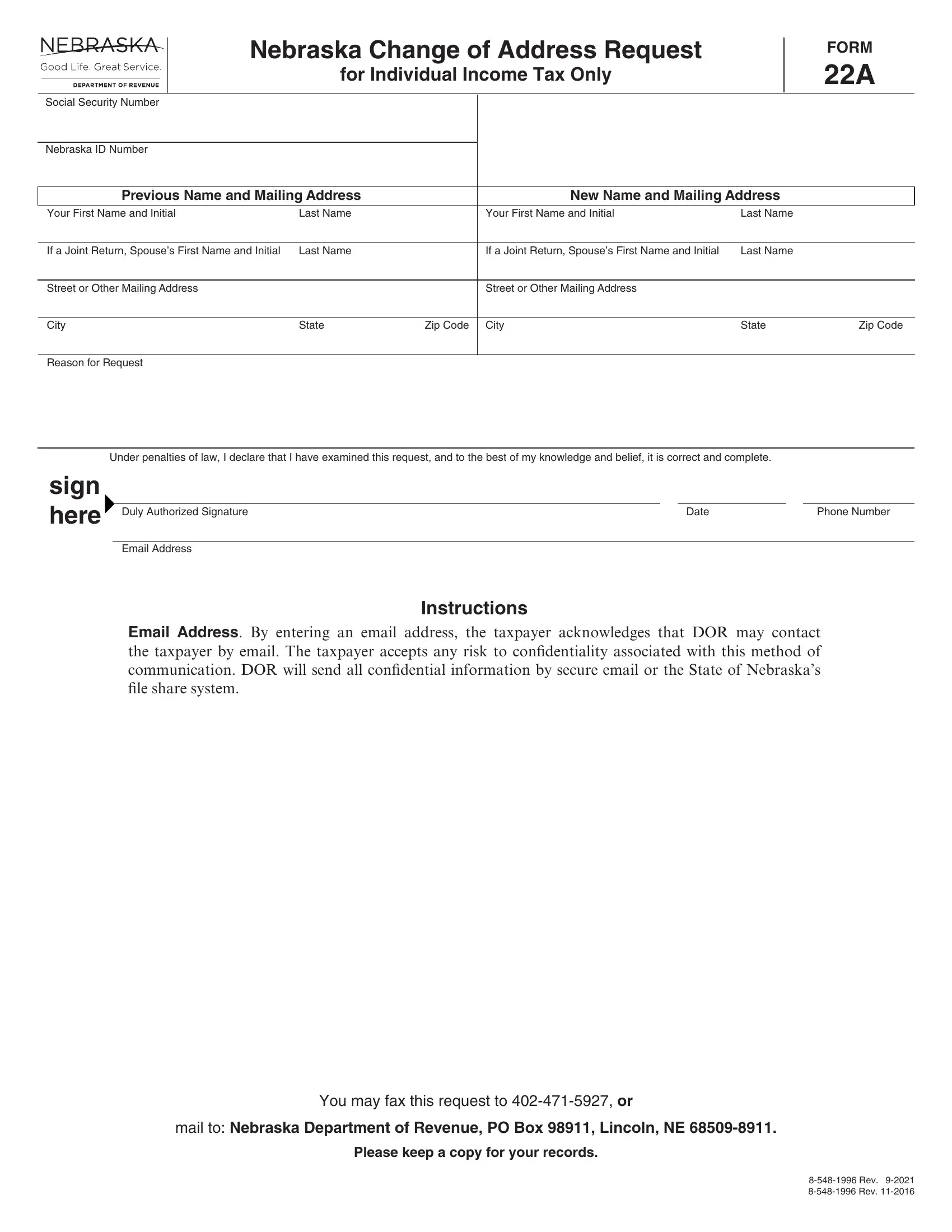

Should you would like to fill out Nebraska Form 22A, you don't have to download any programs - simply try our online tool. We are aimed at giving you the best possible experience with our tool by continuously releasing new capabilities and upgrades. With all of these updates, using our tool becomes better than ever! Here is what you would have to do to get going:

Step 1: Open the PDF in our tool by clicking the "Get Form Button" above on this page.

Step 2: With the help of this advanced PDF tool, you may do more than merely fill out blanks. Try all the features and make your docs seem great with customized textual content added in, or optimize the file's original content to perfection - all comes along with an ability to insert any graphics and sign it off.

It is simple to finish the form following this helpful guide! Here is what you need to do:

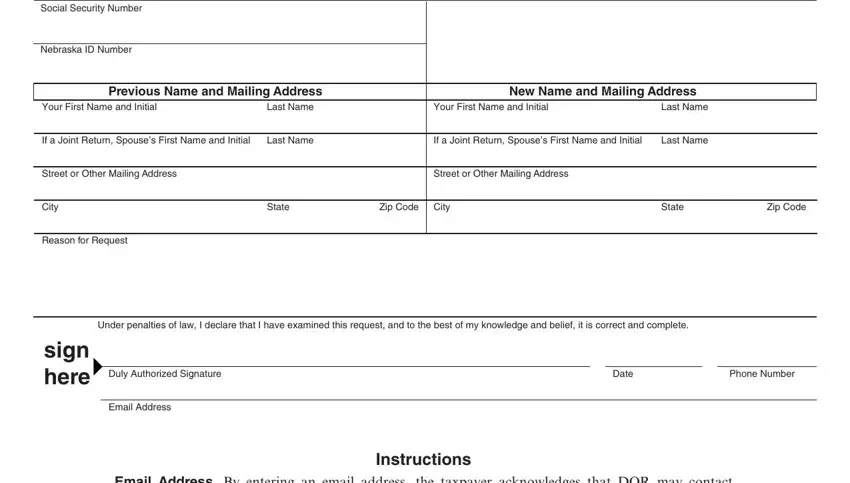

1. When filling out the Nebraska Form 22A, ensure to complete all of the needed blanks within the relevant section. It will help to hasten the process, enabling your information to be processed quickly and correctly.

Step 3: When you have glanced through the details in the fields, press "Done" to finalize your FormsPal process. Right after starting afree trial account at FormsPal, it will be possible to download Nebraska Form 22A or send it through email promptly. The document will also be accessible through your personal account menu with your every modification. FormsPal is invested in the confidentiality of our users; we always make sure that all personal information put into our editor continues to be protected.