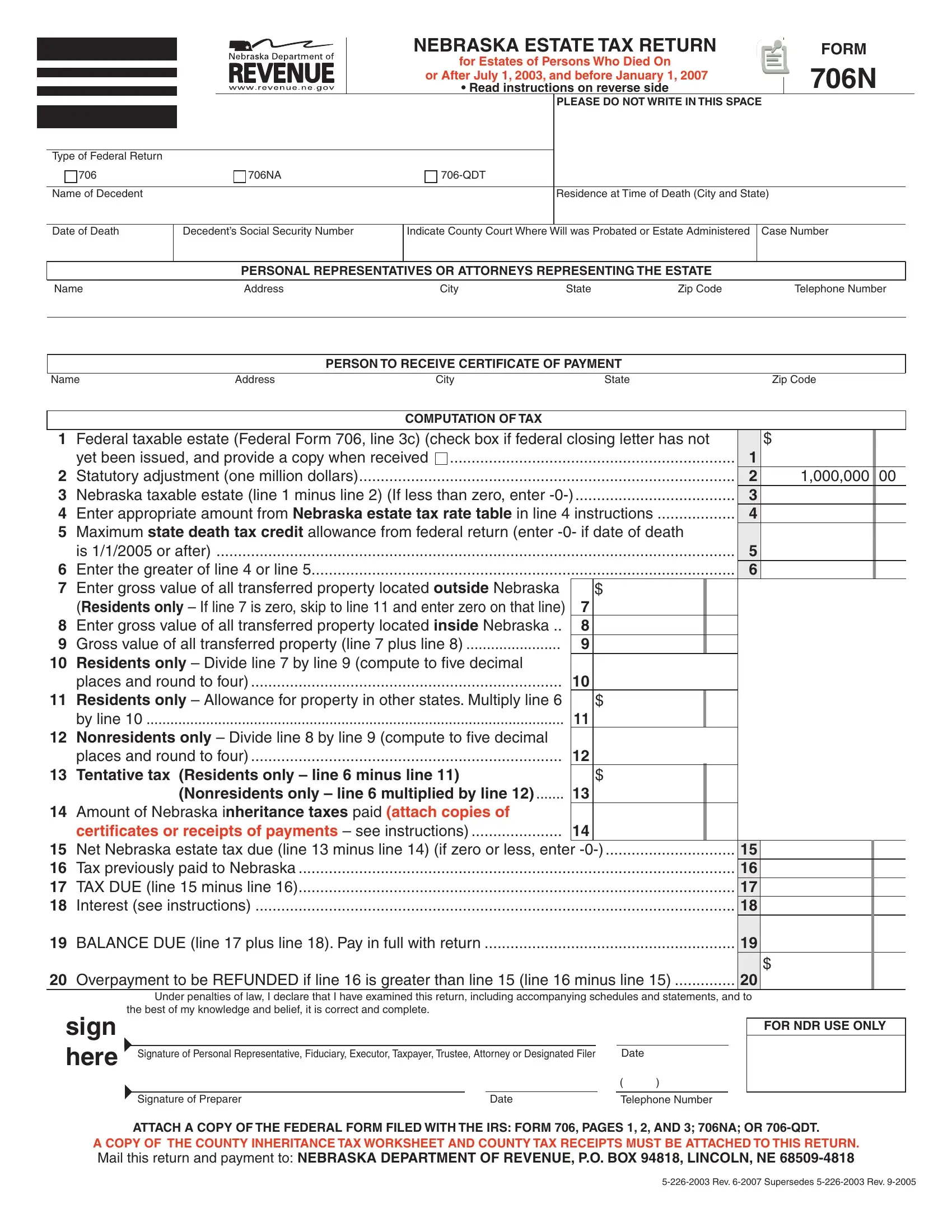

Generation-skipping transfers due to taxable distributions or taxable terminations made on or after July 1, 2003, and before January 1, 2007 should be reported using the Nebraska Generation-Skipping Transfer Tax Return, Form 706N-GST. Transfers made on or after January 1, 2003, but before July 1, 2003, should use Nebraska Form 706N-GST-T. Transfers made before January 1, 2003, should use Nebraska Form 706N-GST-1.

WHENANDWHERETOFILE.This return is due 12 months after the date of death of the decedent. This return is to be filed with the Nebraska Department of Revenue, P.O. Box 94818, Lincoln, Nebraska 68509-4818.

HAVEQUESTIONS?Check our Web site: www.revenue.ne.gov or call 1-800-742-7474 (toll free in Nebraska and Iowa) or 1-402-471-5729.

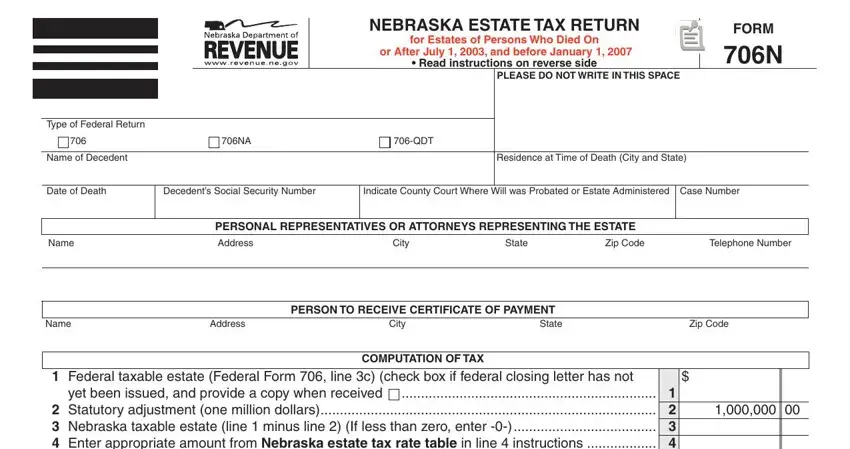

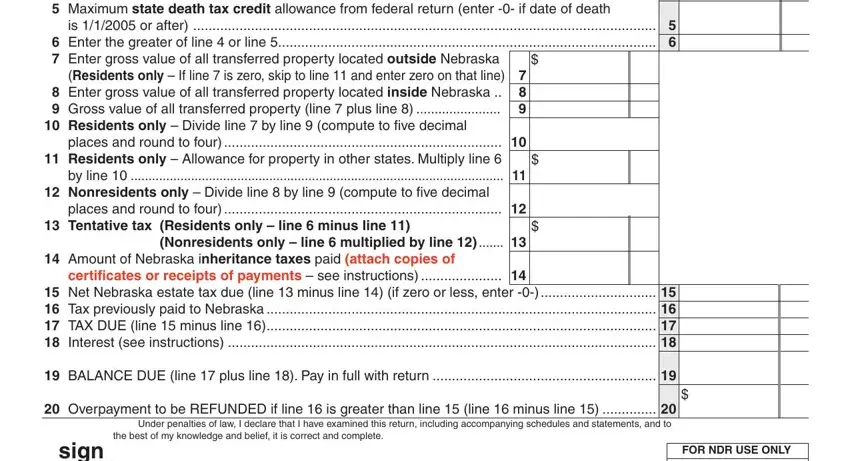

AMOUNTOFTAX.The amount of estate tax due the state of Nebraska begins with the greater of two amounts. The first amount is the maxi- mum state tax credit allowance upon the tax imposed by Chapter 11 of the Internal Revenue Code. (Note: This allowance has been completely phased out on the federal return for decedents with dates of death after December 31, 2004.) The second amount is the Nebraska taxable estate (federal taxable estate [Federal Form 706 line 3c] minus one million dollars) multiplied by the tax rates in the Nebraska estate tax table — see line 4 instructions. Certain adjustments are allowed as reflected in lines 7 through 14. The net Nebraska estate tax due as a result of these calcula- tions is entered on line 15.

INTEREST.If the tax due as computed on line 15 of this return is not paid by the prescribed due date, interest on the unpaid tax will be assessed at the statutory rate from the due date until payment is received. The rate of interest may be adjusted on January 1 of every odd-numbered year.

FEDERALRETURNS. Attach to this return a copy of Federal Form 706 (pages 1, 2, and 3), 706NA, or 706-QDT that was filed with the Internal Revenue Service. If a federal return is not required to be filed, a pro forma Federal Form 706 (pages 1, 2, and 3) should be prepared and filed with the Nebraska return.

FEDERAL CLOSING LETTER. If a federal return is required to be filed attach a copy of the Internal Revenue Service or federal court determination of estate tax, i.e., the federal closing letter which sets out the federal estate tax liability. If the determination is unavailable, the box on line 1 must be checked. When the closing letter is issued by the Internal Revenue Service or the federal court, a copy of the determination must be filed with the Nebraska Department of Revenue by the personal representative within ten days of receipt.

CERTIFICATEEVIDENCINGPAYMENT.A certificate evidencing payment of Nebraska estate tax will be issued after the Nebraska Estate Tax Return has been filed and the tax paid. The Nebraska Estate Tax Return has not been properly filed until the federal closing letter (if any) and certificates or receipts evidencing tax payments to other states or political subdivisions have been provided.

INHERITANCETAXWORKSHEET.Attach a copy of the inheritance tax worksheet filed with the appropriate Nebraska county court.

AMENDEDRETURN.If the amount of Nebraska tax due is affected by a change made by the Internal Revenue Service or otherwise by the filing of an amended federal return, then an amended Nebraska return must be filed. Complete Form 706N, mark it “Amended” at the top of the return, and attach a copy of the dated notice of change from the Internal Revenue Service or a copy of the amended federal return.

REFUNDOFOVERPAYMENT.An overpayment of tax to the state of Nebraska will be refunded upon the filing of an amended return. The claim for refund must be filed with the department within four years after the date of overpayment, or within one year of a change in the amount of federal tax due, whichever is later. The party making such overpayment

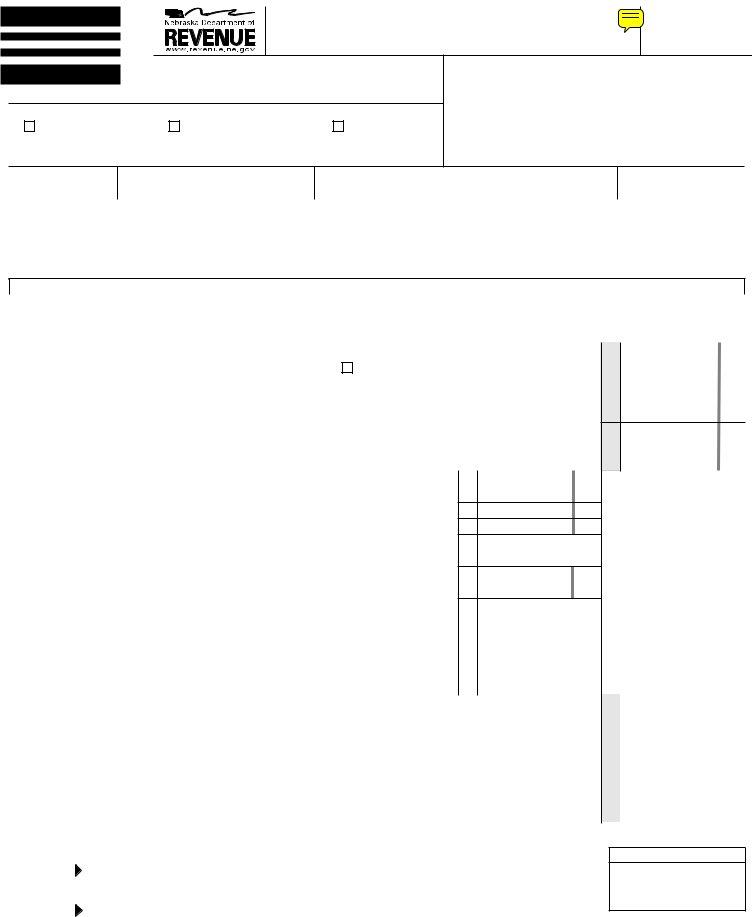

|

Nebraskataxableestate |

|

|

|

OfExcess |

|

fromline3 |

|

|

|

|

|

Over |

|

Atleast |

Butlessthan |

|

Tax= |

+ % |

|

|

$ |

0 |

$ |

100,000 |

$ |

0 |

5.6 |

$ |

0 |

|

100,000 |

|

500,000 |

|

5,600 |

6.4 |

|

100,000 |

|

500,000 |

|

1,000,000 |

|

31,200 |

7.2 |

|

500,000 |

|

1,000,000 |

|

1,500,000 |

|

67,200 |

8.0 |

|

1,000,000 |

|

1,500,000 |

|

2,000,000 |

|

107,200 |

8.8 |

|

1,500,000 |

|

2,000,000 |

|

2,500,000 |

|

151,200 |

9.6 |

|

2,000,000 |

|

2,500,000 |

|

3,000,000 |

|

199,200 |

10.4 |

|

2,500,000 |

|

3,000,000 |

|

3,500,000 |

|

251,200 |

11.2 |

|

3,000,000 |

|

3,500,000 |

|

4,000,000 |

|

307,200 |

12.0 |

|

3,500,000 |

|

4,000,000 |

|

5,000,000 |

|

367,200 |

12.8 |

|

4,000,000 |

|

5,000,000 |

|

6,000,000 |

|

495,200 |

13.6 |

|

5,000,000 |

|

6,000,000 |

|

7,000,000 |

|

631,200 |

14.4 |

|

6,000,000 |

|

7,000,000 |

|

8,000,000 |

|

775,200 |

15.2 |

|

7,000,000 |

|

8,000,000 |

|

9,000,000 |

|

927,200 |

16.0 |

|

8,000,000 |

|

9,000,000 |

|

|

1,087,200 |

16.8 |

|

9,000,000 |

LINE7.Enter the gross value of the transferred property located outside Nebraska.

For a resident decedent, this is the value of real estate and tangible personal property located outside of Nebraska.

For a nonresident decedent, this is the entire value of his or her estate, less the value of any interest in Nebraska real estate and tangible personal property located within Nebraska. Intangibles held in Nebraska at the time of a nonresident’s death are to be valued at their fair market value and included on line 7.

Residentsonly – If the gross value of the transferred property located outside Nebraska is zero, skip to line 11 and enter zero on that line. If line 7 is greater than zero, however, complete lines 8 through 10 before proceeding to line 11. Use line 9 instructions for assistance in determining the appropriate gross value amounts.

LINE8. Enter the gross value of all transferred property within Nebraska. This includes a nonresident decedent’s interest in Nebraska real estate and tangible personal property.

LINE9.Enter the gross value of all transferred property. This amount is the total gross estate reported on the federal return. This gross amount is prior to any adjustments for expenses or any other allowable deductions used in computing the taxable estate.

LINE14.Attach a copy of the county inheritance tax worksheet and copies of receipts or certificates evidencing payment of inheritance tax.

LINE 19. Attach a check or money order payable to the Nebraska Department of Revenue for the sum reported on line 19.

SIGNATURES.A personal representative, fiduciary, executor, taxpayer, trustee, attorney, or designated filer of the estate must sign this return. An attorney must indicate the state wherein currently qualified to practice law. If another person is authorized to sign this return, there must be a power of attorney on file with the department.

Any person who is paid for preparing this return must also sign the return as preparer.