Working with PDF files online is always surprisingly easy using our PDF editor. Anyone can fill out dwss nv gov energy assistance here within minutes. To have our tool on the forefront of efficiency, we aim to put into operation user-driven features and improvements on a regular basis. We are routinely happy to receive suggestions - join us in revampimg how you work with PDF documents. To get the ball rolling, go through these basic steps:

Step 1: Click the "Get Form" button in the top area of this page to get into our editor.

Step 2: The editor lets you change PDF forms in a range of ways. Modify it with personalized text, correct what is originally in the file, and place in a signature - all possible in no time!

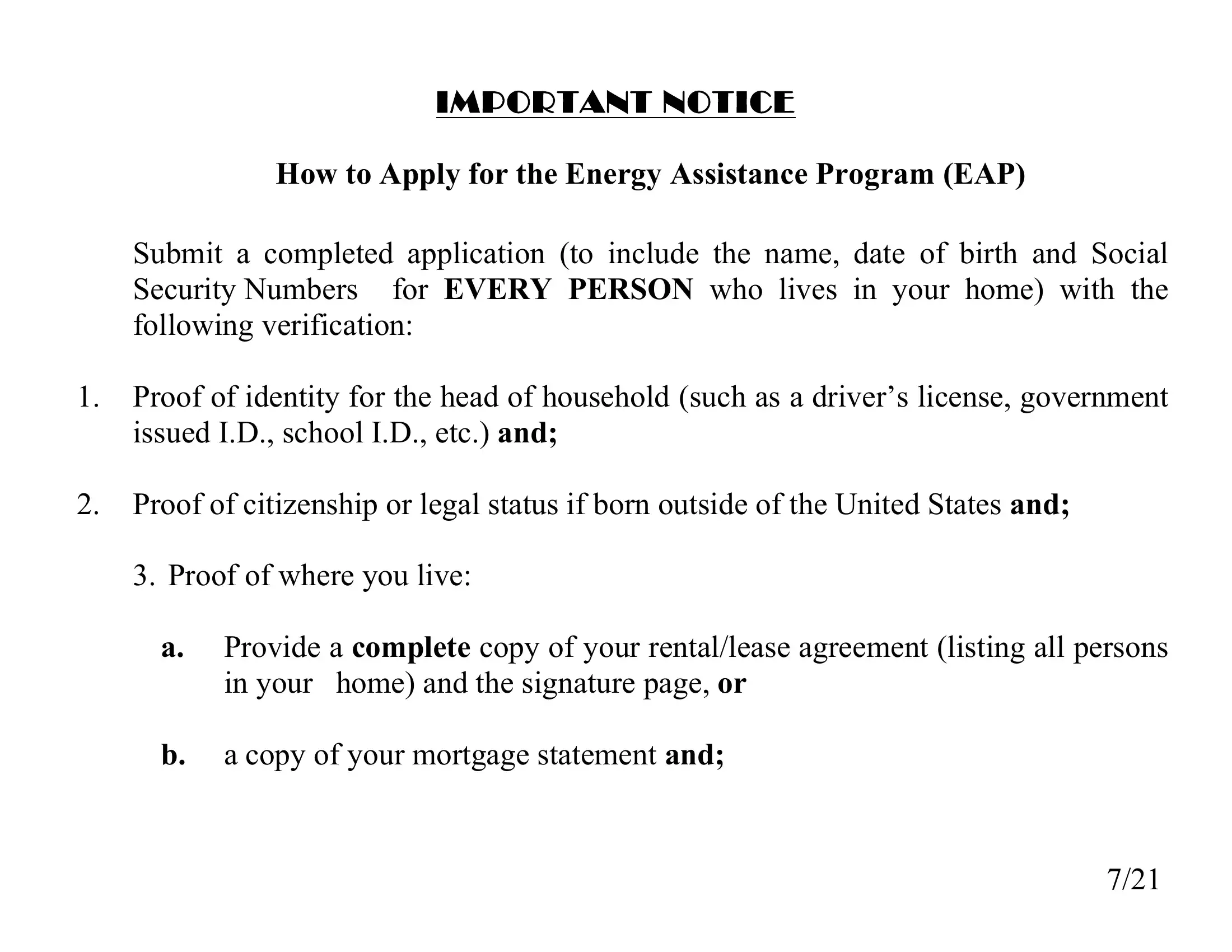

It will be simple to complete the form using out helpful tutorial! Here is what you should do:

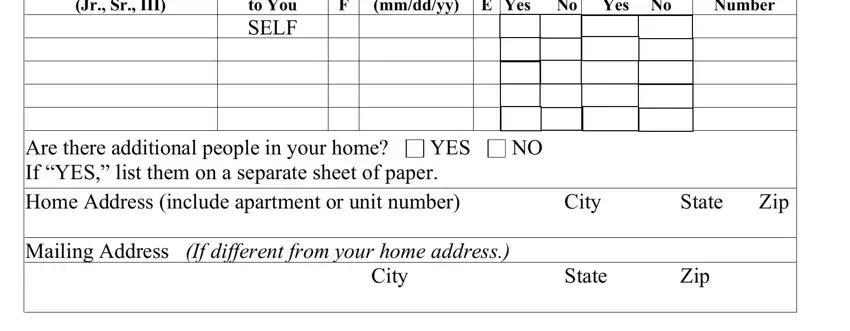

1. First, while filling out the dwss nv gov energy assistance, start in the part containing following fields:

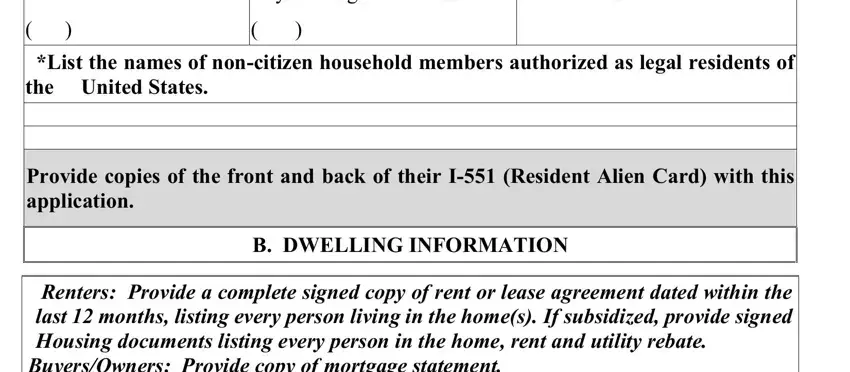

2. Right after finishing the previous part, go to the subsequent step and complete all required details in these blanks - Home Phone, DayMessageCell Phone, Email Address, List the names of noncitizen, the United States, Provide copies of the front and, B DWELLING INFORMATION, and Renters Provide a complete signed.

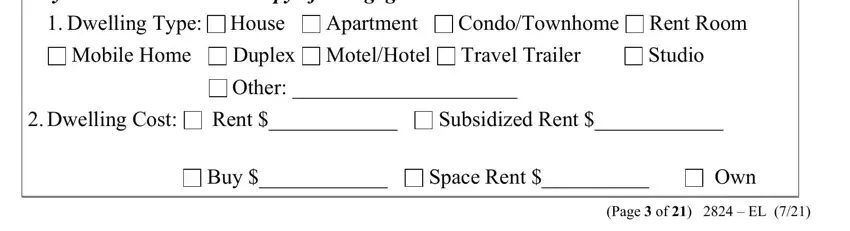

3. Through this part, have a look at Renters Provide a complete signed, Dwelling Type, House, Apartment, CondoTownhome, Rent Room, Mobile Home, Duplex, MotelHotel, Travel Trailer, Studio, Dwelling Cost, Rent, Subsidized Rent, and Other. All these need to be filled out with greatest accuracy.

Be really careful while filling out Rent and Rent Room, since this is where most people make errors.

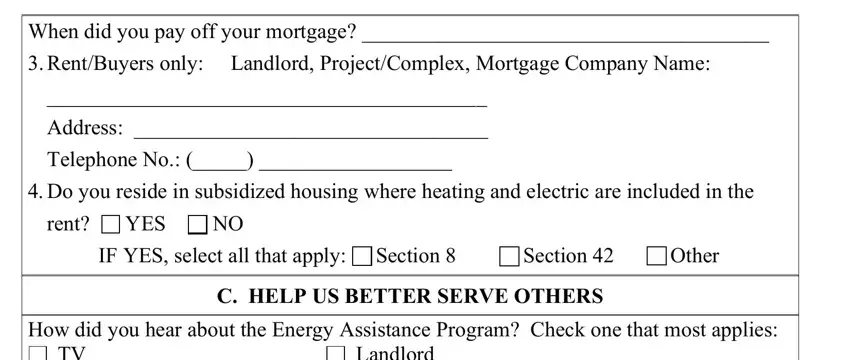

4. This subsection arrives with the next few empty form fields to type in your particulars in: When did you pay off your mortgage, RentBuyers only Landlord, Address, Telephone No, Do you reside in subsidized, rent, YES, IF YES select all that apply, Section, Section, Other, C HELP US BETTER SERVE OTHERS, How did you hear about the Energy, TV Radio Print Media Social, and Landlord Previous EAP Participant.

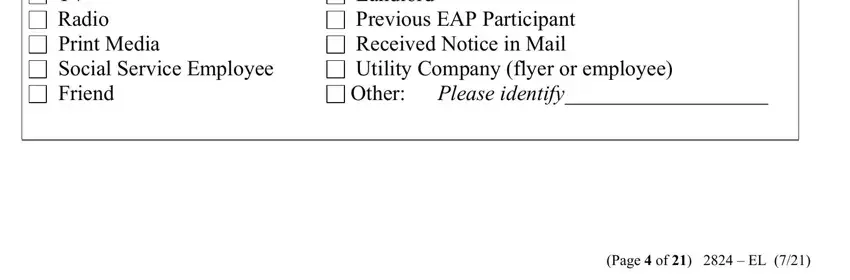

5. To wrap up your form, this last subsection features some extra blank fields. Entering TV Radio Print Media Social, Landlord Previous EAP Participant, and Page of EL will finalize the process and you'll definitely be done quickly!

Step 3: Proofread all the details you've inserted in the form fields and then click the "Done" button. Join FormsPal right now and immediately use dwss nv gov energy assistance, prepared for downloading. All modifications you make are preserved , so that you can customize the file at a later time if needed. FormsPal is committed to the confidentiality of our users; we make sure that all personal data handled by our editor remains protected.