|

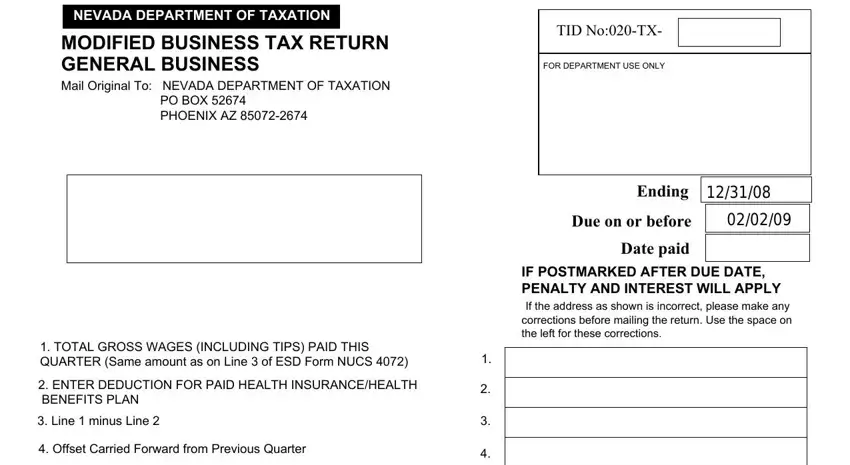

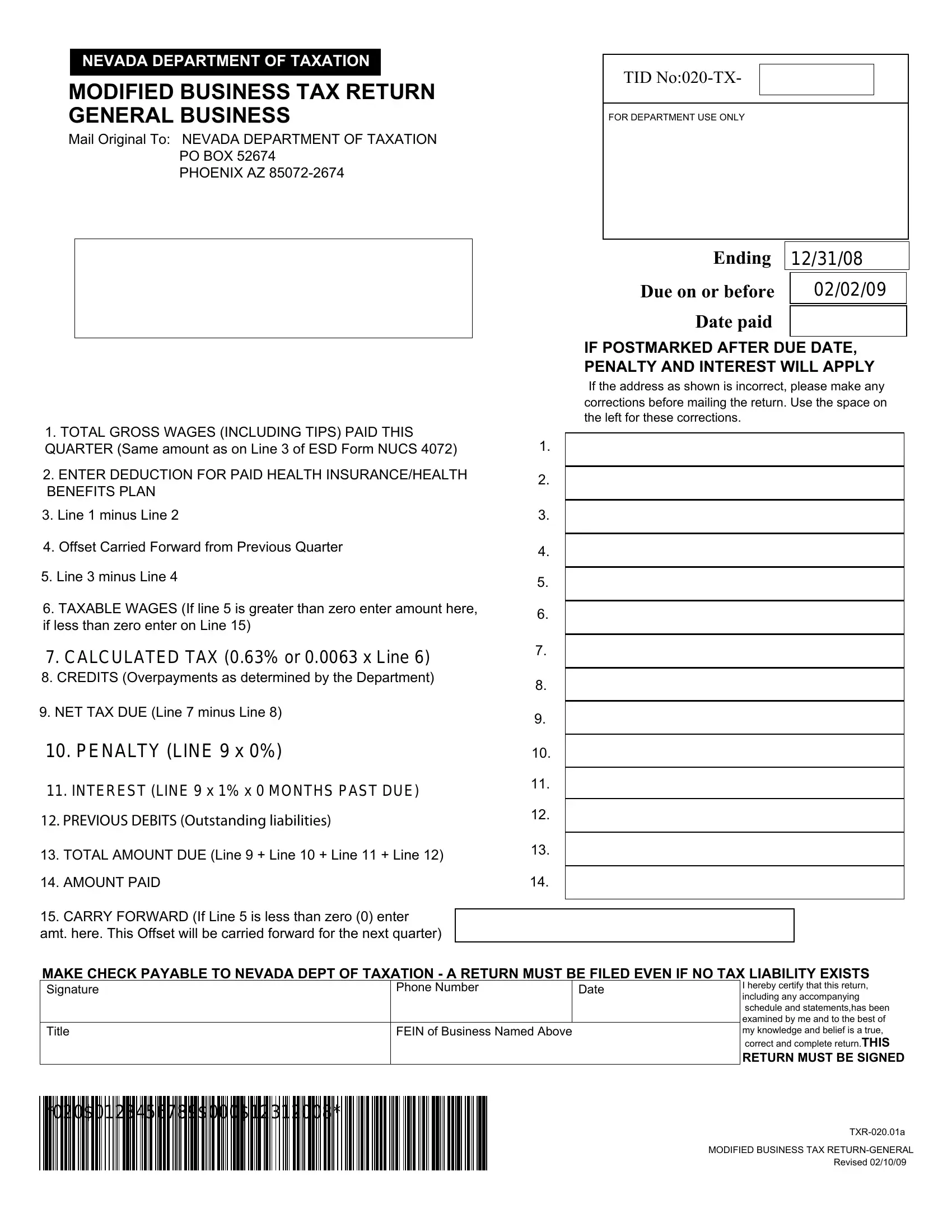

NEVADA DEPARTMENT OF TAXATION |

|

|

|

|

|

|

|

|

|

|

|

MODIFIED BUSINESS TAX RETURN |

|

TID No:020-TX |

|

|

|

GENERAL BUSINESS (Revised 2016) |

|

FOR DEPARTMENT USE ONLY |

|

|

Mail Original To: NEVADA DEPARTMENT OF TAXATION |

|

|

|

|

|

|

|

P O BOX 7165 |

|

|

|

|

|

|

|

|

|

|

|

SAN FRANCISCO, CA 94120-7 |

|

|

|

|

|

|

|

|

|

|

|

To email, save this form to your computer and email the attachment to: |

|

PERIOD ENDING: |

|

|

|

|

|

|

DUE BY: |

|

|

|

nevadaolt@tax.state.nv.us with the subject of 'Modified Business Tax Return' |

|

|

|

|

|

|

Use this form for the quarterly period beginning July 1, 2016 |

|

|

DATE PAID: |

|

|

|

|

|

IF POSTMARKED AFTER DUE DATE, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PENALTY AND INTEREST WILL APPLY |

|

|

|

|

|

|

|

|

|

|

1. |

TOTAL GROSS WAGES (INCLUDING TIPS) PAID THIS QUARTER |

|

1. |

|

|

|

|

2a. |

ENTER DEDUCTION FOR PAID HEALTH INSURANCE/HEALTH BENEFITS PLAN |

|

2a. |

|

|

|

|

2b. |

ENTER DEDUCTION FOR QUALIFIED VETERANS WAGES (See instructions) |

|

2b. |

|

|

|

|

3. |

LINE 1 MINUS LINE 2a AND LINE 2b |

|

|

|

|

|

3. |

|

|

|

|

4. |

OFFSET CARRIED FORWARD FROM PREVIOUS QUARTER |

|

4. |

|

|

|

|

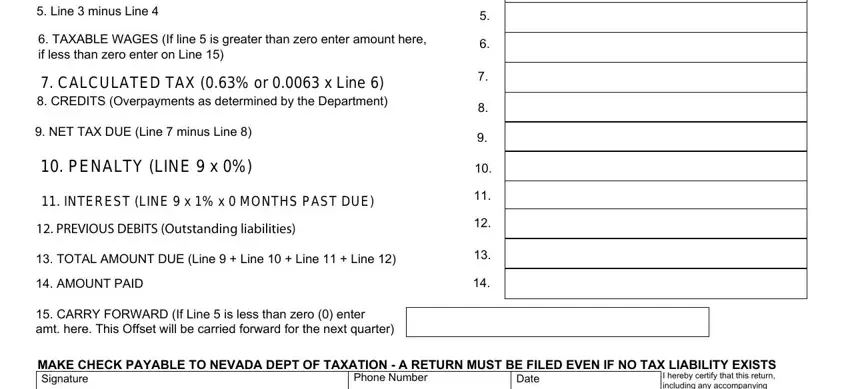

5. |

LINE 3 MINUS LINE 4 |

|

|

|

|

|

5. |

|

|

|

|

6. |

TAXABLE WAGES (If Line 5 is greater than zero (0) enter amount here, if less than zero |

|

|

|

|

|

|

|

|

|

|

|

|

enter on line 18) |

|

|

|

|

|

6. |

|

|

|

|

7. |

ENTER THRESHOLD OF $50,000 |

|

|

|

|

|

7. |

|

|

|

|

8. |

TAXABLE WAGES (Line 5 minus Line 7, but not less than $0 |

|

8. |

|

|

|

|

9. |

CALCULATED TAX (Line 8 x 0.01475) |

|

|

|

|

|

9. |

|

|

|

|

10. COMMERCE TAX CREDIT |

|

|

|

|

|

10. |

|

|

|

|

11. |

OTHER CREDITS (Overpayments or other approved credits, see instructions) |

|

11. |

|

|

|

|

12. |

NET TAX DUE (Line 9 minus Line 10 minus Line11) |

|

12. |

|

|

|

|

13. |

PENALTY (LINE 12 x 0%) See Instructions |

0 |

|

|

|

|

13. |

|

|

|

|

14. |

INTEREST (See instructions for current rate and calculation) |

|

14. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

PREVIOUS DEBITS (Outstanding liabilities) |

|

|

|

|

|

15. |

|

|

|

|

16. |

TOTAL AMOUNT DUE (Line 12 + Line 13 + Line 14 + Line 15) |

|

16. |

|

|

|

|

17. |

AMOUNT PAID |

|

|

|

|

|

17. |

|

|

|

|

18. |

CARRY FORWARD (If Line 5 is less than zero (0) enter amount |

|

18. |

|

|

|

|

|

here. This offset will be carried forward for the next quarter) |

|

|

|

|

|

|

MAKE CHECK PAYABLE TO NEVADA DEPT OF TAXATION - A RETURN MUST BE FILED EVEN IF NO LIABILITY EXISTS |

Signature |

|

|

Phone Number |

Date |

|

|

I hereby certify this return, including any |

|

|

|

|

|

|

|

|

|

accompanying schedules and statements have |

|

|

|

|

|

|

|

|

|

been examined by me and to the best of my |

Title |

|

|

|

FEIN of Business Name Above |

|

|

|

|

|

|

|

|

|

knowledge and belief is true, correct and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

complete. |

|

THIS RETURN MUST |

BE SIGNED |

|

|

|

|

|

|

*020$$000$101900* |

|

|

101900 |

|

|

|

|

|

|

|

|

TXR-020.05

MODIFIED BUSINESS TAX RETURN-GENERAL Revised 06/21/16

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY

(Financial Institutions need to use the form developed specifically for them, TXR-021.04)

IF YOU COMPLETE THIS FORM ONLINE THE CALCULATIONS WILL BE MADE FOR YOU

Line 1. Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter Line 2a. Employer paid health care costs, paid this calendar quarter, as described in NRS 363B.115.

Line 2b. Enter deduction for qualified Veterans wages. Attach employee verification of Unemployment Benefits and signed affidavit that employee meets the requirements pursuant to AB71 of the 78th (2015) legislative session.

Line 3. Net taxable wages. Add Line 2a and Line 2b. Subtract this sum from Line 1.

Line 4. Offsets carried forward are created when allowable health care costs exceed gross wages in the previous quarter. If applicable, enter the previous quarter's offset here. This is not a credit against any tax due. This reduces the wage base upon which the tax is calculated.

Line 5. Line 3 minus Line 4.

Line 6. Net taxable wages is the amount that will be used in the calculation of the tax. If line 5 is greater than zero, this is the taxable wages. If line 5 is less than zero, then no tax is due. (This amount will be entered on line 18 as the offset carried forward for the next quarter. The offset carried forward is only limited to the health care deduction. This excludes the deduction for veteran wages.)

Line 7. Enter the threshold of $50,000.00. SB483 set the threshold to $50,000.00 for quarterly wages. Tax is calculated on wages over this threshold. Line 8. Taxable wages. The threshold in Line 7 is subtracted from Line 5 to calculate taxable wages; do not enter an amount if less than 0.

Line 9. Calculated Tax. Multiply Line 8 x .01475, the rate established by SB483.

Line 10. Commerce Tax Credit – Enter 50% of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed. Do not enter an amount less than zero. If the credit amount is higher than the MBT tax owed it may be carried forward up to the fourth quarter immediately following the end of the Commerce Tax year for which Commerce Tax is paid.

Line 11. Other Credits - Enter amount of overpayment of Modified Business Tax (MBT) made in prior reporting periods for which you have received a Department of Taxation credit notice. Credit notices received from the Department are not cumulative. Do not take the credit if you have applied for a refund. NOTE: Only credits established by the Department may be used. The 78th (2015) legislative session enacted several Bills that created credits towards the MBT that may be taken on this tax return if qualified. These credits except for the college savings plan contributions require prior approval by the Department and a credit notice. Please attach credit notice and/or College Savings Plan Contributions Form to this return.

Line 12. Net Tax Due - Line 9 minus Line 10. This amount is due and payable by the due date; the last day of the month following the applicable quarter. If payment of the tax is late, penalty and interest (as calculated below) are applicable.

Line 13. Penalty - If this return will not be submitted/postmarked and the taxes paid on or before the due date as shown on the face of this return, the amount of penalty due is based on the number of days late payment is made per NAC 360.395. Determine the number of days the payments is late and multiply the net tax owed by the appropriate rate based on the table below. The result is the amount of penalty that should be entered. For example, if the taxes were due January 31, but not paid until February 15. The number of days late is 15 so the penalty is 4%. The maximum penalty amount is 10%.

|

Number of days late |

Penalty Percentage |

Multiply By |

|

|

|

|

|

|

1-10 |

2% |

0.02 |

11-15 |

4% |

0.04 |

|

16 - 20 |

6% |

0.06 |

21- 30 |

8% |

0.08 |

|

31 + |

10% |

0.1 |

Line 14. Interest: To calculate interest for each month late, multiply Line 11 x 0.75% (or .0075).

Line 15. Previous Debits - Enter only those liabilities that have been established for prior quarters by the Department and for which you have received a liability notice.

Line 16. Total Amount Due -Total lines 12 through line 15 and enter amount due. Line 17. Amount Paid - Enter the amount remitted with return.

Line 18. Carry Forward - If line 5 is less than zero enter figure here. This amount will be carried forward to the next quarter (offset)

GENERAL INFORMATION:

GENERAL BUSINESSES MUST USE FORM TXR-020.05 FINANCIAL INSTITUTIONS MUST USE FORM TXR-021.05

Who Must File: Every employer who is subject to the Nevada Unemployment Compensation Law (NRS 612) except for non-profit 501(c) organizations, Indian tribes, and political sub-divisions. A copy of the form NUCS 4072, as filed with Nevada Employment Security Division, does not need to be included with the original return, but should be available upon request by the Department.

Businesses that have ceased doing business (gone out of business) in Nevada must notify the Employment Security Division and the Department of Taxation in writing, the date the business ceased doing business. The Department will send written notice when a credit request has been processed and the credit is available for use/refund.

Please do not use/apply a credit prior to receiving Departmental notification that it is available.

** For up to date information on tax issues, be sure to check our website -- ** http://tax.nv.gov/ -- every January, April, July and October for Tax Notes articles.