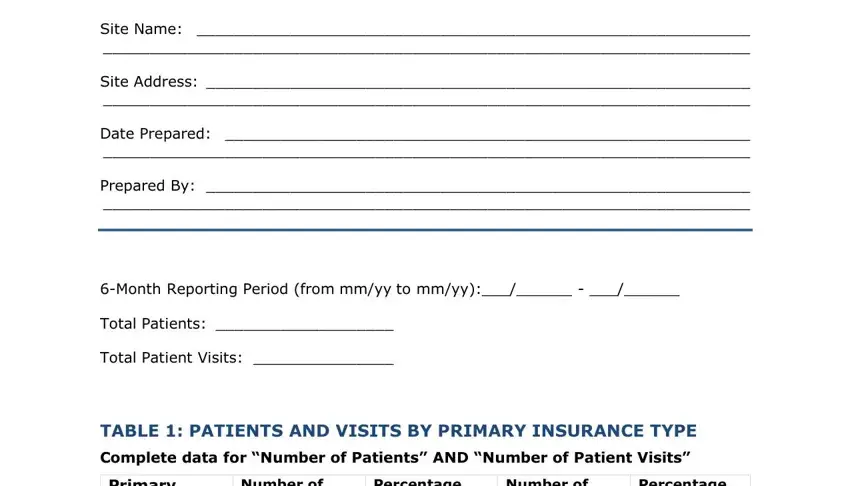

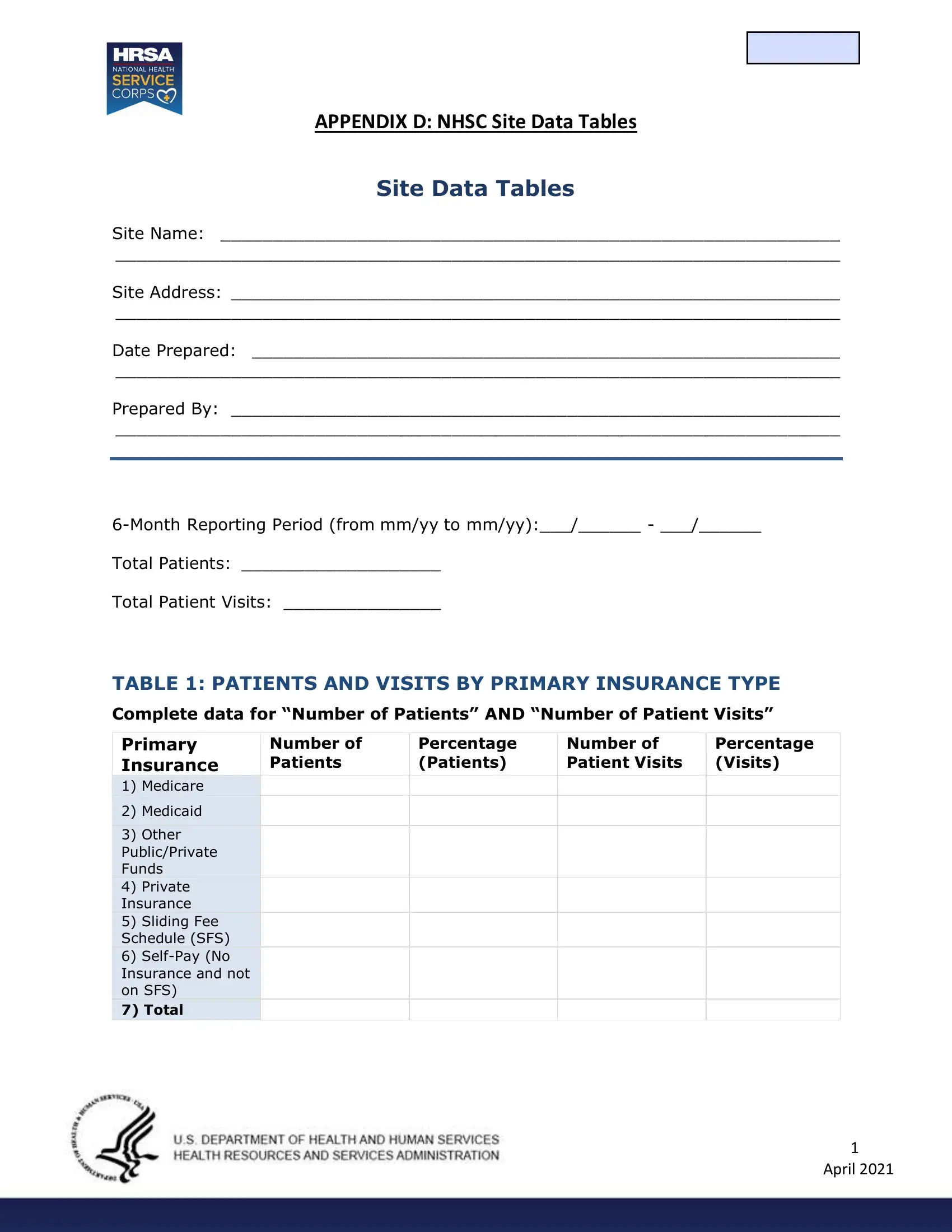

APPENDIX D: NHSC SITE DATA TABLES

Site Data Tables

Site Name: ___________________________________________________________

_____________________________________________________________________

Site Address: __________________________________________________________

_____________________________________________________________________

Date Prepared: ________________________________________________________

_____________________________________________________________________

Prepared By: __________________________________________________________

_____________________________________________________________________

6-Month Reporting Period (from mm/yy to mm/yy):___/______ - ___/______

Total Patients: ___________________

Total Patient Visits: _______________

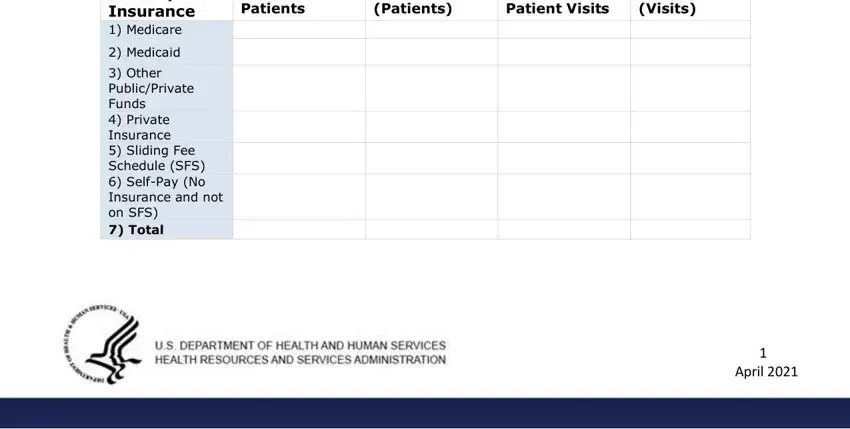

TABLE 1: PATIENTS AND VISITS BY PRIMARY INSURANCE TYPE

Complete data for “Number of Patients” AND “Number of Patient Visits”

Primary |

Number of |

Percentage |

Number of |

Percentage |

Insurance |

Patients |

(Patients) |

Patient Visits |

(Visits) |

1) |

Medicare |

|

|

|

|

2) |

Medicaid |

|

|

|

|

|

|

|

|

|

|

3) |

Other |

|

|

|

|

Public/Private |

|

|

|

|

Funds |

|

|

|

|

4) |

Private |

|

|

|

|

Insurance |

|

|

|

|

5) |

Sliding Fee |

|

|

|

|

Schedule (SFS) |

|

|

|

|

6) |

Self-Pay (No |

|

|

|

|

Insurance and not |

|

|

|

|

on SFS) |

|

|

|

|

7) Total |

|

|

|

|

|

|

|

|

|

|

1 April 2021

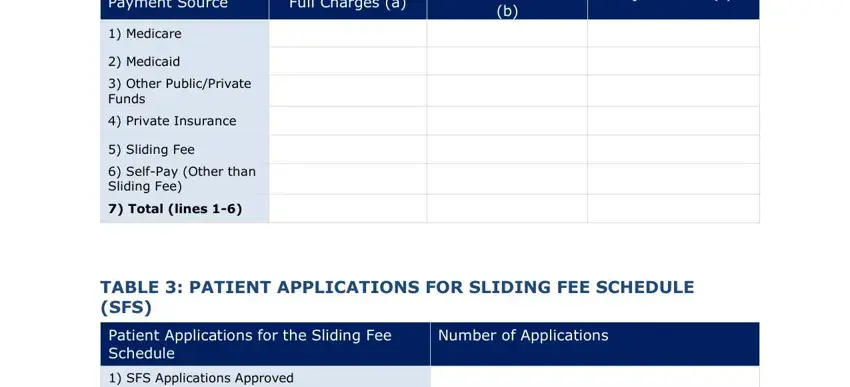

TABLE 2: PATIENT SERVICE CHARGES, COLLECTIONS, AND ADJUSTMENTS

|

Payment Source |

|

|

Full Charges (a) |

|

|

Amount Collected |

|

Adjustments (c) |

|

|

|

|

|

|

|

|

|

(b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

1) |

Medicare |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2) |

Medicaid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3) |

Other Public/Private |

|

|

|

|

|

|

|

|

|

Funds |

|

|

|

|

|

|

|

|

|

4) |

Private Insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5) |

Sliding Fee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6) |

Self-Pay (Other than |

|

|

|

|

|

|

|

|

|

Sliding Fee) |

|

|

|

|

|

|

|

|

|

7) Total (lines 1-6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TABLE 3: PATIENT APPLICATIONS FOR SLIDING FEE SCHEDULE (SFS)

|

Patient Applications for the Sliding Fee |

|

|

Number of Applications |

|

|

|

|

|

|

Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

1) |

SFS Applications Approved |

|

|

|

|

|

|

|

|

|

|

|

|

2) |

SFS Applications Not Approved |

|

|

|

|

|

|

|

|

|

|

|

|

3) Total SFS Applications Received |

|

|

|

|

|

|

|

|

|

|

|

2 April 2021

TABLE 4: SERVICE SITE STAFFING

|

Personnel by Major Service Categories |

|

|

FTEs |

|

|

|

|

|

|

|

|

|

|

|

|

|

Medical Services |

|

|

|

|

|

|

|

|

|

|

|

|

1) |

Family Practitioners |

|

|

|

|

|

|

|

|

|

|

|

|

2) |

General Practitioners |

|

|

|

|

|

|

|

|

|

|

|

|

3) |

Internists |

|

|

|

|

|

|

|

|

|

|

|

|

4) Obstetrician/Gynecologists |

|

|

|

|

|

|

|

|

|

|

|

|

5) |

Pediatricians |

|

|

|

|

|

|

|

|

|

|

|

|

6) |

Psychiatrists |

|

|

|

|

|

|

|

|

|

|

|

|

7) |

Other Physician Specialists |

|

|

|

|

|

|

|

|

|

|

|

|

8) Total Physicians (lines 1-7) |

|

|

|

|

|

|

|

|

|

|

|

|

9) |

Nurse Practitioners/Physician Assistants |

|

|

|

|

|

|

|

|

|

|

|

|

10) Certified Nurse Midwives |

|

|

|

|

|

|

|

|

|

|

|

|

11) Nurses |

|

|

|

|

|

|

|

|

|

|

|

|

12) Other Medical Support Personnel |

|

|

|

|

|

|

|

|

|

|

|

|

13) Total Medical Services (lines 8-12) |

|

|

|

|

|

|

|

|

|

|

|

Ancillary Services

14) Laboratory Services Personnel

15) X-Ray Services Personnel

16) Pharmacy Personnel

17) Total Ancillary Services (lines 14-16)

Dental Services

18) Dentists

19) Dental Hygienists

20) Dental Assistants, Aides, Technicians, and Support Personnel

21) Total Dental Services (lines 18-20)

Mental Health (MH) and Behavioral Health (BH) Services

22) Mental Health & Behavioral Health Specialists

23) Mental Health & Behavioral Health Support Personnel

24) Total MH & BH Services (lines 22-23)

25) TOTAL (lines 13, 17, 21, and 24)

3 April 2021

General Instructions

Reporting Period

The reporting period should include up-to-date data for the preceding six months. Please indicate the start and end dates of the six months for which the site is reporting. The total number of patients and the total number of patient visits should be based upon actual data.

Scope of Activity Reported

The NHSC Site Data Tables are site specific (one per physical address). Activity at other sites owned or operated by the applicant site is to be excluded.

All related activity of all providers at the site is to be reported, including activity of all NHSC and non-NHSC providers at the site. Related activity includes all comprehensive primary care—whether medical, dental or behavioral and mental health—and ancillary service provided onsite.

These services are an integral part of the comprehensive primary care delivery system:

•Under direction and control of the applicant site; and

•Provided by the site’s providers to the applicant site’s patients.

The services are provided at the approved site location or by the site’s providers to the applicant site’s patients at approved off-site locations, such as the patient’s home, nursing home, emergency room or hospital.

Sites may elect to include or exclude all or some portion of referred care services paid by the applicant site which are rendered to the site’s patients at off-site locations. This election may be based upon the ability or ease of reporting this information on a site specific basis. The same scope of off-site referred care should be used to complete the visit, patient, charge, and cost tables.

Who Submits Site Data Tables

The NHSC Site Data Tables are to be filed by those parties which enter into an agreement with the Secretary of the Department of Health and Human Services to participate as an NHSC member site and which are not currently receiving grant support from the Health Resources and Services Administration’s Bureau of Primary Health Care (HRSA/BPHC). The NHSC Site Data Tables are to be completed prior to an NHSC Site Visit. Only one report per site is to be filed.

The following eligible Auto-Approved NHSC Sites ARE NOT required to submit the NHSC Site Data Tables: Federally Qualified Health Centers (FQHCs) and FQHC Look-Alikes. The standard HRSA/BPHC Uniform Data System (UDS) report will be reviewed in place of the site data tables.

The following eligible NHSC sites must provide NHSC Site Data Tables upon request if HRSA needs to determine NHSC site eligibility: 1) ITUs, 2) Federal Prisons, 3) State Prisons, and

4)ICE Health Service Corps site. All other eligible NHSC site types must submit NHSC Site Data Tables at time of site application, recertification, and NHSC Site Visit.

Detailed Table Instructions

4 April 2021

Table 1: Patients or Visits by Primary Insurance Type

This table reflects the number of patients and patient visits by primary insurance type and/or payer source for the reporting period. A patient may have coverage under more than one insurance plan, different coverage for different services and this coverage may change over the course of a year. When medical services are provided, report the patient’s primary health insurance covering primary medical care, if any, as of the last visit during the reporting period. If medical services are not provided, report the patient’s primary insurance, if any, for the services offered. Report the patient’s primary health insurance even though it may not have covered the services rendered during the patient’s last visit.

Primary insurance is defined as the insurance plan or program that the site would bill first for services rendered.

Example: Report Medicare as the primary insurance if a patient has both Medicare and Medicaid because Medicare is billed before Medicaid. Report the employer plan as the primary insurance if a patient has both an employer plan and Medicare because the employer plan is billed first.

(Line 1) Medicare: patients whose primary insurance is a plan for Medicare beneficiaries including Rural Health Clinic (RHC), managed care, Federally Qualified Health Center (FQHC), and other reimbursement arrangements administered by Medicare or by a fiscal intermediary.

(Line 2) Medicaid: patients whose primary insurance is a plan for Medicaid beneficiaries including RHC, managed care, FQHC, Early Periodic Screening, Diagnosis, and Treatment (EPSDT) Program, Child Health Insurance Program (CHIP) and other reimbursement arrangements administered either directly by the state agency or by a fiscal intermediary

(Line 3) Other Public/Private Funds: patients with no insurance but who have categorical or other grant funds applied to their accounts for services rendered. This also includes state or local indigent care or charity care programs that are earmarked to subsidize services rendered to uninsured patients, such as the Massachusetts Free Care Pool, New Jersey Uncompensated Care Program, New York Public Goods Pool Funding, New Mexico Tobacco Program, or Colorado Indigent Care Program.

(Line 4) Private Insurance: patients whose primary insurance is a private insurance plan, managed care plan, or a contractual arrangement. This includes plans such as Blue Cross and Blue Shield, commercial insurance, managed care plans, self-insured employer plans, group contracts with unions and employers, and service contracts with employers and others. Patients with health benefit plans purchased for government employees, retirees and dependents, such as TRICARE, the Federal Employees Insurance Program, state employee health insurance benefit programs, teacher health insurance, as well as workers’ compensation, and similar plans are to be classified as private insurance patients.

(Line 5) Sliding Fee Schedule (SFS): patients participating in the site’s sliding fee discount program who do not have other coverage. NHSC sites are expected to make services available through the use of a sliding fee discount schedule or other documented means of eliminating financial barriers for those at or below 200 percent of the Federal Poverty Guidelines (FPG). All Sliding Fee Discount Programs must include the following elements:

•Applicable to all individuals and families with annual incomes at or below 200 percent

5 April 2021

of the most current FPG;

•Provide a full discount for individuals and families with annual incomes at or below 100 percent of the FPG, with allowance for a nominal charge only, consistent with site’s policy; and

•Adjust fees (partial sliding fee discount) based on family size and income for individuals and families with incomes above 100 percent and at or below 200 percent of the FPG.

View the most current HHS Poverty Guidelines. The data reported here should be based upon the number of patients making use of the sliding fee discount policy as their primary source of coverage.

(Line 6) Self-Pay (no insurance and not on SFS): patients without any health insurance and not participating in the site’s sliding fee discount program are to be classified as self- pay.

(Line 7) Total: the sum of lines 1-6.

Table 2: Patient Service Charges, Collections, and Adjustments

This table shows the patient service charges, receipts, and sliding fee discounts by payment source for all related activity of all providers at the site to which the NHSC provider is assigned. See the General Instructions for a definition of the scope of activity to be reported. Report in whole dollars.

Charges and collections are to be reported in six pay classes: Medicare, Medicaid, Other Public/Private Funds, Private Insurance, Sliding Fee Schedule, and Self-Pay. Charges and receipts are to be identified with the payer, which is the responsible party. For instance, Medicare receipts are attributable to Medicare even though the receipts were made by an intermediary such as Blue Shield. Similarly, charges and receipts for which a Medicare beneficiary is personally responsible, such as deductibles and copayments, are self-pay rather than Medicare charges and receipts.

(Column a) Full Charges: the gross charges as established by the site for the services rendered during the reporting period. Charges are reported at their full value for all services prior to any adjustments. Fee-for-service charges are uniformly reported at the full charge rate from the site’s fee schedule. Sites with capitation contracts or who are reimbursed on a cost based flat fee, such as an RHC rate or FQHC rate, are to report the normal full charge from the site’s fee schedule rather than the negotiated visit capitation or contract rate.

Charges are to reflect the amount for which the payer is responsible. Deductibles, copayments, and uncovered services for which the patient is personally responsible should be reclassified and reported as self-pay. Similarly, any charges not payable by a third party payer that are due from the patient or another third party should be deducted from the payer’s charges and added to the account of the secondary payer. The reclassification of charges to secondary and subsequent payers may be estimated based upon a sample.

Sites may elect to include or exclude all or some portion of paid referred care services rendered to the site’s patients at off-site locations. This election may be based upon the ability or ease of reporting this information on a site-specific basis. The same scope of off- site referred care should be used to complete the visit, patient, charge, and cost tables.

6 April 2021

(Column b) Amount Collected: the actual cash received during the period for services rendered, regardless of the date of service. This includes RHC and FQHC settlement receipts, case management fee receipts, incentive receipts from managed care plans, and other similar receipts.

Amounts collected are the amounts collected from the payer. If there is more than one payer involved in a given visit, the charges due from the primary payer and the amount collected from the primary payer are reported on the primary payer line. The charges due from the secondary payer are reported on the secondary payer line along with any amounts collected from the secondary payer. The reclassification of charges and collections to secondary and subsequent payers may be estimated based upon a sample of accounts.

(Column c) Adjustments: the difference between the full charges and the amount actually received or expected. The only adjustments to be reported here are self-pay adjustments.

(Line 1) Medicare (Title XVIII): charges and receipts related to services provided to Medicare beneficiaries that are payable by insurance plans operated under Title 18 of the Social Security Act, including FQHC, RHC, or any other reimbursement arrangement including capitated managed care administered by Medicare or its fiscal intermediaries.

(Line 2) Medicaid (Title XIX): charges and receipts related to services provided to Medicaid beneficiaries and payable by insurance plans operated under Title 19 of the Social Security Act, including FQHC, RHC, case management, fee-for-service managed care, EPSDT Program, CHIP and any other reimbursement arrangement, including capitated managed care, administered either directly by the state agency or by its fiscal intermediaries.

(Line 3) Other Public/Private Funds: charges and receipts related to services provided to patients and payable by categorical or other grant funds. This also includes state or local indigent care or charity care programs that are earmarked to subsidize services rendered to uninsured patients, such as the Massachusetts Free Care Pool, New Jersey Uncompensated Care Program, New York Public Goods Pool Funding, New Mexico Tobacco Program, or Colorado Indigent Care Program.

(Line 4) Private Insurance: charges and receipts related to services provided to patients and payable by insurance plans other than those reported above, such as a private insurance plan, managed care plan, or a contractual arrangement. This includes plans such as Blue Cross and Blue Shield, commercial insurance, managed care plans, self-insured employer plans, group contracts with unions and employers, and service contracts with employers, schools, health departments, and others. Health benefit plans offered to government employees, retirees and dependents, such as TRICARE, the Federal Employees Insurance Program, state employee health insurance benefit programs, teacher health insurance, as well as workers’ compensation, and similar plans are to be classified as private insurance.

(Line 5) Sliding Fee Schedule (SFS) and SFS Adjustments: charges and receipts related to services provided to patients participating in the site’s sliding fee discount program who do not have other coverage. NHSC sites are expected to make services available through the use of a sliding fee discount schedule or other documented means of eliminating financial barriers for those at or below 200 percent of the federal poverty income guidelines.

SFS Adjustments: the value of charge discounts granted to patients prior to service and

7 April 2021

based upon financial hardship. It does not include professional courtesy, staff, service incentive, or similar discounts. Also, it does not include bad debt adjustments related to patients who were initially charged full fee but unable to pay because of financial hardship or other reasons. If a hardship fund is used to pay for the referred lab, x-ray, pharmacy or other care for sliding fee patients, report the charge value of those services in column (a) and an offsetting sliding fee adjustment in column (c). Sliding fee discounts reflect the site’s compliance with its assurance to the NHSC that there are no financial barriers to care for those at or below 200 percent of the current federal poverty income guideline.

(Line 6) Self-Pay and Self-Pay Adjustments: charges and receipts related to services provided to patients without any principal health insurance or to patients with insurance but only that portion for which the patient is personally liable such as deductible, copayments, and uncovered charges. Charges not paid by a third party payer and due from the patient should be deducted from the full charges of the third party payer and added to the full charges for the self-pay patients. This also includes charges not payable by categorical or other grant funds.

Self-Pay Adjustments: the value of all self-pay adjustments only. This includes bad debt to self-pay patients who were initially charged a full, discounted, or partial fee but who subsequently were either unwilling or unable to pay the amounts charged. It does not include bad debt related to other pay sources, which may be caused by a failure to file timely claims, payer bankruptcy or similar reasons.

(Line 7) Total: the sum of lines 1–6.

Table 3: Patient Applications for the Sliding Fee Schedule

This table provides information on the number of unique sliding fee schedule applications submitted by patients/clients during the reporting period.

(Line 1) SFS Applications Approved: the number of patient applications for the sliding fee schedule received during the reporting period that were approved for discounted service.

(Line 2) SFS Applications Not Approved: the number of patient applications for the sliding fee schedule received during the reporting period that were not approved for discounted services for any reason (e.g., incomplete application, patient did not meet poverty guideline requirements, application not processed).

(Line 3) Total SFS Applications Received: the total number of patient applications for the sliding fee schedule received during the reporting period. This should be equal to the sum of lines 1-2.

Table 4: Service Site Staffing

This table profiles the personnel by major service category. The number of staff is reported in full time equivalents (FTEs).

Staff: salaried full-time or part-time employees of the applicant site who work on behalf of the site and non- salaried individuals paid by the applicant site who work for the site on a regular schedule that is controlled by the site under any of the following compensation arrangements: contract, NHSC assignment, retainer, capitation, block time, fee-for-service, and donated time. Provider staff work at the NHSC approved site. Support staff may

8 April 2021

work for the site at other locations. Regularly scheduled means a pre-assigned number of work hours devoted to the site’s activities.

FTEs are reported for staff and are not reported for non-staff individuals. Some examples of staff and non-staff personnel are noted below:

•NHSC providers are considered staff.

•Providers working on-site under contract on a scheduled basis are considered staff.

•Referral providers who are paid by the applicant site are considered non-staff when working independently at unapproved off-site locations such as the referral provider’s office.

•Contracted support staff working under a contract which replaces personnel the site would otherwise have hired, who work directly for the site, who may work either on or off-site, and who work for the site on a regularly scheduled basis are consider “staff” whose time or FTE value is to be reported. This might include personnel employed by a practice management company, a management services organization, billing service company, or similar contractor. If individuals under these arrangements work on an irregular, unscheduled or indirect basis, they are considered non-staff and their FTEs are not counted.

•Professionals working for the site under legal, audit, actuarial, management consulting, and similar contracts for services provided on a one-time, sporadic, or unscheduled basis are considered non-staff.

•Consulting pathologists, radiologists, and other consulting providers who provide services on an unscheduled or sporadic basis are considered non-staff.

FTEs: full time equivalents for all staff. Full time equivalents are computed on an individual basis by dividing the total number of hours in the reporting period for which a person was compensated by the total number of hours in the year considered by the site to be full-time. The total number of hours for which an individual was compensated includes the number of hours a person was present for work and paid for their time, as well as paid leave time including vacation, sick leave, continuing education trips, etc. An annual hours pay base of 2,080 (40 hours/week x 52 weeks/year) is typical but the base may vary by organization and by class of employee. Employees who work less than the annual hour’s base are normally considered part time. An individual staff member is not to be reported as more than 1.00 full time equivalents regardless of any overtime hours worked or compensation paid. Round FTEs to the second decimal place.

Salaried provider staff FTEs are to be calculated based upon the number of paid hours, not the number of scheduled hours. A provider who schedules 32 hours per week to see patients but who is paid for a 40-hour week is considered full time or 1.00 FTE.

Contract provider and support staff FTEs are to be calculated by dividing the hours the staff worked by the hours a full time employee of that type would be expected to work. The time worked in the numerator is to be taken from contracts, invoices, schedules or similar sources. The denominator or base of hours considered full-time for these arrangements should not include leave time unless leave is directly charged or the time salaried clinicians of that type are ordinarily not scheduled to see patients. For example, if full time salaried providers are expected to schedule 32 hours of patient care per week, a contract provider who was paid for 16 hours of scheduled patient care per week would be considered half time or 0.50 FTE. The annual scheduled hour’s base considered full-time for contract providers is likely to vary by clinical specialty.

9 April 2021

Time for personnel performing more than one function should be allocated as appropriate among the major personnel service categories. For example, the time of a physician who is also a medical director should be allocated between medical care services and administration. Time for nurses who also provide case management services should be allocated between medical care and case management.

Personnel by Major Service Category: FTEs are classified into four service categories.

The categories are: medical care services; ancillary services, dental services; and mental health and behavioral health services.

(Lines 1 through 7) Physicians: (M.D. or D.O.): separate FTE totals for family practitioners, general practitioners, internists, obstetrician/gynecologists, pediatricians, psychiatrists, including those physicians who obtained a Drug Addiction Treatment Act of 2000 (DATA 2000) waiver, and all other specialists. Use board certification to classify physicians by specialty. Classify physicians with more than one board certification in the specialty representing the service the physician provides most, or allocate based upon time spent.

(Line 8) Total Physicians: FTE total for medical services, lines 1-6.

(Line 9) Nurse Practitioners and Physician Assistants: FTE total for nurse practitioner and physician assistant staff performing medical services. Nurse practitioners include psychiatric nurse practitioners. Nurse practitioners and physician assistants also include those who obtained a DATA 2000 waiver.

(Line 10) Certified Nurse Midwives: FTE total for nurse midwives performing medical service.

(Line 11) Nurses: FTE total for nurses that are involved in provision of medical services, including registered nurses, licensed practical nurses, home health and visiting nurses, clinical nurse specialists, and public health nurses. If an individual’s time is divided between medical and nonmedical services, allocate the FTEs to reflect this division of time. For example, nurses who provide case management or education/counseling services in addition to medical care should be allocated between medical services and other services.

(Line 12) Other Medical Support Personnel: FTE total for medical assistants, nurse aides, and all other personnel providing services together with or in direct support of services provided by a physician, nurse practitioner, physician assistant, certified nurse midwife, or nurse. FTEs for registration, reception, appointments, transcription, patient records, and other support personnel are not reported.

(Line 13) Total Medical Services: FTE total for medical services, lines 8-12.

(Line 14) Laboratory Services Personnel: FTE total for pathologists, medical technologists, laboratory technicians and assistants, and phlebotomists. This refers exclusively to medical personnel not dental personnel. Dental personnel performing laboratory services are reported on lines 18-20. Lab visits are not reported.

(Line 15) X-ray Services Personnel: FTE total for radiologists, X-ray technologists, X-ray technicians and ultrasound technicians. Only report medical personnel not dental personnel. Dental personnel performing x-ray services are reported on lines 18-20. X-ray visits are not reported.

10

April 2021

(Line 16) Pharmacy Personnel: FTE total for pharmacists and pharmacist assistants.

(Line 17) Total Ancillary Services: FTE total for ancillary services, lines 14 through 16.

(Line 18) Dentists: FTE total for general practitioners and specialists including oral surgeons, periodontists, and pedodontists.

(Line 19) Dental Hygienists: FTE total for dental hygienists.

(Line 20) Dental Assistants, Aides, Technicians & Support Personnel: FTE total for other dental personnel including dental assistants, aides, and technicians.

(Line 21) Total Dental Services: FTE total for dental services, lines 18-20.

(Line 22) Mental Health and Behavioral Health Specialists: FTE total for licensed individuals providing counseling or treatment services related to mental health or behavioral health, including clinical psychologists, clinical social workers, psychiatric social workers, psychiatric nurses, mental health nurses, and family therapists. Report psychiatrists, including those who obtained a DATA 2000 waiver, on line 6 under physicians. Report psychiatric nurse practitioners, including those who obtained a DATA 2000 waiver, on line 9 under nurse practitioners.

(Line 23) Mental Health and Behavioral Health Support Personnel: FTE total for assistants, aides, and all other personnel providing services in conjunction with or in direct support of services provided by mental health and behavioral health specialists.

(Line 24) Total Mental Health and Behavioral Health Services: FTE total for mental health and behavioral health services, lines 22 and 23.

(Line 25) Total: FTE grand total, lines 13, 17, 21, and 24.

11

April 2021