When you would like to fill out Bor, you won't have to install any kind of applications - simply try using our online tool. The editor is constantly maintained by our staff, getting additional functions and growing to be better. In case you are seeking to get going, this is what you will need to do:

Step 1: First of all, access the tool by clicking the "Get Form Button" in the top section of this site.

Step 2: As soon as you open the online editor, you will find the form made ready to be filled in. Other than filling in different blank fields, it's also possible to perform some other things with the form, such as writing your own text, editing the initial text, inserting graphics, placing your signature to the form, and more.

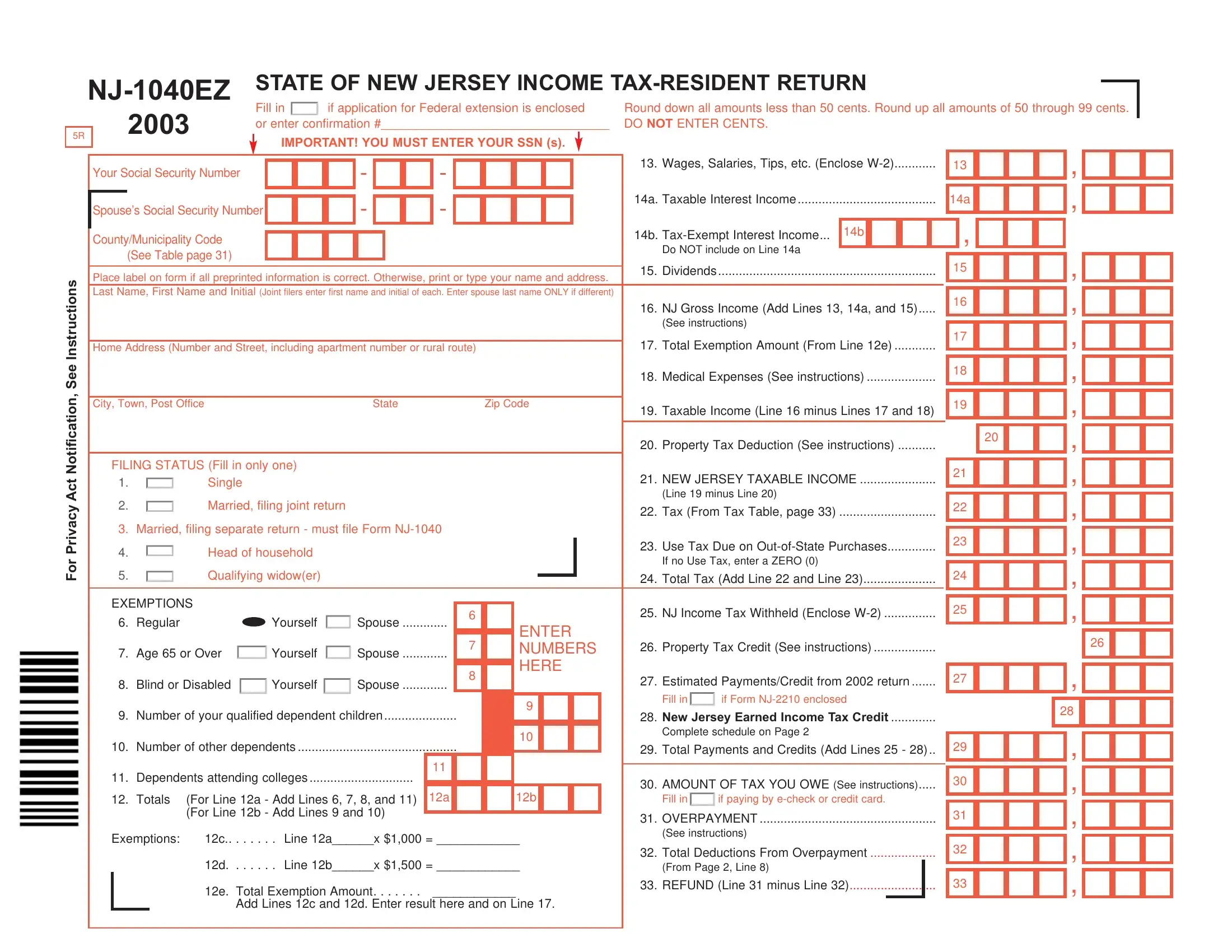

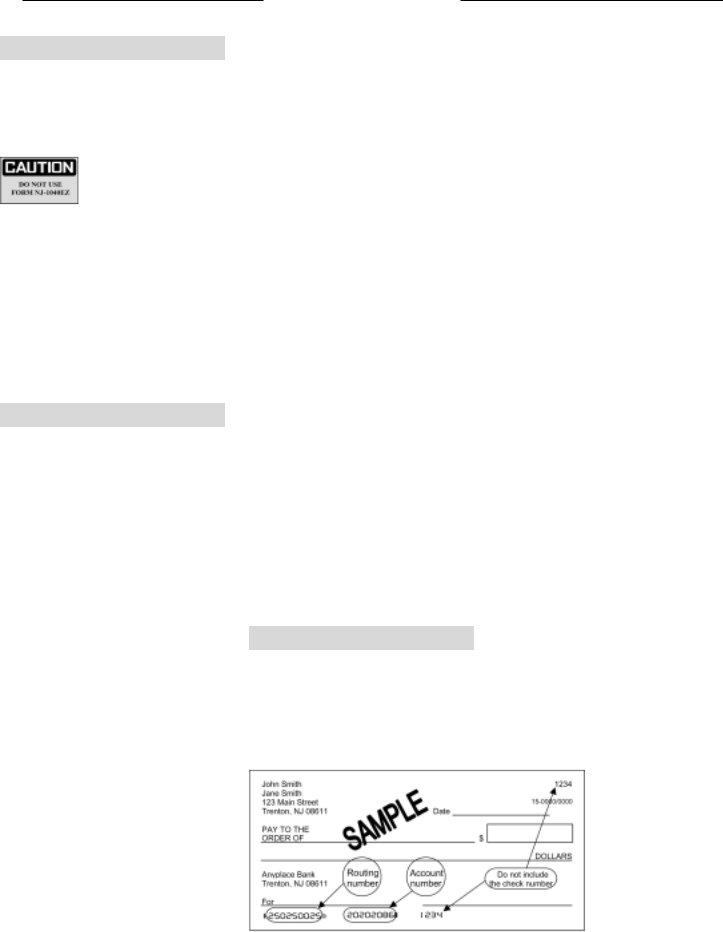

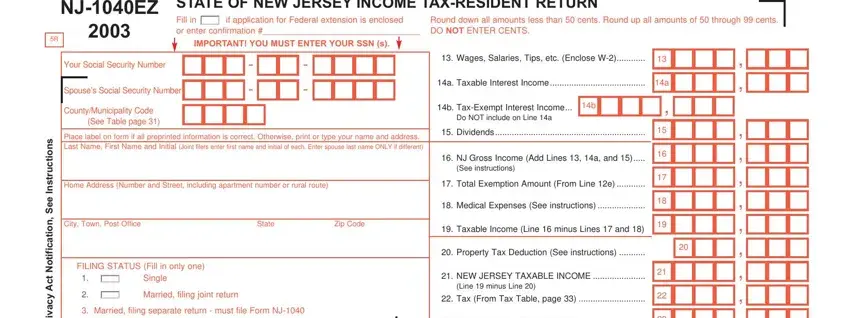

So as to fill out this document, be sure to provide the required details in every blank:

1. The Bor will require particular details to be typed in. Be sure that the next blank fields are complete:

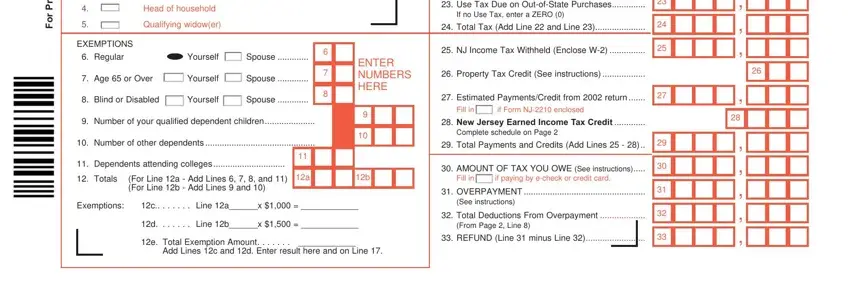

2. Your next step is usually to submit these fields: i r P r o F, Head of household, Qualifying widower, EXEMPTIONS, Regular, Yourself, Spouse, Age or Over, Yourself, Spouse, Blind or Disabled, Yourself, Spouse, ENTER NUMBERS HERE, and Number of your qualified.

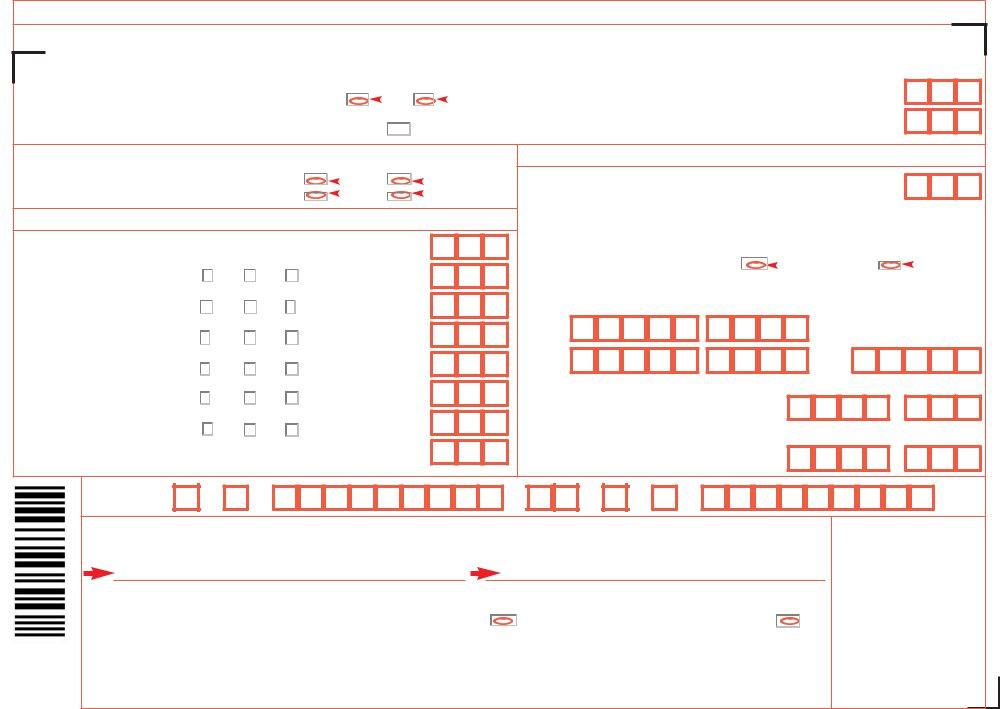

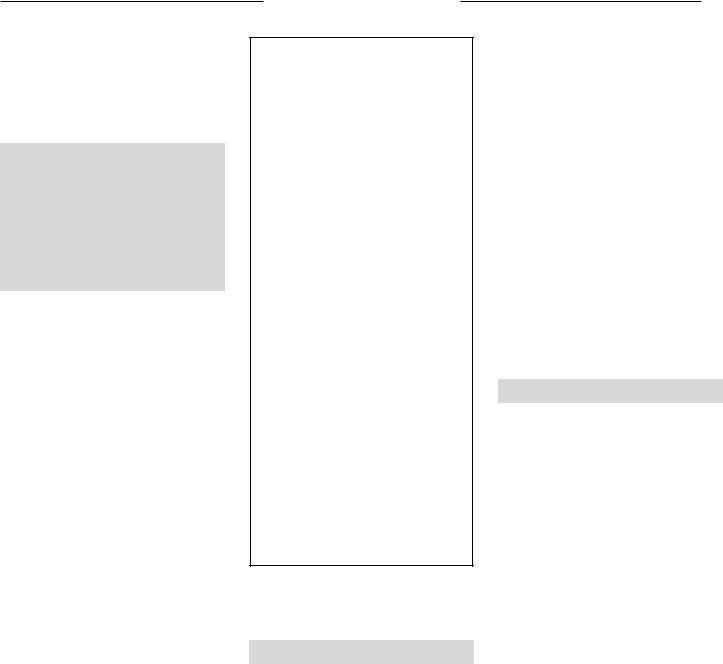

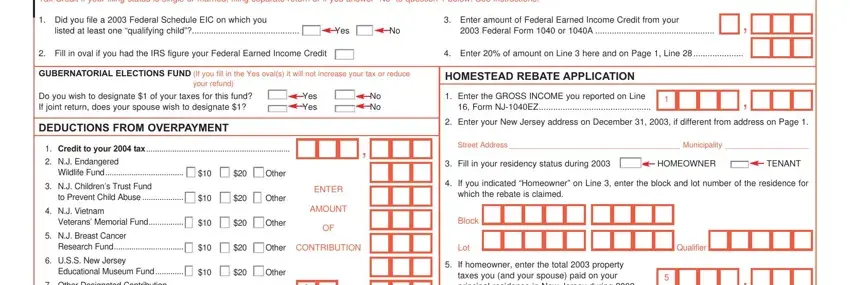

3. Completing You may be eligible for the New, Did you file a Federal Schedule, Enter amount of Federal Earned, listed at least one qualifying, Yes, Federal Form or A, Fill in oval if you had the IRS, Enter of amount on Line here, GUBERNATORIAL ELECTIONS FUND If, your refund, HOMESTEAD REBATE APPLICATION, Do you wish to designate of your, Yes Yes, No No, and Enter the GROSS INCOME you is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

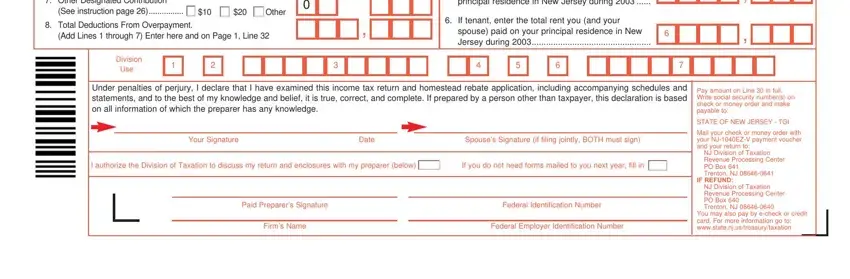

4. Your next section needs your details in the subsequent places: Other Designated Contribution, See instruction page cid cid, Total Deductions From Overpayment, Add Lines through Enter here and, If homeowner enter the total, If tenant enter the total rent you, Division, Use, Under penalties of perjury I, Your Signature, Date, Spouses Signature if filing, I authorize the Division of, If you do not need forms mailed to, and Paid Preparers Signature. Just be sure you provide all of the needed information to move further.

Always be extremely attentive while filling out Date and I authorize the Division of, because this is the part in which many people make mistakes.

5. The final stage to submit this PDF form is critical. Ensure that you fill in the required fields, like Contact our Customer Service, Touchtone phones within NJ NY PA, Visit our Web site at, Visit a New Jersey public library, Dial NJ TaxFax at from your fax, TTY Equipment Users Only Call, Write to NJ Division of Taxation, Taxpayer Forms Services PO Box, online, Visit the New Jersey Division of, You may also reach us by email at, Subscribe to NJ Tax ENews the, Who Can Help, Trained volunteers in the VITA, and New Jersey Earned Income Tax Credit, prior to using the form. Otherwise, it might give you a flawed and possibly nonvalid paper!

Step 3: Make sure your details are right and then just click "Done" to progress further. Get the Bor the instant you sign up at FormsPal for a free trial. Easily use the pdf document inside your personal account, together with any edits and adjustments conveniently synced! FormsPal is focused on the personal privacy of our users; we make sure all personal data going through our system continues to be protected.