a 3128 can be filled in easily. Just try FormsPal PDF tool to perform the job quickly. In order to make our tool better and more convenient to work with, we continuously work on new features, with our users' feedback in mind. Starting is easy! All you have to do is take the following basic steps directly below:

Step 1: Click the "Get Form" button at the top of this page to get into our PDF tool.

Step 2: When you launch the tool, you will notice the form all set to be filled out. Other than filling out different fields, you may as well do other sorts of things with the form, specifically putting on your own textual content, editing the initial text, inserting graphics, affixing your signature to the form, and more.

This PDF doc will need specific information; in order to ensure accuracy, please make sure to consider the following recommendations:

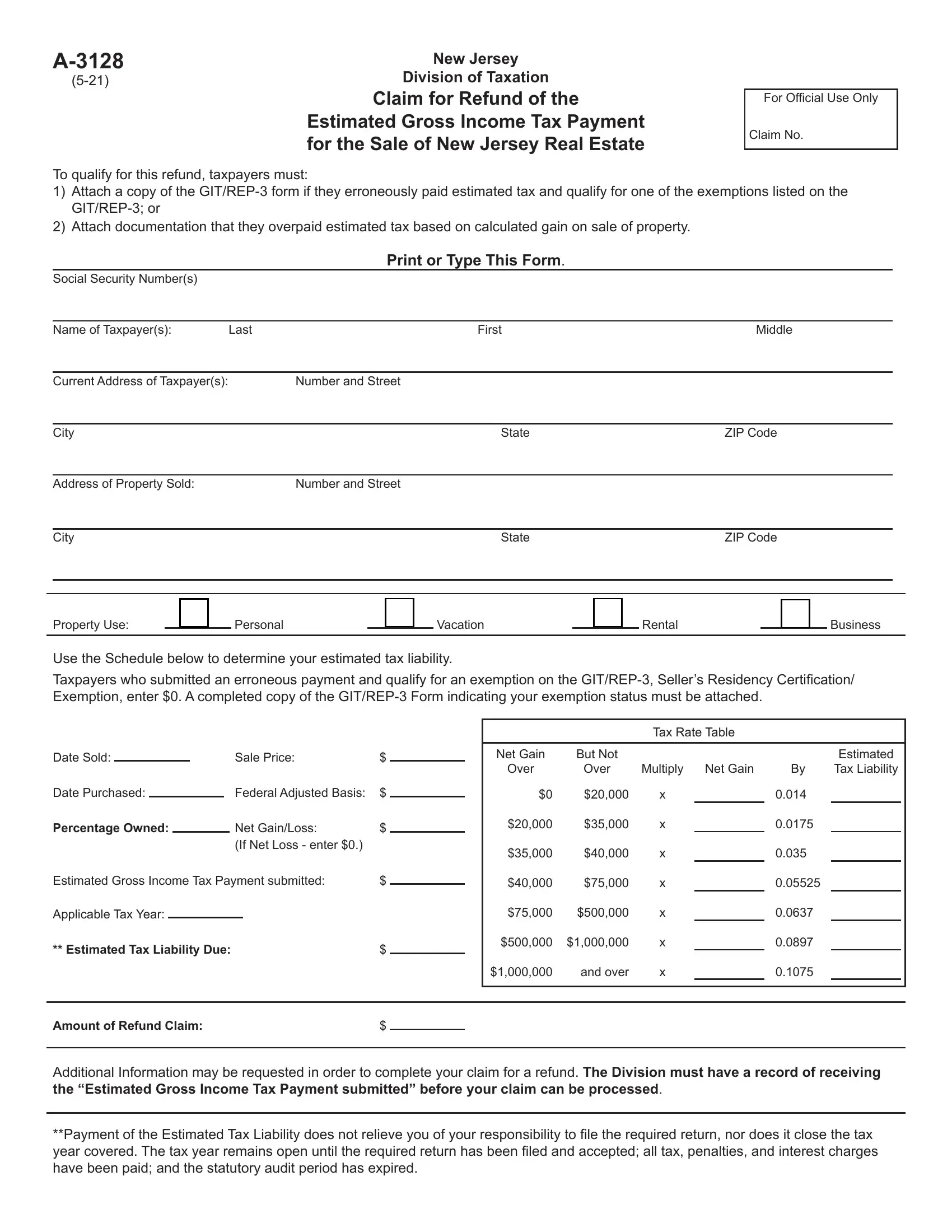

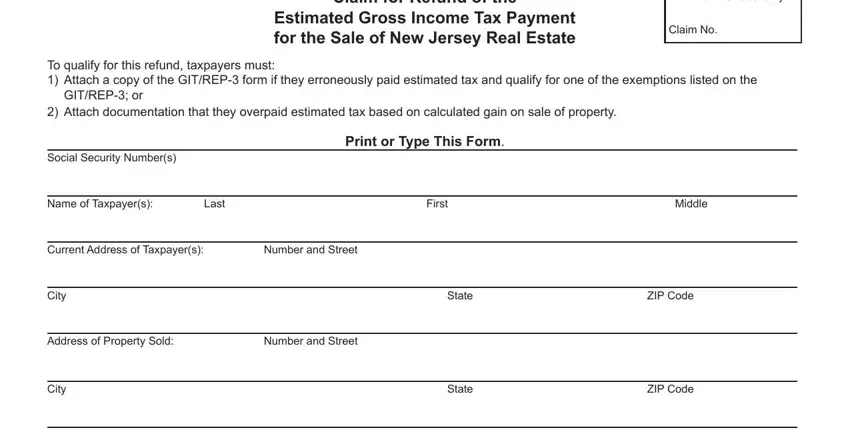

1. It's vital to fill out the a 3128 correctly, so take care when filling in the parts containing these fields:

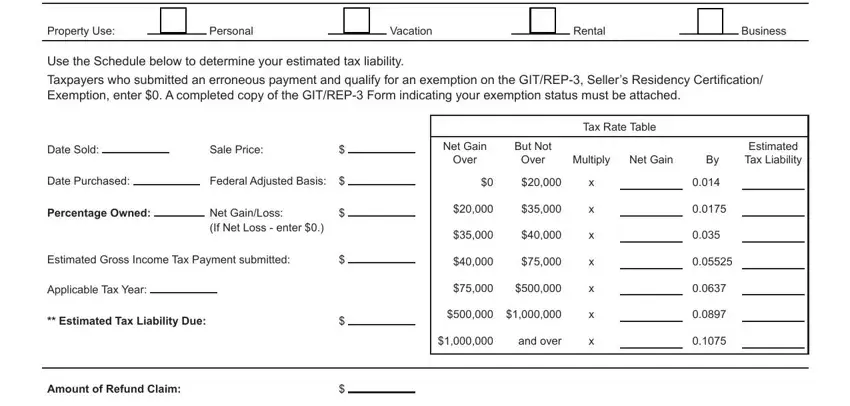

2. Right after the last section is filled out, go to type in the applicable details in all these: Property Use, Personal, Vacation, Rental, Business, Use the Schedule below to, Date Sold, Sale Price, Date Purchased, Federal Adjusted Basis, Percentage Owned, Net GainLoss If Net Loss enter, Estimated Gross Income Tax Payment, Applicable Tax Year, and Estimated Tax Liability Due.

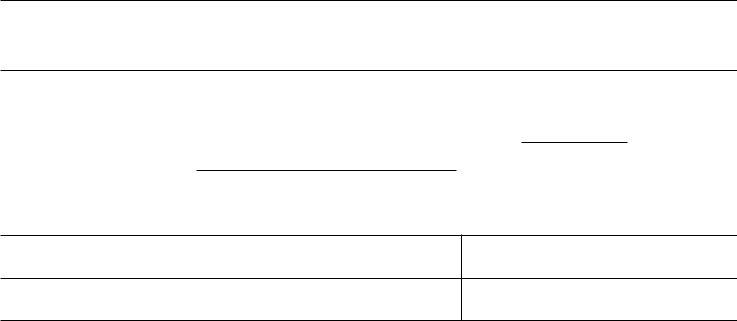

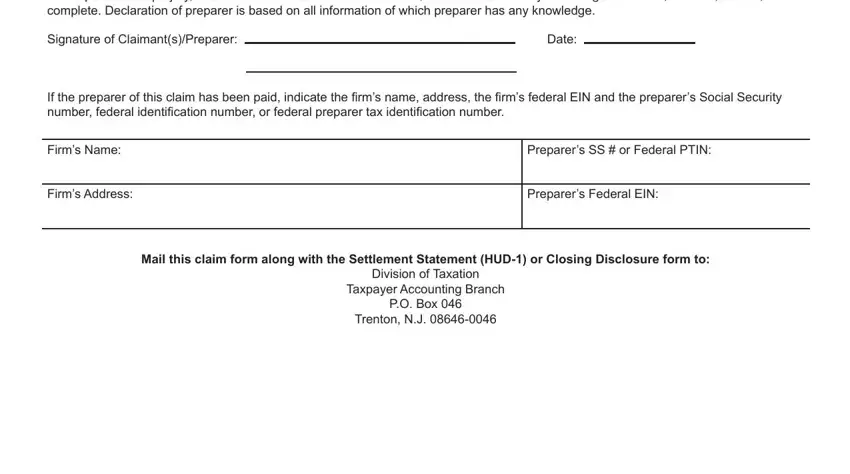

3. The following segment is focused on Under penalties of perjury I, Signature of ClaimantsPreparer, Date, If the preparer of this claim has, Firms Name, Firms Address, Preparers SS or Federal PTIN, Preparers Federal EIN, Mail this claim form along with, Division of Taxation, Taxpayer Accounting Branch, PO Box, and Trenton NJ - type in these empty form fields.

Those who work with this PDF frequently make errors when completing Division of Taxation in this area. Ensure you read twice what you enter right here.

Step 3: Go through what you've entered into the blank fields and hit the "Done" button. Right after registering afree trial account at FormsPal, you will be able to download a 3128 or send it through email at once. The document will also be easily accessible via your personal account page with your each change. We do not sell or share any information you type in when dealing with forms at our website.