Using the online PDF tool by FormsPal, you may fill in or modify njw3 right here and now. To have our tool on the forefront of efficiency, we strive to put into operation user-driven capabilities and enhancements on a regular basis. We are at all times pleased to get suggestions - join us in revolutionizing how we work with PDF docs. In case you are looking to start, here's what it will require:

Step 1: Hit the "Get Form" button above on this webpage to get into our editor.

Step 2: This tool offers the opportunity to work with PDF files in a variety of ways. Enhance it by adding your own text, correct existing content, and include a signature - all at your fingertips!

It really is straightforward to finish the document with this practical guide! Here's what you want to do:

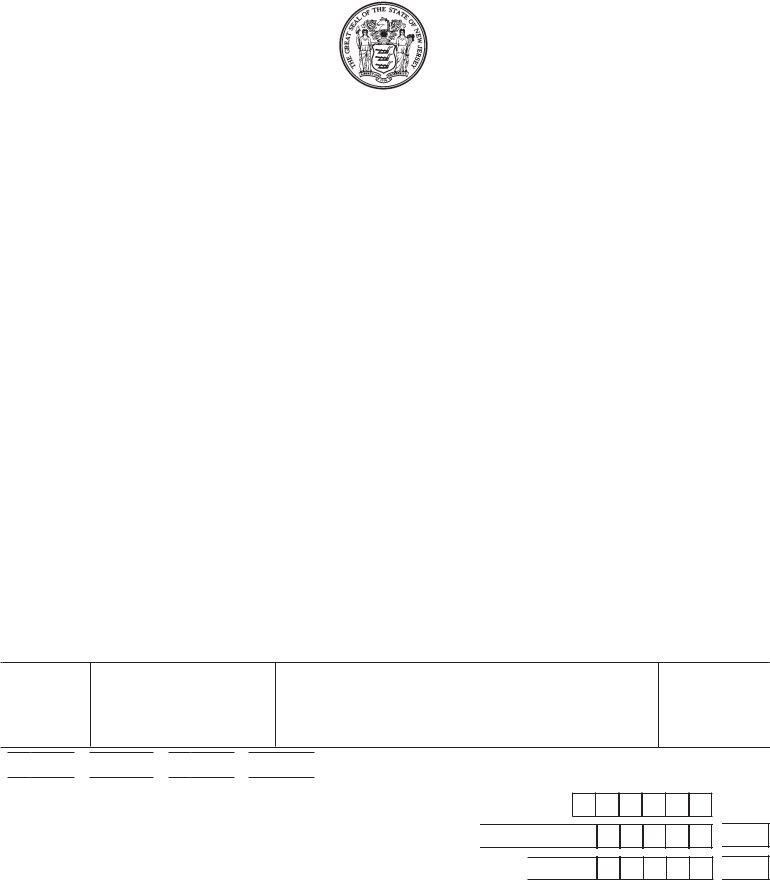

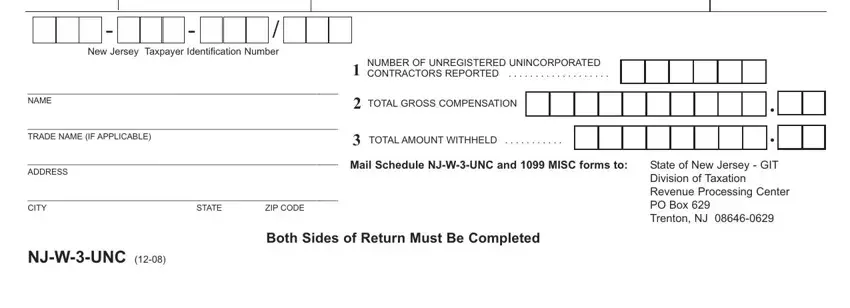

1. The njw3 requires specific information to be typed in. Make sure the following fields are complete:

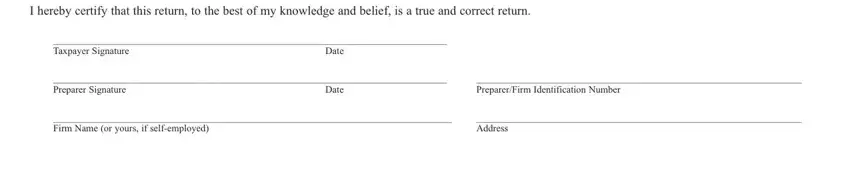

2. Once your current task is complete, take the next step – fill out all of these fields - I hereby certify that this return, Taxpayer Signature, Date, Preparer Signature, Date, PreparerFirm Identification Number, Firm Name or yours if selfemployed, and Address with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

When it comes to Date and Preparer Signature, be sure you double-check them in this section. Both these could be the most important ones in this document.

Step 3: Make sure your information is correct and then simply click "Done" to progress further. Find the njw3 as soon as you register online for a 7-day free trial. Conveniently gain access to the form inside your FormsPal cabinet, along with any edits and changes automatically synced! With FormsPal, you can complete forms without the need to be concerned about information leaks or records getting shared. Our protected software helps to ensure that your personal details are maintained safely.