The NJ-1040 form is a cornerstone document for New Jersey residents, navigating through income tax return processes with an extensive scope that encompasses various facets of an individual's financial activities over the past year. From basic identification details to intricate financial data, this form encapsulates a wide array of information, including social security numbers, filing status, exemptions, and an exhaustive list of income sources like wages, interest income, dividends, and profits from businesses, among others. It further delves into deductions and credits, aiming to provide a comprehensive framework for accurately calculating taxable income and tax dues or refunds. Additionally, the form offers options for making charitable contributions to recognized funds, outlines parameters for tax withholdings, and even addresses special tax credits such as those for child and dependent care, thus reflecting a meticulous design to accommodate diverse taxpayer needs. With sections dedicated to various exclusions, deductions, and the calculation of the total tax due or overpayment, NJ-1040 stands as a testament to the detailed financial reporting and tax calculation requirements imposed by New Jersey state law, emphasizing the state’s efforts to streamline tax filing while ensuring accuracy and compliance.

| Question | Answer |

|---|---|

| Form Name | Nj1040 Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | form nj 1040, nj 1040 instructions, nj 1040 tax form, get form nj 1040 |

For Privacy Act Notification, See Instructions

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

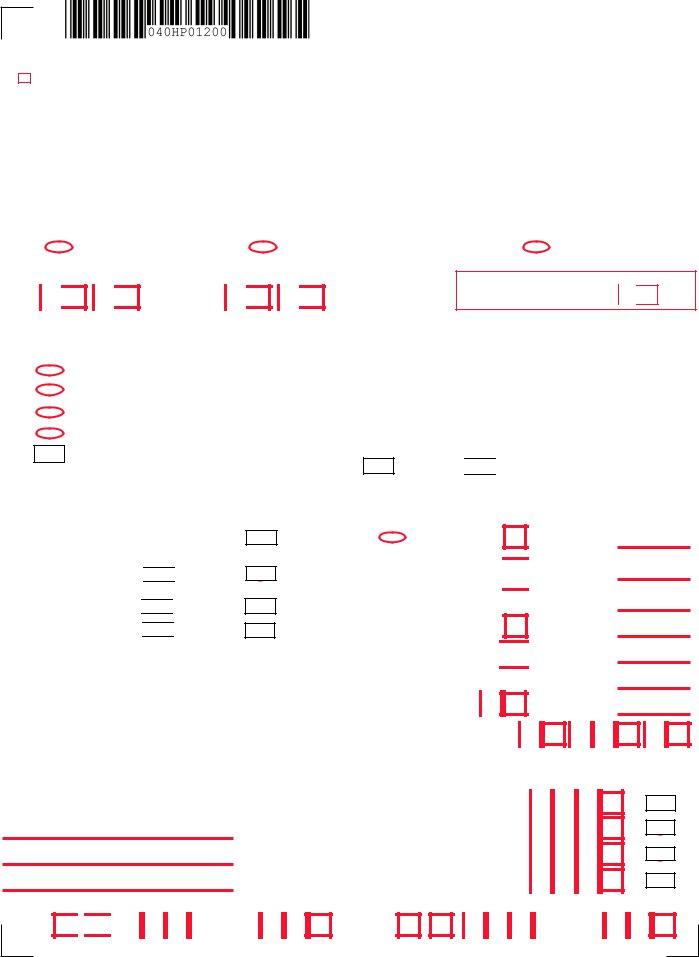

2020 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Jersey Resident |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Tax Return |

|||||

5R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Affix preprinted label below ONLY if the information is correct. |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Your Social Security Number (required) |

|

|

|

|

Last Name, First Name, Initial (Joint Filers enter first name and middle initial of each. Enter |

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

spouse’s/CU partner’s last name ONLY if different.) |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Spouse’s/CU Partner’s SSN (if filing jointly) |

|

Home Address (Number and Street, including apartment number) |

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

County/Municipality Code (See Table page 50) |

|

City, Town, Post Office |

|

State |

ZIP Code |

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Fill in |

|

|

|

if federal extension filed. |

|

Fill in |

|

|

if the address above is a foreign address. |

Fill in |

|

|

if your address has changed. |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From: MM / D D / 2 0 To: MM / D D / 2 0

Fiscal year filers only:

Enter month of your year end

MM

2021

Filing Status

Fill in only one.

1. |

|

Single |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

Married/CU Couple, filing joint return |

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

3. |

|

Married/CU Partner, filing separate return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

4. |

|

Head of Household |

Enter spouse’s/CU partner’s SSN |

||||||||||||||||

|

|||||||||||||||||||

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

5.

Qualifying Widow(er)/Surviving CU Partner

Indicate the year of your spouse’s/CU partner’s death:

2018 or 2019

Exemptions

Fill in the ovals that apply. You must enter a total in the boxes to the right and complete the calculation.

6.Regular ..............................

7.Senior 65+ (Born

in 1955 or earlier) ..............

8.Blind/Disabled....................

9.Veteran ...............................

Self

Self

Self Self

Spouse/ |

|

Domestic |

|

||

CU Partner |

|

Partner |

|

Spouse/CU Partner ..........................................

Spouse/CU Partner ..........................................

Spouse/CU Partner ...........................................

x $1,000 |

= |

|

x $1,000 |

= |

|

x |

$1,000 |

= |

x |

$6,000 = |

|

10.Qualified Dependent Children ...........................................................................................................

11.Other Dependents .............................................................................................................................

12.Dependents Attending Colleges (See instructions) ...........................................................................

x $1,500 |

= |

|

x |

$1,500 |

= |

x |

$1,000 |

= |

13. Total Exemption Amount (Add totals from the lines at 6 through 12) |

13. |

||||||||||||||||||

14. Dependent Information. Provide the following information for each dependent. |

|

|

|

|

|

|

|

|

|

||||||||||

Last Name, First Name, Middle Initial |

|

Social Security Number |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

,

Birth Year

.

No Health Insurance

Division

use

1 2

3

|

|

|

|

|

- |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

6 |

|

|

|

|||

|

|

|

|

|

|

|

|

4 |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7

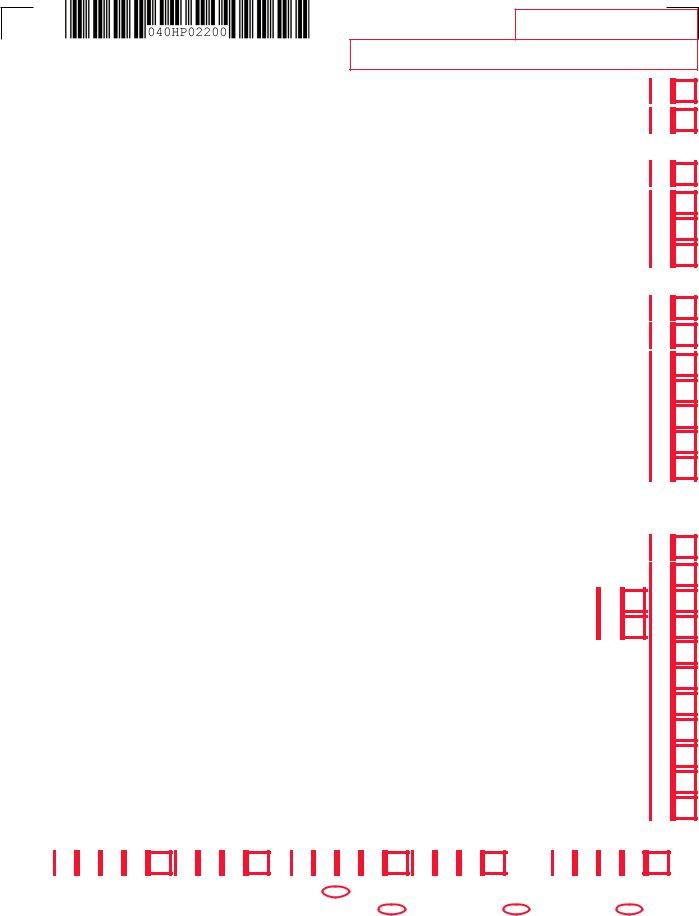

Page 2

Your Social Security Number

Name(s) as shown on Form

15. |

Wages, salaries, tips, and other employee compensation (State wages from |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Box 16 of enclosed |

15. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||

16a. |

Taxable interest income (Enclose federal Schedule B if over $1,500) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(See instructions) |

16a. |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

16b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(See instructions) Do not include on line 16a |

16b. |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. |

Dividends |

17. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

18. |

Net profits from business (Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(Enclose federal Schedule C) |

18. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

19. |

Net gains or income from disposition of property (Schedule |

19. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20a. |

Pensions, Annuities, and IRA Withdrawals (See instructions) |

20a. |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20b. |

Excludable Pensions, Annuities, and IRA Withdrawals |

20b. |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

21. |

Distributive Share of Partnership Income (Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

(Enclose Schedule |

21. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

22. |

Net pro rata share of S Corporation Income (Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

(Enclose Schedule |

22. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

23. |

Net gains or income from rents, royalties, patents, and copyrights |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(Schedule |

23. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24. |

Net Gambling Winnings (See instructions) |

24. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25. |

Alimony and Separate Maintenance Payments received |

25. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26. |

Other (Enclose documents) (See instructions) |

26. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27. |

Total Income (Add lines 15, 16a, 17 through 20a, and 21 through 26) |

27. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

28a. |

Retirement/Pension Exclusion (See instructions) |

28a. |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

28b. |

Other Retirement Income Exclusion (See Worksheet D and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

instructions pages |

28b. |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

28c. |

Total Exclusion Amount (Add lines 28a and 28b) |

|

|

|

|

|

|

|

|

|

|

28c. |

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||

29. |

New Jersey Gross Income (Subtract line 28c from line 27) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(See instructions) |

29. |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||||

30. |

Exemption Amount (Enter amount from line 13. |

|

|

|

|

|

30. |

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

31. |

Medical Expenses (See Worksheet F and instructions) |

|

|

|

|

|

31. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

32. |

Alimony and Separate Maintenance Payments (See instructions) |

|

|

|

|

|

32. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

33. |

Qualified Conservation Contribution |

|

|

|

|

|

33. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

34. |

Health Enterprise Zone Deduction |

|

|

|

|

|

34. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

35. |

Alternative Business Calculation Adjustment (Schedule |

|

|

|

|

|

35. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

36. |

Organ/Bone Marrow Donation Deduction (See instructions) |

|

|

|

|

|

36. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

37. |

Total Exemptions and Deductions (Add lines 30 through 36) |

|

|

|

|

|

37. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

38. |

Taxable Income (Subtract line 37 from line 29) |

38. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||||

39a. |

Total Property Taxes (18% of Rent) Paid (See instructions page 23) ... |

39a. |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

. |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

39b. Block

.

Lot

.

Qualifier

39c. County/Municipality Code |

|

|

|

|

|

|

|

Fill in |

|

if you completed Worksheet G. |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

39d. Indicate your residency status during 2020 (fill in only one oval) |

|

|

Homeowner |

|

Tenant |

|

Both |

|||||||||||

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

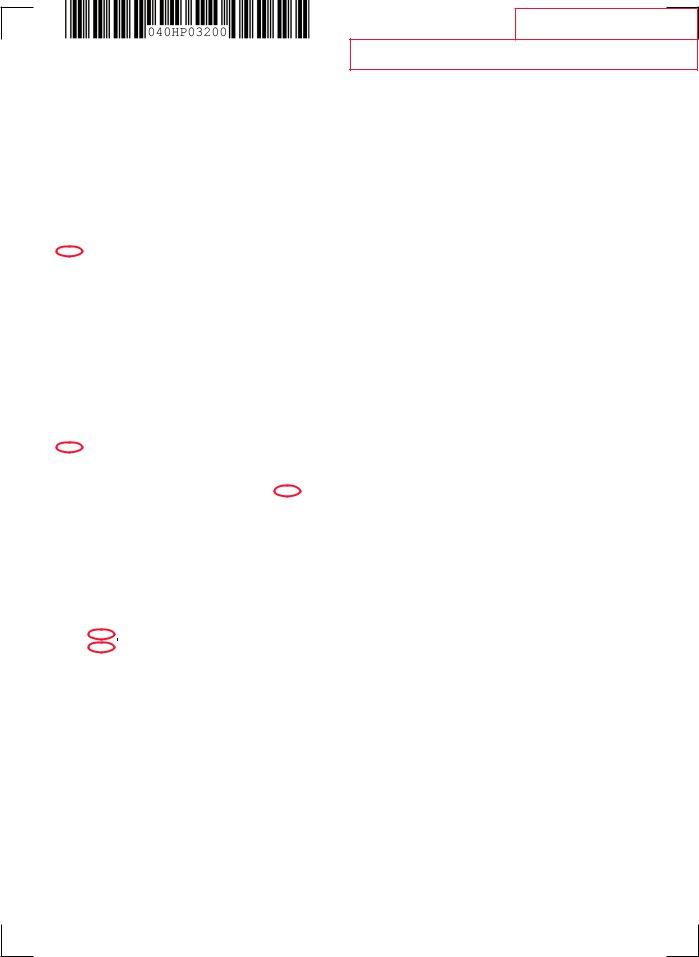

Page 3

Your Social Security Number

Name(s) as shown on Form

40. |

.......................................................Property Tax Deduction (From Worksheet H) (See instructions) |

|

|

|

|

|

|

|

40. |

|

|

|

|||||||

41. |

New Jersey Taxable Income (Subtract line 40 from line 38) |

41. |

|

|

|

|

|

, |

|

|

|

||||||||

|

|

|

|

|

|

|

|

||||||||||||

42. |

Tax on Amount on line 41 (Tax Table page 52) |

Enter Code |

42. |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|||||||||||||||

43. |

Credit For Income Taxes Paid to Other Jurisdictions |

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

(Enclose Schedule |

|

|

|

|

|

43. |

|

|

|

|

|

|||||||

44. |

Balance of Tax (Subtract line 43 from line 42) |

|

|

|

|

|

44. |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

45. |

Child and Dependent Care Credit (See instructions) |

|

|

|

|

|

|

|

45. |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Fill in |

|

|

if you are a CU couple claiming the Child and Dependent Care Credit |

|

|

|

|

|

|

|

||||||||

46. |

..................................................................................................Sheltered Workshop Tax Credit |

|

|

|

|

|

46. |

|

|

|

|

|

|||||||

47. |

Gold Star Family Counseling Credit (See instructions) |

|

|

|

|

|

47. |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

48. |

Credit for Employer of Organ/Bone Marrow Donor (See instructions) |

|

|

|

|

|

48. |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

49. |

Total Credits (Add lines 45 through 48) |

|

|

|

|

|

49. |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

50. |

Balance of Tax After Credits (Subtract line 49 from line 44) If zero or less, make no entry |

50. |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|||||||||||||||

51. |

Use Tax Due on Internet, |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

(See instructions) If no Use Tax, enter 0.00 |

|

|

|

|

|

51. |

|

|

|

|

|

|||||||

52. |

Interest |

on |

Underpayment of Estimated Tax |

|

|

|

|

|

52. |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Fill in |

|

|

if Form |

|

|

|

|

|

|

|

|

|

|

|

|

|||

53. |

....................................................................Shared Responsibility Payment (See instructions) |

|

|

|

|

|

53. |

|

|

|

|

|

|||||||

|

REQUIRED Enclose Schedule HCC and fill in |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

54. |

..................................................................................Total Tax Due (Add lines 50 through 53) |

|

|

|

|

|

54. |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

55. |

Total New Jersey Income Tax Withheld (Enclose Forms |

55. |

|

|

|

|

, |

|

|

|

|||||||||

56. |

Property Tax Credit (See instructions page 23) |

|

|

|

|

|

|

|

56 |

||||||||||

57. |

New Jersey Estimated Tax Payments/Credit from 2019 tax return |

57. |

|

|

|

|

, |

|

|

|

|||||||||

58. |

New Jersey Earned Income Tax Credit (See instructions) |

|

|

|

|

|

|

|

58. |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Fill in |

|

|

if you had the IRS calculate your federal earned income credit |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

Fill in |

|

|

if you are a CU couple claiming the NJ Earned Income Tax Credit |

|

|

|

|

|

|

|

|||||||

59. |

Excess New Jersey UI/WF/SWF Withheld (Enclose Form |

|

59. |

|

|

||||||||||||||

60. |

Excess New Jersey Disability Insurance Withheld (Enclose Form |

............... |

|

60. |

|

|

|||||||||||||

|

|

|

|

||||||||||||||||

61. |

Excess New Jersey Family Leave Insurance Withheld (Enclose Form |

........ 61. |

|

|

|||||||||||||||

|

|

||||||||||||||||||

62. |

Wounded Warrior Caregivers Credit (See instructions) |

|

|

|

|

|

|

|

62. |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

63. |

63. |

|

|

|

|

, |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

64. |

Total Withholdings, Credits, and Payments (Add lines 55 through 63) |

64. |

|

|

|

|

, |

|

|

|

|||||||||

65. |

If line 64 is less than line 54, you have tax due. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Subtract line 64 from line 54 and enter the amount you owe |

65. |

|

|

|

|

, |

|

|

|

|||||||||

|

If you owe tax, you can still make a donation on lines 68 through 75. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

66. |

If the total on line 64 is more than line 54, you have an overpayment. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Subtract line 54 from line 64 and enter the overpayment |

66. |

|

|

|

|

, |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

67. |

.Amount from line 66 you want to credit to your 2021 tax |

67. |

|

|

|

|

, |

|

|

|

|||||||||

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

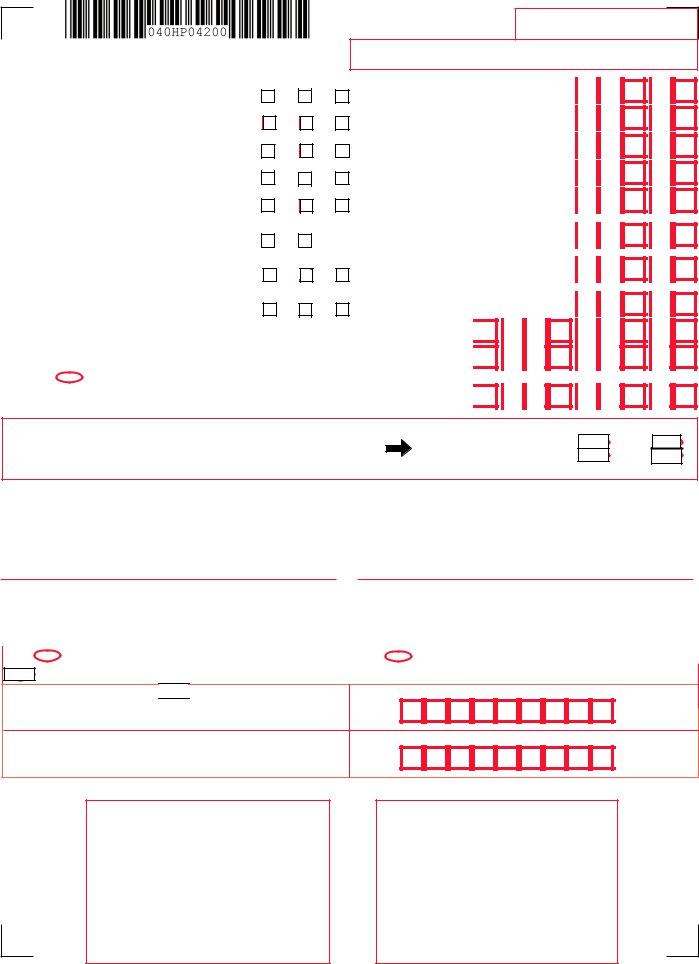

Page 4

Your Social Security Number

Name(s) as shown on Form

68. |

Contribution to N.J. |

|

|

|

|

|

Endangered Wildlife Fund |

$10 |

$20 |

Other |

68. |

69. |

Contribution to N.J. Children’s Trust |

|

|

|

|

|

Fund To Prevent Child Abuse |

$10 |

$20 |

Other |

69. |

70. |

Contribution to N.J. Vietnam |

|

|

|

|

|

Veterans’ Memorial Fund |

$10 |

$20 |

Other |

70. |

71. |

Contribution to N.J. Breast |

|

|

|

|

|

Cancer Research Fund |

$10 |

$20 |

Other |

71. |

72. |

Contribution to U.S.S. New Jersey |

|

|

|

|

|

Educational Museum Fund |

$10 |

$20 |

Other |

72. |

.

.

.

.

.

73. |

Other Designated Contribution |

|

|

|

|

|

|

|

|

Enter Code |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

...................................................(See instructions) |

$10 |

$20 |

|

Other |

|

|

|

|

|

|||||

74. |

Other Designated Contribution |

|

|

|

|

|

|

|

|

|

Enter Code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

...................................................(See instructions) |

|

|

$10 |

|

$20 |

|

Other |

|

|

|

|

|

||

75. |

Other Designated Contribution |

|

|

|

|

|

|

|

|

Enter Code |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

...................................................(See instructions) |

|

|

$10 |

$20 |

|

Other |

|

|

|

|

|

|||

76. |

Total Adjustments to Tax Due/Overpayment amount |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

(Add lines 67 through 75) |

|

|

|

|

|

|

76. |

|

|

|

||||

77. |

Balance due (If line 65 is more than zero, add line 65 and line 76) |

|

|

77. |

|

|

|

||||||||

|

|

|

|

|

|||||||||||

|

Fill in |

if paying by |

|

|

|

|

|

|

|

|

|

|

|

|

|

78. |

...................Refund amount (If line 66 is more than zero, subtract line 76 from line 66) |

78. |

|

|

|

||||||||||

|

|

|

|||||||||||||

73.

74.

75.

,

,

,

,

,

,

.

.

.

.

.

.

Gubernatorial Elections Fund

Do you want to designate $1 to the Gubernatorial Elections Fund? If joint return, does your spouse want to designate $1?

This does not reduce your refund or increase your balance due.

You |

Yes |

No |

Spouse/CU Partner |

Yes |

No |

Signature

Under penalties of perjury, I declare that I have examined this Income Tax return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has any knowledge.

Your Signature |

|

Date |

|

Spouse’s/CU Partner’s Signature (required if filing jointly) |

Date |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Driver’s License Number (Voluntary) (See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fill in |

|

if death certificate is enclosed. |

|

|

|

|

Fill in |

|

|

|

if you do not want a paper form next year. |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I authorize the Division of Taxation to discuss my return and enclosures with my preparer (below).

Paid Preparer’s Signature (Fill in if

Federal Identification Number

Firm’s Name

Firm’s Federal Employer Identification Number

Keep a copy of this return and all supporting documents for your records.

Tax Due Address

Mail payment along with the

State of New Jersey

Division of Taxation

Revenue Processing Center – Payments PO Box 111

Trenton, NJ

Include Social Security number and make check or money order payable to:

State of New Jersey – TGI

You can also make a payment on our website: www.njtaxation.org

Refund or No Tax Due Address

Mail to:

State of New Jersey

Division of Taxation

Revenue Processing Center – Refunds PO Box 555

Trenton, NJ