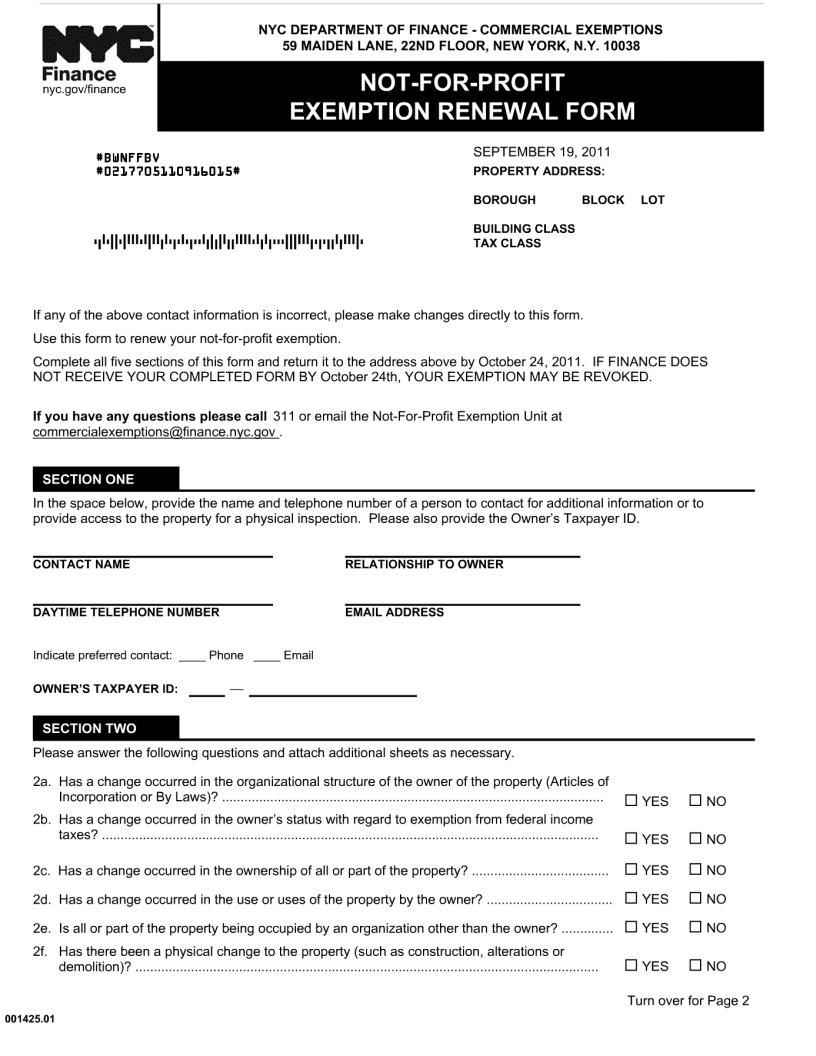

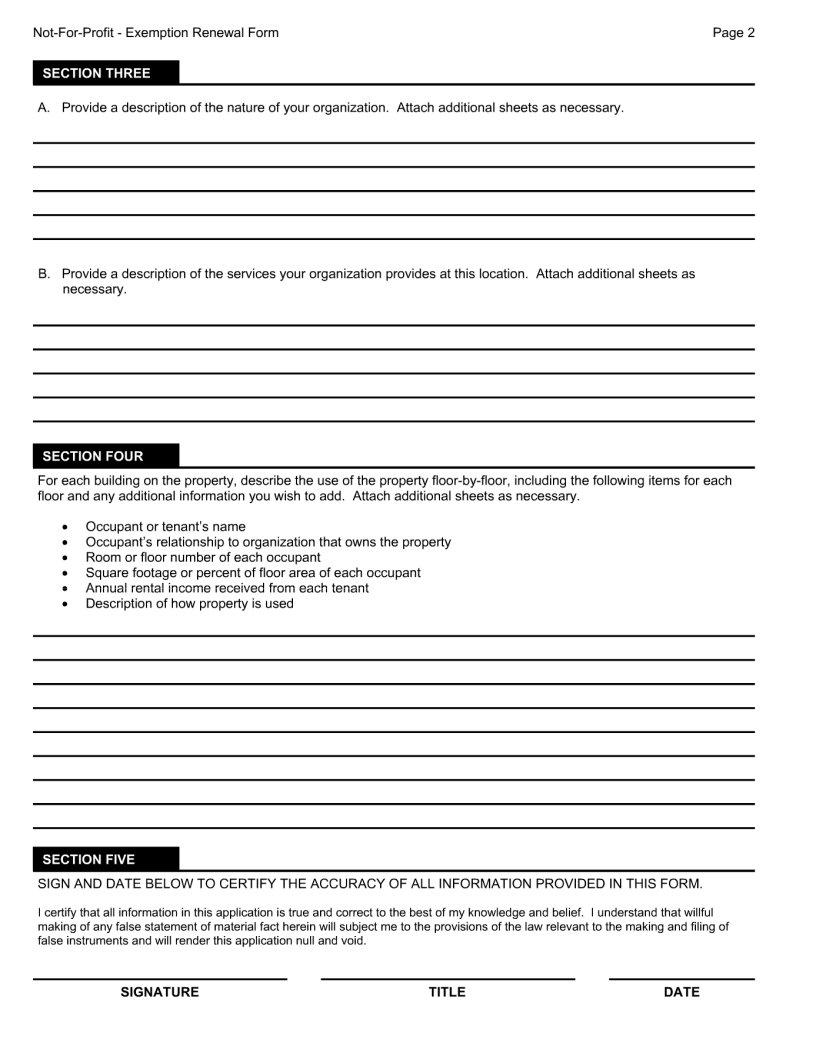

In the bustling metropolis of New York City, where the pulse of community service and charitable work resonates deeply through its diverse neighborhoods, the Non-Profit Exemption Renewal form stands as a critical document for organizations dedicated to making a difference without the motive of profit. This form is not merely paperwork; it represents a lifeline for non-profit entities, enabling them to continue benefiting from tax exemptions that are essential for their operations. Far from being a one-time task, the renewal process requires attention to detail and an understanding of the criteria set by the city's regulatory bodies. It is through this meticulous process that non-profits can navigate the complexities of compliance, ensuring they retain their financial benefits and can focus on their mission of service. Delving into the major aspects of this form sheds light on the procedural necessities, the importance of timely submissions, and the ongoing commitment required of non-profit organizations in maintaining their exempt status. Understanding the nuances of the Non-Profit Exemption Renewal NYC form is paramount for these entities to thrive and continue their invaluable contributions to the fabric of New York City.

| Question | Answer |

|---|---|

| Form Name | Non Profit Exemption Renewal Form Nyc |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | commercialexceptions, not for profit exemption renewal form, nyc gov commercial exemptions, nyc gov commercialexemptions |