Using PDF forms online is quite easy with this PDF tool. You can fill in North Dakota Form 38 here with no trouble. Our tool is continually evolving to give the very best user experience possible, and that is because of our resolve for continual enhancement and listening closely to customer feedback. It just takes a few easy steps:

Step 1: Access the PDF file inside our tool by clicking on the "Get Form Button" above on this webpage.

Step 2: This tool helps you work with PDF forms in a range of ways. Transform it with any text, correct what is already in the PDF, and include a signature - all within several mouse clicks!

This form will require some specific information; to ensure consistency, please be sure to take note of the suggestions listed below:

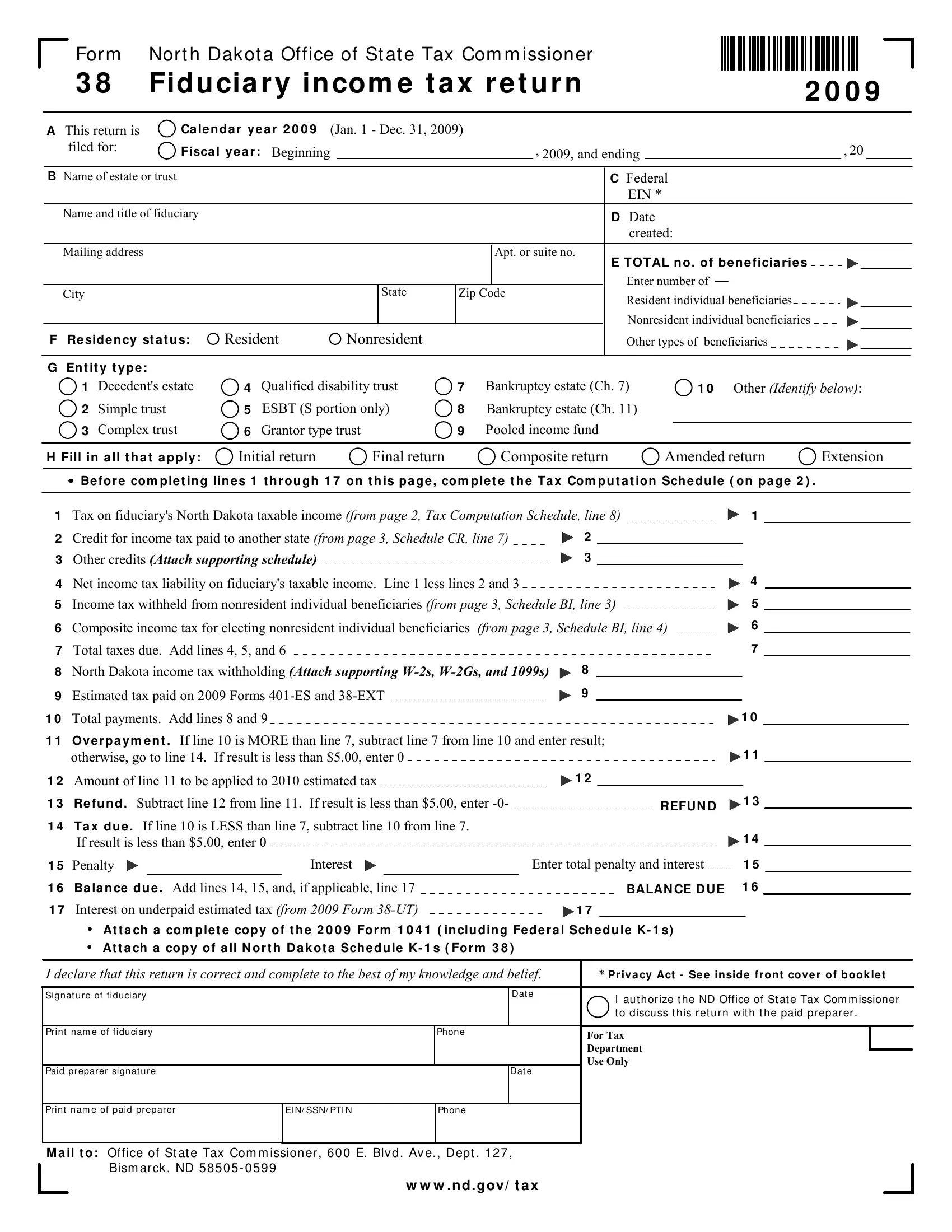

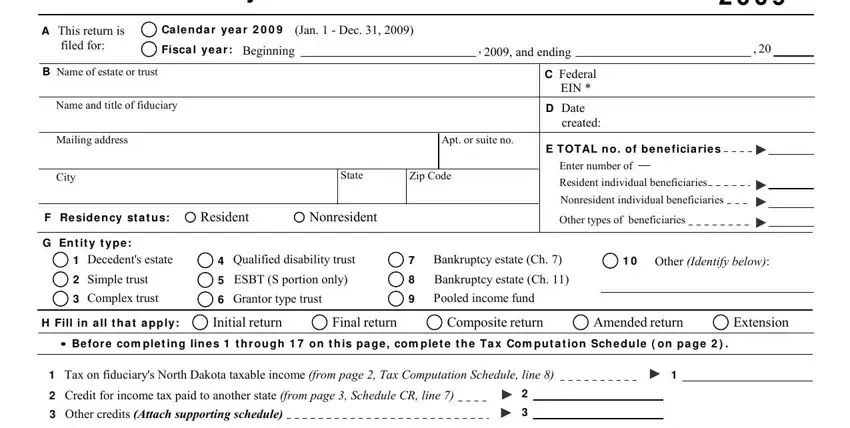

1. To start off, when filling out the North Dakota Form 38, start out with the section with the following blanks:

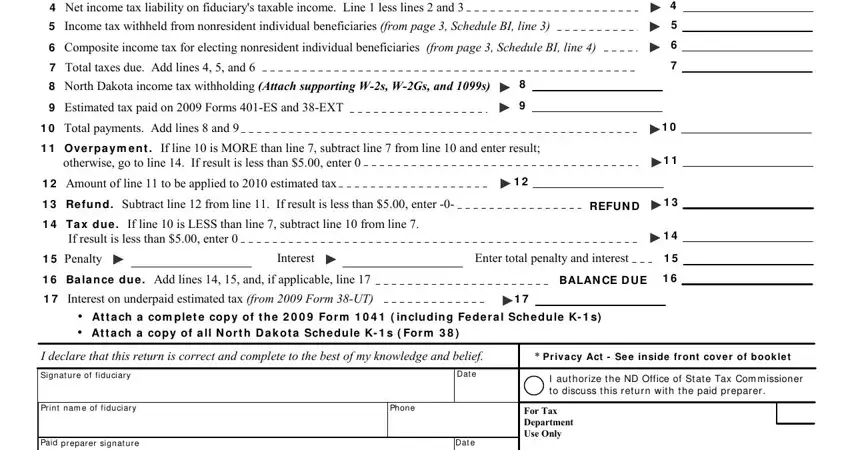

2. Just after completing this part, head on to the next part and enter the essential particulars in these blanks - Net income tax liability on, Income tax withheld from, Composite income tax for electing, Total taxes due Add lines and, North Dakota income tax, Estimated tax paid on Forms ES, Total payments Add lines and, Ov e r p a y m e n t If line, Amount of line to be applied to, Re fu n d Subtract line from, REFUN D, Ta x d u e If line is LESS, Penalty, Interest, and Enter total penalty and interest.

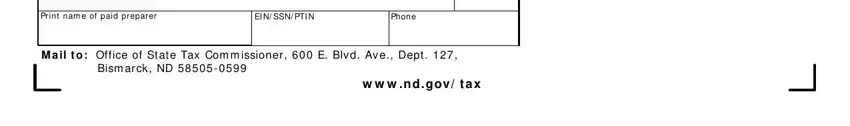

3. Completing Print nam e of paid preparer, EI N SSN PTI N, Phone, M a il t o Office of St at e Tax, and w w w ndgov t a x is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

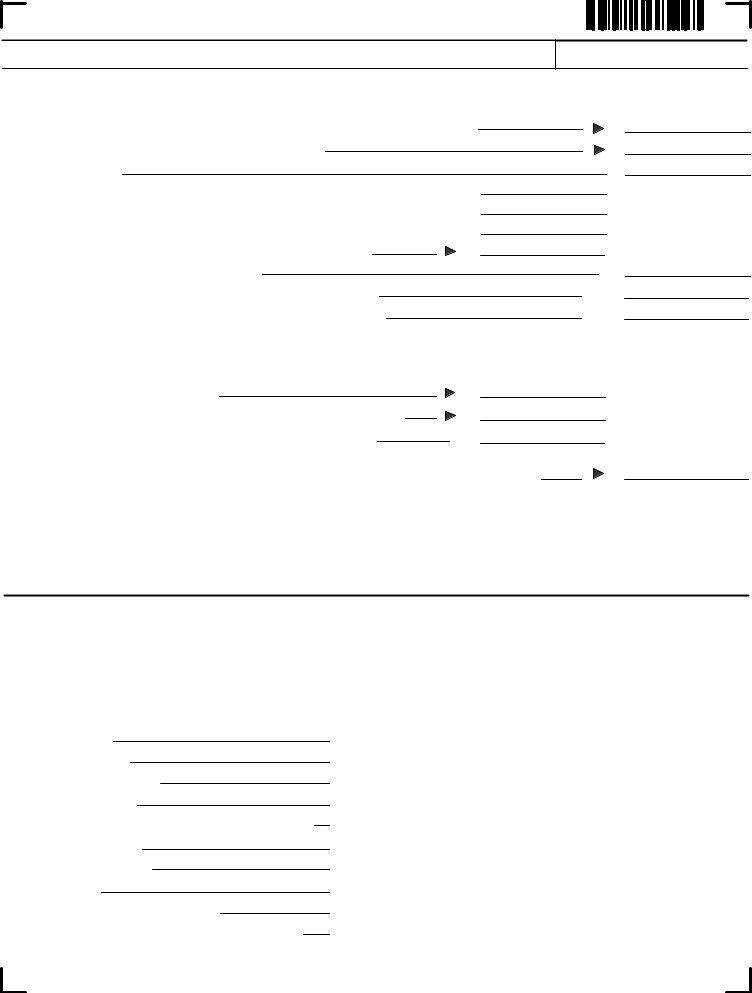

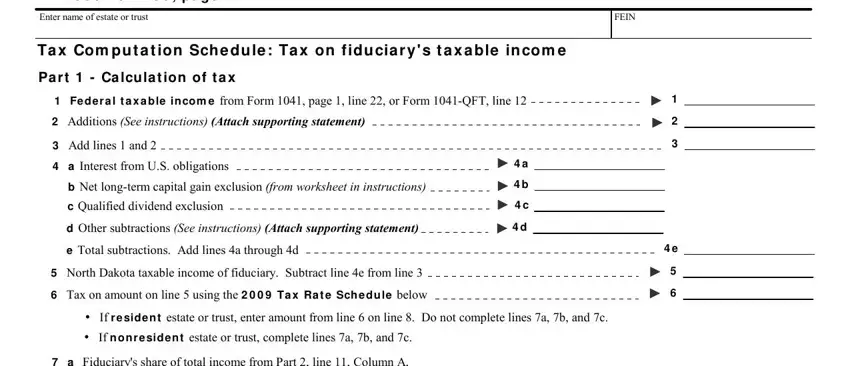

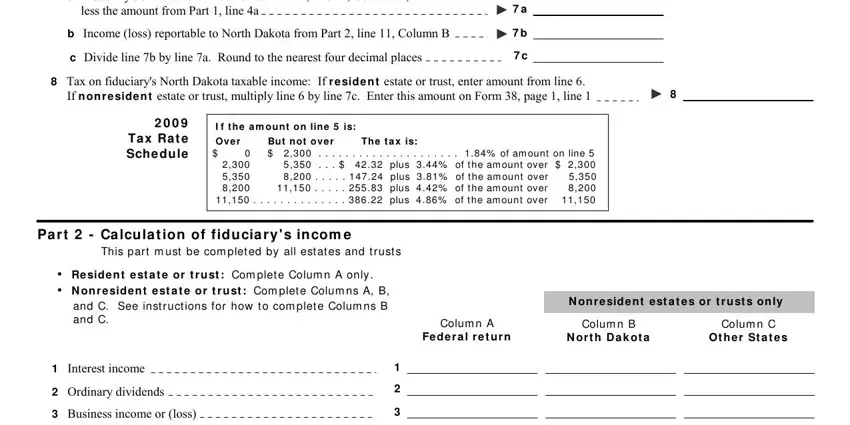

4. Filling out Nort h Dakot a Office of St at e, Enter name of estate or trust, FEIN, Ta x Com pu t a t ion Sch e du le, Pa r t Ca lcula t ion of t a x, Fe de r a l t a x a ble in com e, Additions See instructions Attach, Add lines and, a Interest from US obligations, b Net longterm capital gain, c Qualified dividend exclusion, d Other subtractions See, e Total subtractions Add lines a, North Dakota taxable income of, and Tax on amount on line using the is vital in the next section - make sure to devote some time and fill out each blank area!

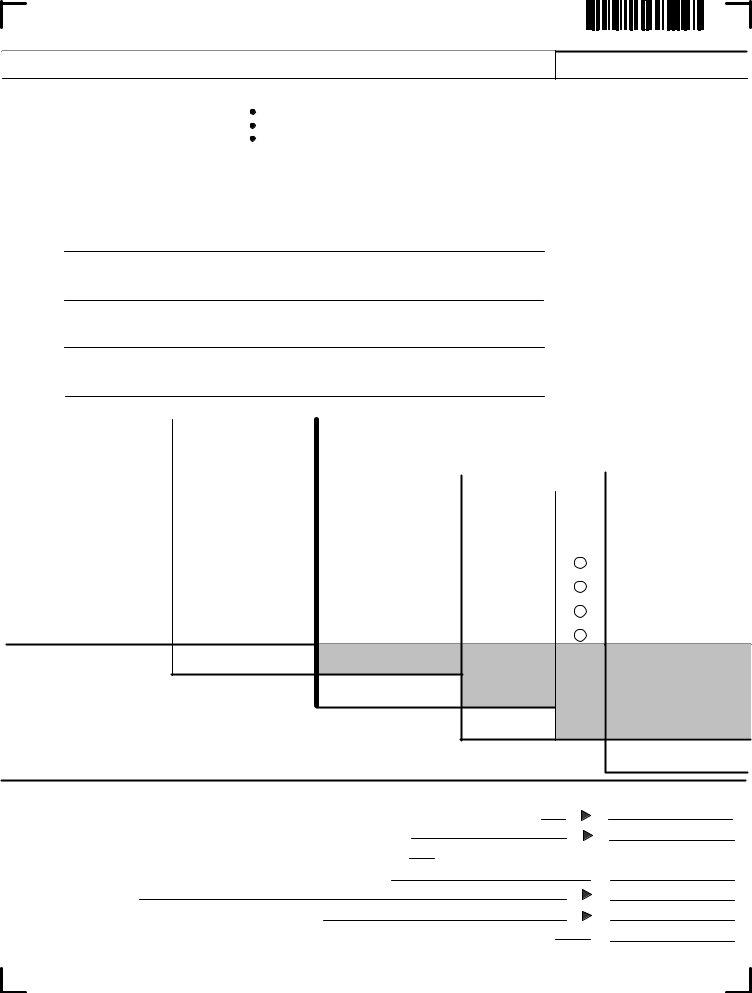

5. The form should be finalized with this part. Further you'll find a detailed set of fields that must be completed with correct information to allow your form usage to be accomplished: a Fiduciarys share of total, b Income loss reportable to North, c Divide line b by line a Round to, Tax on fiduciarys North Dakota, Ta x Ra t e Sche dule, I f t he a m ount on line is, Ove r But not ove r The t a x is, N on r e side n t e st a t e s or, Colum n A, Fe de r a l r e t u r n, Colum n B, N or t h D a k ot a, Colum n C, Ot h e r St a t e s, and Pa r t Ca lcu la t ion of fidu.

Be very attentive while completing I f t he a m ount on line is and a Fiduciarys share of total, since this is the section where most people make some mistakes.

Step 3: As soon as you have reread the information in the file's blank fields, simply click "Done" to conclude your FormsPal process. Get your North Dakota Form 38 when you sign up at FormsPal for a 7-day free trial. Conveniently get access to the pdf file inside your FormsPal account, together with any edits and adjustments all saved! FormsPal guarantees safe document editor with no data record-keeping or any type of sharing. Rest assured that your data is in good hands with us!