Handling PDF files online is definitely very easy with this PDF tool. You can fill out North Dakota Form 58 here and try out a number of other functions we provide. FormsPal professional team is ceaselessly endeavoring to improve the tool and enable it to be even easier for people with its handy functions. Enjoy an ever-improving experience now! Should you be looking to start, this is what it requires:

Step 1: Click the "Get Form" button in the top part of this webpage to get into our editor.

Step 2: As you access the file editor, you will see the form ready to be filled in. Other than filling in different fields, you may as well do many other things with the file, particularly writing custom words, modifying the initial text, inserting illustrations or photos, placing your signature to the document, and much more.

It's straightforward to finish the pdf with this practical tutorial! This is what you want to do:

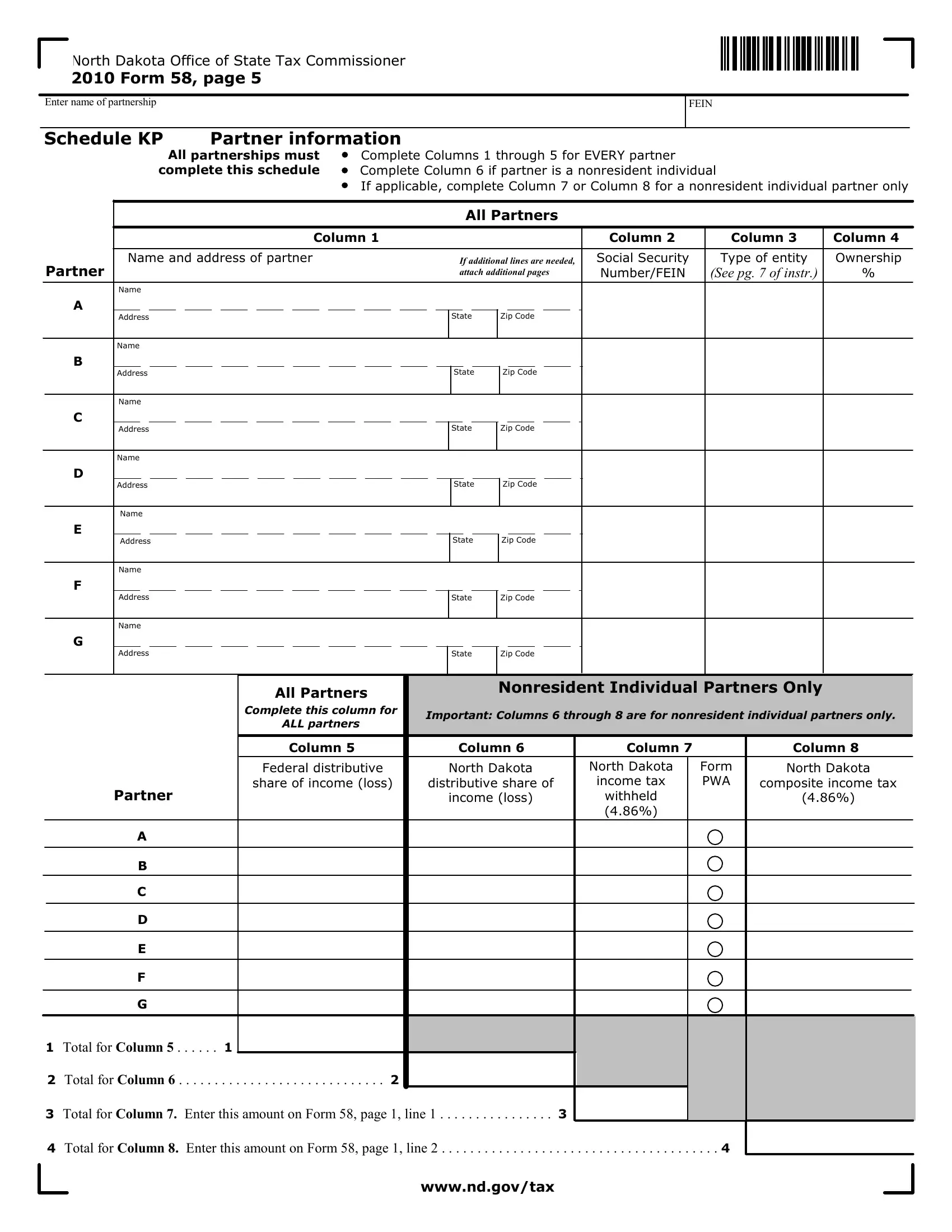

1. First of all, once completing the North Dakota Form 58, beging with the part that contains the next blanks:

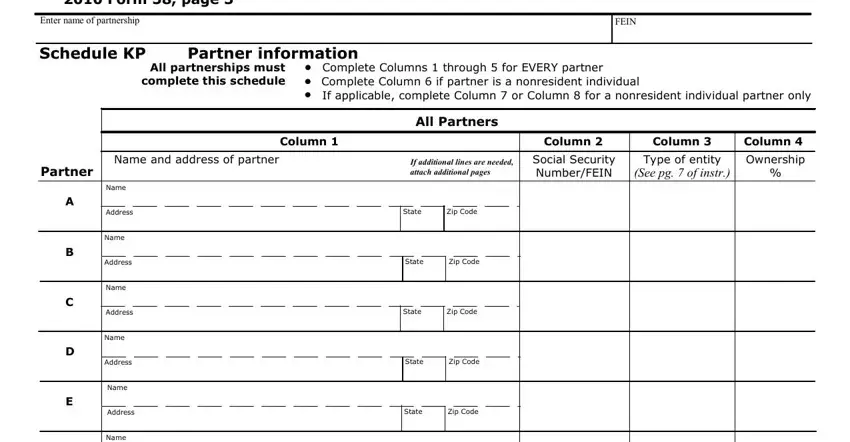

2. Just after finishing this section, go to the next stage and complete all required details in all these blanks - State Zip Code, State Zip Code, Nonresident Individual Partners, Important Columns through are, Column, North Dakota, composite income tax, Address, Name, Address, All Partners, Complete this column for, ALL partners, Column, and Column.

It's very easy to make an error while filling in your Nonresident Individual Partners, therefore be sure you reread it prior to deciding to submit it.

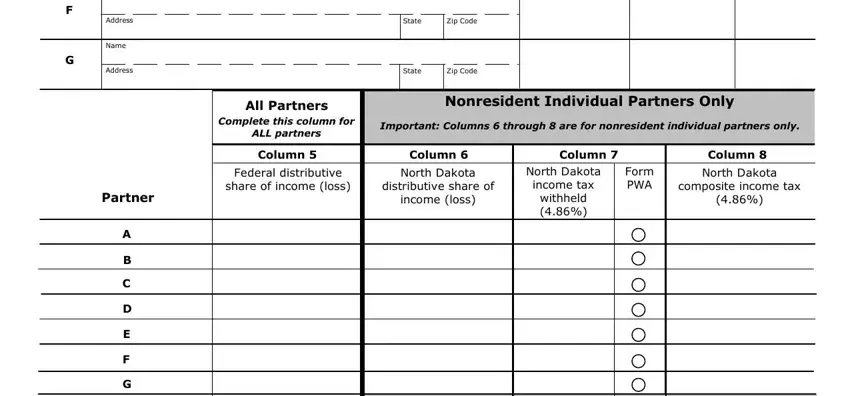

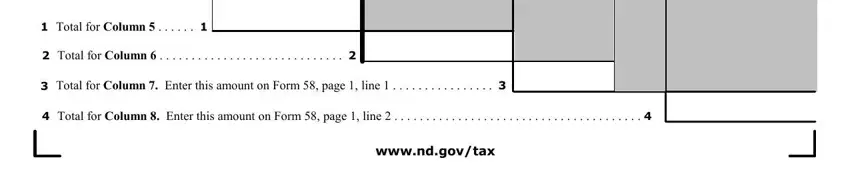

3. The third part will be straightforward - fill in every one of the blanks in Total for Column, Total for Column, Total for Column Enter this, Total for Column Enter this, and wwwndgovtax to complete this segment.

Step 3: As soon as you've looked over the details in the file's blanks, just click "Done" to finalize your form at FormsPal. Join FormsPal right now and instantly use North Dakota Form 58, set for download. All changes made by you are saved , letting you modify the form further anytime. FormsPal provides protected form completion without personal data recording or distributing. Be assured that your information is safe with us!