Whenever you desire to fill out nycers form teir4, there's no need to install any kind of programs - just make use of our PDF editor. To keep our tool on the leading edge of practicality, we aim to adopt user-driven features and enhancements regularly. We're routinely glad to receive feedback - assist us with revampimg PDF editing. With some easy steps, you are able to start your PDF journey:

Step 1: Firstly, open the pdf editor by pressing the "Get Form Button" at the top of this page.

Step 2: Using our online PDF editing tool, it's possible to accomplish more than merely fill out blank form fields. Try all of the features and make your documents appear professional with custom text added, or optimize the file's original content to perfection - all that comes with the capability to incorporate any images and sign it off.

It's easy to fill out the form using this detailed tutorial! Here is what you need to do:

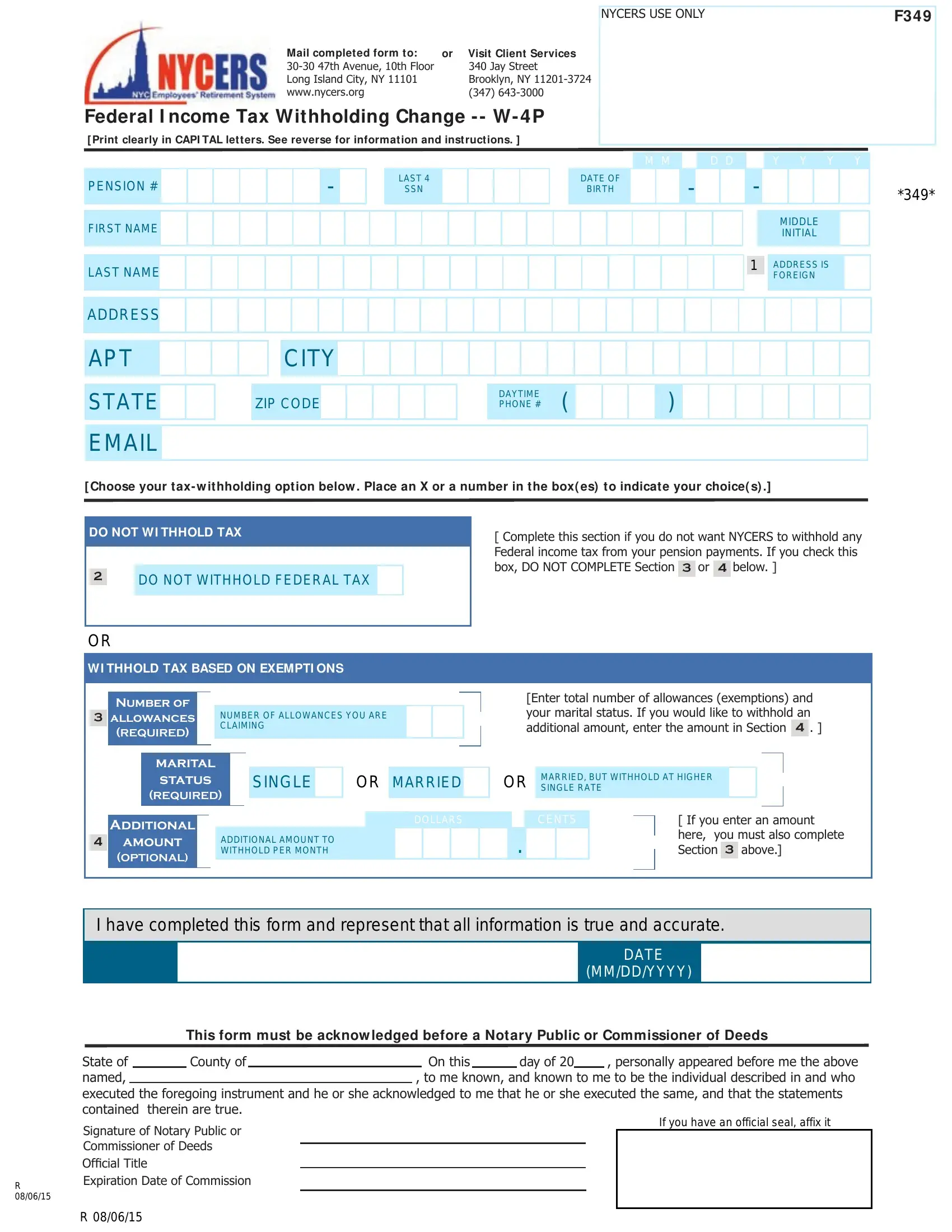

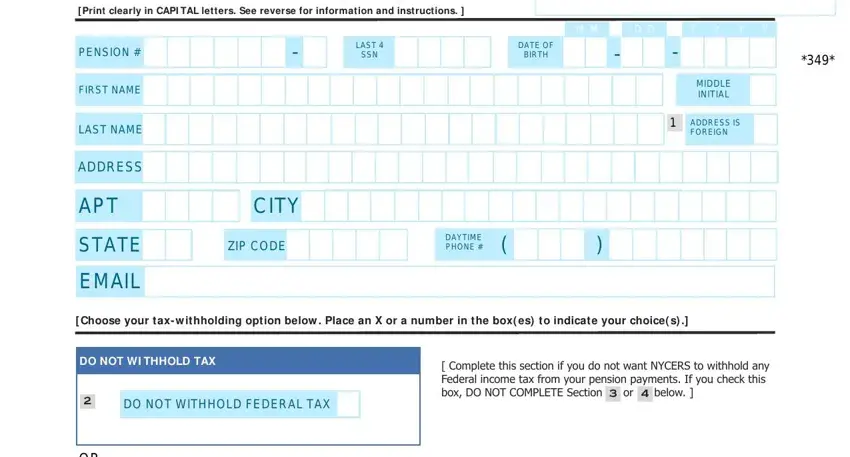

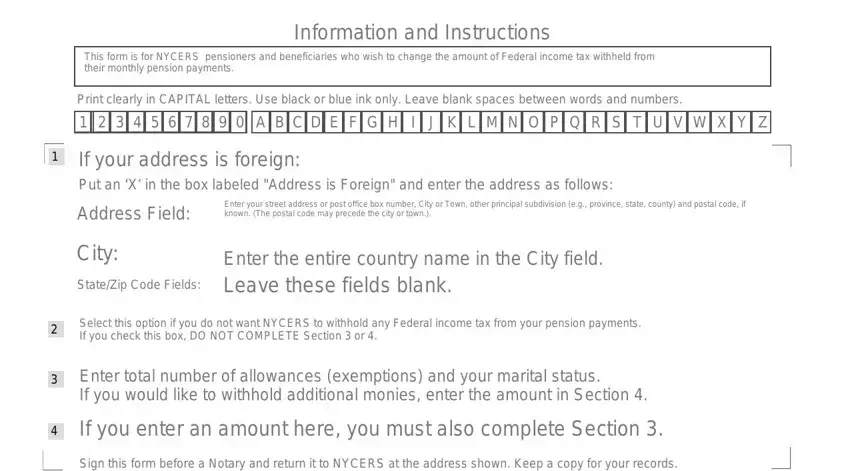

1. When completing the nycers form teir4, make certain to incorporate all of the needed fields in their corresponding area. This will help speed up the work, enabling your details to be handled quickly and appropriately.

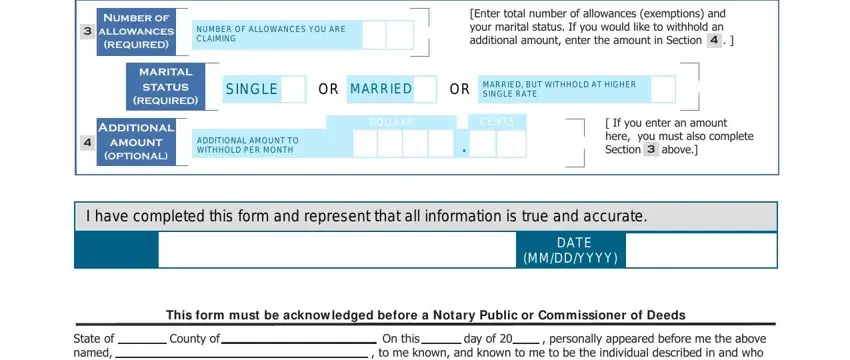

2. Given that the previous segment is complete, you're ready to include the required particulars in Number of allowances, REQUIRED, marital status, REQUIRED, Additional, amount, OPTIONAL, Enter total number of allowances, If you enter an amount here you, This form must be acknow ledged, State of County of named executed, and On this day of personally so you can progress further.

A lot of people frequently make mistakes while filling in This form must be acknow ledged in this section. Be sure to re-examine everything you type in here.

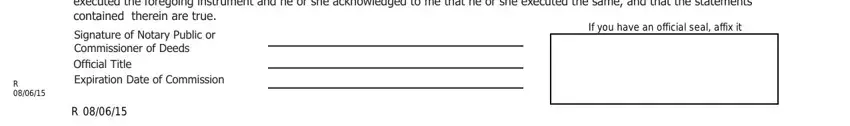

3. In this particular step, review State of County of named executed. Each one of these must be filled in with highest accuracy.

4. This next section requires some additional information. Ensure you complete all the necessary fields - - to proceed further in your process!

5. The final notch to finalize this document is pivotal. You'll want to fill out the necessary fields, including , before finalizing. If not, it can end up in a flawed and possibly nonvalid form!

Step 3: Once you have glanced through the information provided, simply click "Done" to finalize your form. Right after starting afree trial account at FormsPal, you will be able to download nycers form teir4 or send it via email directly. The document will also be easily accessible through your personal account with your every single modification. FormsPal guarantees your information privacy by using a protected method that never records or distributes any sort of sensitive information provided. Be assured knowing your docs are kept confidential any time you use our editor!