The NYS-45-MN form is a critical document for employers in New York State, serving as a Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return. This comprehensive form requires employers to detail pertinent information regarding their workforce and financial obligations to the state, including unemployment insurance contributions, wage reporting, and tax withholdings for both the state and select cities within New York. Employers must accurately mark the quarter for which they are filing, enter their UI Employer registration number, Withholding identification number, and provide employer legal names. Notably, the form is designed to gather information on the number of full-time and part-time employees, total remuneration paid, and specific remuneration paid to each employee beyond certain thresholds within the quarter. Additionally, it includes sections for computing the unemployment insurance contributions due based on wages subject to contribution, adjustments for over or underpayments from previous periods, and total payment due for both unemployment insurance and withheld taxes. Modifications for quarterly or seasonal adjustments are accommodated, and there's also provision for reporting any changes in business information that might affect tax responsibilities. Furthermore, the form can be used to correct or add withholding information from Form NYS-1, tying together various reporting and payment obligations into a single, scannable document intended to streamline the process for both employers and the New York State Department of Taxation and Finance.

| Question | Answer |

|---|---|

| Form Name | Nys 45 Mn Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | PTIN, printable nys 45, NYS, nys 45 mn form |

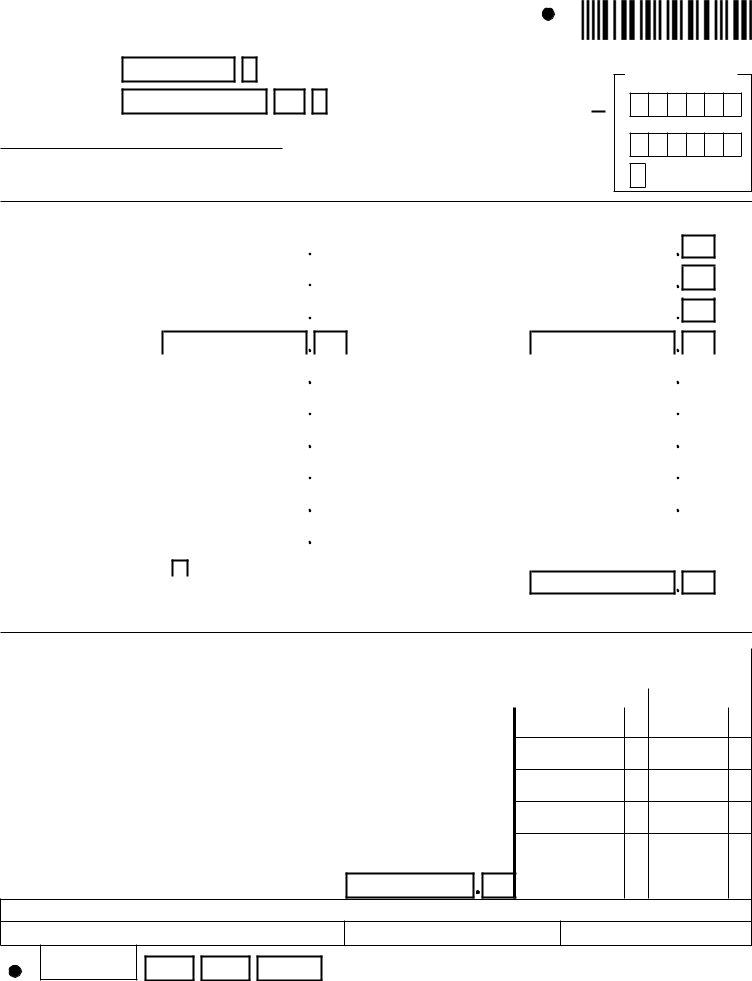

Reference these numbers in all correspondence:

UI Employer registration number

Withholding identification number

Employer legal name:

Quarterly Combined Withholding, Wage Reporting,

And Unemployment Insurance Return

Mark an X in only one box to indicate the quarter (a separate return must be completed for each quarter) and enter the tax year.

Jan 1 - |

|

Apr 1 - |

|

July 1 - |

|

Oct 1 - |

|

Tax |

|

|

|

|

|

|

|||||

Mar 31 |

|

Jun 30 |

|

Sep 30 |

|

Dec 31 |

|

year |

|

1 |

2 |

3 |

4 |

|

Y Y |

||||

If seasonal employer, mark an X in the box ......

40519418

For office use only

Postmark

Received date

Number of employees |

a. First month |

|

b. Second month |

|

c. Third month |

Enter the number of |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

employees who worked during or received pay for the |

|

|

|

|

|

week that includes the 12th day of each month. |

|

|

|

|

|

|

|

|

|

|

UI SK

AI |

|

SI |

|

WT |

|

|

|

SK |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Part A - Unemployment insurance (UI) information |

|

|

|

Part B - Withholding tax (WT) information |

|||||

1. |

Total remuneration paid this |

|

|

|

|

|

12. |

New York State |

|

|

|

0 |

0 |

|

|||||

|

quarter |

|

|

|

|

tax withheld |

|

||

2. |

Remuneration paid this quarter |

|

|

|

|

|

13. |

City of New York |

|

|

|

|

|

|

|

||||

|

to each employee in excess of |

|

|

0 |

0 |

|

|||

|

$8,500 since January 1 |

|

|

|

|

tax withheld |

|

||

|

|

|

|

|

|

|

|

|

|

3. |

Wages subject to contribution |

|

|

0 |

0 |

14. |

City of Yonkers |

|

|

|

(subtract line 2 from line 1) |

|

|

|

tax withheld |

|

|||

4.UI contributions due

|

Enter your |

|

|

|

|

15. |

Total tax withheld |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Tax rate |

|

|

|

% |

|

|

|

|

|

|

........(add lines 12, 13, and 14) |

|

|

|

|

|

|

||||

5. |

|

|

|

|

|

|

|

WT credit from previous |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

16. |

|

|

|

|

|

|

|

|

||||||||||

|

(multiply line 3 × .00075) |

|

|

|

|

|

|

...quarter’s return (see instr.) |

|

|

|

|

|

|

|

|||||||

6. |

UI previously underpaid with |

|

|

|

|

|

|

|

Form |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

17. |

|

|

|

|

|

|

|

|

|

||||||||

|

interest |

|

|

|

|

|

|

|

.........................for quarter |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

18. |

Total payments |

|

|

|

|

|

|

|

|

||||

7. |

Total of lines 4, 5, and 6 |

|

|

|

|

|

|

(add lines 16 and 17) |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

19. |

Total WT amount due (if line 15 |

|

|

|

|

|

|

|

|

||||

8. |

Enter UI previously overpaid |

... |

|

|

|

|

|

|

is greater than line 18, enter difference) .. |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

9. |

Total UI amounts due (if line 7 |

|

|

|

|

|

|

20. |

Total WT overpaid (if line 18 |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

is greater than line 8, enter difference) ... |

|

|

|

|

|

|

is greater than line 15, enter difference |

|

|

|

|

|

|

|

|

||||||

10. |

Total UI overpaid (if line 8 |

|

|

|

|

|

|

|

here and mark an X in 20a or 20b)* |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

20b. Credit to next quarter |

|

|

||||||||||

|

is greater than line 7, enter difference |

|

|

|

|

|

20a. |

Apply to outstanding |

|

|

|

|

or |

|

|

|||||||

|

|

|

|

|

|

|||||||||||||||||

|

and mark box 11 below)* |

|

|

|

|

|

|

|

liabilities and/or refund ... |

|

|

|

|

.........withholding tax |

|

|

||||||

11.Apply to outstanding liabilities

and/or refund |

|

21. Total payment due (add lines 9 and 19; make one |

|

||

|

|

remittance payable to NYS Employment Taxes) |

*An overpayment of either tax cannot be used to offset the amount due on the other tax.

Complete Parts D and E on back of form, if required. This is a scannable form; please file the original.

Part C – Employee wage and withholding information

Quarterly employee/payee wage reporting information (if more than five employees or if |

|

Annual wage and withholding totals |

||||

|

If this return is for the 4th quarter or the last return you will be |

|||||

reporting other wages, do not make entries in this section; complete Form |

|

|||||

|

filing for the calendar year, complete columns d and e. |

|||||

|

|

|

|

|

|

|

a Social security number |

b Last name, first name, middle initial |

c UI total remuneration/gross |

|

d Gross wages or distribution |

e Total tax withheld |

|

|

|

wages paid this quarter |

|

(see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals (column c must equal remuneration on line 1; see instructions for exceptions) .........

Sign your return: I certify that the information on this return and any attachments is to the best of my knowledge and belief true, correct, and complete.

Taxpayer’s signature

Signer’s name (please print)

Title

Date

Telephone number

Withholding identification number

Part D - Form |

40519425 |

|

Use Part D only for corrections/additions for the quarter being reported in Part B of this return. To correct original withholding information reported on Form(s)

|

a |

|

b |

|

|

c |

|

d |

|

|

|

||||

|

Original |

|

Original |

|

|

Correct |

|

Correct |

|

|

|

||||

last payroll date reported on |

|

total withheld |

|

last payroll date |

|

total withheld |

|

|

|

||||||

Form |

|

reported on Form |

|

|

(MMDD) |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

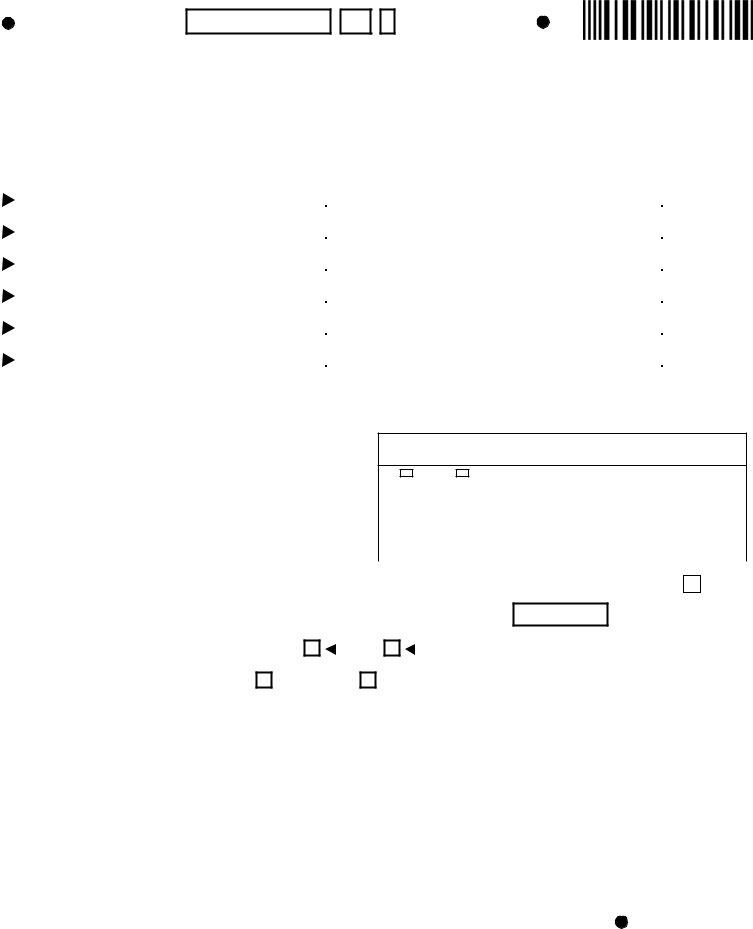

Part E - Change of business information

22.Enter below the address at which you want to receive this form if different from the preprinted address.

Taxpayer’s trade name

c/o: |

attn: |

(if applicable, mark either box and enter name) |

||

|

|

|

||

Number and street or PO box |

|

|||

|

|

|

|

|

City |

|

|

State |

ZIP code |

|

|

|

|

|

If the above address is for your paid preparer, mark this box and the c/o

box, and enter preparer’s name on the second line above .......................

23. If you permanently ceased paying wages, enter the date (MMDDYY) of the final payroll

(see Note below) ............................................................................................................................

24.Did you sell or transfer all or part of your business?

Yes

No

If Yes, indicate if sale or transfer was in

Whole or

Part

Note: Complete Form

If you are using a paid preparer or a payroll service, the section below must be completed.

Paid |

Preparer’s signature |

Telephone number |

Date |

|

Mark an X if |

|

|

Preparer’s SSN or PTIN |

|||

|

|

|

|||||||||

|

( |

) |

|

|

|

|

|

|

|||

preparer’s |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

use |

Preparer’s firm name (or yours, if |

|

Address |

|

|

|

Preparer’s EIN |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payroll service name |

|

|

|

Payroll service’s EIN |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Checklist for mailing:

•File original return and keep a copy for your records

•Complete lines 9 and 19 to ensure proper credit of payment

•Enter your withholding ID number on your remittance

•Make remittance payable to NYS Employment Taxes

•Enter your telephone number in boxes below your signature Need help or forms? Call 1 800

Mail to:

NYS EMPLOYMENT TAXES PO BOX 4119 BINGHAMTON NY