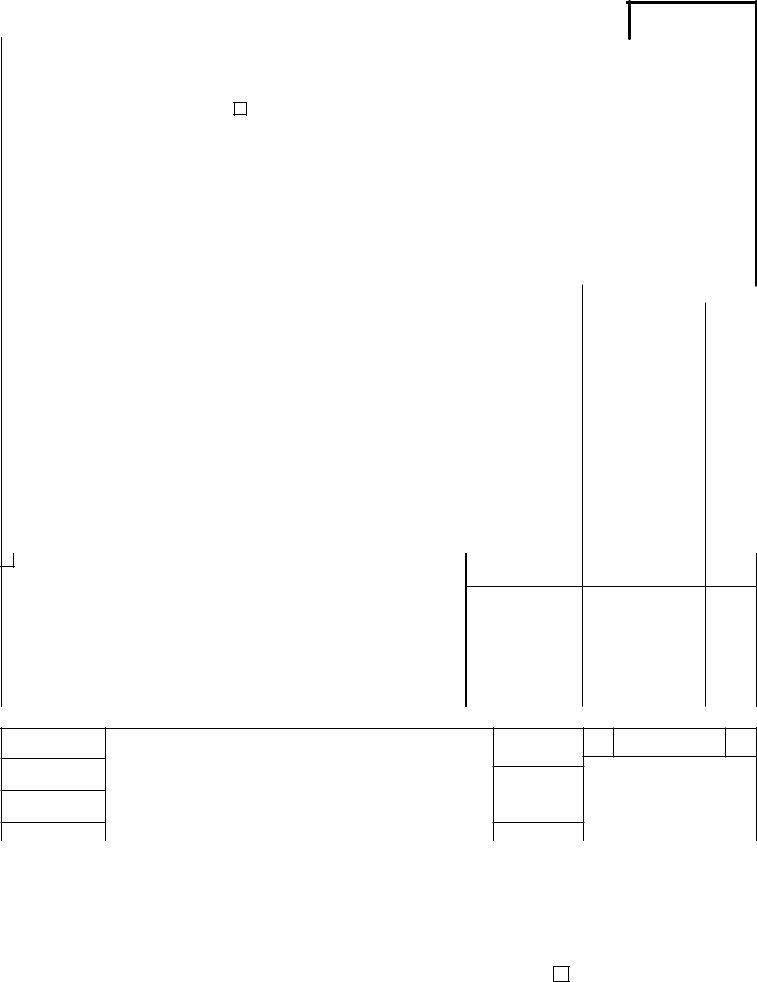

Every form and document within the states serves a unique purpose, meticulously designed to streamline various administrative processes. The New York State Aid Voucher form, known in the bureaucratic world as AC 1171 (Rev 10/96), is no exception, serving as a crucial piece of documentation for processing state aid transactions. Featuring fields for essential information such as the Voucher Number, Originating Agency Code, Payment Date, and Payee Details, it encompasses a comprehensive framework for recording and requesting payments. It’s designed not only to track the flow of funds but also to ensure that the expenditures meet the stringent requirements set forth by applicable statutes. Besides the monetary aspects, this form serves as a legal affirmation by the payee that the funds requested have indeed been used appropriately, as they certify that no portion of the claim has been paid except as stated, and that the balance claimed is due and owing. Moreover, the inclusion of fields such as the State Aid Program or Applicable Statute highlights the adaptability of this form to various programs and statutes, making it a versatile tool in the administration of state aid. For auditors and financial controllers within state agencies and municipalities, the New York State Aid Voucher form is an indispensable instrument, ensuring fiscal responsibility while facilitating the smooth operation of state-funded initiatives.

| Question | Answer |

|---|---|

| Form Name | Nys State Aid Voucher Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | ac 1171 rev 3 2002, state aid voucher fillable, state of new york state aid voucher form, aid voucher get |

AC 1171 (Rev 10/96)

STATE

OF STATE AID VOUCHER

NEW YORK

Voucher No.

1 |

Originating Agency |

|

|

|

|

|

|

Orig. Agency Code |

Interest Eligible (Y/N) |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment Date |

(MM) |

(DD) (YY) |

OSC Use Only |

|

|

|

|

Liability Date |

|

(MM) (DD) |

|

(YY) |

|

|||||||

|

|

/ |

/ |

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

Payee ID |

|

|

Additional |

3 Zip Code |

|

Route |

Payee Amount |

|

|

|

|

|

MIR Date (MM) (DD) (YY) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Payee Name (Limit to 30 spaces) |

|

|

|

|

|

IRS Code |

IRS Amount |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payee Name (Limit to 30 spaces) |

|

|

|

|

|

Stat. Type |

Statistic |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address (Limit to 30 spaces) |

|

|

|

|

|

|

|

|

5 |

Ref/Inv. No. (Limit to 20 spaces) |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (Limit to 30 spaces) |

|

|

|

|

|

|

|

|

Ref/Inv. Date |

(MM) |

(DD) (YY) |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (Limit to 20 spaces) |

(Limit to 2 spaces) à |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Date |

Check or |

|

|

|

|

|

|

Description of Charges |

|

|

|

|

|

|

Amount |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Paid |

Voucher No. |

|

(If Personal Service, show name, title, period covered) |

|

|

|

Dollars |

Cents |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7State Aid Program or Applicable Statute:

TOTAL

8 |

Payee Certiication: |

|

|

|

|

I certify that the above expenditures have been made in accordance with the provisions of the Applicable Statute; that the |

|

Less Receipts |

|

|

claim is just and correct; that no part thereof has been paid except as stated; that the balance is actually due and owing, |

|

|

|

|

and that taxes from which the State is exempt are excluded. |

|

|

|

è_________________________________________________________ |

_______________________________ |

|

NET |

|

|

Signature in Ink |

Date |

|

|

|

Title____________________________________________________________________________________________ |

|

State Aid |

|

|

|

|

|

|

|

Name of Municipality ______________________________________________________________________________ |

|

_____% Claimed |

|

|

|

|

||

|

|

|

|

|

|

FOR STATE AGENCY USE ONLY |

|

STATE COMPTROLLER’S |

|

Merchandise Received

Date

Page No.

By

I certify that this claim is correct and just, and payment is approved.

__________________________________________________________________________________

By

__________________________________________________________________________________

Date

Veriied

Audited

State

Aid

Certiied For Payment

of

State AId Amount

By ______________________________

|

|

|

|

|

Expenditure |

|

|

Liquidation |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost Center Code |

|

|

Object |

Accum |

Amount |

Orig. Agency |

|

PO/Contract |

Line |

F/P |

|

Dept. |

Cost Center Unit |

Var. |

Yr. |

Dept. |

Statewide |

|

||||||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distribution: Original to OSC with Copy to Agency and Municipality

Check if Continuation form is attached