Should you would like to fill out texas information occasional, there's no need to install any software - simply give a try to our online tool. The editor is continually upgraded by us, acquiring new functions and turning out to be greater. All it requires is several easy steps:

Step 1: Just click on the "Get Form Button" in the top section of this page to open our pdf file editor. This way, you'll find everything that is needed to fill out your file.

Step 2: The tool offers the opportunity to change your PDF document in many different ways. Modify it by adding any text, adjust original content, and put in a signature - all manageable in minutes!

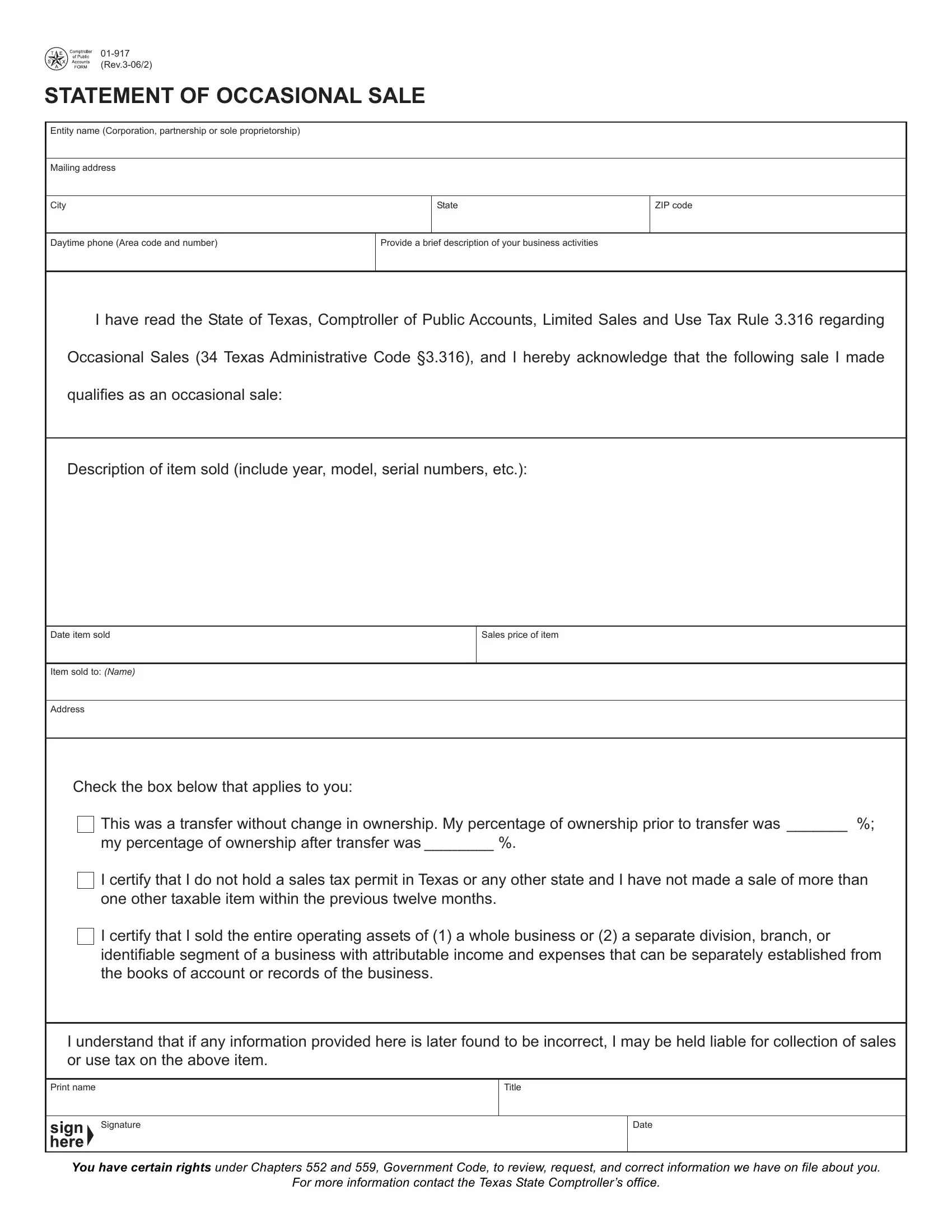

With regards to the blanks of this particular form, here's what you should consider:

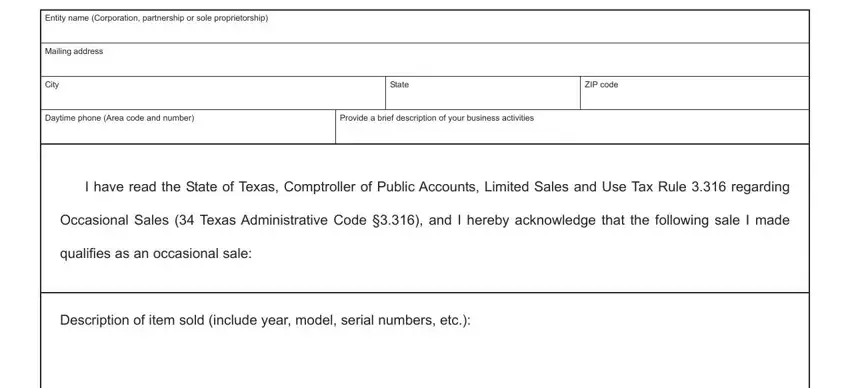

1. While filling out the texas information occasional, make sure to complete all of the important fields within its corresponding part. It will help expedite the process, enabling your details to be processed swiftly and appropriately.

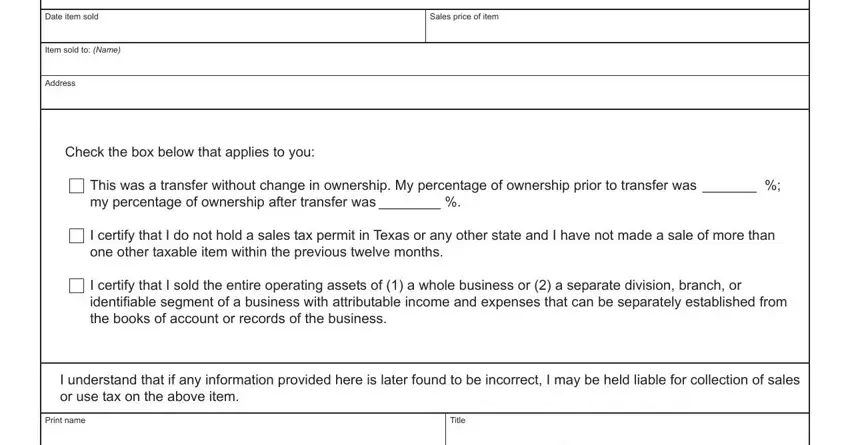

2. Your next stage is to fill out these fields: Date item sold, Item sold to Name, Address, Sales price of item, Check the box below that applies, This was a transfer without change, I certify that I do not hold a, I certify that I sold the entire, I understand that if any, Print name, and Title.

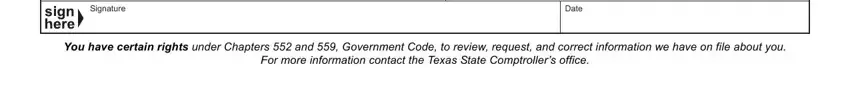

3. The following portion is mostly about Signature, Date, You have certain rights under, and For more information contact the - fill out all these empty form fields.

Be very mindful when filling out Date and You have certain rights under, because this is the section where many people make mistakes.

Step 3: Soon after double-checking your fields and details, hit "Done" and you're done and dusted! Grab your texas information occasional as soon as you register here for a free trial. Easily get access to the pdf from your FormsPal account page, along with any edits and changes conveniently saved! We do not sell or share any information you enter when completing forms at our website.