7 statement can be filled out without difficulty. Just open FormsPal PDF editing tool to complete the job right away. The tool is consistently maintained by us, acquiring cool functions and turning out to be greater. Getting underway is easy! Everything you should do is stick to the following basic steps down below:

Step 1: Press the "Get Form" button above. It'll open up our tool so that you can start filling out your form.

Step 2: Once you access the online editor, you will see the form all set to be filled out. Other than filling in different blanks, it's also possible to perform other actions with the PDF, such as writing any text, modifying the original text, adding illustrations or photos, signing the PDF, and a lot more.

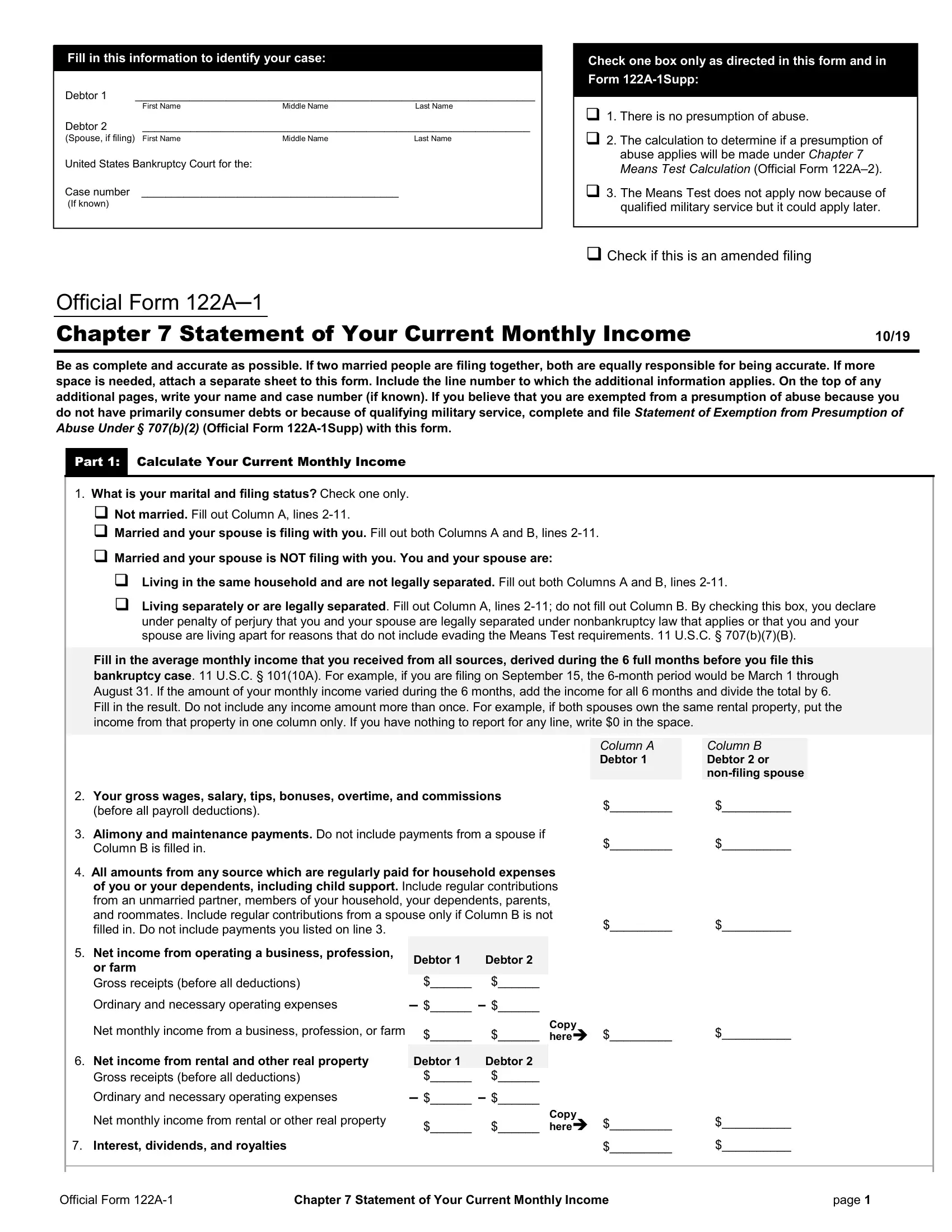

With regards to the fields of this particular PDF, here is what you need to know:

1. First of all, while completing the 7 statement, start in the section containing subsequent blank fields:

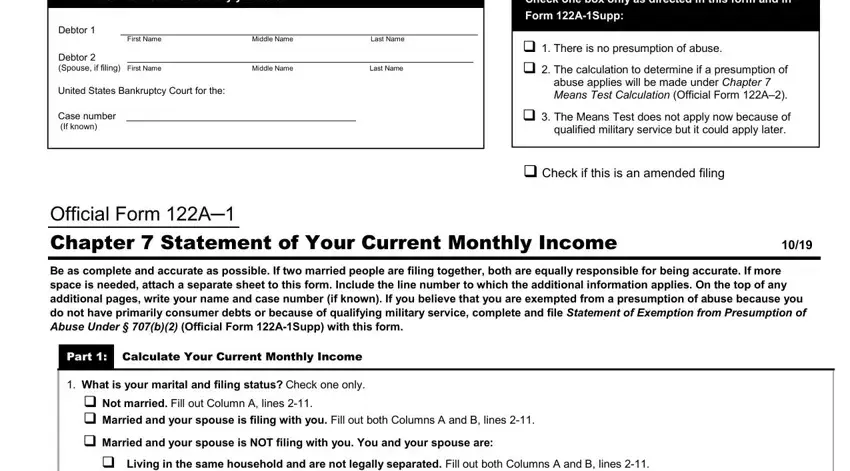

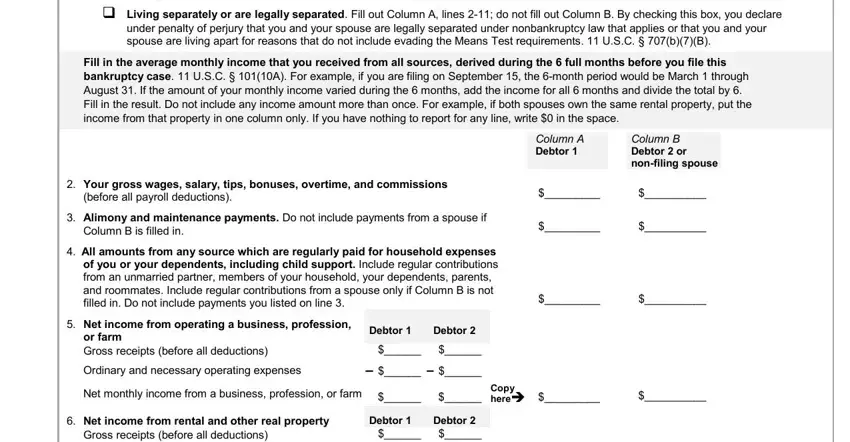

2. Immediately after the first section is completed, go on to type in the relevant details in all these - Living in the same household and, under penalty of perjury that you, Fill in the average monthly income, Your gross wages salary tips, before all payroll deductions, Column A Debtor, Column B Debtor or nonfiling, Alimony and maintenance payments, Column B is filled in, All amounts from any source which, Net income from operating a, or farm Gross receipts before all, Ordinary and necessary operating, Debtor, and Debtor.

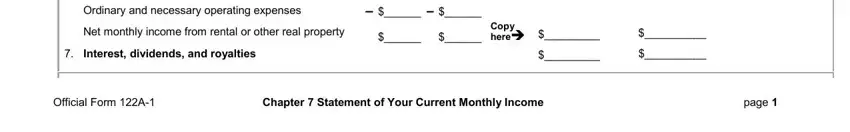

3. In this specific step, examine Gross receipts before all, Ordinary and necessary operating, Net monthly income from rental or, Interest dividends and royalties, Copy here, Official Form A, Chapter Statement of Your Current, and page. All of these will need to be filled in with highest attention to detail.

When it comes to Ordinary and necessary operating and page, be sure you don't make any errors here. Both these are certainly the key fields in this document.

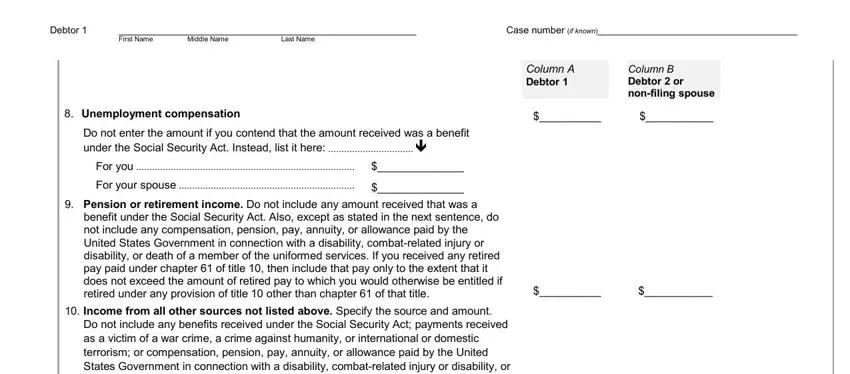

4. The following part requires your involvement in the subsequent parts: Unemployment compensation, Do not enter the amount if you, For you, For your spouse, Pension or retirement income Do, benefit under the Social Security, Income from all other sources not, Do not include any benefits, Column B Debtor or nonfiling, Column A Debtor, First Name, Middle Name, Last Name, Case number if known, and Debtor. Just remember to enter all required information to go further.

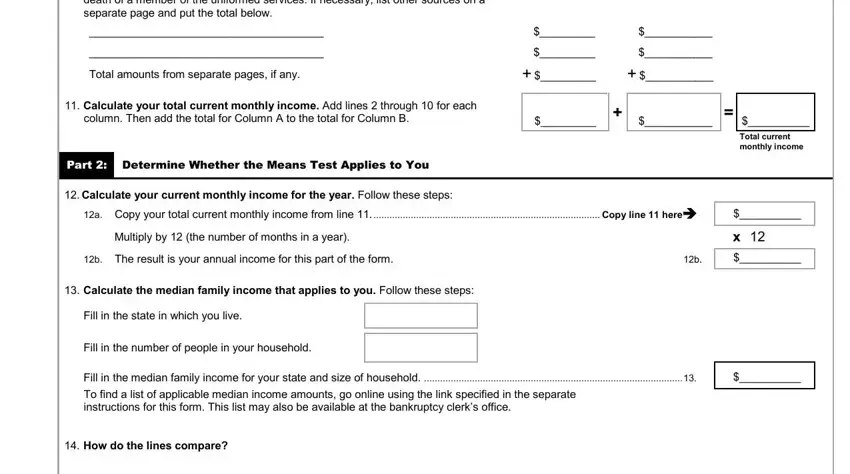

5. This last step to conclude this document is pivotal. You'll want to fill in the required form fields, and this includes Do not include any benefits, Total amounts from separate pages, Calculate your total current, column Then add the total for, Part Determine Whether the Means, Total current monthly income, Calculate your current monthly, a Copy your total current monthly, Multiply by the number of months, b The result is your annual income, Calculate the median family, Fill in the state in which you live, Fill in the number of people in, Fill in the median family income, and To find a list of applicable, prior to finalizing. Neglecting to do this may give you an unfinished and possibly nonvalid form!

Step 3: Always make sure that the information is correct and then simply click "Done" to progress further. Go for a free trial subscription with us and acquire direct access to 7 statement - which you can then use as you wish in your FormsPal account. At FormsPal.com, we do our utmost to be sure that all of your information is stored protected.