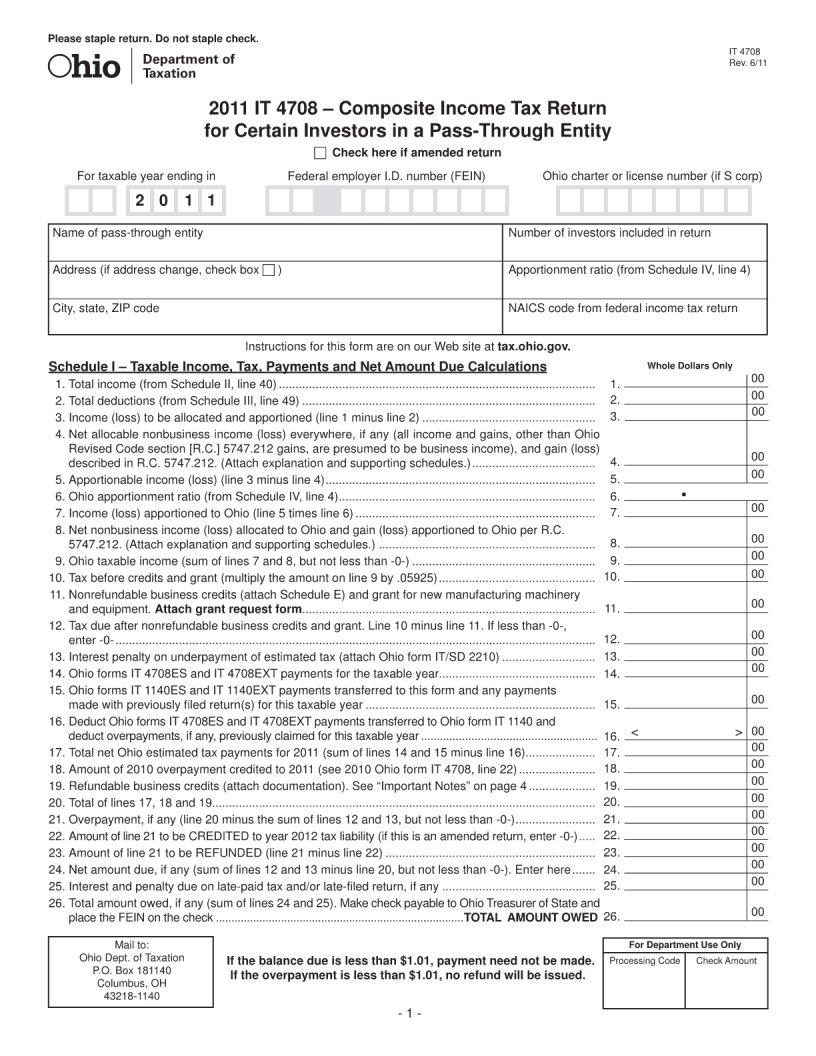

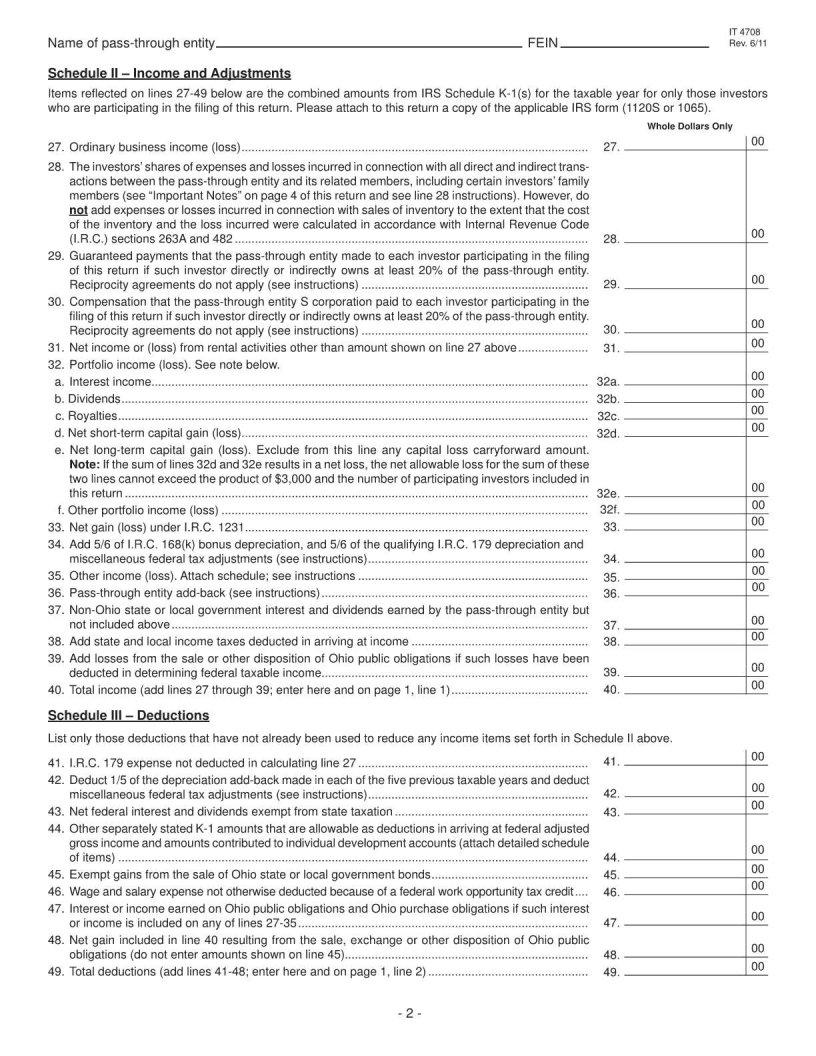

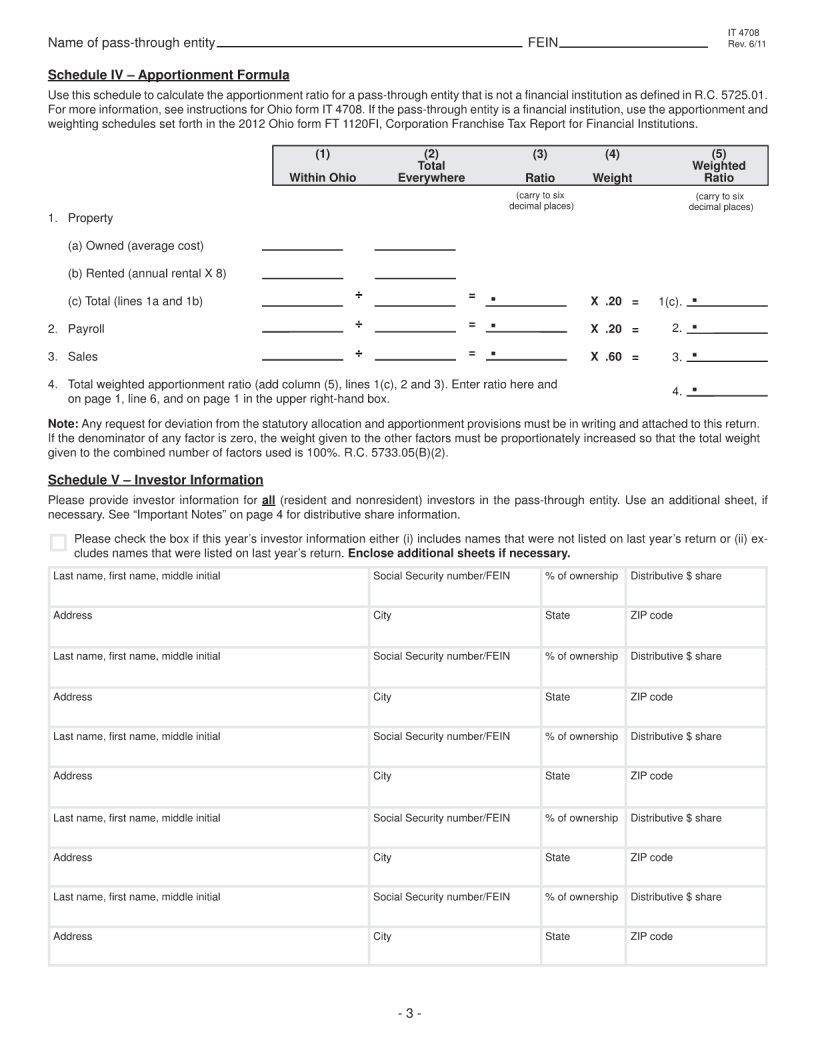

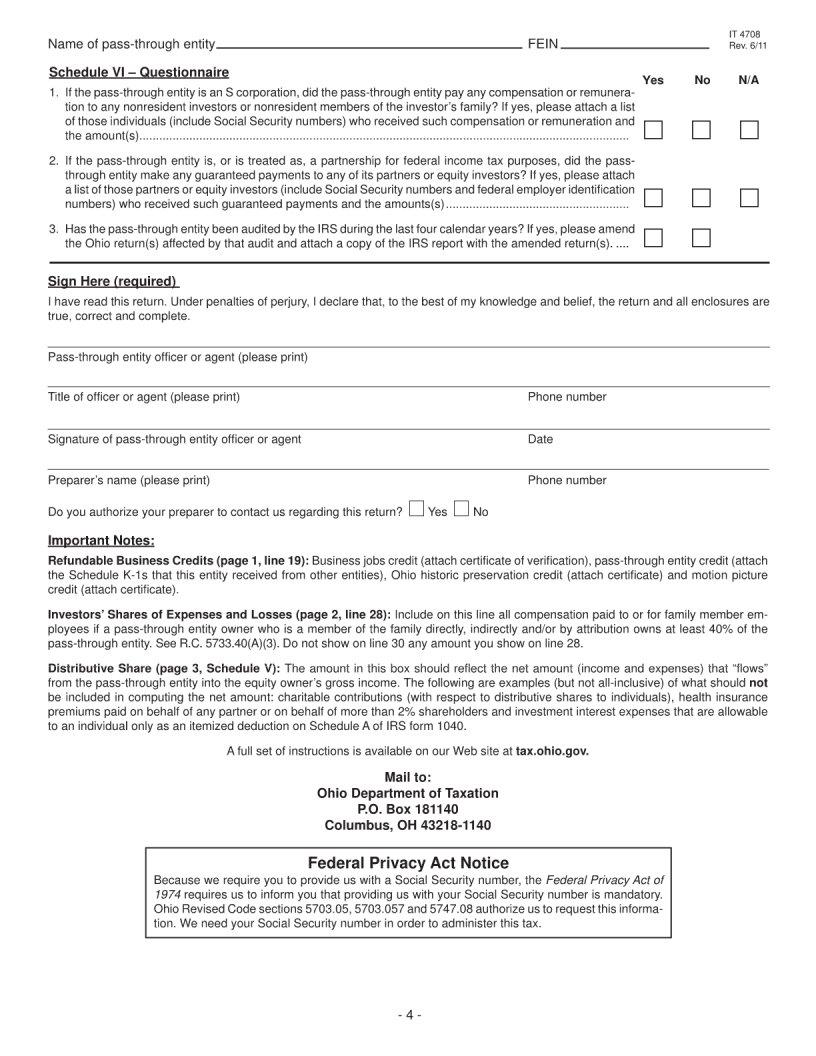

Navigating tax obligations can often feel like a daunting task, particularly for those in Ohio involved with trusts or estates. One crucial piece of the puzzle is the Ohio IT 4708 form, an essential document that ensures fiduciaries meet their state income tax responsibilities efficiently and correctly. It serves as a pass-through entity tax form specifically designed for trusts and estates, playing a pivotal role in the tax filing process. The form outlines how to declare income, deductions, and credits that apply to an entity, making it vital for fiduciaries to understand and complete it accurately to comply with Ohio state tax laws. Besides compliance, mastering the IT 4708 can also uncover potential tax benefits, making it as much an opportunity as an obligation. This form embodies the balance between fulfilling legal responsibilities and optimizing tax outcomes, making it a key focus for anyone managing trusts or estates within Ohio.

| Question | Answer |

|---|---|

| Form Name | Ohio Form It 4708 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | PIT_IT4708 2011 ohio it 4708 instructions form |