In the realm of employer responsibilities within Ohio, understanding and correctly managing the Ohio SD 141X form is essential, especially for those handling the school district income tax withholding. This form, formally known as the Amended School District Employer’s Annual Reconciliation of Tax Withheld, serves a crucial role in ensuring accuracy in the reporting and adjustment of taxes withheld for school districts. Issued by the Ohio Department of Taxation, this document requires employers to meticulously reconcile the total amount of school district income tax withheld throughout the tax year against any previous payments or refunds related to this tax. The form is divided into sections where employers must detail their Ohio Withholding Account Number, Federal Employer Identification Number, and provide comprehensive information regarding withheld taxes, including adjustments for any overpayment or underpayment identified after filing the original SD 141 form. Additionally, it includes provisions for final returns in case of business closure or cessation of withholding obligations. The document stresses the importance of accuracy and honesty, with a declaration section for the preparer's signature, asserting the completeness and correctness of the provided information. Designed to streamline the reconciliation process, the SD 141X is a testament to the intricate system in place for managing school district income tax withholding in Ohio, all the while offering a digital filing option through the Ohio Business Gateway for added convenience.

| Question | Answer |

|---|---|

| Form Name | Ohio Form Sd 141X |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | SDIT_SD141X sd 141x amended form |

HIO

Department of Taxation

Tax Year

SD 141X Rev. 11/07

SD 141X – Amended School District Employer’s Annual Reconciliation of Tax Withheld

|

Ohio Withholding Account Number |

|

Federal Employer Identification Number |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

Number and street

CityStateZIP code

1. |

Enter the total amount of school district income tax required to be withheld forALL |

|

|

|

active school districts during the year |

1. |

|

2. |

Enter previous payments including any balance due paid with Ohio form SD 141; |

|

|

|

deduct any refund received from Ohio form SD 141 |

2. |

|

3. |

If line 2 is LESS than line 1, subtract line 2 from line 1 and enter the balance of |

|

|

|

school district income tax due |

AMOUNT YOU OWE |

3. |

4. |

If line 2 is GREATER than line 1, subtract line 1 from line 2 and enter the overpay- |

|

|

|

ment of school district income tax |

YOUR REFUND |

4. |

Go paperless! File your

return through

Ohio Business Gateway:

www.obg.ohio.gov

Final return: Check the box if out of business or no more SD employ- ees. Explain on back.

NOTE: If you do not owe any taxes, write 0.00 in the space on line 3. If you have a balance due, make your check

payable to: School District Income Tax. Complete the reverse side for each school district you withheld for, the tax liability for each district, and the total payment for each district.

I declare under penalties of perjury that to the best of my knowledge and belief this is a true, correct and complete return.

Signature of responsible person |

Title |

Telephone number |

|

|

|

|

|

Address, number and street |

City |

State |

ZIP code |

|

|

|

|

Social Security number of responsible person |

|

Date |

|

For Departmental Use

Mail to:

School District Income Tax

P.O. BOX 182388

Columbus, Ohio

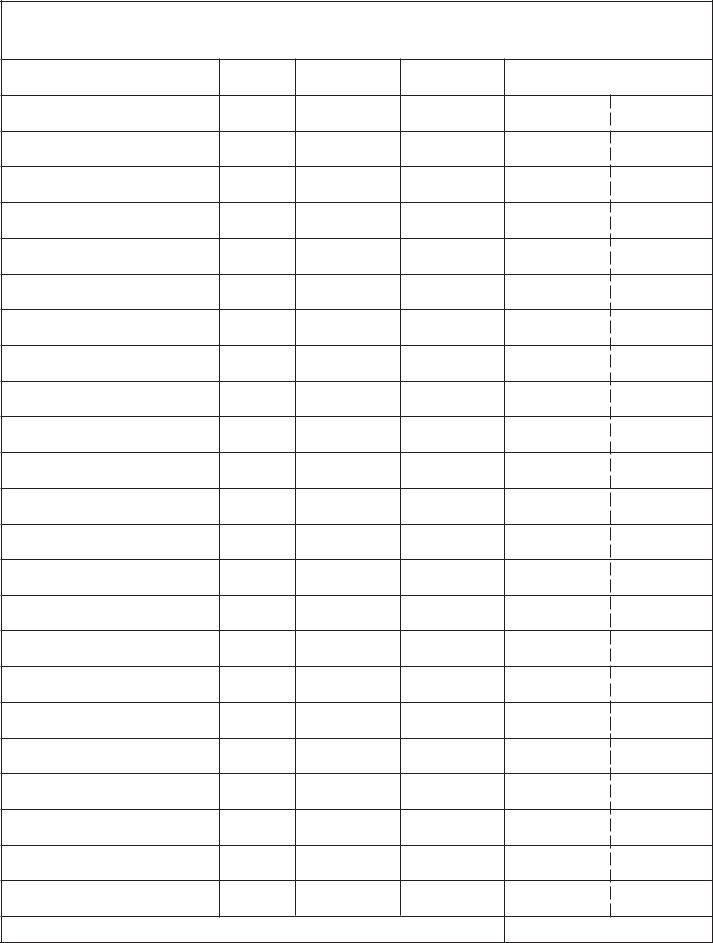

INSTRUCTIONS: For all active school districts that you were required to withhold for, you must list the total tax liability for each district and the total payment for each district. If your payment does not equal the amount to be withheld, enter the net result for each district (over) or under in the net result column. Enter your net result on the front on line 3 or line 4.

School District

Name

School District #

Amount To Be

Withheld

Payment

Made

Net Result

(Over) Under

Net amount must agree with line 3 or 4 on front side of return.