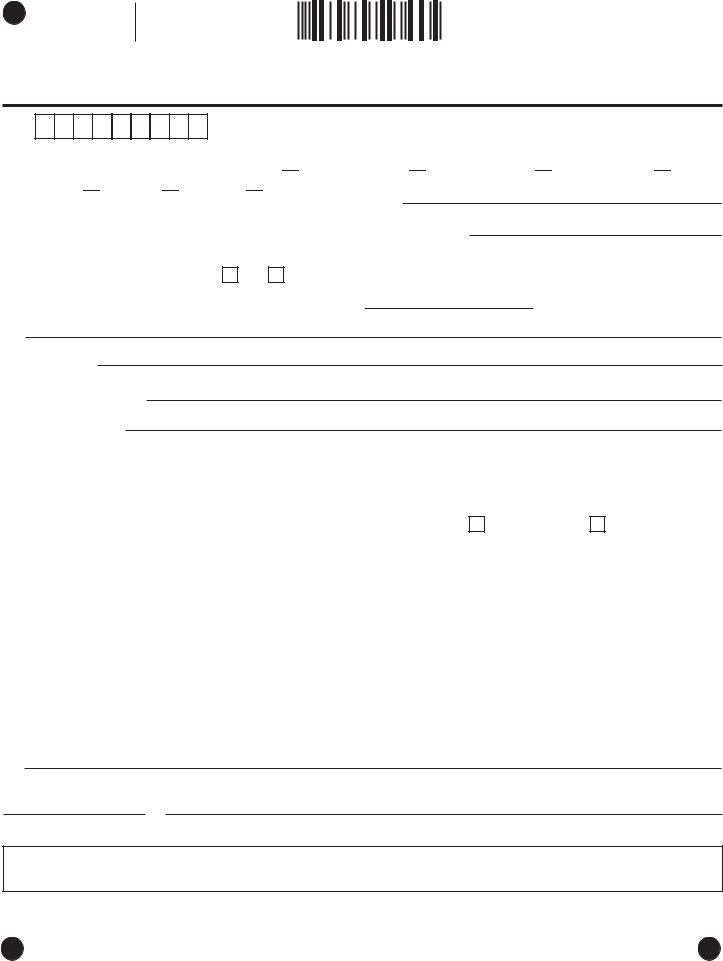

In the state of Ohio, individuals and entities planning to engage in sales activities on a temporary basis in a location where they do not have a permanent place of business are required to obtain a Transient Vendor's License. This is where the Ohio Department of Taxation's ST 1T form comes into play. As outlined in the document, the application process caters to a variety of business structures, ranging from sole proprietorships and partnerships to corporations and nonprofit organizations. Applicants are prompted to provide detailed information including their Federal Employer Identification Number, Social Security Number or Individual Taxpayer Identification Number, and the Ohio corporate charter number, if applicable. The form also requires details on the nature of the business, estimated sales tax to be collected, and the start date of taxable sales in Ohio. Furthermore, it asks for a comprehensive list of officers or partners, including their personal identification numbers and addresses, if operating as a corporation or partnership. A modest fee of $25 accompanies the application, emphasizing the state's regulatory measures to ensure compliance and proper tax administration. Through providing disclosures as per the Federal Privacy Act of 1974, the form reassures applicants about the mandatory submission of their Social Security numbers, underlining the legal stipulations that safeguard their privacy and the integrity of the tax system in Ohio.

| Question | Answer |

|---|---|

| Form Name | Ohio Form St 1T |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | Nonprot, identication, hio, xed |

HIO

Department of Taxation

P.O. BOX 182215

COLUMBUS, OH

ST 1T Rev. 12/09

Application for

07100100 |

|

|

Transient Vendor's License |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

Vendor's license no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

(For department use only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal employer identification no. |

Social Security no. / ITIN |

Ohio corporate charter no. / certificate no. |

1.Check type of ownership: (10) Sole owner (20) Partnership (30) Corporation (150) Nonprofi t (50) LLC (70) LLP (80) LTD Other (please specify)

2.When did you or will you begin making taxable sales in Ohio? (MM/DD/YY)

3.Are you obtaining this license to make sales at a temporary place of business in a county in which you have

no fi xed place of business? Yes |

No |

4. Provide NAICS code and state nature of business activity

(For the most current listings, search

NAICS on our Web site at tax.ohio.gov.)

5. Legal name

(Corporation, sole owner, partnership, etc.)

6.Trade name or DBA

7.Primary address

|

|

|

Address of corporation, sole owner, partnership, etc. |

City |

|

|

|

State |

|

|

|

ZIP code |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Business phone no. |

|

|

Fax no. |

|

|

|

|

Secondary phone no. |

||||||||||

8. |

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

(If different from above) |

|

City |

|

|

|

State |

|

|

|

ZIP code |

||||||||

9. |

How much sales tax do you expect to collect each month? Less than $200 |

$200 or greater |

|

|

|

|

|

|

|

|||||||||||

10. |

If you operate as a corporation or partnership, list appropriate names, addresses and identifi cation numbers below. |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

Name |

Street |

City |

State |

ZIP code |

SSN / ITIN / FEIN |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

Name |

Street |

City |

State |

ZIP code |

SSN / ITIN / FEIN |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

Name |

Street |

City |

State |

ZIP code |

SSN / ITIN / FEIN |

|||||||||||||

11.Name, phone number, fax number and

NamePhone no.Fax no.E-mail address

Date |

Signature of applicant |

Fee for this license – $25 (made payable to Ohio Treasurer of State). Send the original application and $25 fee to the address above.

Federal Privacy Act Notice

Because we require you to provide us with a Social Security number, the Federal Privacy Act of 1974 requires us to inform you that providing us with your Social Security number is mandatory. Ohio Revised Code sections 5703.05, 5703.057 and 5747.08 authorize us to request this informa- tion. We need your Social Security number in order to administer this tax.