Our PDF editor that you will take advantage of was developed by our best software engineers. You can easily get the state ohio tax lien payoff request document promptly and conveniently with our app. Merely keep up with this particular guideline to get going.

Step 1: On the web page, hit the orange "Get form now" button.

Step 2: Now it's easy to modify the state ohio tax lien payoff request. This multifunctional toolbar will let you include, erase, alter, and highlight content or perform similar commands.

For every single segment, fill out the information requested by the software.

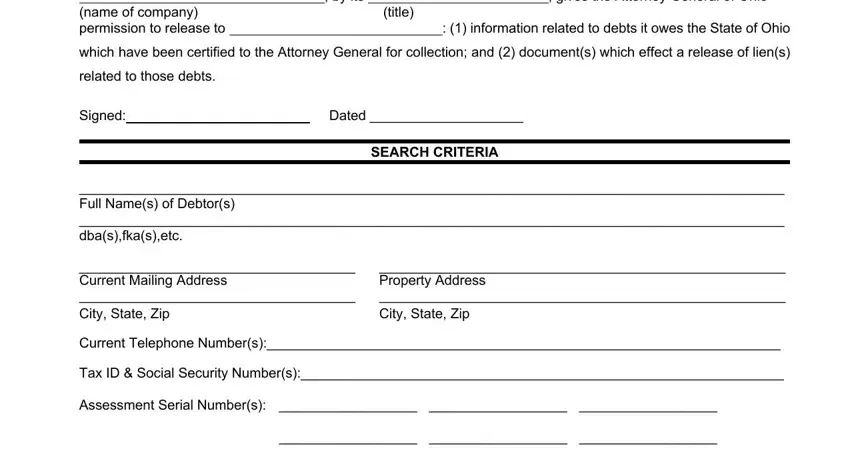

Indicate the information in by its gives the Attorney, title, which have been certified to the, related to those debts, Signed Dated, SEARCH CRITERIA, Full Names of Debtors dbasfkasetc, Current Mailing Address City, Property Address City State Zip, Current Telephone Numbers, Tax ID Social Security Numbers, and Assessment Serial Numbers.

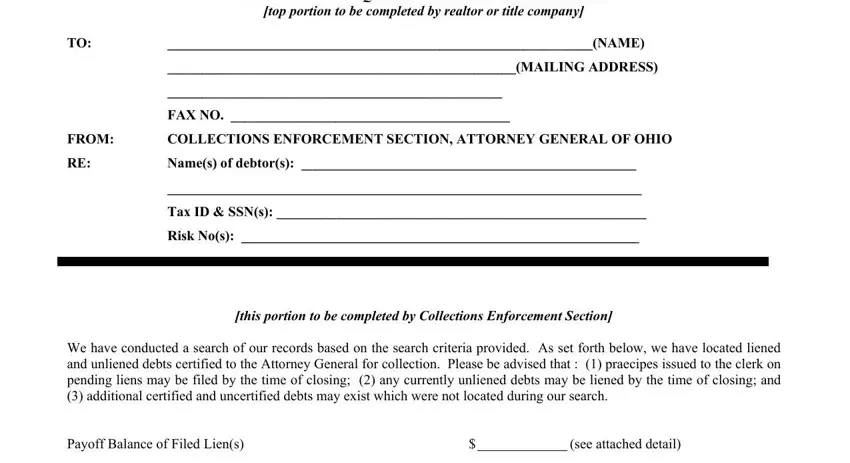

In the segment referring to RESPONSE TO REQUEST FOR PAYOFF, NAME, MAILING ADDRESS, FAX NO, FROM, COLLECTIONS ENFORCEMENT SECTION, Names of debtors, Tax ID SSNs, Risk Nos, this portion to be completed by, We have conducted a search of our, Payoff Balance of Filed Liens, and see attached detail, you are required to put down some expected details.

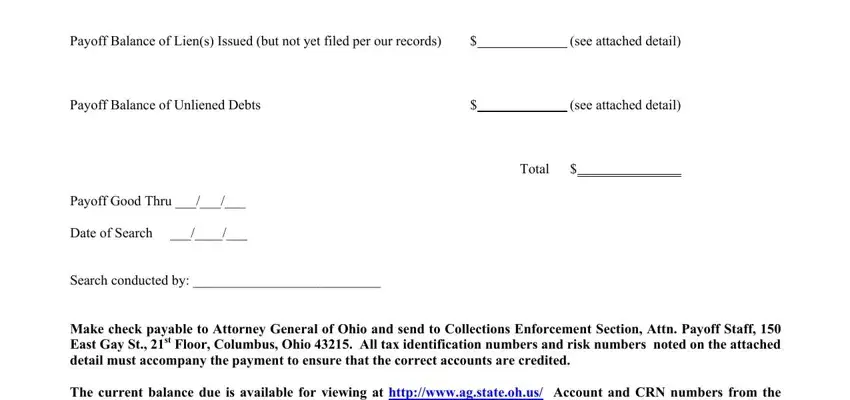

It is essential to define the rights and responsibilities of both sides in box Payoff Balance of Liens Issued but, see attached detail, Payoff Balance of Unliened Debts, see attached detail, Total, Payoff Good Thru, Date of Search, Search conducted by, Make check payable to Attorney, and The current balance due is.

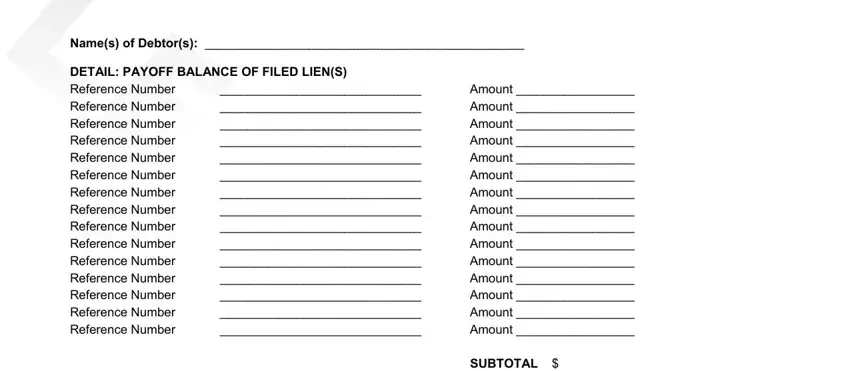

End by taking a look at the next areas and preparing them accordingly: Names of Debtors, DETAIL PAYOFF BALANCE OF FILED, Amount Amount Amount Amount, and SUBTOTAL.

Step 3: Select "Done". It's now possible to upload your PDF file.

Step 4: Create duplicates of the document - it can help you avoid future issues. And don't be concerned - we don't distribute or watch your data.