ohio exemption certificate can be completed online easily. Simply open FormsPal PDF editor to finish the job right away. FormsPal team is dedicated to making sure you have the best possible experience with our tool by continuously introducing new capabilities and improvements. With these improvements, using our tool gets easier than ever! With some easy steps, you are able to start your PDF journey:

Step 1: Open the form in our editor by clicking on the "Get Form Button" at the top of this page.

Step 2: The tool will allow you to customize nearly all PDF files in a range of ways. Transform it by writing any text, adjust existing content, and place in a signature - all at your fingertips!

This document requires specific details; to guarantee accuracy, you need to pay attention to the guidelines below:

1. Complete the ohio exemption certificate with a number of essential blanks. Get all the required information and ensure nothing is forgotten!

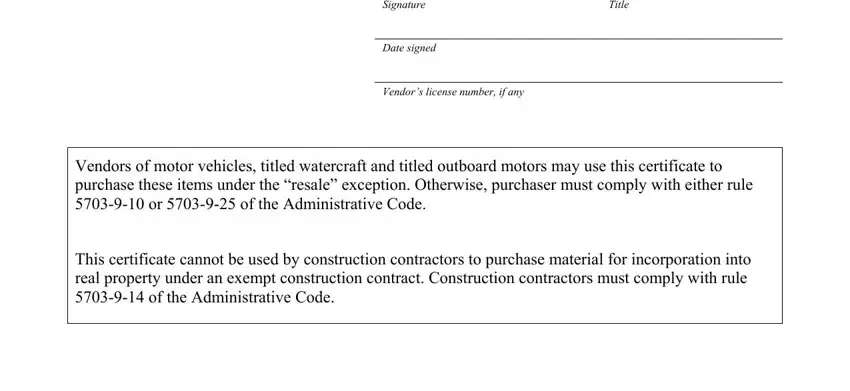

2. When this array of blanks is filled out, proceed to type in the relevant details in these - Signature Title, Date signed, Vendors license number if any, Vendors of motor vehicles titled, and This certificate cannot be used by.

Be really attentive while completing Vendors license number if any and Vendors of motor vehicles titled, because this is where most people make mistakes.

Step 3: Look through the information you've typed into the blanks and then hit the "Done" button. Obtain your ohio exemption certificate the instant you subscribe to a 7-day free trial. Easily use the form in your FormsPal cabinet, along with any edits and adjustments being all kept! Here at FormsPal.com, we strive to be certain that all of your details are kept protected.