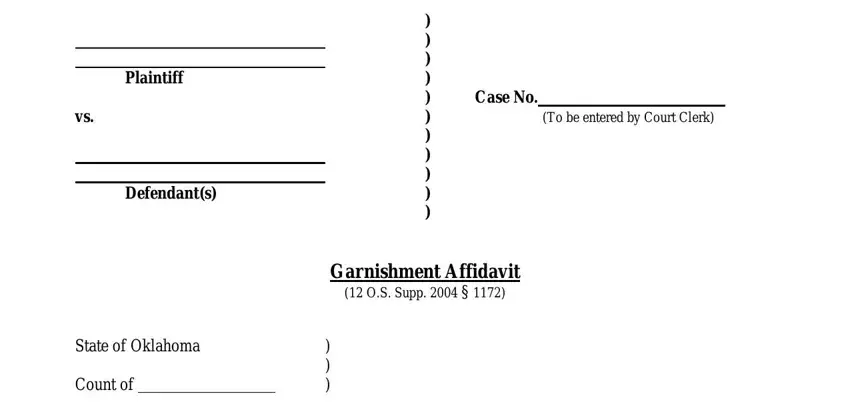

IN THE DISTRICT COURT OF |

Payne |

COUNTY, STATE OF OKLAHOMA |

|

|

) |

|

|

|

|

) |

|

|

|

|

) |

|

|

Plaintiff |

) |

|

|

|

|

) |

Case No. |

vs. |

) |

|

(To be entered by Court Clerk) |

|

|

) |

|

|

|

|

) |

|

|

|

|

) |

|

|

Defendant(s) |

) |

|

|

|

|

) |

|

|

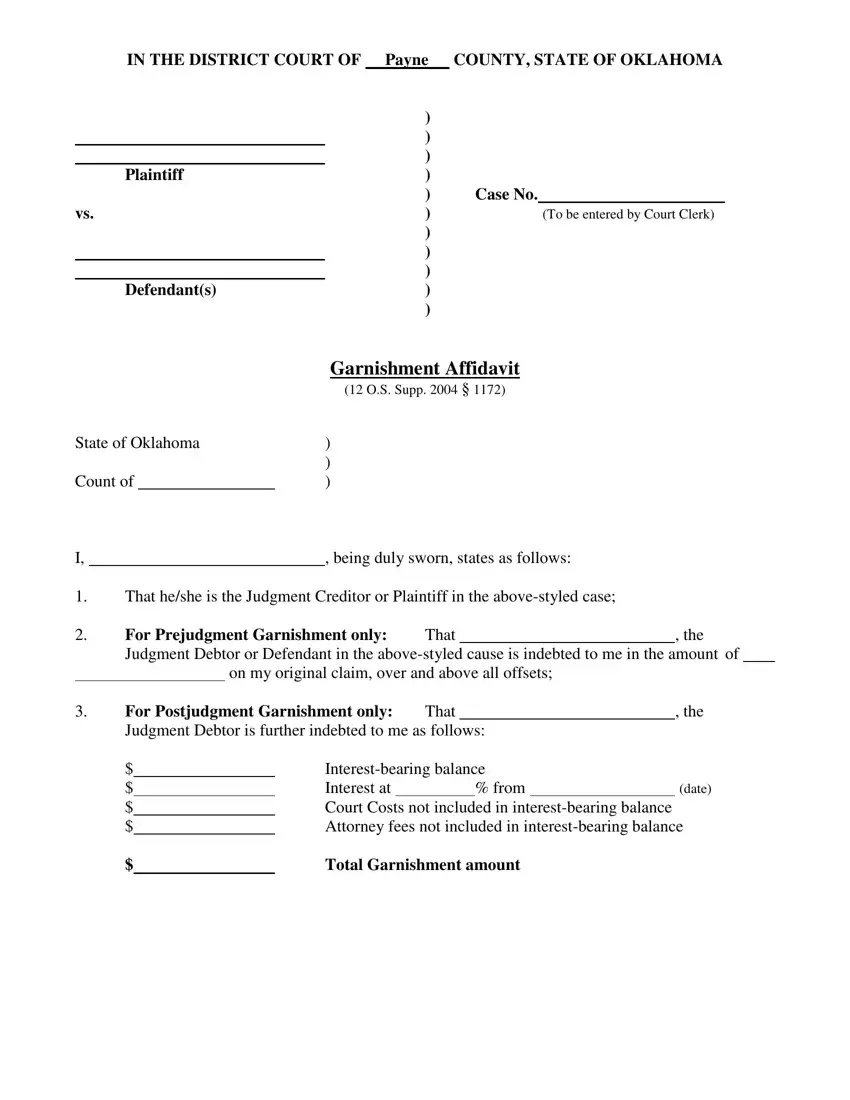

Garnishment Affidavit

(12 O.S. Supp. 2004 § 1172)

State of Oklahoma |

) |

|

|

) |

Count of |

|

) |

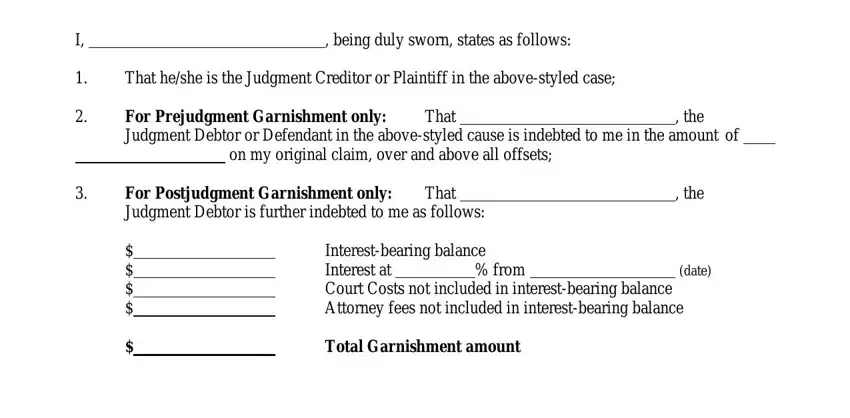

I, |

|

, being duly sworn, states as follows: |

1.That he/she is the Judgment Creditor or Plaintiff in the above-styled case;

|

|

|

|

|

|

|

|

|

|

2. |

For Prejudgment Garnishment only: |

That |

|

, the |

|

Judgment Debtor or Defendant in the above-styled cause is indebted to me in the amount of |

|

|

|

on my original claim, over and above all offsets; |

|

3. |

For Postjudgment Garnishment only: |

That |

|

, the |

|

Judgment Debtor is further indebted to me as follows: |

|

|

$ |

|

|

Interest-bearing balance |

|

|

$ |

|

|

Interest at |

|

% from |

(date) |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

Court Costs not included in interest-bearing balance |

|

|

$ |

|

|

Attorney fees not included in interest-bearing balance |

|

$ |

|

|

Total Garnishment amount |

|

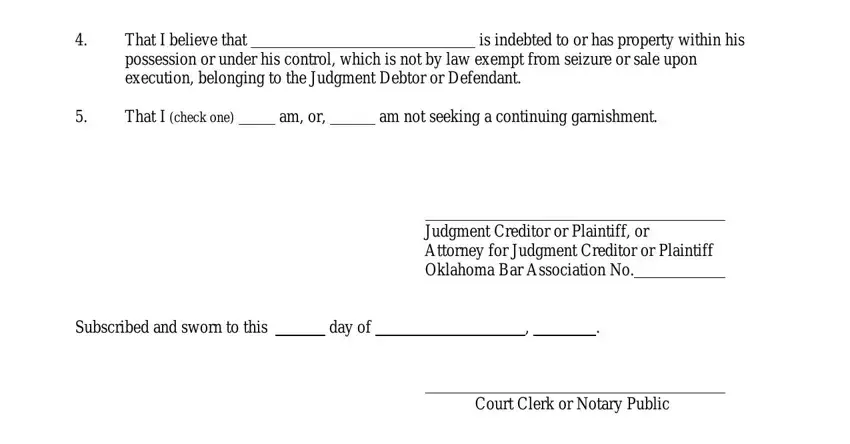

4. |

That I believe that |

|

|

|

|

is indebted to or has property within his |

|

possession or under his control, which is not by law exempt from seizure or sale upon |

|

execution, belonging to the Judgment Debtor or Defendant. |

5. |

That I (check one) |

|

|

am, or, |

|

am not seeking a continuing garnishment. |

Judgment Creditor or Plaintiff, or

Attorney for Judgment Creditor or Plaintiff

Oklahoma Bar Association No.

Subscribed and sworn to this |

|

day of |

|

, |

|

. |

Court Clerk or Notary Public

Deputy

(Seal)

My Commission Expires:

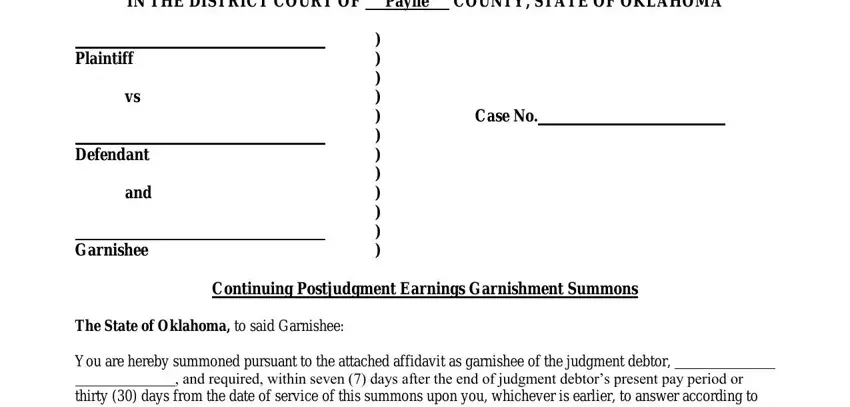

IN THE DISTRICT COURT OF |

Payne |

COUNTY, STATE OF OKLAHOMA |

|

|

) |

|

|

Plaintiff |

) |

|

|

|

|

) |

|

|

vs |

) |

|

|

|

|

) |

Case No. |

|

|

) |

|

|

Defendant |

) |

|

|

|

|

) |

|

|

and |

) |

|

|

|

|

) |

|

|

|

|

) |

|

|

Garnishee |

) |

|

|

Continuing Postjudgment Earnings Garnishment Summons

The State of Oklahoma, to said Garnishee:

You are hereby summoned pursuant to the attached affidavit as garnishee of the judgment debtor,

,and required, within seven (7) days after the end of judgment debtor’s present pay period or thirty (30) days from the date of service of this summons upon you, whichever is earlier, to answer according to law whether you are the employer of, or indebted to, or under any liability to, the judgment debtor and to withhold the required amount from the judgment debtor’s earnings for the earnings pay periods for which this summons is effective, and pay the required amount to the attorney for the judgment creditor, or the judgment creditor if not represented by an attorney, unless otherwise ordered by the court. At the time that you file your answer with the clerk of this court, you must deliver or mail a copy of your answer to the judgment creditor’s attorney, or judgment creditor if not represented by an attorney, and to the judgment debtor unless the judgment debtor is otherwise given actual written notice, which may consist of a notation on judgment debtor’s statement of earnings. You are directed to withhold the amount calculated on the answer form or the present judgment balance, whichever is less, and to pay the same to the judgment creditor’s attorney, or the judgment creditor if not represented by an attorney, at the time you file your answer. For garnishment purposes, “earnings” means any form of payment to an individual including, but not limited to salary, commission, or other compensation, but does not include reimbursements for travel for state employees.

If garnishee is indebted to or holds earnings belonging to judgment debtor, the garnishee immediately shall mail by first-class mail a copy of the notice of garnishment and exemptions, and the application for hearing, to the judgment debtor at the last-known address of the judgment debtor shown on the records of the garnishee at the time the garnishment summons was served on the garnishee. If more than one address is shown on the records of the garnishee at the time of service of the summons, the garnishee shall discharge his duty by mailing to any one of the addresses shown on its records. In lieu of the mailing, the garnishee may hand-deliver a copy of the notice of garnishment and exemptions, and the application for hearing, to the judgment debtor.

You are hereby directed to pay with your answer the amounts required by law and in case of your failure to do so, you will be liable to further proceedings according to law, and judgment shall be rendered against you in the amount of the judgment rendered against the principal judgment debtor which has a present balance of $

together with costs in the principal action and costs of the garnishment proceedings.

Because this is a continuing garnishment, garnishee will withhold and continue to withhold and pay to the judgment creditor’s attorney, or the judgment creditor if not represented by an attorney, the amounts calculated on the answer form from judgment debtor’s earnings as they accrue until one of the following first occurs: (1) the total earnings withheld equals the total balance due on the judgment, (2) the employment relationship is terminated, (3) the judgment is vacated, modified or satisfied in full, (4) the garnishment

summons is dismissed, or (5) 180 days have elapsed from the date of service of the garnishment summons. The garnishment summons shall continue in effect and shall apply to a pay period beginning before the end of the 180- day period even if the conclusion of the pay period extends beyond the 180-day period. This summons may also be suspended or modified for a specific period of time within the effective period of the garnishment by agreement of the parties in writing and filed with the clerk of the court. If the judgment debtor is already subject to a garnishment, this summons shall take effect immediately upon the conclusion of the prior garnishment, and shall be effective for its full period of time. Garnishee shall answer once to disclose the prior garnishment and shall not be required to answer again until this garnishment becomes effective.

Issued this |

|

day of |

|

, |

|

, and shall be returned with proof of service within ten |

(10) days of this date. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Court Clerk |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: Deputy |

|

|

|

|

|

|

Judgment Creditor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attorney |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OBA # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Officer’s Return |

|

|

|

|

|

|

|

|

|

|

|

|

Received this writ on the |

|

day of |

|

, |

|

|

|

, at |

|

o’clock |

|

m and |

Executed the same in |

|

|

|

County on the |

|

|

|

day of |

|

|

, |

|

|

, at |

|

o’clock |

|

|

|

m by |

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated this |

|

day of |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sheriff

Deputy

AOC Form 52b

Revised 8/05

(Please check

|

IN THE DISTRICT COURT OF |

Payne COUNTY, STATE OF OKLAHOMA |

|

|

|

|

) |

|

|

|

|

Plaintiff |

) |

|

|

|

|

|

|

|

) |

|

|

|

|

|

vs |

) |

Case No. |

|

|

|

) |

|

|

|

|

|

|

|

|

) |

|

|

|

|

Defendant |

) |

|

|

|

|

|

|

|

) |

|

|

|

|

|

and |

) |

|

|

|

|

|

|

|

) |

|

|

|

|

|

|

|

|

) |

|

|

|

|

Garnishee |

) |

|

|

|

|

|

|

|

Continuing and Garnishee’s Answer/Affidavit |

State of Oklahoma |

) |

|

|

|

|

County of |

|

|

) |

SS |

I, |

|

|

, being duly sworn deposes and says: |

If Garnishee is an Individual:

That he is the garnishee herein. That he does business in the name of

.

If Garnishee is a Partnership:

|

|

|

|

|

That he is a member of |

|

, a partnership composed |

of garnishee and |

|

|

. |

If Garnishee is a Corporation:

That he is the |

|

|

|

(official title) of |

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

(garnishee) organization, organized under the laws of the state of |

|

|

. |

Garnishee, or |

|

|

on behalf of garnishee, having been served with a |

garnishment summons on the |

|

day of |

|

, |

|

|

, and having knowledge of |

the facts and being sworn, states: |

|

|

|

|

|

|

|

|

|

1.At the time of the service of the garnishment summons, or upon the date it became

effective, the garnishee was not indebted to the judgment debtor for any amount of money nor did the garnishee have possession or control of any property, money, goods, chattels, credits, negotiable instruments or effects belonging to the judgment debtor or in which the judgment

debtor had an interest because the employee/individual/judgment debtor was:

appropriate response)

Not employed

Employed but not amounts due; specify reason:

Other; specify:

2.At the time of service of the garnishment summons or upon the date it became effective, the garnishee was indebted to the judgment debtor or had possession or control of the following property, money, goods, chattels, credits, negotiable instruments or effects belonging to the

judgment debtor as follows: (Please check appropriate response)

Earnings as shown on the attached Calculation for Garnishment of Earnings form which is incorporated by reference into this answer;

Other, specify:

3.Nothing has been withheld due, to a prior garnishment or continuing garnishment which will

|

|

|

|

|

|

|

|

|

|

|

|

|

expire on |

|

|

|

|

and is in Case Number |

|

in the District |

|

Court of |

|

|

|

County, Oklahoma. |

|

|

4. |

On |

|

|

, |

|

|

|

, the garnishee mailed a copy of the Notice of |

Garnishment & Exemptions and Application for Hearing by first-class mail to the judgment debtor at:

Address

City

StateZip

Date Mailed

Or, hand delivered the same to judgment debtor at:

Judgment Debtor

Place

Note: This must be done during each pay period in which the garnishment is in effect.

5.The garnishee makes the following claim of exemption on the part of the judgment debtor, or has the following objections, defenses, or setoffs to judgment creditor’s right to apply garnishee’s indebtedness to judgment debtor upon judgment creditor’s claim:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here ( ) if additional pages are necessary. |

|

|

|

|

By: |

|

|

|

|

Date: |

|

|

|

|

|

Title: |

|

|

|

|

|

|

|

|

Subscribed and sworn to before me on this |

|

|

day of |

|

, |

|

. |

Notary Public

My Commission expires:

A continuing garnishment remains in effect until one of the following occurs: (1) the judgment is paid in full; (2) the employment relationship is terminated; (3) the judgment is vacated, modified or paid in full;

(4)garnishment action is dismissed; (5) the expiration of 180 days from the date of service of the summons. (If a pay period begins within 180 days but ends after the expiration, the pay period is subject to the garnishment).

AOC Form 54; Revised 8/05

|

|

|

|

|

|

|

|

|

|

|

Calculation for Continuing Garnishment of Earnings |

|

|

|

|

|

For the pay period in effect at the time of said service: |

|

|

|

|

|

1. |

(a) Enter the pay period of judgment debtor |

1(a) |

|

(weekly, biweekly, semimonthly, monthly or other) |

|

|

|

|

|

|

If other, please describe: |

|

|

|

|

|

|

|

|

(b) Enter the date the judgment debtor’s present pay period |

1 |

(b) |

|

began (present pay period means the pay period for which the |

|

|

|

|

|

|

calculation is made): |

|

|

|

|

|

|

(c) Enter the date the judgment debtor’s present pay period ends: |

1 |

(c) |

|

2. |

(a) Enter the gross earnings for entire pay period: |

2 |

(a) |

|

|

(b) Calculate deductions from said amount as required by law: |

2 |

(b) |

|

(2(b) is the total of i, ii, and iii) |

|

|

|

|

|

|

i. Federal income tax withholding |

|

|

|

|

|

|

|

|

ii. FICA income tax withholding |

|

|

|

|

|

|

|

|

iii. State income tax withholding |

|

|

|

|

|

|

|

|

(c) Net earnings: 2(a) less 2(b): |

2 |

(c) |

|

3. |

(a) If judgment debtor is subject to withholding for child support |

3 |

(a) |

|

garnishment or income assignment, enter maximum allowable |

|

|

|

|

|

|

percentage (50%, 55%, 60%, 65%) |

|

|

|

|

|

|

(b) Enter actual percentage withheld: |

3 |

(b) |

|

|

(c) Subtract 3(b) from 3(a) and enter percentage: |

3 |

(c) |

|

|

(d) Enter the lesser of 25% or line 3(c) here (if no child support or |

3 |

(d) |

|

Income assignment, enter 25%): |

|

|

|

|

|

4. |

Multiply the percentage in 3(d) times the net earnings in 2(c) and enter: |

4. |

|

|

|

|

5. |

(a) Multiply and enter the present federal minimum wage as follows: |

5 |

(a) |

|

Weekly or more often by 30; |

|

|

|

|

|

|

Biweekly by 60; |

|

|

|

|

|

|

Semimonthly by 65; |

|

|

|

|

|

|

Monthly by 130. |

|

|

|

|

|

|

For any other pay period, increase the multiple for a weekly pay |

|

|

|

|

|

|

period using the assumption that a month contains 4-1/3 weeks. |

|

|

|

|

|

|

(b) Subtract the amount on line 5(a) from the amount on line 2(c): |

5 |

(b) |

|

6. |

Enter the smaller of the amounts entered on line 4 or 5(b). Pay this |

6. |

|

amount to the attorney for judgment creditor, or judgment creditor |

|

|

if not represented by an attorney. |

|

When completed, mail original answer to: |

|

, District Court |

Clerk, |

|

County Court House in |

|

|

County, |

Oklahoma. |

|

|

|

|

|

You must send your check for the amount garnished with a copy of your answer to the attorney for judgment creditor, or the judgment creditor if there is no attorney. (Check the appropriate response and show address used in the mailing):

Attorney for Judgment Creditor:

Judgment Creditor:

Revised 8/05

IN THE DISTRICT COURT OF |

Payne COUNTY, STATE OF OKLAHOMA |

|

) |

|

|

|

|

Plaintiff |

) |

|

|

|

|

|

) |

|

|

|

|

vs |

) |

Case No. |

|

) |

|

|

|

|

|

) |

|

|

|

|

Defendant |

) |

|

|

|

|

|

) |

|

|

|

|

and |

) |

|

|

|

|

|

) |

|

|

|

|

|

) |

|

|

|

|

Garnishee |

) |

|

|

|

|

Claim for Exemption and Request for Hearing

1. Funds sought in garnishment are exempt from execution because they are (check applicable box):

A. Social Security benefits – 42 U.S.C. §407.

B. Supplemental security income – 42 U.S.C. §1383(d).

C. Unemployment benefits – 40 O.S. §2-303.

D. Workmen’s Compensation benefits – 85 O.S. §48.

E. Welfare benefits – 56 O.S. §173.

F. Veteran’s benefits – 38 U.S.C. §3101, 31 O.S. §7.

G. Monies in Possession of Police Pensions – 11 O.S. §50-124.

H. Monies in Possession of Fireman’s Relief & Pension Fund – 11 O.S. §49-126.

I. Monies in Possession of County Employees Retirement System – 19 O.S. §959.

J. Monies in Possession of Public Employees Retirement Fund – 74 O.S. §923.

K. Teacher’s Annuities or Retirement Allowance – 70 O.S. §17-109.

L. Annuities and pension payments under Railroad Retirement Act – 45 U.S.C. §231(m).

M. United States Civil Service Retirement and Disability Pension Fund Payments – 5 U.S.C. §8346.

N. United States Civil Service Survivor Annuities – 5 U.S.C. §8346.

O. Interest in Retirement, Pension, and Profit Sharing Plans – 60 O.S. §327, 60 O.S. §328.

P. The Wages of Seamen – 46 U.S.C. §601.

Q. Funds vested in the Alien Property Custodian – 50 U.S.C. Appx. §9(f).

R. Prepaid Burial Benefits – 36 O.S. §6125.

S. Proceeds of Group-Life Insurance Policy – 36 O.S. 3632, and 36 O.S. §4026.

T. Alimony, support, separate maintenance, or child support necessary for support of judgment debtor or dependent – 31 O.S. §1.1.

U. Personal wage exemption because of undue hardship – 31 O.S. §1.1.

V. Other (please state):

2. |

Check one box: |

|

|

|

|

|

All funds are exempt, or, |

|

|

|

|

|

|

|

|

|

|

I believe the following amount of money is exempt: $ |

|

|

|

|

|

|

|

|

|

(Fill in the amount of funds to be exempt). |

|

|

3. |

Check if applicable: |

|

|

|

|

|

I have attached copies of the documents that show that my money is exempt. |

|

|

|

|

|

|

4. |

If garnishment is for wages, this claim and request is filed for the pay period |

|

|

|

|

through |

|

, inclusive. |

5. |

I request that this matter be set for hearing. |

|

|

Signature

Address for mailing of Court Hearing Notice

|

|

Address for mailing a copy of Claim to Judgment |

|

|

|

|

|

|

|

|

|

|

You must mail the original to the Court Clerk of |

Payne County at the following address: |

606 South Husband, Room 206 |

|

|

|

|

Stillwater, Oklahoma 74074 |

|

|

|

|