Life is filled with uncertainties, and planning for the future is a step many take to ensure peace of mind for themselves and their loved ones. For federal employees, one such planning tool is the OMB 3206-0136 form, officially known as the Federal Employees' Group Life Insurance (FEGLI) Designation of Beneficiary form. This form plays a critical role in determining how the benefits of the FEGLI Program will be distributed upon the insured's death. It requires detailed information about the insured, including their name, date of birth, social security number, and employment details, along with comprehensive data on the beneficiary or beneficiaries designated to receive the life insurance proceeds. Furthermore, it outlines a clear process for insured individuals or assignees to cancel or change a beneficiary designation, emphasizes the importance of witnesses who cannot benefit from the policy, and details the procedure for agency use. The instructions provided on the form ensure clarity on its completion and underline the importance of keeping beneficiary designations up to date, signifying the insured's intent and possibly reflecting changes in personal circumstances, such as marriage, divorce, or the birth of a child. This form isn't just paperwork; it's a critical step in securing the well-being of those we care about the most, making its proper completion and submission a priority for every federal employee enrolled in FEGLI.

| Question | Answer |

|---|---|

| Form Name | Omb Form 3206 0136 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | OPM, OFEGLI, form omb 3208, omb 3208 |

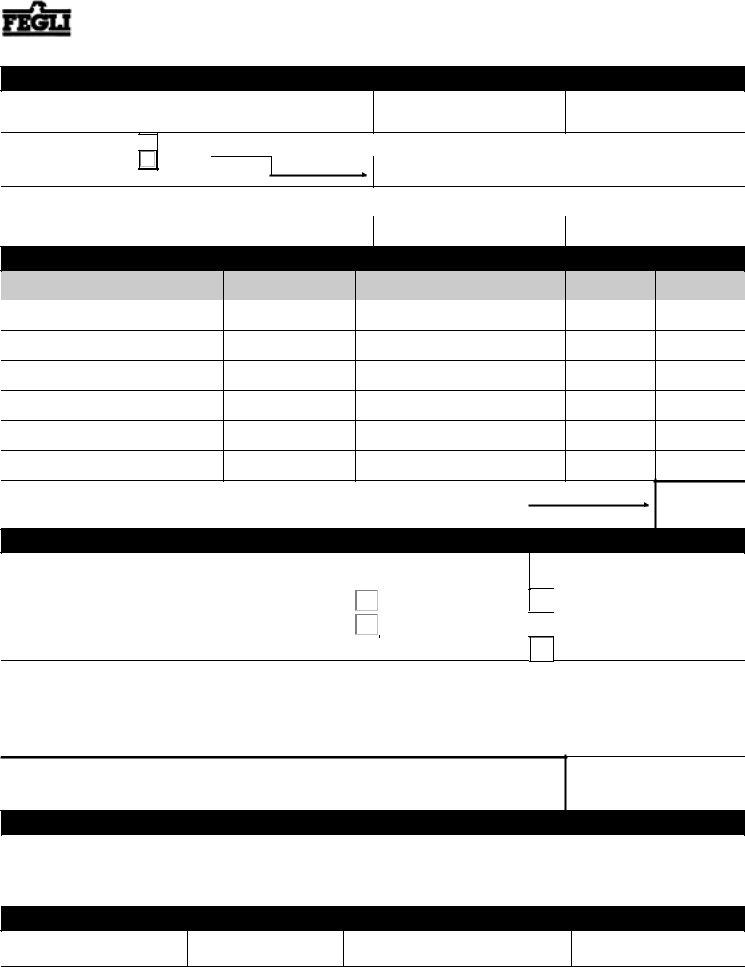

Federal Employees Group Life Insurance

Designation of Beneficiary

Federal Employees' Group Life Insurance (FEGLI) Program

(DO NOT erase or

Form Approved

OMB No.

Important:

Read instructions on the Back of Part 2 before completing this form.

A. Information About the Insured (not the Assignee, if there is one) (type or print)

Name of Insured (Last, first, middle)

Date of birth of Insured (mm/dd/yyyy)

Social Security Number of Insured

The Insured is:

Place an "X" in the appropriate box.

an employee

a retiree

a compensationer

If the Insured is retired or receiving Federal Employees' Compensation, give CSA, CSI, or OWCP claim number:

Department or agency where the Insured works (If retired, last department or agency where the Insured worked):

Department or agency

Bureau or division

Location (city, state, and ZIP code)

B. Information About the Beneficiary or Beneficiaries (See Back of Part 1 for examples) (type or print)

First name, middle initial, and last name of

each beneficiary

Social Security Number

Address (Including ZIP code)

Relationship

Percent or fraction

designated

Total (M ust equal 100% or 1.0) (Do not use dollar amounts)

(Do not put a Total if you designated types of insurance. See example 4 on Back of Part 1.)

C. Statement of Insured or Assignee (type or print)

Your name and address (Including ZIP code) |

Please check one: |

|

|

I am: |

|

|

|

the Insured |

|

|

|

|

|

an Assignee |

|

|

|

|

|

|

|

See Back of Part 2 for definitions |

|

|

|

|

Please check all three:

I have not assigned the insurance.

Two people who witnessed my signature signed below.

I did not name either witness as a beneficiary.

I understand that if there is a valid assignment on file, only the assignee has the right to designate a beneficiary. If a valid assignment is not on file, but there is a valid court order on file with the agency or the U.S. Office of Personnel Management, as appropriate, any designation I complete for the same benefits is not valid.

I understand that if this Designation is valid, it will stay in effect unless it is canceled. (See "When Is A Designation Canceled?" on the Back of Part 2).

I understand that if this Designation is invalid for any reason, the Office of Federal Employees' Group Life Insurance will pay benefits according to the next most recent valid designation. If there isn't one, it will pay according to the order listed on the Back of Part 2.

I am canceling any and all previous Designations of Beneficiary under the Federal Employees' Group Life Insurance Program and am now designating the beneficiary(ies) named above.

Signature of Insured/Assignee (Only the Insured/Assignee may sign. Signatures by guardians, conservators or through a power of attorney are not acceptable.) This form is not valid unless the Insured/Assignee signs in this box.

Date (mm/dd/yyyy)

D. Witnesses To Signature (A witness is not eligible to receive a payment as a beneficiary.)

Signature of witness |

Address (Including ZIP code) |

|

|

Signature of witness |

Address (Including ZIP code) |

|

|

E. For Agency Use Only

Receiving agency

Date of receipt (mm/dd/yyyy)

Signature of authorized agency official

Title

Part 1 - Original

U.S. Office of Personnel Management |

|

|

|

SF 2823 |

FEGLI Handbook (RI |

NSN |

Previous editions are not usable. |

Revised April 2001 |

Examples of Designations

1.How to designate one beneficiary Show beneficiary's full name. Do not write names as M.E. Brown or as Mrs. John H. Brown. If you want to designate your estate, enter "My estate" in the beneficiary column.

First name, middle initial, and last name of

each beneficiary

Mary E. Brown

Social Security Number

Address (Including ZIP code)

214 Central Avenue

Munice, IN 47303

Relationship

Niece

Percent or fraction

designated

100%

2.How to designate more than one beneficiary Be sure that the shares to be paid to the several beneficiaries add up to 100 percent or 1.0. Read instructions on the Back of Part 2 if you need more room.

First name, middle initial, and last name of |

Social Security Number |

Address (Including ZIP code) |

Relationship |

Percent or fraction |

|

each beneficiary |

|

|

|

designated |

|

Jose P. Lopez |

360 Williams Street |

Nephew |

|||

Red Band, NJ 07701 |

|||||

|

|

|

|

||

|

|

|

|

|

|

Rosa L. Rowe |

792 Broadway |

Mother |

|||

Whiting, IN 46392 |

|||||

|

|

|

|

||

|

|

|

|

|

3.How to designate a contingent beneficiary (Someone to receive the benefits if the person you designate dies before the Insured dies)

First name, middle initial, and last name of |

Social Security Number |

Address (Including ZIP code) |

Relationship |

Percent or fraction |

|

each beneficiary |

|

|

|

designated |

|

John M. Parrish, if living |

810 West 180th Street |

Father |

100% |

||

New York, NY 10033 |

|||||

|

|

|

|

||

|

|

|

|

|

|

Otherwise to: Susan A. Parrish |

810 West 180th Street |

Sister |

100% |

||

New York, NY 10033 |

|||||

|

|

|

|

||

|

|

|

|

|

4. How to designate different beneficiaries for Basic and Optional insurance You cannot designate Option C - Family.

First name, middle initial, and last name of |

Social Security Number |

Address (Including ZIP code) |

Relationship |

Percent or fraction |

|

each beneficiary |

|

|

|

designated |

|

Leroy D. White |

124 Elm Street |

Father |

100% |

||

Dayton, OH 45420 |

Basic |

||||

|

|

|

|||

|

|

|

|

|

|

Jane M. Smith |

421 Spring Avenue |

Sister |

100% |

||

Portland, ME 04101 |

Option A |

||||

|

|

|

|||

|

|

|

|

|

|

Elizabeth J. Allen |

234 Fifth Avenue |

Daughter |

50% |

||

New York, NY 10029 |

Option B |

||||

|

|

|

|||

|

|

|

|

|

|

Ann J. Borden |

678 Ninth Street |

Daughter |

50% |

||

Philadelphia, PA 19123 |

Option B |

||||

|

|

|

|||

|

|

|

|

|

5.How to designate an inter vivos trust (A trust that you set up during your lifetime)

First name, middle initial, and last name of |

Social Security Number |

Address (Including ZIP code) |

Relationship |

Percent or fraction |

|

each beneficiary |

|

|

|

designated |

|

Trustee(s) or Successor Trustee(s) as |

|

|

Trustee |

100% |

|

provided in the John Q. Public Trust |

|

|

|||

Agreement dated 12/18/1999, if valid. |

|

|

|

|

|

Otherwise to: |

|

|

|

|

|

|

|

|

|

|

|

Mary E. Brown |

214 Central Avenue |

Niece |

100% |

||

Munice, IN 47303 |

|||||

|

|

|

|

||

|

|

|

|

|

6.How to designate a testamentary trust (A trust that is set up when you die, according to terms in your will)

First name, middle initial, and last name of |

Social Security Number |

Address (Including ZIP code) |

Relationship |

Percent or fraction |

|

each beneficiary |

|

|

|

designated |

|

Trustee(s) or Successor Trustee(s) as |

|

|

Trustee |

100% |

|

provided in my Last Will and Testament, |

|

|

|||

|

|

|

|

||

if valid. Otherwise to: |

|

|

|

|

|

|

|

|

|

|

|

Maria Sufuentes |

5909 Pacific Avenue, NW |

Niece |

100% |

||

Washington, DC 20019 |

|||||

|

|

|

|

||

|

|

|

|

|

7. How to cancel all designations of beneficiary

First name, middle initial, and last name of

each beneficiary

Social Security Number

Address (Including ZIP code)

Relationship

Percent or fraction

designated

Cancel prior designations

Back of Part 1 |

SF 2823 |

|

Revised April 2001 |

||

|

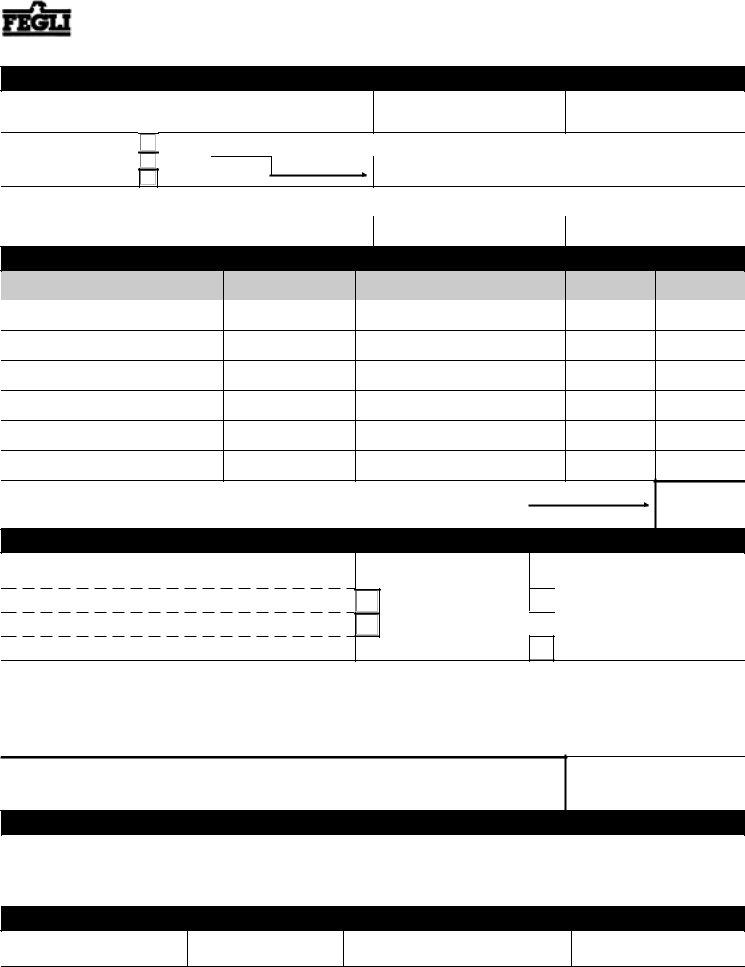

Federal Employees Group Life Insurance

Designation of Beneficiary

Federal Employees' Group Life Insurance (FEGLI) Program

(DO NOT erase or

Form Approved

OMB No.

Important:

Read instructions on the Back of Part 2 before completing this form.

A. Information About the Insured (not the Assignee, if there is one) (type or print)

Name of Insured (Last, first, middle) |

Date of birth of Insured (mm/dd/yyyy) |

Social Security Number of Insured |

The Insured is: |

an employee |

If the Insured is retired or receiving Federal Employees' Compensation, give CSA, |

Place an "X" in the |

a retiree |

CSI, or OWCP claim number: |

|

||

appropriate box. |

a compensationer |

|

|

|

Department or agency where the Insured works (If retired, last department or agency where the Insured worked):

Department or agency

Bureau or division

Location (City, state, and ZIP code)

B. Information About the Beneficiary or Beneficiaries (See Back of Part 1 for examples) (type or print)

First name, middle initial, and last name of

each beneficiary

Social Security Number

Address (Including ZIP code)

Relationship

Percent or fraction

designated

Total (M ust equal 100% or 1.0) (Do not use dollar amounts)

(Do not put a Total if you designated types of insurance. See example 4 on Back of Part 1.)

C. Statement of Insured or Assignee (type or print)

Your name and address (Including ZIP code) |

Please check one: |

|

I am: |

the Insured |

an Assignee |

See Back of Part 2 for definitions

Please check all three:

I have not assigned the insurance.

Two people who witnessed my signature signed below.

I did not name either witness as a beneficiary.

I understand that if there is a valid assignment on file, only the assignee has the right to designate a beneficiary. If a valid assignment is not on file, but there is a valid court order on file with the agency or the U.S. Office of Personnel Management, as appropriate, any designation I complete for the same benefits is not valid.

I understand that if this Designation is valid, it will stay in effect unless it is canceled. (See "When Is A Designation Canceled?" on the Back of Part 2).

I understand that if this Designation is invalid for any reason, the Office of Federal Employees' Group Life Insurance will pay benefits according to the next most recent valid designation. If there isn't one, it will pay according to the order listed on the Back of Part 2.

I am canceling any and all previous Designations of Beneficiary under the Federal Employees' Group Life Insurance Program and am now designating the beneficiary(ies) named above.

Signature of Insured/Assignee (Only the Insured/Assignee may sign. Signatures by guardians, conservators or through a power of attorney are not acceptable.) This form is not valid unless the Insured/Assignee signs in this box.

Date (mm/dd/yyyy)

D. Witnesses To Signature (A witness is not eligible to receive a payment as a beneficiary.)

Signature of witness |

Address (Including ZIP code) |

|

|

Signature of witness |

Address (Including ZIP code) |

|

|

E. For Agency Use Only

Receiving agency

Date of receipt (mm/dd/yyyy)

Signature of authorized agency official

Title

Part 2 - Duplicate

U.S. Office of Personnel Management |

|

|

|

SF 2823 |

FEGLI Handbook (RI |

NSN |

Previous editions are not usable. |

Revised April 2001 |

INSTRUCTIONS: The Insured or assignee must sign this form. Two people must witness the signature and sign as witnesses. The Insured's agency (or U.S. Office of Personnel Management [OPM], if the Insured is an annuitant or insured as a compensationer) must receive the designation before the Insured's death. A person with a power of attorney or other similar legal authority may not sign for the Insured or assignee. A witness cannot be a beneficiary. The agency or OPM, as appropriate, must receive certified court orders involving FEGLI on or after July 22, 1998, and before the Insured's death.

Please read the additional instructions below before completing this form.

"You" and "your" refer to the person completing this form (the Insured or an assignee). The "Insured" is the insured employee, annuitant or compensationer. The "Assignee" is a person(s), firm(s), or trust(s) (usually named on an Assignment form, RI

Who receives benefits when the Insured dies? By law, the Office of Federal Employees' Group Life Insurance (OFEGLI) pays benefits in this order:

If the Insured assigned ownership of his/her insurance (usually by filing an RI

First, to the beneficiary(ies) the assignee(s) validly designated; Second, if none, to the assignee(s).

If the Insured did not assign ownership and there is a valid court order (see 5 Code of Federal Regulations Part 870) on file with the agency or OPM, as appropriate, OFEGLI will pay benefits according to the court order.

If the Insured did not assign ownership and there is no valid court order on file with the agency or OPM, as appropriate, then OFEGLI will pay:

First, to the beneficiary(ies) the Insured validly designated; Second, if none, to the Insured's widow or widower;

Third, if none of the above, to the Insured's child or children and the descendants of any deceased children (a court will usually have to appoint a guardian to receive payment for a minor child);

Fourth, if none of the above, to the Insured's parents in equal shares, or the entire amount to the surviving parent;

Fifth, if none of the above, to the

Sixth, if none of the above, to the Insured's other next of kin entitled under the laws of the State where the Insured lived.

Do I have to designate a beneficiary? No. But if you want OFEGLI to pay differently than listed above and you have not assigned the life insurance and there is no valid court order on file with the agency or OPM, as appropriate, you need to designate a beneficiary.

What if one of the beneficiaries dies or is disqualified for any reason? Unless you indicate otherwise on your designation of beneficiary, OFEGLI will distribute that beneficiary's share equally among the surviving beneficiaries, or entirely to the sole survivor.

What if none of the beneficiaries is living when the Insured dies? OFEGLI will pay the benefits according to the order of precedence listed above.

Can I cancel or change this designation at any time? Yes, you may cancel or change your designation at any time, without the knowledge of or consent of the beneficiary(ies), unless you assigned the insurance or there is a valid court order on file with the agency or OPM, as appropriate.

Is a change or cancellation of beneficiary in my last will or testament valid? It is valid only if you sign your will, two people who witnessed your signature sign your will, and your agency (or OPM, for retirees or insured compensationers) receives your will before the Insured's death.

What if I don't know a beneficiary's social security number? If you don't know the number, leave it blank. But having the number helps speed up the payment of benefits.

Can a witness receive benefits as a designated beneficiary? No.

Who can I name as a beneficiary? You may name any person, firm, corporation or legal entity (except an agency of the Federal or District of Columbia government).

Can I use a common disaster clause? Yes. A common disaster clause is a statement that says that a designated beneficiary is entitled to the benefits only if he/she survives the Insured by a specified minimum number of days. The number of days cannot exceed 30. You can name a contingent beneficiary. If you don't name a contingent and your beneficiary does not live long enough to qualify, OFEGLI will pay according to the order listed in the first column.

Can I designate a trust? Yes. See examples 5 and 6 on the Back of Part 1. Those examples name a contingent beneficiary in case the trust is not valid. You don't have to name a contingent beneficiary unless you want to. If the trust is not valid, and you do not name a contingent, OFEGLI will pay according to the order listed in the first column.

When is a designation canceled? A designation of beneficiary is automatically canceled 31 days after the Insured stops being insured. It is also canceled if either the Insured or assignee assigns the insurance or if the Insured or assignee submits another valid designation.

What if the Insured elected a full living benefit? Then there is no Basic left. So if you want to designate different types of insurance to different beneficiaries (see example 4 on the Back of Part 1), you should only list Option A and Option

B.

Who can sign this form? The Insured or Assignee (if applicable) must sign this form. The signature of a guardian, conservator or other fiduciary (including, but not limited to, those acting according to a Power of Attorney or a Durable Power of Attorney) is not acceptable.

What if I erase or cross out something on this form? You should complete another form. Erasures,

What if I need more room? Write "See Attached" in Part B of the form. Use a blank sheet. Print your name, date of birth and social security number at the top of the attachment. List the information required in Part B for each beneficiary. Sign the form and attachment. Have the same two people witness both of your signatures and sign the form and attachment.

Where can I get more information? The FEGLI Handbook (RI

Where should I send this form? Send it to the Insured's employing agency if the Insured:

is an employee; or

has been receiving compensation payments from the Office of Workers' Compensation Programs for less than 12 months and is still on the agency's rolls as an employee.

Send it to the Office of Personnel Management, Retirement Operations Center, P.O. Box 45, Boyers, PA

is a retiree; or

is receiving compensation payments from the Office of Workers' Compensation Programs and is not still employed or has been receiving compensation payments for at least 12 months.

The agency or OPM will note receipt in section E of the form and return a copy to you as evidence that it received and filed the original.

Properly completed designations are not valid unless the appropriate office listed above receives them before the Insured's death.

Privacy Act and Public Burden Statements

Title 5, U.S. Code, chapter 87, Life Insurance, authorizes solicitation of this information. The Office of Federal Employees' Group Life Insurance (OFEGLI) will use the information you furnish to determine your beneficiary(ies) for benefits under the Federal Employees' Group Life Insurance Program. OFEGLI is not a Federal agency. It is staffed by employees of the contracted life insurance carrier. It may share this information with the Office of Personnel Management (OPM). Agencies and/or OPM will place this information in the Insured's Official Personnel Folder or retirement file. OPM or OFEGLI may disclose this information to other Federal agencies or Congressional offices which may have a need to know it in connection with your application for a job, license, grant or other benefit. It may also be shared and is subject to verification, via paper, electronic media, or through the use of computer matching programs, with national, state, local or other charitable or social security administrative agencies to determine and issue benefits under their programs. In addition, to the extent this information indicates possible violation of civil or criminal law, it may be shared and verified, as noted above, with an appropriate Federal, state, or local law enforcement agency.

We also ask for the Insured's Social Security Number to use it as an individual identifier in the Federal Employees' Group Life Insurance Program. Public Law

requires that any person doing business with the Federal government furnish a social security number or tax identification number. This is an amendment to title 31, Section 7701.

While the law does not require you to supply all the information requested on this form, doing so will help in the prompt processing of your designation.

Agencies other than the Office of Personnel Management may have further routine uses for disclosure of information from the records systems in which they file copies of this form. If this is the case, they should provide you with any such uses which are applicable at the time you complete this form.

We think this form takes an average of 15 minutes to complete, including the time for reviewing instructions, getting the needed data, and reviewing the completed form. Send comments regarding our estimate or any other aspect of this form, including suggestions for reducing completion time, to the Office of Personnel Management, Reports and Forms Coordinator,

Keep Your Designation Current. Submit a New One If the Address of One of Your Beneficiaries Changes or If Your Intentions Change

(for example, due to a change in family status, such as marriage, divorce, death, birth, etc.). |

SF 2823 |

|

Back of Part 2 |

||

Revised April 2001 |