In today's interconnected world, the ease of opening a bank account has become increasingly important. The Open Ecobank Account form facilitates this process, catering to a diverse set of clients including individuals, joint accounts, partnerships, and minors. This comprehensive form requires detailed personal and financial information to ensure compliance and secure banking. Applicants can specify the type of account they wish to open, such as current, savings, or other; select the currency; and detail the intended purpose of the account, which might range from managing salary deposits to business transactions. The form also meticulously gathers personal identification details, residential status, and employment information, emphasizing the importance of correctness and validity. Furthermore, it extends the option to apply for additional banking services like internet banking, debit cards, and e-statements, among others, signifying the bank's adaptability to modern banking needs. The declaration section underscores the applicant's agreement to the bank's terms and conditions, establishing a formal contract. Ecobank's global account conditions highlight the regulatory framework, operational guidelines, and disclosure agreements, ensuring that both the bank and account holders are protected under a mutual understanding of rights and responsibilities. This form, therefore, acts as a critical first step towards establishing a transparent, secure, and efficient banking relationship between Ecobank and its prospective clients.

| Question | Answer |

|---|---|

| Form Name | Open Ecobank Account Form |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | online bank account registration, online bank account registration in ghana, ecobank online account opening, how to create a bank account online |

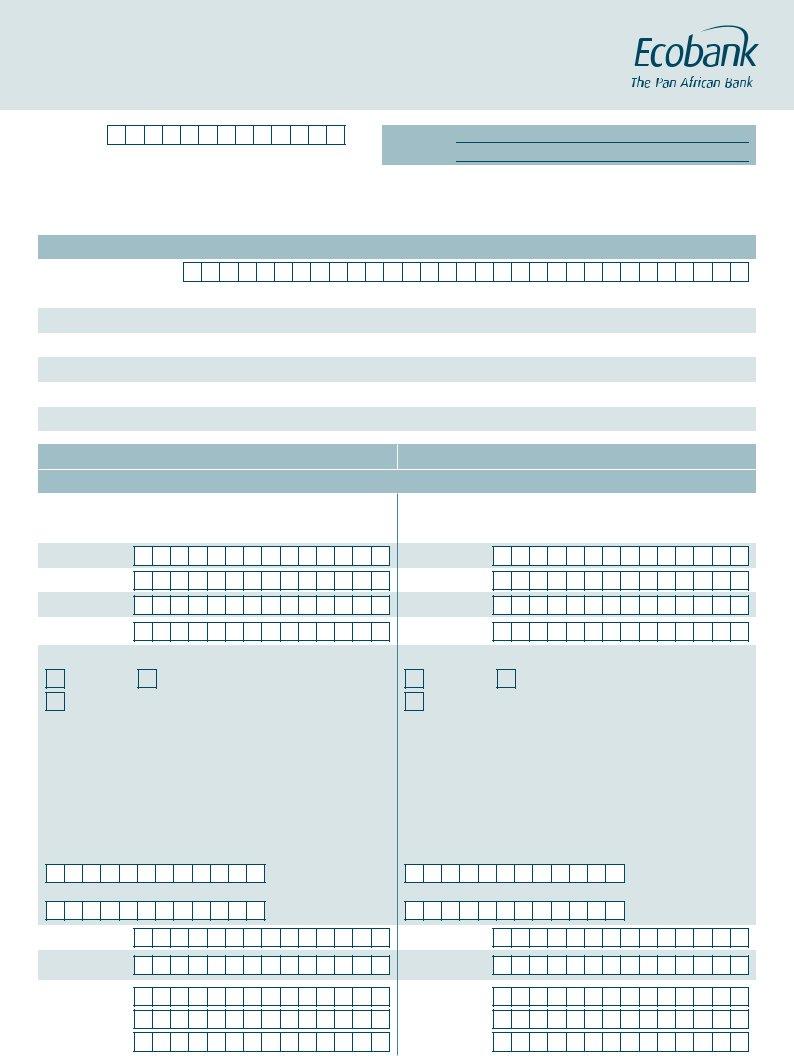

APPlICATION TO OPEN AN ACCOUNT

JOINT, PARTNERSHIP AND MINORS

TO: ECObANk

(INDICATE COUNTRY NAME)

FOR bANk USE ONlY ACCOUNT Nº:

PLEASE READ CAREFULLY AND COMPLETE ALL RELEVANT SECTIONS. SHOULD YOU HAVE ANY qUESTIONS A MEMBER OF STAFF wILL BE HAPPY TO ASSIST YOU. (PlEASE COmPlETE IN blOCk CAPITAlS ANd TICk wHERE NECESSARY)

ACCOUNT SPECIFICATIONS

NAmE OF ACCOUNT:

|

|

JOINT |

|

PARTNERSHIP |

|

|

MINOR |

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TYPE OF ACCOUNT: |

|

CURRENT |

|

SAVINGS |

|

|

OTHER (PLEASE STATE) |

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

CURRENCY OF ACCOUNT: |

|

LOCAL CURRENCY |

|

OTHER (PLEASE SPECIFY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

PURPOSE OF ACCOUNT: |

|

SALARY |

|

BUSINESS |

|

|

OTHER (PLEASE SPECIFY) |

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REGISTRATION Nº (IF APPLICABLE): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

RESIdENTIAl STATUS: |

|

RESIDENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

FIRST ACCOUNT HOldER / GUARdIAN |

|

|

|

|

|

SECONd ACCOUNT HOldER / mINOR |

|

|

|

|

|

|

|

|

||||||||||||||||

PERSONAl dETAIlS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TITlE: |

|

MR. |

|

MRS. |

|

MISS. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DR. |

|

PROF. |

|

OTHER |

|

|

|

|

|

|

|

SURNAmE:

FIRST NAmE:

OTHER NAmE:

mAIdEN NAmE:

(IF APPLICABLE)

FORm OF IdENTIFICATION:

|

PASSPORT |

|

|

|

|

|

NATIONAL ID |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER (PLEASE SPECIFY) |

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CUSTOmER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ID Nº: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PHOTO |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ISSUE DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

d |

d |

|

m |

m |

|

Y |

Y |

|

Y |

Y |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXPIRY DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

d |

d |

|

m |

m |

|

Y |

Y |

|

Y |

Y |

|

|

||||||||||

SOCIAL SECURITY Nº (IF APPLICABLE):

TAX PAYER Nº (IF APPLICABLE):

OCCUPATION:

EmPlOYER’S

NAmE:

EmPlOYER’S

AddRESS:

TITlE: |

|

MR. |

|

MRS. |

|

MISS. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DR. |

|

PROF. |

|

OTHER |

|

|

|

|

|

|

|

SURNAmE:

FIRST NAmE:

OTHER NAmE:

mAIdEN NAmE:

(IF APPLICABLE)

FORm OF IdENTIFICATION:

|

PASSPORT |

|

|

|

|

|

NATIONAL ID |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER (PLEASE SPECIFY) |

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CUSTOmER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ID Nº: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PHOTO |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ISSUE DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

d |

d |

|

m |

m |

|

Y |

Y |

|

Y |

Y |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXPIRY DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

d |

d |

|

m |

m |

|

Y |

Y |

|

Y |

Y |

|

|

||||||||||

SOCIAL SECURITY Nº (IF APPLICABLE):

TAX PAYER Nº (IF APPLICABLE):

OCCUPATION:

EmPlOYER’S

NAmE:

EmPlOYER’S

AddRESS:

1

PERSONAl dETAIlS (CONTINUED)

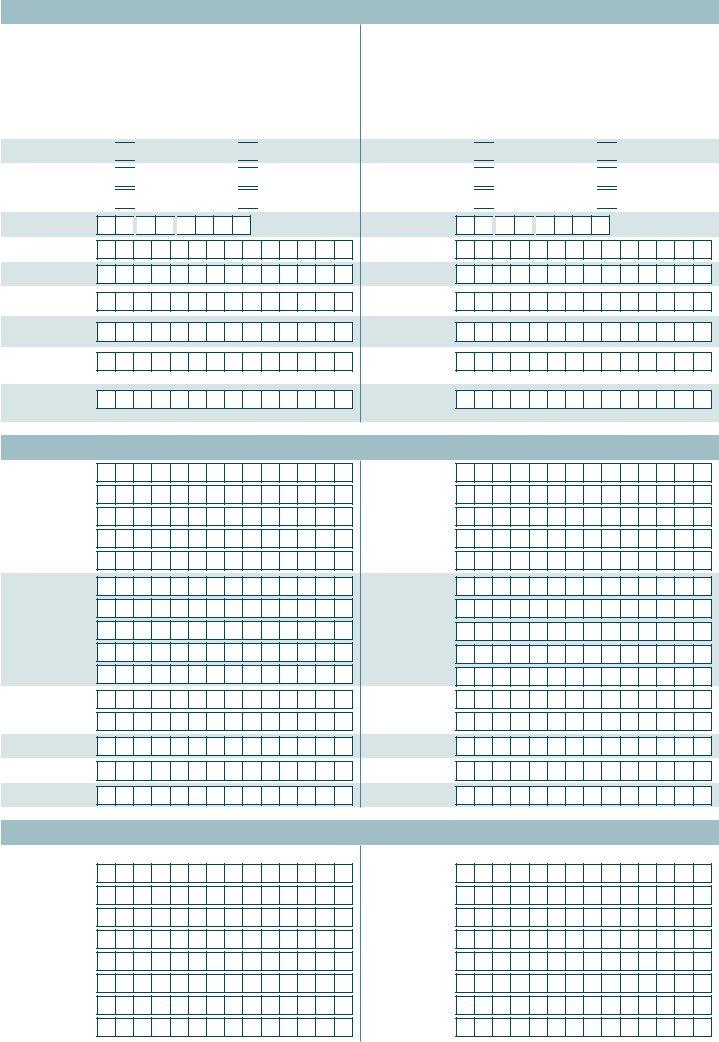

RESIdENTIAl STATUS: |

|

RESIDENT |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||

RESIDENT PERMIT Nº: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RESIdENTIAl STATUS: |

|

RESIDENT |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||

RESIDENT PERMIT Nº: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERMIT VALIDITY:

GENdER:

mARITAl STATUS:

ISSUE DATE: EXPIRY DATE:

MALE

SINGLE DIVORCED

d |

d |

|

m |

m |

|

Y |

Y |

Y |

Y |

|

|

|

|

|

|

|

|

|

|

d |

d |

|

m |

m |

|

Y |

Y |

Y |

Y |

FEMALE

MARRIED wIDOwED

PERMIT VALIDITY:

GENdER:

mARITAl STATUS:

ISSUE DATE: EXPIRY DATE:

MALE

SINGLE DIVORCED

d |

d |

|

m |

m |

|

Y |

Y |

Y |

Y |

|

|

|

|

|

|

|

|

|

|

d |

d |

|

m |

m |

|

Y |

Y |

Y |

Y |

FEMALE

MARRIED wIDOwED

dATE OF bIRTH:

PlACE OF bIRTH:

NATIONAlITY:

mOTHER’S mAIdEN NAmE:

mOTHER’S FIRST NAmE:

SPOUSE’S

SURNAmE:

(IF APPLICABLE)

SPOUSE’S OTHER NAmE:

(IF APPLICABLE)

d d m m Y Y Y Y

dATE OF bIRTH:

PlACE OF bIRTH:

NATIONAlITY:

mOTHER’S mAIdEN NAmE:

mOTHER’S FIRST NAmE:

SPOUSE’S

SURNAmE:

(IF APPLICABLE)

SPOUSE’S OTHER NAmE:

(IF APPLICABLE)

d d m m Y Y Y Y

APPlICANTS’ dETAIlS FOR CORRESPONdENCE

RESIdENTIAl

AddRESS:

TOwN:

CITY:

COUNTRY:

POSTAl

AddRESS:

EmAIl:

TEl Nº:

mObIlE Nº:

FAX Nº:

APPlICANTS’ OTHER dETAIlS

NEXT OF kIN:

NAME:

ADDRESS:

RELATIONSHIP:

TEL Nº:

EMAIL:

RESIdENTIAl AddRESS:

TOwN:

CITY:

COUNTRY:

POSTAl

AddRESS:

EmAIl:

TEl Nº:

mObIlE Nº:

FAX Nº:

NEXT OF kIN: NAME:

ADDRESS:

RELATIONSHIP:

TEL Nº:

EMAIL:

2

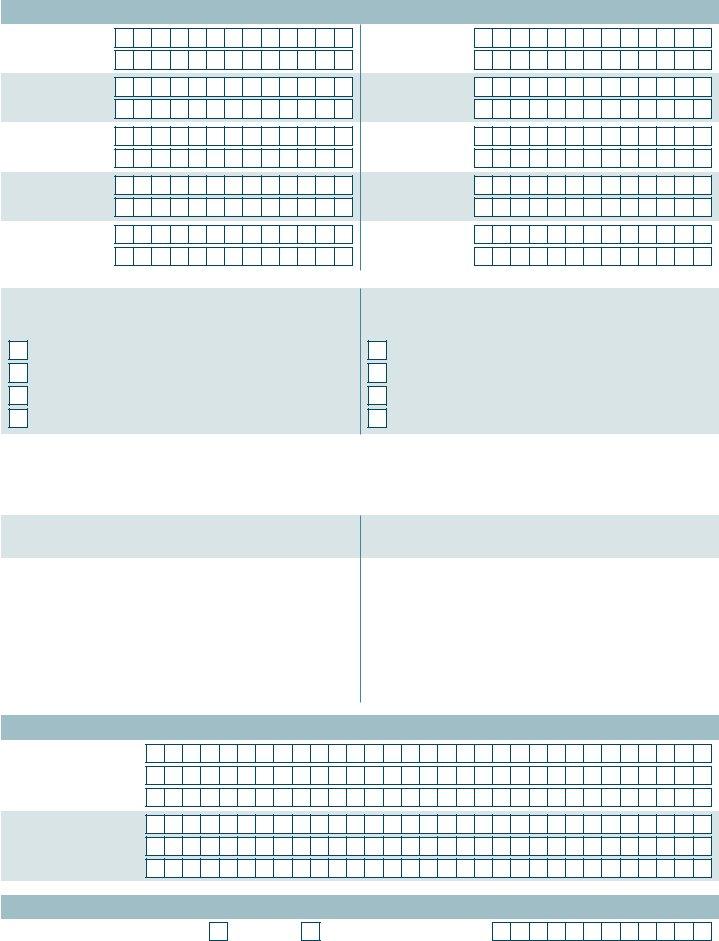

APPlICANT’S OTHER dETAIlS (CONTINUED)

I HEREbY APPlY FOR THE FOllOwING SERvICES:

(IF YOU DO NOT wISH TO HAVE SOME OF THESE SERVICES, PLEASE TICk THEM. A SEPARATE FORM MAY BE REqUIRED FOR SOME OF THE SERVICES.)

INTERNET BANkING |

|

DEBIT CARD |

|

|

|

|

|

|

|

CHEqUE BOOk |

|

|

|

|

|

|

|

|

STANDING ORDER |

|

|

|

|

|

|

I HEREbY APPlY FOR THE FOllOwING SERvICES:

(IF YOU DO NOT wISH TO HAVE SOME OF THESE SERVICES, PLEASE TICk THEM. A SEPARATE FORM MAY BE REqUIRED FOR SOME OF THE SERVICES.)

INTERNET BANkING |

|

DEBIT CARD |

|

|

|

|

|

|

|

CHEqUE BOOk |

|

|

|

|

|

|

|

|

STANDING ORDER |

|

|

|

|

|

|

dISPATCH mOdE FOR CORRESPONdENCE ANd STATEmENTS: |

|

POST |

|

HOLD |

|

SPECIAL DELIVERY (OFFERED AT EXTRA COST) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STATEmENT FREQUENCY: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

MONTHLY |

|

qUARTERLY |

|

OTHER (PLEASE INDICATE) |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

dO YOU HAvE ANY OTHER ACCOUNT wITH ECObANk: |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

YES |

|

NO |

|

|

|

||

dO YOU bANk ElSEwHERE? |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||||||

|

YES |

|

NO |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PlEASE lIST YOUR OTHER bANkS (IF APPLICABLE): |

|

|

|

|

||||||||||

NAME OF BANk: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

DO YOU HAVE A CREDIT FACILITY: |

|

YES |

|

NO |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|||||

NAME OF BANk: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

DO YOU HAVE A CREDIT FACILITY: |

|

YES |

|

NO |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

dO YOU HAvE ANY OTHER ACCOUNT wITH ECObANk: |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

YES |

|

NO |

|

|

|

||

dO YOU bANk ElSEwHERE? |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||||||

|

YES |

|

NO |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PlEASE lIST YOUR OTHER bANkS (IF APPLICABLE): |

|

|

|

|

||||||||||

NAME OF BANk: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

DO YOU HAVE A CREDIT FACILITY: |

|

YES |

|

NO |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|||||

NAME OF BANk: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

DO YOU HAVE A CREDIT FACILITY: |

|

YES |

|

NO |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REFERENCES / INTROdUCERS

NAmE:

AddRESS:

NAmE:

AddRESS:

INITIAl dEPOSIT

PAYmENT mETHOd: |

|

CASH |

|

|

|

CHEqUE

TRANSFERAmOUNT:

3

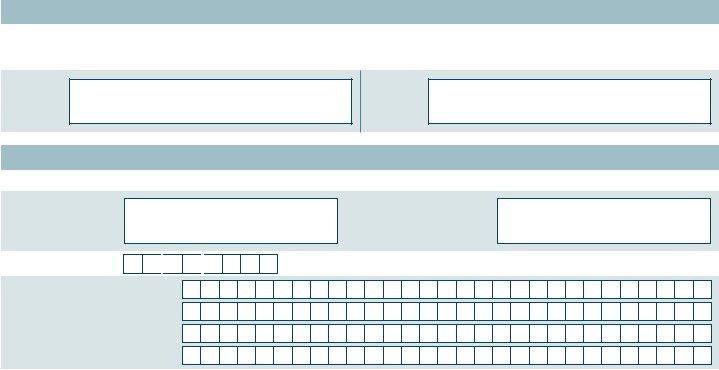

dEClARATION

The information which I have provided in this form is accurate and is valid at the date of opening the account. I have also fully read and understood the terms and conditions for operating an Ecobank Account as contained herein, and also the accompanying booklet as applicable and agree to be bound by all terms and conditions as applicable to the banking services applied for by me. I therefore request that you open an account and provide your services to me in line with the above information.

SIGNATURE:

SIGNATURE:

JURAT (THIS SHOULD BE ADOPTED wHERE THE APPLICANT IS NOT LITERATE OR IS BLIND AND THE FORM IS READ TO HIM / HER BY A THIRD PARTY)

I agree to abide by the contents of this agreement and acknowledge that it has been truly and audibly read over and explained to me by an Interpreter.

mARk OF CUSTOmER /

THUmbPRINT:

dATE:d d m m Y Y Y Y

NAmE OF INTERPRETER:

AddRESS OF INTERPRETER:

lANGUAGE OF INTERPRETATION:

mAGISTRATE / COmmISSIONER FOR OATHS:

GlObAl ACCOUNT CONdITIONS

Please read this page carefully. It provides you with important information about your Ecobank account(s).

A. TERmS / SCOPE

The information contained on this page together with any further instructions

and conditions that may be prescribed by the bank from time to time shall constitute the terms of the agreement between the customer and Ecobank. when this application form has been signed, it will be deemed to have been accepted as binding on the customer and the Ecobank representative ofice or afiliate where the account is held.

These conditions apply to each account opened under the Account Opening Form or in any other acceptable manner.

These conditions are supplemented and / or amended for Accounts held in certain countries or territories by local conditions (the “Local Conditions”), which will be supplied to the Customer by Ecobank and will be binding on the Customer and Ecobank.

If there is a conlict between these conditions and any Local Conditions, the Local Conditions prevail; and if there is a conlict between these conditions or any Local Conditions and any agreement relating to a service or product provided to the Customer (a “Service”), that agreement prevails.

The Customer will provide to Ecobank all documents and other information reasonably required by it in relation to any Account or any Service.

b. THE ACCOUNT

The Customer shall assume full responsibility for the genuineness, correctness and validity of all endorsements appearing on all cheques, orders, bills, notes, negotiable instruments, receipts or other instructions deposited into the account.

The Bank will not be responsible for any loss of funds deposited with it arising from any future Government order, law, levy, tax, embargo, moratorium, exchange restriction or any other cause beyond its control.

Your account shall be debited for any service charge that is set by the Bank from time to time.

All notices or letters will be sent to the physical, postal or electronic address supplied by you and will be considered duly delivered and received at the time it is delivered or seven days after posting.

The bank will not be liable for funds handed over to members of its staff other than the Cashiers / Tellers in the bank’s premises with the appropriate deposit slip.

Any anomaly in the entries on your bank statements must be brought to the attention of the bank within 30 days of the date thereof and you agree that failure to give such notice absolves the bank from all liabilities arising thereof.

The Bank may exercise its general lien or any similar right it is entitled to including the right to combine and consolidate all or any of the Customer’s accounts with the Bank, and the right to set off or transfer any sum or sums standing to the credit of any one or more of such accounts against liabilities in any other account.

C. INSTRUCTIONS

Ecobank may rely on the authority of each person designated (in a form acceptable to Ecobank) by the Customer to send Instructions or do any other thing until Ecobank has received written notice or other notice acceptable to it of any change from

a duly authorized person and Ecobank has had a reasonable time to act (after which time it may rely on the change).

Each of the Customer and Ecobank will comply with certain agreed security procedures (the “Procedures”) designed to verify the origination of instructions between them such as enquiries, advices and instructions.

Ecobank is not obliged to do anything other than what is contained in the Procedures to establish the authority or identity of the person sending an Instruction. Ecobank is not responsible for errors or omissions made by the Customer or the duplication of any Instruction by the Customer and may act on any Instruction by reference to an account number only, even if an account name is provided. Ecobank may act on an Instruction if it reasonably believes it contains suficient information.

Ecobank may decide not to act on an Instruction where it reasonably doubts its contents, authorization, origination or compliance with the Procedures and will promptly notify the Customer (by telephone if appropriate) of its decision.

If the Customer informs Ecobank that it wishes to recall, cancel or amend an Instruction, Ecobank will use its reasonable efforts to comply.

If Ecobank acts on any Instruction sent by any means requiring manual intervention (such as telephone, telex, telefax, electronic mail or disks sent by messenger) then, if Ecobank complies with the Procedures, the Customer will be responsible for any loss Ecobank may incur in connection with that Instruction.

d. CHEQUES

The Bank is under no obligation to honour any cheque drawn on the account unless there are suficient funds in the account to cover the value of the said cheques and such cheques may be returned unpaid.

All cheques or other orders signed by you (or either or both of you if a joint account)

will be processed by the Bank and your account will be debited for such cheques whether such account is for the time being in credit or overdrawn or may become

in consequence of such debit.

The Bank may exercise its discretion in allowing withdrawals against uncleared cheque(s) where the cheques are returned unpaid thereafter, the Bank shall have the right to hold on to the returned cheque and take further action it deems appropriate to recover the value of the withdrawal from you. The Bank shall have the right whenever it deems appropriate to conirm the issuance of a cheque drawn on the Customer’s current account failing which the cheque may be returned with ‘Drawer’s Conirmation Required’ endorsed thereon.

4

You must ensure that your cheque book is kept in a safe place to prevent unauthorized persons from gaining access to same as failure to do this, may be a ground for any consequential loss being charged to your account.

If your cheque book gets lost, missing or stolen you must notify the Bank immediately. The Bank shall not be held liable for any unauthorized use of your cheque book where the loss or otherwise of same was not reported immediately.

Ecobank may supply checks, payments instruments and related materials to the Customer and the Customer will make reasonable efforts to avoid any fraud, loss, theft, misuse or dishonor in respect of them. The Customer will promptly notify Ecobank in writing of the loss or theft of any check or payment instrument and will return to Ecobank or destroy any unused checks, payment instruments and related materials when the relevant Account is closed.

E. OvERdRAwN ACCOUNTS

Overdraft may be available to customers upon arrangement with the Bank. If you do

not have such arrangement, the Bank may in its discretion, nonetheless honour a cheque even though such account may become overdrawn in consequence. In such a case,

the Customer agrees to repay the overdraft within 7 days, and bear the extra fee and interest at our current rate for unauthorized borrowing for the period that the account remains in debit. If your account does not have enough cleared funds to cover an amount you want to draw, we reserve the right to return your cheque unpaid.

The Bank reserves the right to use credit balances on your current account (s) to offset any outstanding exposures on any of your accounts.

F. STATEmENTS ANd AdvICES

Statements and Advices can be delivered to the Customer either physically, by post or electronically

where requested, the Bank may provide electronic Statements or

‘as available’ and without any warranty of itness for a speciic purpose. we do not warrant that this service will always be uninterrupted, or that any information provided is accurate and current as at the time it is received. The Bank disclaims responsibility for the service provided by any network provider.

Irrespective of the channel used to deliver the statement or advice, the Customer will notify Ecobank in writing of anything incorrect in a statement or advice promptly

and in any case within thirty (30) days from the date on which the statement or advice is sent to the Customer.

G. INTEREST, FEES ANd OTHER AmOUNTS

You will be liable for the payment of interest charges at the rate ixed by the Bank from time to time for any outstanding debit on your current account. Your current account may also be debited for the Bank’s usual banking charges, interest, commission, etc.

Unless otherwise agreed, Ecobank may modify at any time the rate of interest, fees or other amount applicable to any Account or Service (but subject to any legal requirement as to notice).

H. FORCE mAJEURE

Neither the Customer nor Ecobank will be responsible for any failure to perform any

of its obligations with respect to any Account if such performance would result in it being in breach of any law, regulation or other requirement of any government or other authority in accordance with which it is required to act or if its performance is prevented, hindered or delayed by a Force Majeure Event; in such case its obligations will be suspended,

for so long as the force Majeure Event continues (and, in the case of Ecobank, no other representative ofice or afiliate shall become liable). “Force Majeure Event” means any event due to any cause beyond the reasonable control of the relevant party, such as restrictions on convertibility or transferability, requisition, involuntary transfers, unavailability of any system, sabotage, ire, lood, explosion, acts of God, civil commotion, strikes or industrial action of any kind, riots, insurrection, war or acts of government.

I. SHARING OF INFORmATION

Ecobank will treat information relating to the Customer as conidential, but (unless consent is prohibited by law) the Customer consents to the transfer and disclosure by Ecobank

of any information relating to the Customer to and between the representative ofices, afiliates and agents of Ecobank and third parties selected by any of them, whenever situated, for conidential use (including in connection with the provision of any Service and for data processing, statistical and risk analysis purposes).

Ecobank and any representative ofice, afiliate, agent or third party may transfer and disclose any such information as required by any law, court, regulator or legal process.

J. ElECTRONIC mONITORING OR RECORdING

The Customer and Ecobank consent to telephonic or electronic monitoring or recording for security and quality of service purposes and agree that either may produce telephonic recording or computer records as evidence in any proceedings brought in connection with these conditions or any local conditions.

k. CHANGE OF mANdATE

The customer must notify the Bank immediately of any change in the address, directors, committee members, trustees, designated members, secretaries. Any modiication of change in authorized signatories must be signed in accordance with the existing mandate and accompanied by a resolution to that effect.

l. TERmINATION

Either party may terminate this agreement at any time (but subject to any legal requirement as to notice) by notifying the other in writing.

On closure of an Account, the termination becomes effective after any cheque drawn on the account or outstanding on it have been paid; all cheque books and cards issued to you have been sent back to the bank; and all information and equipments supplied by Ecobank have been returned to the bank.

where the Bank is terminating the agreement and your account is overdrawn, you must pay all sums outstanding on the account otherwise the Bank may take appropriate legal action for recovery.

All mandatory documentation should be completed by the Customer within three

(3)months of opening the account. If you do not provide the required document within three (3) months, the account will be automatically closed after prior notice to you.

m. JURISdICTION

In relation to any account these conditions and the relevant Local Conditions are governed by the law of the country or territory in which that account is held.

N. dISClAImER ClAUSE

The bank disclaims liability for any funds / assets deposited by you which are subsequently found to have derived from illegal source or activities.

You conirm that the funds / assets deposited are not derived from any illegal source or activities.

FOR bANk USE ONlY

ACCOUNT OFFICER:

INITIATOR COdE:

bUSINESS UNIT:

SUbSIC COdE:

ACCOUNT OPENING dATE: |

d |

d |

|

m |

m |

|

|

Y |

|

Y |

|

Y |

|

Y |

|

|

|

|

|

|

|

|

SIGNATURE vERIFICATION: |

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

mANdATE / POwER OF ATTORNEY: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

dEFERREd dOCUmENTATION: |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

dEFERREd PERIOd: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C.S.U.: |

|

|

|

|

|

|

|

|

|

|

|

b.m.: |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5