If you intend to fill out oppenheimer rb0000 108 0617, it's not necessary to download any sort of software - just use our PDF editor. Our tool is continually developing to grant the best user experience attainable, and that is due to our commitment to continuous enhancement and listening closely to comments from customers. By taking some simple steps, you can begin your PDF journey:

Step 1: First, access the tool by pressing the "Get Form Button" at the top of this site.

Step 2: With this advanced PDF tool, it is easy to do more than merely complete blank form fields. Edit away and make your docs seem professional with customized text put in, or modify the file's original input to perfection - all comes along with an ability to incorporate almost any photos and sign the file off.

This document will require particular information to be filled in, therefore ensure you take some time to provide precisely what is requested:

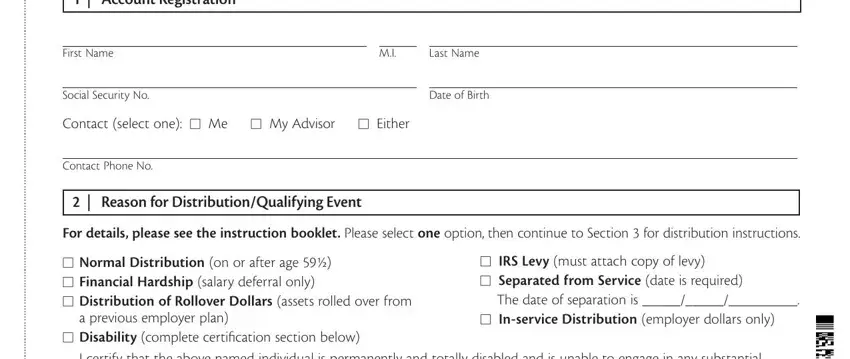

1. It's vital to complete the oppenheimer rb0000 108 0617 correctly, so pay close attention when filling in the parts comprising all these blanks:

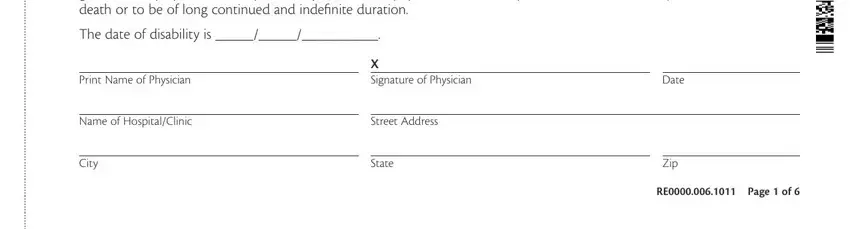

2. Immediately after the first part is done, proceed to type in the applicable details in all these - I certify that the above named, The date of disability is, Print Name of Physician, X Signature of Physician, Name of HospitalClinic, Street Address, City, State, Date, Zip, and RE Page of.

People who work with this document often make some mistakes while filling in Name of HospitalClinic in this section. You need to go over whatever you enter right here.

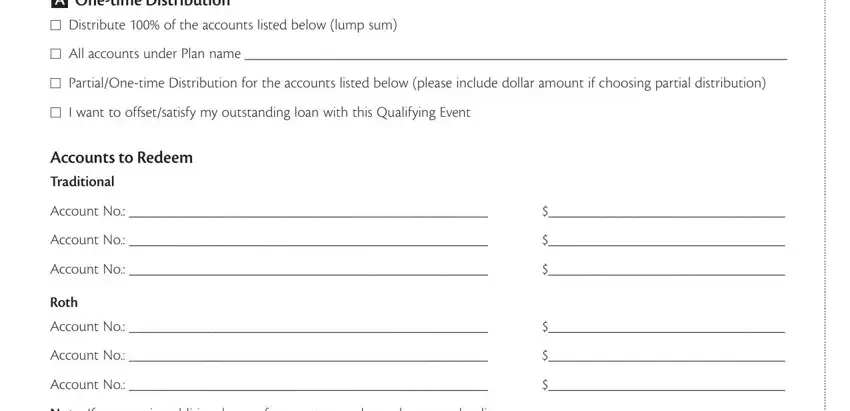

3. The following step is all about A Onetime Distribution M, M All accounts under Plan name, M PartialOnetime Distribution for, M I want to offsetsatisfy my, Accounts to Redeem Traditional, Account No, Account No, Account No, Roth, Account No, Account No, Account No, and Note If you require additional - fill in each one of these empty form fields.

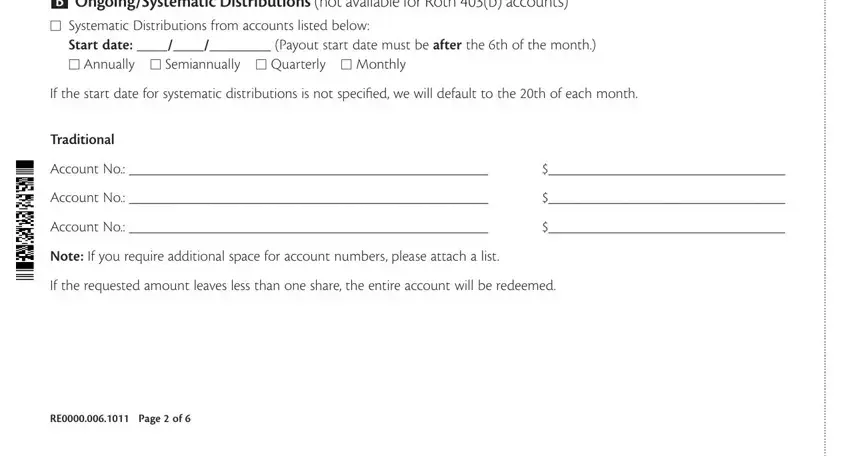

4. All set to start working on this next portion! In this case you have all of these B OngoingSystematic Distributions, Start date Payout start date must, If the start date for systematic, Traditional, Account No, Account No, Account No, Note If you require additional, If the requested amount leaves, and RE Page of blanks to fill out.

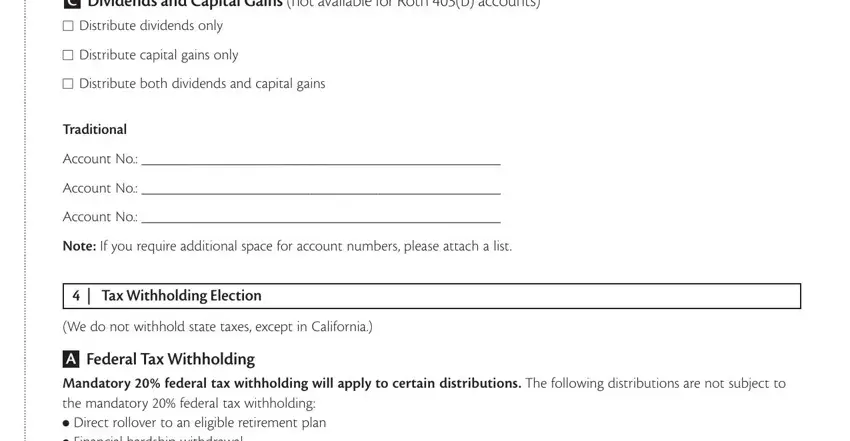

5. And finally, this final part is precisely what you have to wrap up prior to submitting the PDF. The fields under consideration are the following: C Dividends and Capital Gains not, M Distribute capital gains only, M Distribute both dividends and, Traditional, Account No, Account No, Account No, Note If you require additional, Tax Withholding Election, We do not withhold state taxes, and A Federal Tax Withholding.

Step 3: Right after you've looked over the details provided, simply click "Done" to complete your form. Join FormsPal right now and instantly obtain oppenheimer rb0000 108 0617, available for download. All adjustments made by you are kept , which means you can edit the document later on if needed. We do not sell or share any information that you provide while filling out documents at our site.