Are you one of the many entrepreneurs in Oregon who are looking to start a business? If so, then you’ve likely heard of form 2553 and its importance in setting up a limited liability corporation (LLC). Filing this document with the Internal Revenue Service is an essential step when registering your LLC, as it establishes that your business will be taxed as a C-Corp or an S-Corp. In this blog post, we'll discuss everything you need to know about Oregon Form 2553 including how to complete and file it. We will also provide helpful tips on making sure all your information is prepared correctly before submitting the form. So if you want to get started on forming an LLC properly from the start - read on!

| Question | Answer |

|---|---|

| Form Name | Oregon Form 2553 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | FORM2553_0206 oregon employment department tax authorization representative fillable form |

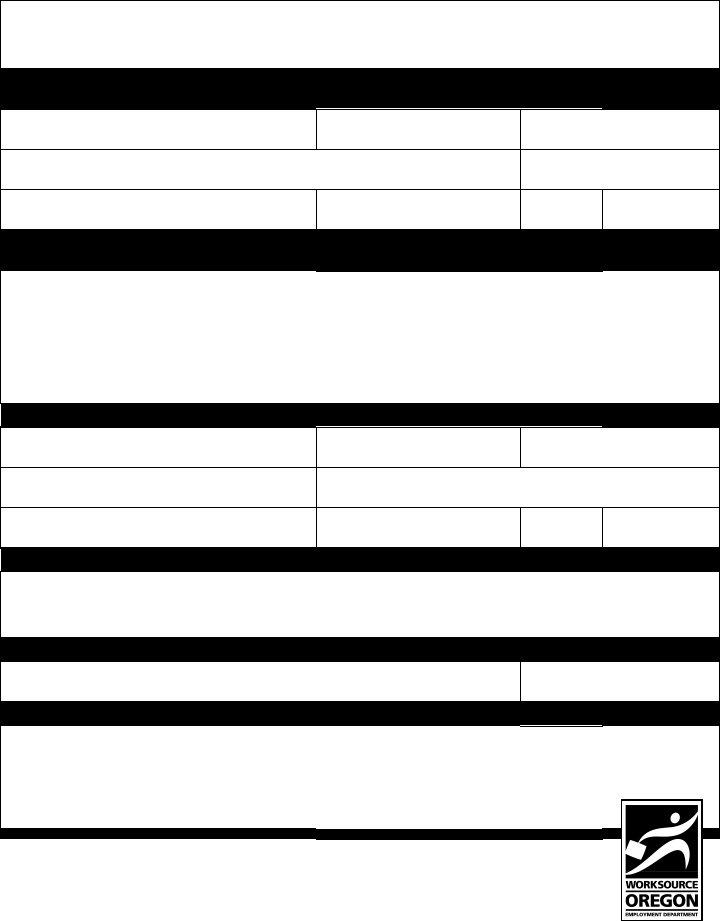

Oregon Employment Department

Tax Authorization Representative

This form allows the Employment Department to disclose your company’s confi dential tax information to your designee. You may designate a person, agency, fi rm or organization.

Owner Name/Title: |

Telephone Number: |

Fax Number: |

|||

|

( |

) |

( |

) |

|

Company Name: |

|

|

BIN: |

|

|

Mailing Address: |

City: |

|

State: |

Zip Code: |

|

The below named is authorized to receive my company’s confi dential tax information and/or discuss tax matters pertaining to my account before the Oregon Employment Department for:

All tax years, or

Specifi c tax years: ____________, ____________, ____________, ____________, ____________,

All tax matters, or

Specifi c tax matters: _______________________________________________________________

I hereby appoint the following person as designee or authorized representative:

Authorization Representative name: |

Telephone Number: |

Fax Number: |

|||

|

( |

) |

( |

) |

|

Title: |

Company name: |

|

|

|

|

Mailing Address: |

City: |

|

State: |

Zip Code: |

|

Note:

This authorization form is active until revoked and automatically revokes and replaces all earlier tax authorizations on fi le with the Oregon Employment Department for the same tax matters and years or periods covered by this form. This information will not be disclosed externally.

This authorization must be signed or it will be returned. |

|

Owner Signature: |

Date: |

WorkSource Oregon Employment Department is an equal opportunity employer/program. Auxiliary aids and services, alternate formats

and language services are available to individuals with disabilities and limited English profi ciency free of cost upon request.

WorkSource Oregon Departamento de Empleo es un programa que respeta la igualdad de oportunidades. Disponemos de servicios o ayudas auxiliares, formatos alternos y asistencia de idiomas para personas con discapacidades o conocimiento limitado del inglés, a pedido y sin costo.

State of Oregon • Employment Department • www.WorkingInOregon.org |

FORM 2553 |

ADDITIONAL INFORMATION

This form is used for two purposes:

•Tax Information Disclosure Authorization

Allows the department to disclose your confi dential tax information to whomever you designate. Original notices of defi ciency or assessment will be mailed to the taxpayer as required by law. The representative will not receive original notices we send to you.

•Tax Authorization Representative Form

Notifi es the department that another person is authorized to receive your confi dential tax information and/or to discuss tax matters pertaining to your account before the Oregon Employment Department.

This form is effective on the date signed. Authorization terminates when the department receives written revocation notice and/or a new form is submitted.

For corporations, “taxpayer” as used on this form, must be the corporation that is subject to Oregon tax.

This form does not preclude the Oregon Employment Department from contacting the taxpayer directly regarding matters pertaining to their account as defined in ORS 657 and OAR 471.

Fax:

or

Mail to:

Employment Department

Tax Section Room 107

875 Union St NE

Salem OR 97311

State of Oregon • Employment Department • www.WorkingInOregon.org |

FORM 2553 |