Any time you want to fill out rev 1500 forms, you don't have to download and install any programs - just try our online tool. FormsPal development team is always working to enhance the tool and enable it to be much better for users with its cutting-edge functions. Make use of the current innovative prospects, and discover a trove of emerging experiences! Here's what you'd have to do to begin:

Step 1: Click the orange "Get Form" button above. It's going to open our editor so you could start filling in your form.

Step 2: After you launch the PDF editor, you will see the document made ready to be filled out. Besides filling in various blank fields, you can also perform other actions with the file, namely adding custom textual content, editing the initial textual content, inserting images, putting your signature on the form, and more.

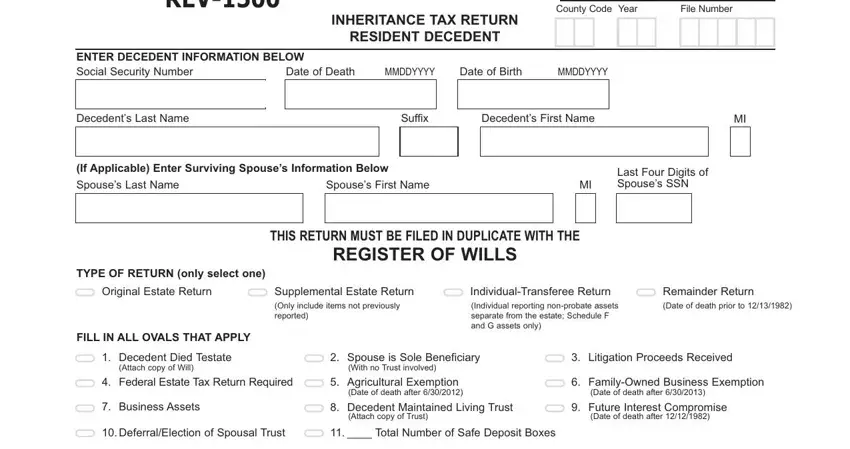

When it comes to blanks of this particular form, this is what you need to know:

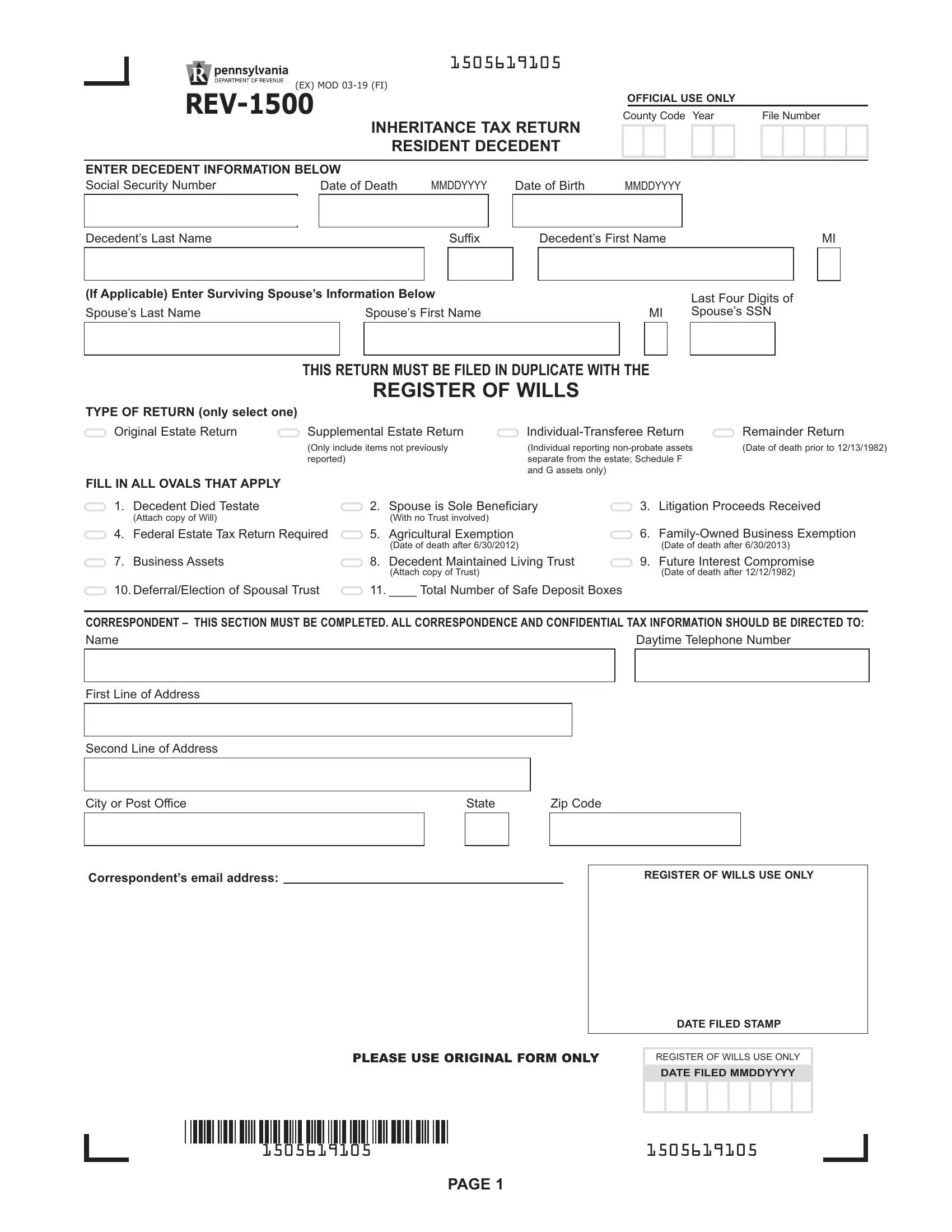

1. When completing the rev 1500 forms, make sure to include all important blank fields within the corresponding section. This will help facilitate the work, enabling your information to be processed quickly and appropriately.

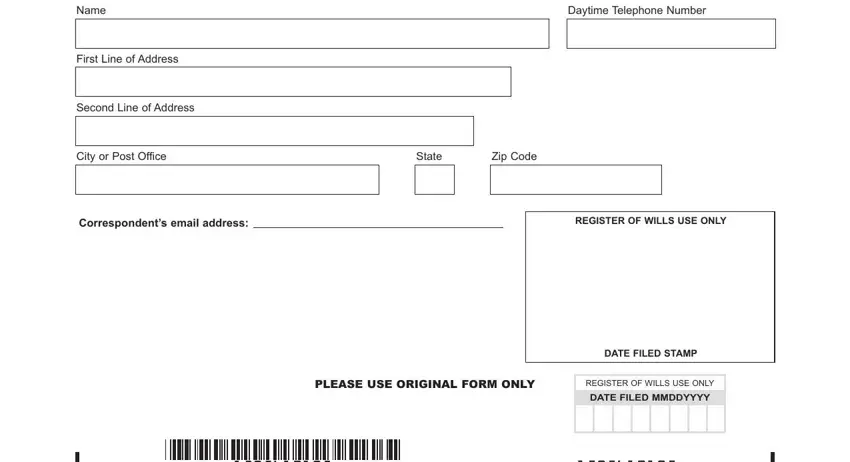

2. Right after performing the previous part, head on to the subsequent step and fill in all required details in all these fields - Name, First Line of Address, Second Line of Address, Daytime Telephone Number, City or Post Office, State, Zip Code, Correspondents email address, REGISTER OF WILLS USE ONLY, PLEASE USE ORIGINAL FORM ONLY, REGISTER OF WILLS USE ONLY, DATE FILED MMDDYYYY, and DATE FILED STAMP.

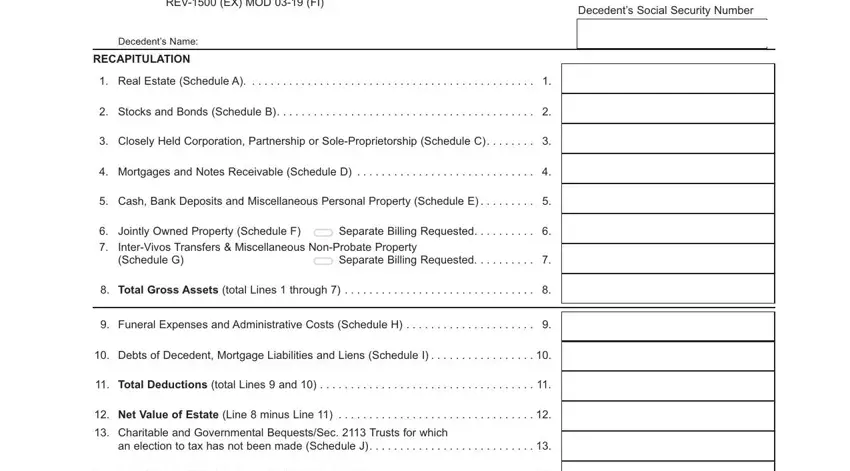

3. This next portion is mostly about REV EX MOD FI, Decedents Social Security Number, Decedents Name, RECAPITULATION, Real Estate Schedule A, Stocks and Bonds Schedule B, Closely Held Corporation, Mortgages and Notes Receivable, Cash Bank Deposits and, Jointly Owned Property Schedule F, Total Gross Assets total Lines, Funeral Expenses and, Debts of Decedent Mortgage, Total Deductions total Lines and, and Net Value of Estate Line minus - fill in all these blank fields.

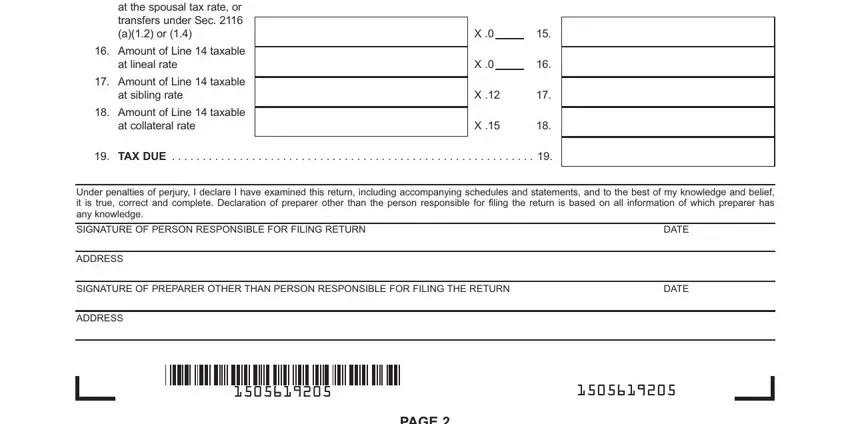

4. The next section arrives with these particular blank fields to look at: Amount of Line taxable at the, Amount of Line taxable at lineal, Amount of Line taxable at, Amount of Line taxable at, TAX DUE, Under penalties of perjury I, SIGNATURE OF PERSON RESPONSIBLE, ADDRESS, SIGNATURE OF PREPARER OTHER THAN, ADDRESS, and PAGE.

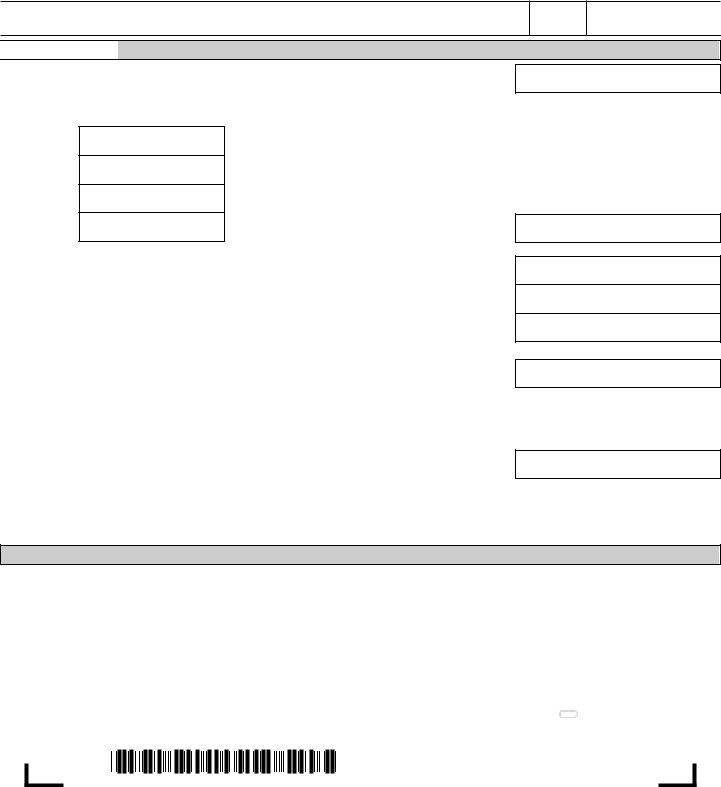

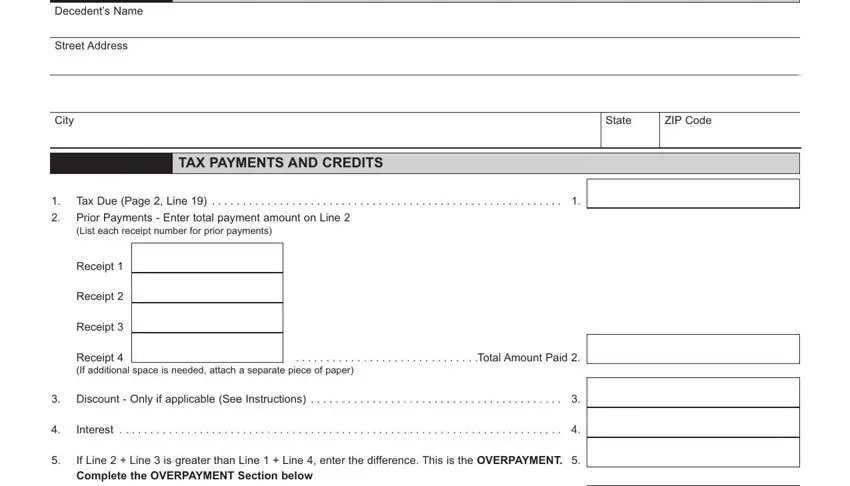

5. The final section to conclude this document is critical. Ensure to fill in the required fields, including Decedents Name, Street Address, City, State, ZIP Code, TAX PAYMENTS AND CREDITS, Tax Due Page Line, Prior Payments Enter total, Receipt, Receipt, Receipt, Receipt, Discount Only if applicable See, Interest, and If Line Line is greater than, before finalizing. Neglecting to accomplish that might end up in an incomplete and possibly unacceptable paper!

Concerning Receipt and Receipt, be certain that you double-check them here. Those two are thought to be the most significant fields in the file.

Step 3: Spell-check what you've inserted in the blanks and click the "Done" button. Join FormsPal now and immediately get access to rev 1500 forms, prepared for download. Every modification you make is handily kept , so that you can edit the file at a later point as needed. With FormsPal, you're able to fill out forms without needing to be concerned about personal information incidents or data entries getting shared. Our secure system ensures that your private information is kept safe.