Navigating the complexities of healthcare and financial planning for a spouse that requires long-term care (LTC) or Home and Community Based Services (HCBS) can be daunting. The PA 1572 form serves as a vital tool for couples in Pennsylvania facing this scenario. It is primarily designed to assess and safeguard a portion of a couple’s assets to support the spouse living in the community, while ensuring eligibility for Medical Assistance for the one needing LTC or HCBS. This form guides you through listing all assets, from bank accounts to real estate and life insurance policies, as of the critical dates of admission or assessment, not the date of form completion. Importantly, it clarifies which resources are considered in the determination of protected amounts that the community spouse can retain before the need to spend down assets arises for Medical Assistance eligibility. While not an application for assistance itself, the PA 1572 form is a crucial step in securing financial stability and health care support, providing peace of mind during challenging times. With provisions for free language assistance and the importance of enclosing only photocopies of resource verification, it is designed to be accessible and protective of applicants' information. Completing this form with thoroughness and accuracy is paramount, as it sets the stage for a written notification of the protected resource amount and the next steps toward applying for assistance. The guidance of family, legal counsel, or local aging agencies is encouraged to navigate this essential process effectively.

| Question | Answer |

|---|---|

| Form Name | Pa Form 1572 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | pa1572, pennsylvania resource assessment form, pa 1572 from, pa 1572 resource form |

PART 4

Instructions for Completing Resource Assessment Form, PA 1572

(To be used by a couple when one of them is in a nursing facility, other medical institution or assessed

eligible for Home and Community Based Services (HCBS), and the other lives in the community.)

Important information for nursing facility residents and their spouses. If you need this information in another language or someone to interpret it, please notify the nursing facility or contact your local County Assistance Office. Language assistance will be provided free of charge.

Información importante para los residentes en hogares de ancianos y sus esposos. Si usted necesita esta información en otro idioma o alguien que se la traduzca, favor de notificar al personal de la residencia o comunicarse con la oficina local de Asistencia del Condado (CAO). Asistencia lingüística será proveída gratis.

Btámansxans¨mabM’’G~krsenAk’ gmNlKlanuëi~¬ak/n½bdbd½uaykarngs¨mab’b‘I/ii ¨bBnìrbs’eK. ebIelakG~k¨tUvkarBtámanenHCaPasaep§geTot

ÉG~kNamak’~eGaybkE¨beGay smCrabmNlUM Klanbdak/nbdaykarëi u ½ u ½ i

ÉTak’TgeTAkaryalyEvi&lEhrbselakGk”Ãß’. CnYyk~M¬ |

gkarbkE¨bnwvg¨tU |

p‘l’eGayeday²tKit«f. |

|

Thoâng tin quan troïng veà cô sôû döôõng laõo daønh cho thöôøng truù nhaân vaø vò phoái ngaãu. Neáu quí vò caàn thoâng tin naøy baèng moät thöù tieáng khaùc hay moät phieân dòch vieân, xin thoâng baùo cho cô sôû döôõng laõo hay lieân laïc vôùi Vaên Phoøng Trôï Caáp Quaän Haït. Trôï giuùp veà ngoân ngöõ seõ ñöôïc cung caáp mieãn phí.

|

). Е |

|

х |

х |

( |

щ |

х |

|

|

|

, |

|

||

|

щ (County Assistance Office). П |

щ |

ч |

|

.

这是发给疗养所的居民及其配偶的重要通知。如果您需要此通

知翻译成其他语种或需要为您提供翻译,请通知疗养所或联系

您所在地区的郡县协助办事处(County Assistance Office)。可提

供免费语言协助。

The Medical Assistance Program - known as MA - helps meet the medical costs of individuals in need of payment of Long Term Care (LTC) services. Generally, an individual must use most of his own resources and income before Medical Assistance will help pay for LTC services. There are, however, special rules (sometimes called the Spousal Impoverishment Provisions) which recognize the importance of pro- tecting a portion of a married couple’s total resources and evaluating the income needs of the spouse who remains in the community.

The purpose of this Resource Assessment Form is to determine how much of a married couple’s total resources may be protected or set aside for the community spouse, and how much, if any, must be spent before the individual in the nursing facility or assessed eligible for HCBS may be eligible for Medical Assistance benefits. Completing this form will help you to protect the maximum amount of your resources under the law.

The Resource Assessment is not an application for Medical Assistance, and you are not obligated to apply for Medical Assistance. If you need help in com pleting this form, your spouse, family member, friend, attorney, or legal services agency can help you. If you or your spouse are over 60 years of age, your local Area Agency on Aging also can help you. If you need Medical Assistance now, contact your county assistance office or your local Area Agency on Aging BEFORE you fill out this form.

A community spouse may keep a minimum amount of resources, or

Photocopies verifying all resources MUST be sent with this form. Do not send original documents as they will NOT be returned to you. An assessment cannot be com- pletedunlessallresourcesareverifiedandtheverificationis submitted with the Resource Assessment Form.

Please read and complete this form carefully. Do NOT complete shaded areas. Sign the form and review the checklist to be certain you have provided all necessary verification. You, your spouse, and if applicable, your legal representative, will be notified in writing of the amount of resources that can be set aside and the amount, if any, that must be spent before you apply for Medical Assistance.

Mail (or deliver) the completed form and verification to the county assistance office in the county where the nursing facility is located, or you are receiving HCBS. The LTC Service Provider can provide you with the address, or check the telephone book.

PA 1572 2/11 |

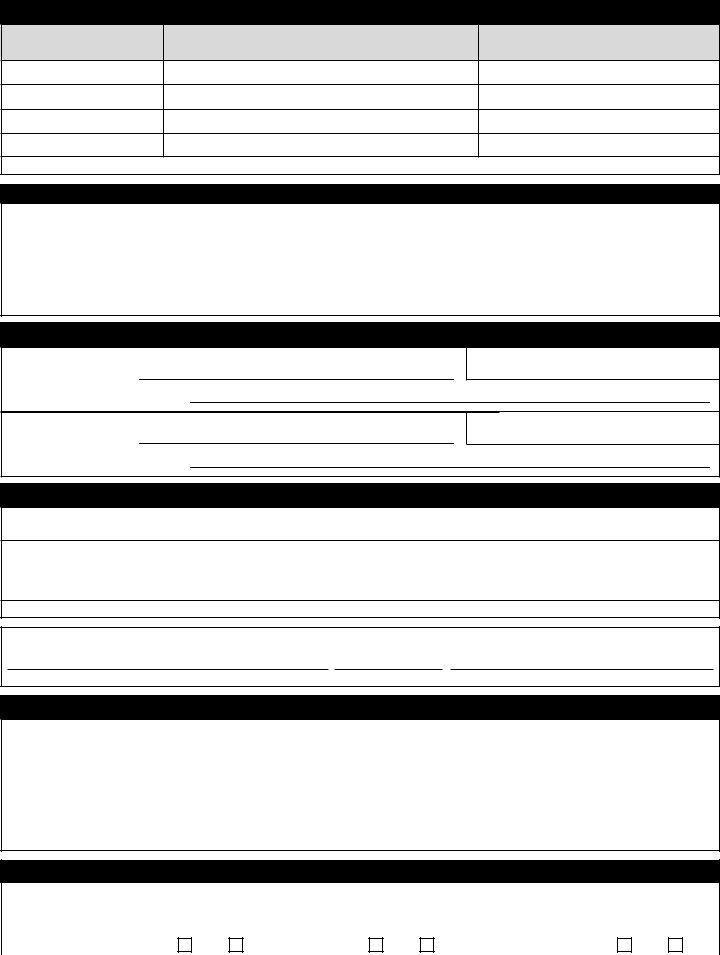

RESOURCES/ACCEPTABLE PROOF

VERIFICATION OF ALL RESOURCES MUST BE ATTACHED TO THE FORM. FOR EXAMPLE:

CODE |

RESOURCE |

VERIFICATION |

*Value as of date of admission to nursing facility or date of assessment for home and community based services (HCBS). |

||

|

|

|

01 |

CASH ON HAND |

Your written statement showing the total amount of money not in the bank or |

|

|

otherwise invested. |

|

|

|

02 |

SAVINGS ACCOUNT(S) |

Photocopies of your bank statements, bank books or a written statement from the |

|

|

financial institution.* |

|

|

|

03 |

CHECKING ACCOUNT(S) |

Photocopies of your bank statement or written statement from the |

|

|

financial institution.* |

|

|

|

04 |

CHRISTMAS AND/OR |

Photocopies of the bank statement or written statement from the financial institution.* |

|

VACATION CLUB |

|

05 |

STOCKS AND/OR BONDS, ETC. |

A written statement from the brokerage firm, issuing agent or authority or institution where the |

|

|

stocks, bonds, etc. were purchased or held; or copy of the stock certificate or bond and a |

|

|

statement of the value.* |

|

|

|

06 |

TRUST FUND |

Photocopy of the trust agreement and inventory of trust assets or other documentation |

|

|

of value.* |

07 |

IRREVOCABLE BURIAL RESERVE |

Photocopy of the burial reserve agreement. |

|

|

|

08 |

REVOCABLE BURIAL RESERVE |

Photocopy of the burial reserve agreement. |

|

|

|

09 |

RESERVED |

|

10 |

LIFE INSURANCE |

A document identifying ownership for each insurance policy and a written statement of cash |

|

|

value from the insurance company.* |

|

|

|

11 |

Your real estate tax bill or a broker’s statement of the fair market value of the property; and |

|

|

PROPERTY |

if the property is rented, the rental agreement or lease.* |

|

|

|

12 |

MOTOR VEHICLE(S) |

A written statement of the value, from a car dealer; or list the year, make, and model of the |

|

|

vehicle, and we will use the automobile red book to determine the value. |

13 |

BOATS, SNOWMOBILES, |

A written statement of the fair market value of the vehicle, from a dealer.* |

|

TRAILERS AND OTHER VEHICLES |

|

|

|

|

14 |

CERTIFICATES OF DEPOSIT |

A written statement from the financial institution listing the value and ownership.* |

15 |

ANNUITIES |

A photocopy of the document that explains the terms, date of purchase, and value of the annuity |

|

|

at the time of admission/or assessment for HCBS.* |

|

|

|

16 |

SAVINGS BONDS |

Photocopies of the bonds or a written statement from a bank that identifies the owner(s) of the |

|

|

bonds, the serial number(s), purchase date, and the value of the bonds at the time of |

|

|

admission.* |

|

|

|

17 |

MUTUAL FUNDS |

An itemized written statement of the value from the mutual fund or brokerage firm.* |

|

|

|

18 |

INCORPORATED OR |

For a corporation, a statement of the value of your stock; for an unincorporated business, |

|

UNINCORPORATED BUSINESS |

documents that established the business and that verify the value of your share of the business. |

|

(PARTNERSHIP/SOLE PROPRIETORSHIP) |

|

|

|

|

19 |

IRA OR KEOGH |

A written statement from the bank or financial institution that identifies the owner(s) and the |

|

|

value.* |

|

|

|

20 |

OTHER |

Photocopy(ies) of any agreement(s) or statement(s) regarding any money or other resources |

|

|

not already listed.* |

|

|

|

PA 1572 2/11 |

COMMONWEALTH OF PENNSYLVANIA - DEPARTMENT OF PUBLIC WELFARE

RESOURCE ASSESSMENT

YOUR INFORMATION IS CONFIDENTIAL FOR USE ONLY BY THE DEPARTMENT OF PUBLIC WELFARE

GENERAL INFORMATION |

|

|

|

|

|

|

|

|

|

|

LAST NAME |

FIRST NAME |

M.I. |

|

DATE OF BIRTH |

|

SOCIAL SECURITY NO. |

||||

|

|

|

|

/ |

/ |

|

|

|

|

|

ADDRESS |

(STREET AND CITY) |

|

|

COUNTY |

|

STATE |

|

ZIP CODE |

||

|

|

|

|

|

|

|

|

|

||

NAME OF LTC SERVICE PROVIDER |

|

|

|

TELEPHONE NO. |

|

DATE OF ADMISSION OR |

||||

|

|

|

( |

) |

|

|

|

HCBS ASSESSMENT |

||

|

|

|

|

|

|

/ |

/ |

|||

SPOUSE’S LAST NAME |

FIRST NAME |

M.I. |

|

DATE OF BIRTH |

|

SOCIAL SECURITY NO. |

||||

|

|

|

|

/ |

/ |

|

|

|

|

|

SPOUSE’S STREET ADDRESS |

CITY |

|

STATE |

|

ZIP CODE |

|

SPOUSE’S TELEPHONE NO. |

|||

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

RESOURCES

VERIFICATIONMUSTACCOMPANYTHISFORMFOREACHRESOURCELISTED.ACCEPTABLEVERIFICATION AND CORRESPONDING RESOURCE CODES ARE LISTED ON THE BACK OF THE INSTRUCTION PAGE.

DO NOT SEND ORIGINAL DOCUMENTS, AS VERIFICATIONS WILL NOT BE RETURNED. If a resource is owned by you and another person other than your spouse, list on a separate sheet of paper the resource and the names of the joint owners. Indicate if you or someone else purchased the asset. If it is not owned in equal shares, provide proof of the division of ownership as well as total value.*

BE CERTAIN TO LIST ALL RESOURCES, SINGLY OR

|

|

OWNER(S) OF RESOURCE |

RESOURCE |

|

*As of the date of admission or HCBS assessment. |

DOCUMENTED |

|||||||||

LAST NAME |

FIRST NAME |

|

M.I. |

CODE |

TOTAL VALUE |

AMOUNT OWED |

|

NET VALUE |

YES |

NO |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

IF YOU NEED ADDITIONAL SPACE, USE NOTES/INFORMATION SECTION OF THE FORM |

|

|

|

|

|

|||||||

|

|

|

NOTE: IF YOUR INTEREST IN ANY RESOURCE IS A LIFE INTEREST, PLEASE INDICATE |

|

|

|

|

|

|||||||

|

|

ENTER THE TWO DIGIT CODE IN THE “RESOURCE CODE” COLUMN THAT BEST DESCRIBES THE RESOURCE THAT YOU ARE IDENTIFYING |

|

|

|

||||||||||

01 |

CASH ON HAND |

|

07 |

IRREVOCABLE BURIAL RESERVE |

13 |

BOATS, SNOWMOBILES, |

18 |

BUSINESS |

|

|

|

||||

02 |

SAVINGS ACCOUNT(S) |

08 |

REVOCABLE BURIAL RESERVE |

|

TRAILERS & OTHER VEHICLES |

19 |

IRA OR KEOGH |

||||||||

03 |

CHECKING ACCOUNT(S) |

09 |

RESERVED |

|

14 |

CERTIFICATES OF DEPOSIT |

20 |

OTHER |

|

|

|

||||

04 |

CHRISTMAS/VACATION CLUB |

10 |

LIFE INSURANCE |

|

15 |

ANNUITIES |

|

|

|

|

|

||||

05 |

STOCKS, BONDS, ETC. |

11 |

16 |

SAVINGS BONDS |

|

|

|

|

|

||||||

06 |

TRUST FUND |

|

12 |

MOTOR VEHICLE(S) |

17 |

MUTUAL FUNDS |

|

|

|

|

|

||||

PA 1572 2/11 |

LIFE INSURANCE - COMPLETE THE INFORMATION BELOW FOR EACH LIFE INSURANCE POLICY

NAME OF INSURED

INSURANCE |

POLICY |

NAME OF |

FACE |

COMPANY |

NUMBER |

BENEFICIARY |

VALUE |

|

|

|

|

CASH* |

DATE |

DOCUMENTED |

|

VALUE |

ACQUIRED |

YES |

NO |

|

|

|

|

*As of the date of admission to the facility or assessment for HCBS.

NOTES/INFORMATION SECTION

LIST ANY PRIOR ADMISSION TO A FACILITY OR ASSESSMENT FOR HCBS

NAME AND |

@ |

ADDRESS OF |

|

LTC SERVICE PROVIDER

DATE OF ADMISSION OR @ ASSESSMENT FOR HCBS

NAME AND |

@ |

ADDRESS OF |

|

LTC SERVICE PROVIDER

DATE OF ADMISSION OR @ ASSESSMENT FOR HCBS

LEGAL REPRESENTATION

ナYES ナNO |

DOES THE INDIVIDUAL HAVE A LEGAL REPRESENTATIVE OTHER THAN THE SPOUSE |

(e.g. |

IF @

YES

NAME |

|

TELEPHONE |

|

|

|

|

|

||

|

|

NUMBER |

|

|

|

|

|

|

|

STREET ADDRESS |

CITY |

STATE |

ZIP CODE |

RELATIONSHIP OF RESIDENT |

|

|

|

|

|

NOTE: YOUR LEGAL REPRESENTATIVE WILL BE SENT A COPY OF THE RESULTS OF THE RESOURCE ASSESSMENT.

I swear or affirm that all of the information I have provided on this form is true and correct to the best of my ability, knowledge and belief.

SIGNATURE |

DATE |

RELATIONSHIP TO INDIVIDUAL IN NEED OF LTC SERVICE |

CHECKLIST

1.DID YOU COMPLETE THE INFORMATION FOR THE INDIVIDUAL IN NEED OF LTC SERVICES?

2.DID YOU COMPLETE THE INFORMATION FOR THE COMMUNITY SPOUSE?

3.DID YOU LIST ALL RESOURCES OWNED ON THE DATE OF ADMISSION OR ASSESSMENT FOR HCBS?

4.DID YOU COMPLETE THE LIFE INSURANCE SECTION?

5.DID YOU READ THE STATEMENT REGARDING THE INFORMATION YOU PROVIDED? DID YOU SIGN THE FORM, INDICATE YOUR RELATIONSHIP TO THE INDIVIDUAL IN NEED OF LTC SERVICES AND DATE THE FORM?

6.DID YOU ATTACH PHOTOCOPIES OF THE DOCUMENTATION TO VERIFY YOUR RESOURCES?

FOR DPW USE ONLY

TOTAL VERIFIED COUNTABLE RESOURCES |

|

|

|

$ __________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

SPOUSE’S SHARE 1/2 TOTAL NET VERIFIED RESOURCES |

$ __________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

ASSESSOR’S SIGNATURE |

|

|

DATE |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

NOTICE |

@ |

INDIVIDUAL RECEIVING LTC |

|

|

|

|

|

|

|

LEGAL |

|

|

|

|

|

|

|||||

SENT TO |

SERVICES |

|

YES |

|

NO |

SPOUSE |

|

YES |

|

NO |

REPRESENTATIVE |

|

|

|

YES |

|

NO |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PA 1572 2/11 |