The home payoff request completing process is hassle-free. Our software lets you use any PDF file.

Step 1: Select the button "Get form here" to get into it.

Step 2: At this point, you are on the form editing page. You can add information, edit present information, highlight certain words or phrases, place crosses or checks, add images, sign the document, erase unrequired fields, etc.

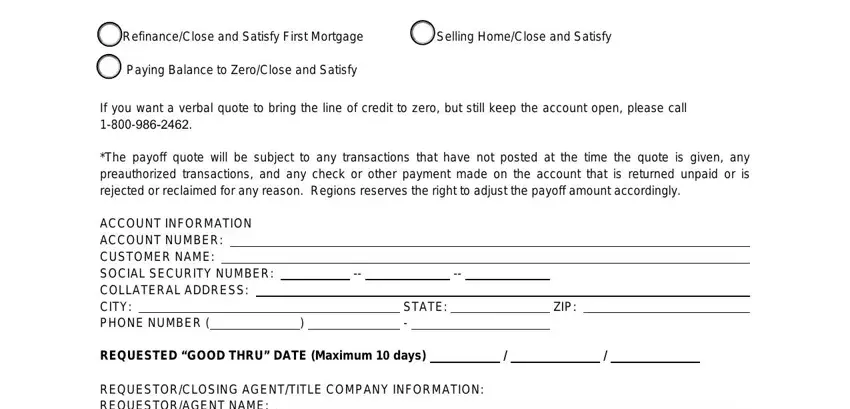

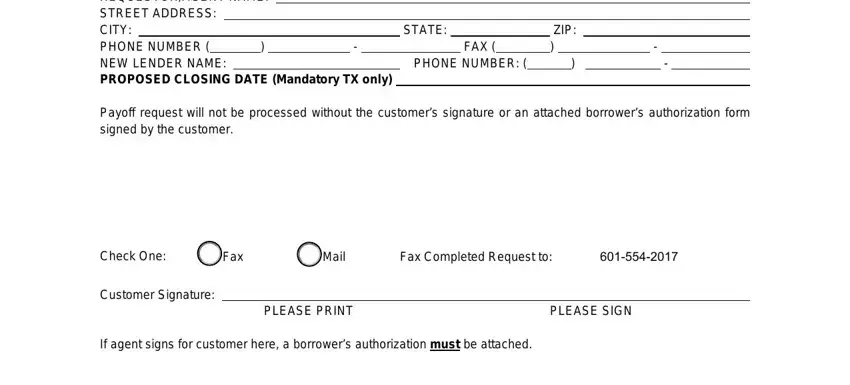

The PDF file you desire to create will contain the following areas:

Please fill in the REQUESTORCLOSING AGENTTITLE, STATE, FAX, PHONE NUMBER, ZIP, Payoff request will not be, Check One Fax, Mail, Fax Completed Request to, Customer Signature, PLEASE PRINT, PLEASE SIGN, and If agent signs for customer here a space with the appropriate information.

Step 3: Once you hit the Done button, the finished document is easily transferable to any type of of your gadgets. Or alternatively, it is possible to deliver it through email.

Step 4: Generate copies of the form - it will help you avoid potential future problems. And fear not - we cannot distribute or watch your information.