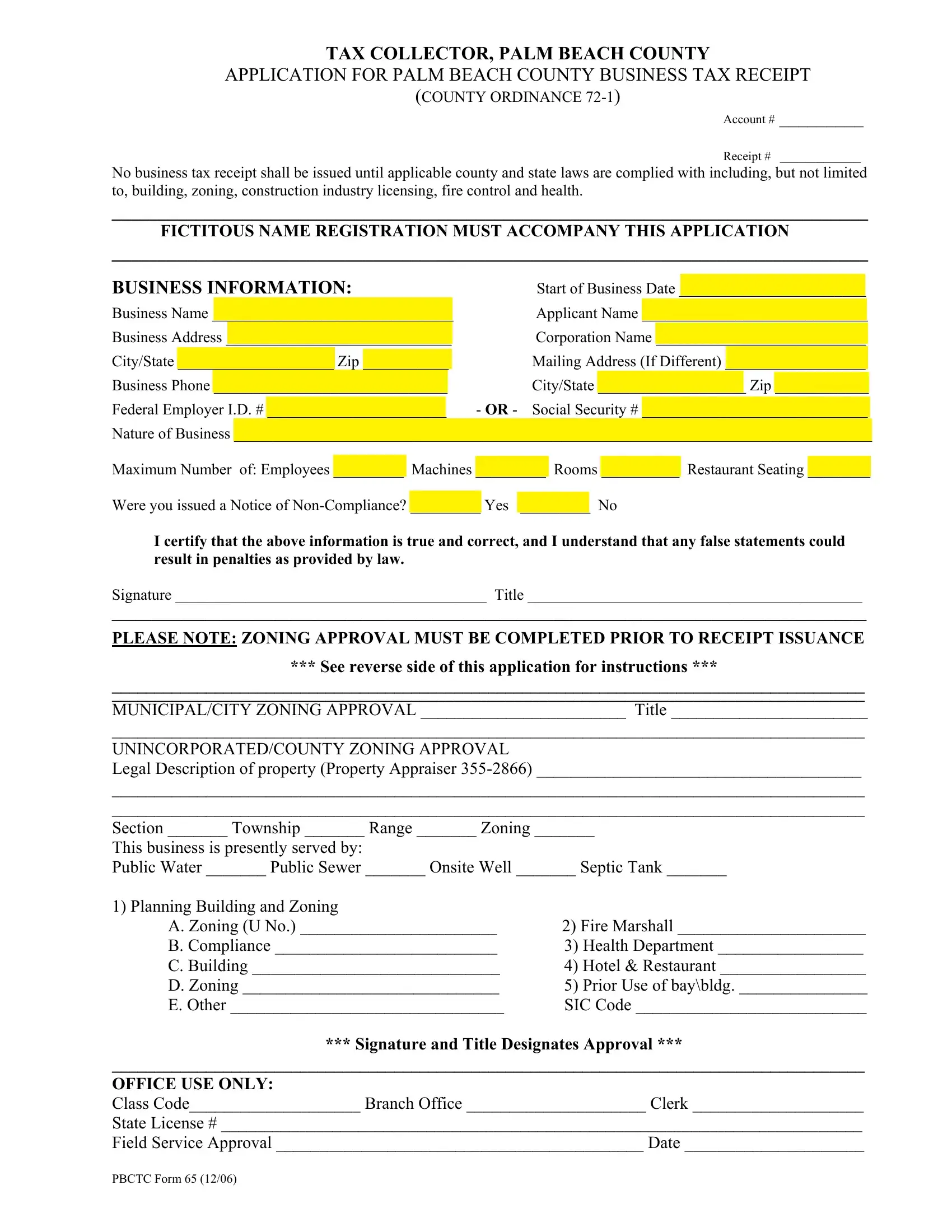

TAX COLLECTOR, PALM BEACH COUNTY

APPLICATION FOR PALM BEACH COUNTY BUSINESS TAX RECEIPT

(COUNTY ORDINANCE 72-1)

Account # _________

Receipt # _____________

No business tax receipt shall be issued until applicable county and state laws are complied with including, but not limited to, building, zoning, construction industry licensing, fire control and health.

_________________________________________________________________________________

FICTITOUS NAME REGISTRATION MUST ACCOMPANY THIS APPLICATION

_________________________________________________________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

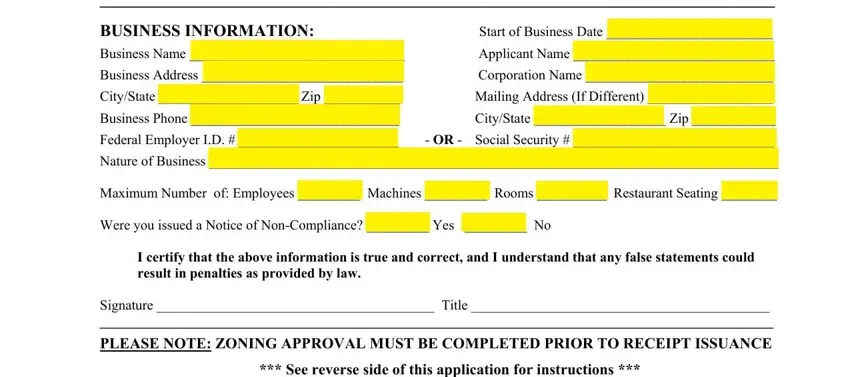

BUSINESS INFORMATION: |

Start of Business Date |

________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Name |

_______________________________ |

|

Applicant Name |

_____________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Address |

_____________________________ |

|

Corporation Name |

___________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City/State |

____________________ |

Zip |

___________ |

|

Mailing Address (If Different) |

__________________ |

|

|

|

|

|

|

|

|

Business Phone |

______________________________ |

|

|

City/State |

___________________ |

Zip |

____________ |

|

|

Federal Employer I.D. # |

_______________________ |

|

- OR - Social Security # |

_____________________________ |

Nature of Business __________________________________________________________________________________

Maximum Number of: Employees _________ Machines _________ Rooms __________ Restaurant Seating ________

Were you issued a Notice of Non-Compliance? _________ Yes _________ No

I certify that the above information is true and correct, and I understand that any false statements could result in penalties as provided by law.

Signature ________________________________________ Title ___________________________________________

_________________________________________________________________________________________________

PLEASE NOTE: ZONING APPROVAL MUST BE COMPLETED PRIOR TO RECEIPT ISSUANCE

*** See reverse side of this application for instructions ***

________________________________________________________________________________________

________________________________________________________________________________________

MUNICIPAL/CITY ZONING APPROVAL ________________________ Title _______________________

________________________________________________________________________________________

UNINCORPORATED/COUNTY ZONING APPROVAL

Legal Description of property (Property Appraiser 355-2866) ______________________________________

________________________________________________________________________________________

________________________________________________________________________________________

Section _______ Township _______ Range _______ Zoning _______

This business is presently served by:

Public Water _______ Public Sewer _______ Onsite Well _______ Septic Tank _______

1) Planning Building and Zoning |

|

A. Zoning (U No.) _______________________ |

2) Fire Marshall ______________________ |

B. Compliance __________________________ |

3) Health Department _________________ |

C. Building _____________________________ |

4) Hotel & Restaurant _________________ |

D. Zoning ______________________________ |

5) Prior Use of bay\bldg. _______________ |

E. Other ________________________________ |

SIC Code ___________________________ |

*** Signature and Title Designates Approval ***

________________________________________________________________________________________

OFFICE USE ONLY:

Class Code____________________ Branch Office _____________________ Clerk ____________________

State License # ___________________________________________________________________________

Field Service Approval ___________________________________________ Date _____________________

PBCTC Form 65 (12/06)

INSTRUCTIONS FOR OBTAINING A BUSINESS TAX RECEIPT

Change of business location requires zoning approval, a new application, payment of a transfer fee and surrender of the current receipt.

Change of ownership requires proof of sale of business, a new application, payment of a transfer fee and surrender of the current receipt.

1)If your business is located inside municipal (city) limits, you must submit the application to the municipality in person for their approval. To determine whether your business is located within a municipality (city), contact the municipality nearest your business location.

2)If your business is located in the unincorporated area of Palm Beach County (outside the limits of a municipality), you must take a legal description of the property to: Planning, Building and Zoning Department, Vista Center, 2300 North Jog Road, West Palm Beach (233-5200) or 2976 State Road #15, Belle Glade (996-1650). Certain home based businesses may be exempt from this procedure.

3)Mail completed application with your check or money order to: Tax Collector, Palm Beach County,

P.O. Box 3715, West Palm Beach, FL 33402-3715. Further information can be obtained by calling

(561)355-2272 or visiting our website: www.pbcgov.com/tax.

***SPECIAL REQUIREMENTS FOR CERTAIN OCCUPATIONS ***

A.If your profession or business is certified by the Department of Business and Professional Regulation

(850-487-1395) or Department of Health (850-488-0595), you must attach a copy of your certification, registration, or license to this application.

B.Banks, mortgage brokers, finance companies, and stockbrokers must be registered with the Office of Financial Regulation (850-410-9805) Attach a copy of the license showing proper business location to this application.

C.Restauranteurs and mobile food unit operators must contact the Division of Hotel & Restaurants

(850-487-1395). You must attach a copy of approved inspection report to this application or obtain an authorized signature on the face of this application.

D.Child care must have the approval of the Palm Beach County Health Department (561-355-3018). You must attach a copy of the license to this application or obtain an authorized signature on the face of this application.

E.Food outlets, auto repair, travel agencies, telemarketers, health and dance (ballroom) studios must submit a permit, registration or exemption from State of Florida, Dept. of Agriculture & Consumer Services (1-800-435-7352).

F.Certified contractors must attach a copy of State of Florida and/ or Palm Beach County Certification. Call 233-5525 for certification information. County receipt is required, countywide municipal receipt is optional. You may submit a single check for both receipts.

BUSINESS TAX RECEIPTS MAY BE OBTAINED IN PERSON AT ANY OF THESE BRANCH OFFICES

Actac Building |

Governmental Center |

Northeast Courthouse Complex |

3551 South Military Trail |

301 North Olive Avenue |

3188 PGA Boulevard |

Lake Worth, FL 33463 |

West Palm Beach, FL 33401 |

Palm Beach Gardens, 33410 |

Glades Office Building |

Southeast Courthouse Complex |

Mid-Western Communities Service Center |

2976 State Road # 15 |

501 South Congress Avenue |

200 Civic Center Way |

Belle Glade, FL 33430 |

Delray Beach, FL 33445 |

Royal Palm Beach, FL 33411 |