Making use of the online PDF editor by FormsPal, you can easily complete or modify connecticut small estate affidavit here. Our tool is continually evolving to deliver the best user experience attainable, and that's thanks to our commitment to continual improvement and listening closely to customer comments. All it takes is a couple of simple steps:

Step 1: Access the form in our tool by clicking the "Get Form Button" at the top of this page.

Step 2: Once you launch the online editor, you will find the form all set to be completed. Other than filling in different blank fields, you could also perform various other things with the PDF, specifically writing any words, changing the initial textual content, adding images, placing your signature to the form, and a lot more.

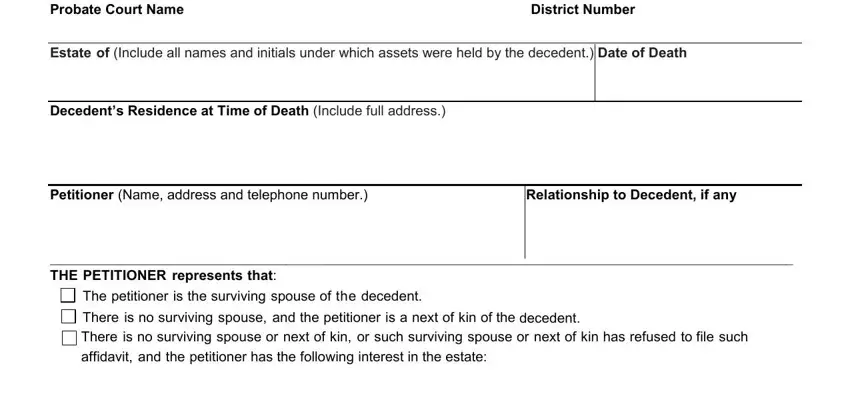

As for the fields of this particular document, here is what you should do:

1. Complete your connecticut small estate affidavit with a selection of necessary blank fields. Collect all the information you need and ensure absolutely nothing is forgotten!

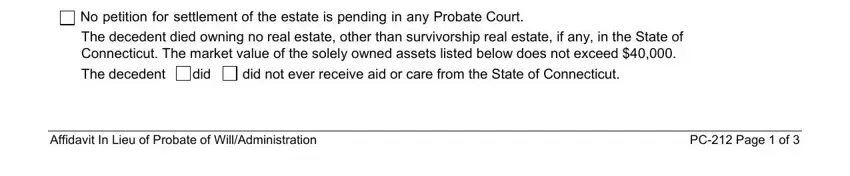

2. After this part is finished, you're ready put in the necessary specifics in No petition for settlement of the, Affidavit In Lieu of Probate of, and PC Page of in order to move forward further.

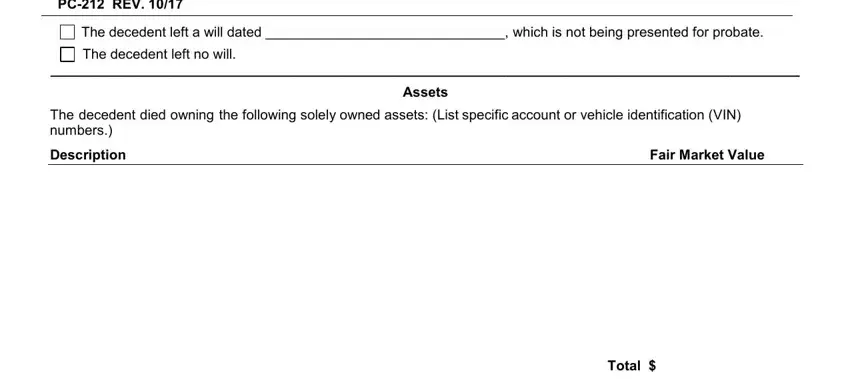

3. This next step will be focused on Affidavit in Lieu of Probate of, The decedent left a will dated, The decedent died owning the, Fair Market Value, Assets, and Total - type in each one of these empty form fields.

It is possible to make a mistake while filling in the Total, thus be sure to look again prior to deciding to finalize the form.

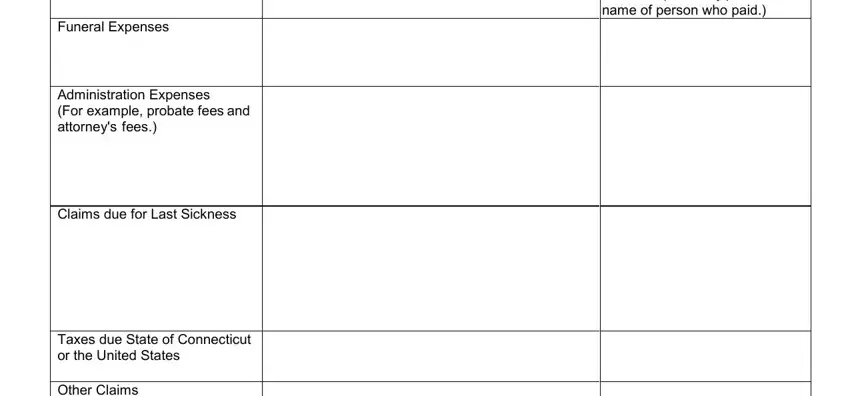

4. Completing Creditor, Amount If already paid state name, Funeral Expenses, Administration Expenses For, Claims due for Last Sickness, Taxes due State of Connecticut or, and Other Claims is paramount in this section - be sure to be patient and be mindful with each field!

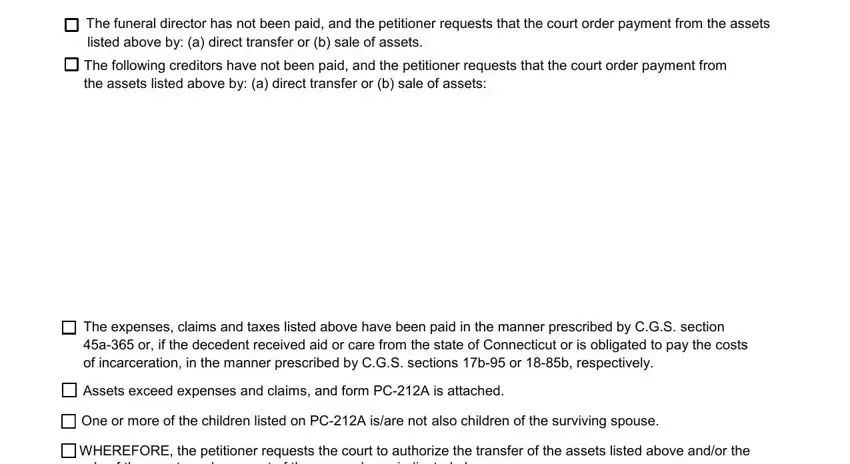

5. Now, the following last segment is what you'll want to wrap up before submitting the PDF. The blanks in this instance include the following: The funeral director has not been, The expenses claims and taxes, Assets exceed expenses and claims, One or more of the children listed, and WHEREFORE the petitioner requests.

Step 3: Right after you have reread the details in the fields, simply click "Done" to finalize your form at FormsPal. After getting afree trial account with us, you'll be able to download connecticut small estate affidavit or email it right away. The document will also be available from your personal account with your each and every modification. When you work with FormsPal, it is simple to fill out forms without needing to worry about personal information leaks or entries being shared. Our secure system helps to ensure that your private data is stored safely.