personal networth statements can be filled out online easily. Simply make use of FormsPal PDF editing tool to complete the task quickly. We at FormsPal are committed to providing you with the ideal experience with our editor by constantly adding new capabilities and upgrades. With all of these updates, working with our editor gets easier than ever before! To start your journey, go through these basic steps:

Step 1: Open the PDF in our tool by pressing the "Get Form Button" above on this webpage.

Step 2: The editor enables you to modify PDF forms in a range of ways. Enhance it with your own text, adjust original content, and place in a signature - all at your disposal!

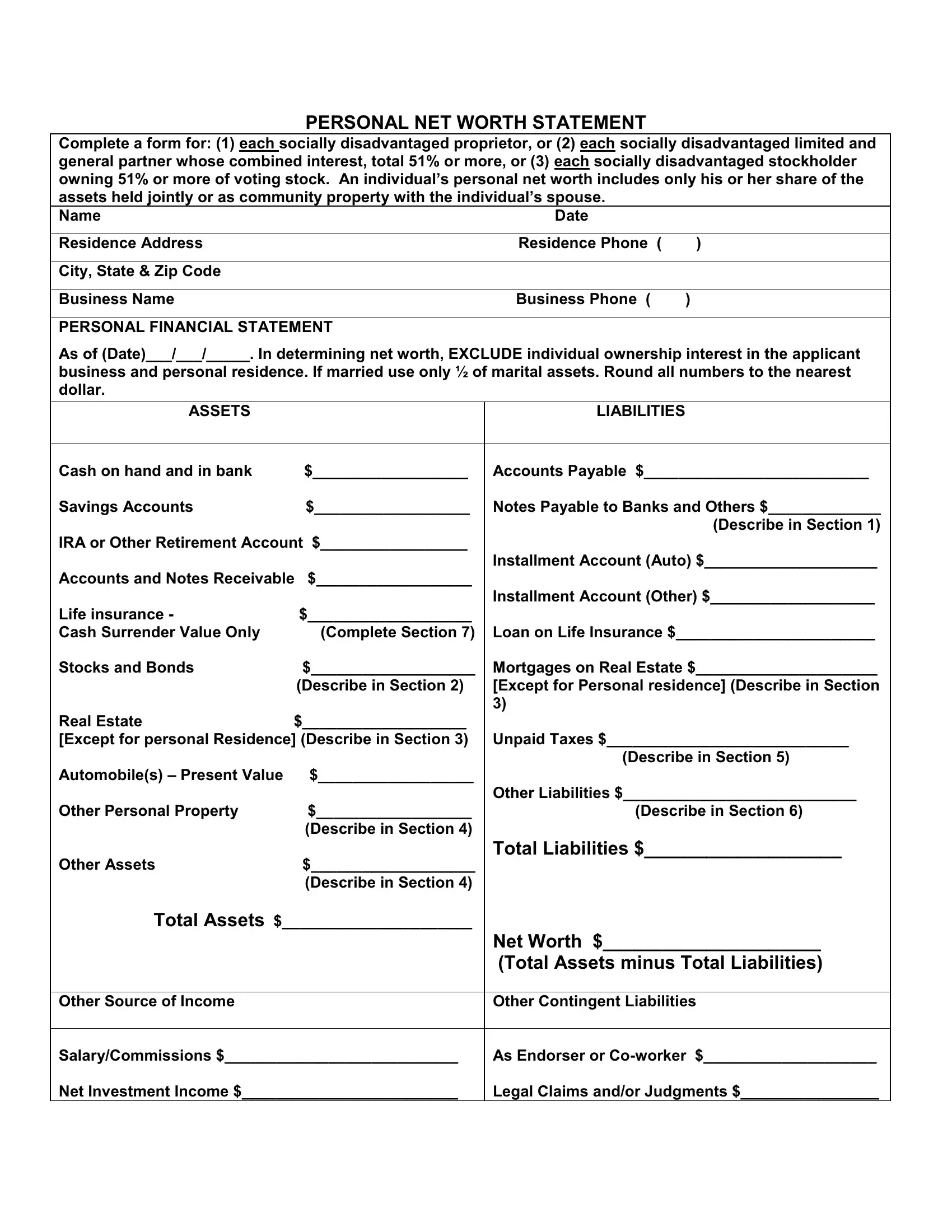

When it comes to blank fields of this specific form, here's what you need to know:

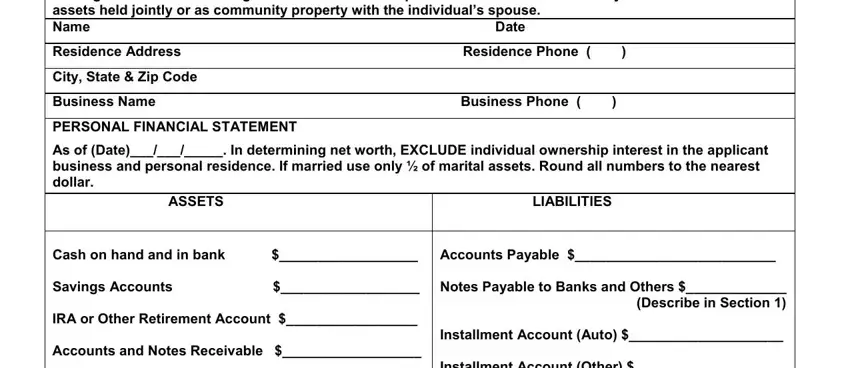

1. Fill out the personal networth statements with a selection of major blanks. Note all of the information you need and be sure absolutely nothing is omitted!

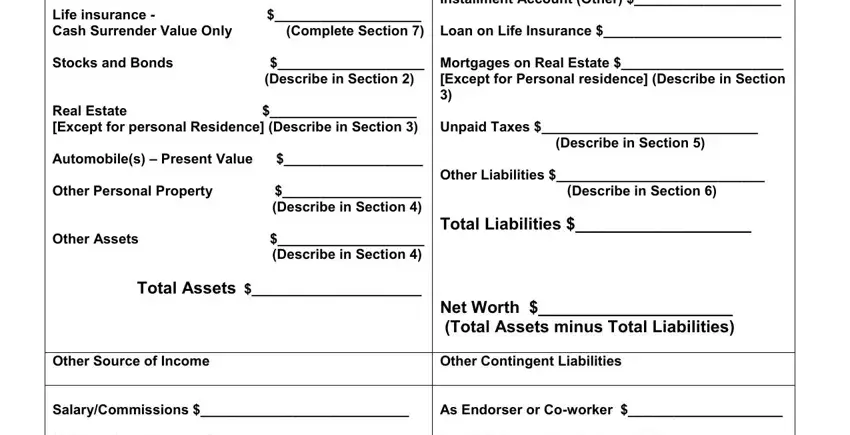

2. Once the previous part is finished, you have to insert the essential details in Cash on hand and in bank Savings, Other Source of Income, SalaryCommissions Net Investment, and Accounts Payable Notes Payable to so you're able to go to the third step.

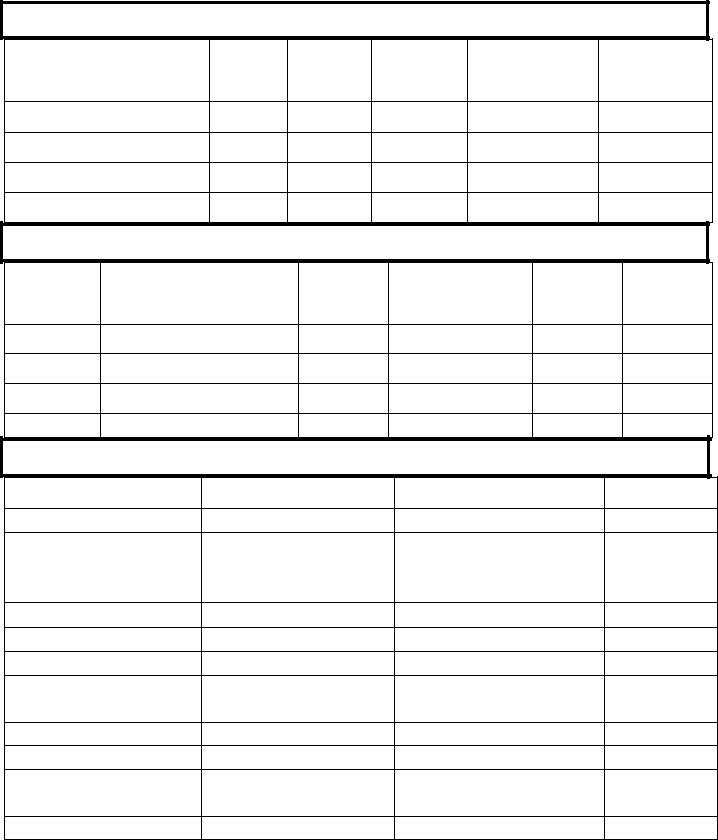

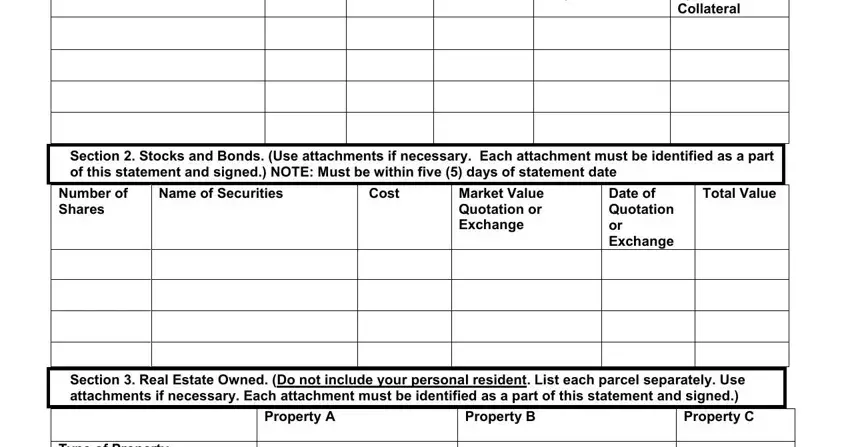

3. The following segment focuses on Frequency weekly monthly etc, How Secured or Endorsed Type of, Section Stocks and Bonds Use, Number of Shares, Name of Securities, Cost, Market Value Quotation or Exchange, Section Real Estate Owned Do not, Property A, Property B, Type of Property, Date of Quotation or Exchange, Total Value, and Property C - fill in all these blank fields.

Always be really attentive when completing Property B and Section Stocks and Bonds Use, as this is where most users make mistakes.

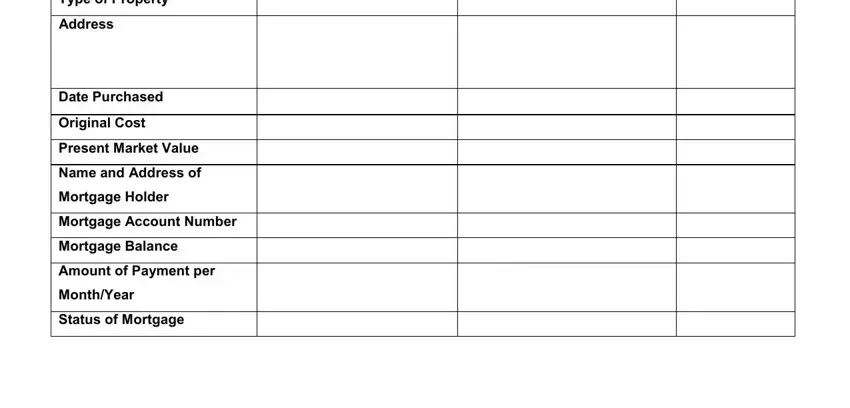

4. All set to proceed to this next section! In this case you'll have all of these Type of Property, Address, Date Purchased, Original Cost, Present Market Value, Name and Address of, Mortgage Holder, Mortgage Account Number, Mortgage Balance, Amount of Payment per, MonthYear, Status of Mortgage, and Property C blank fields to fill out.

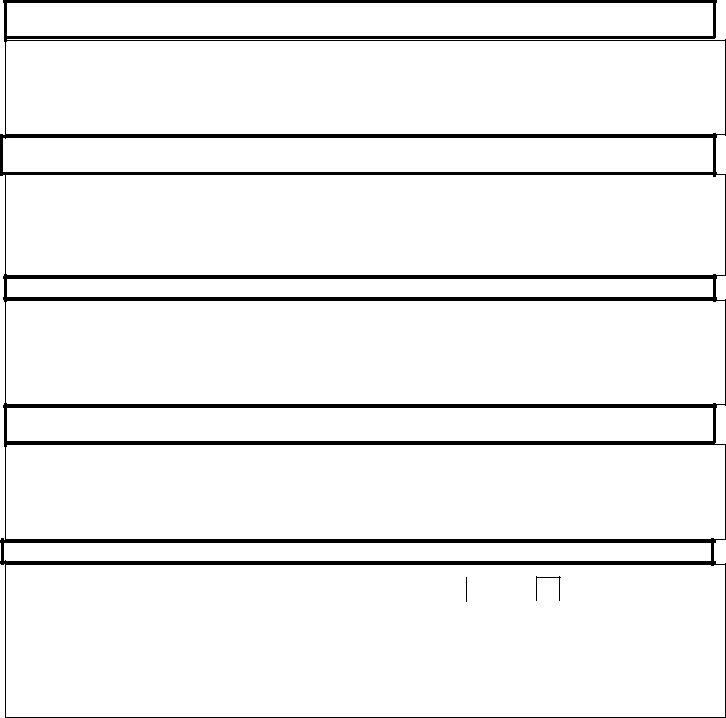

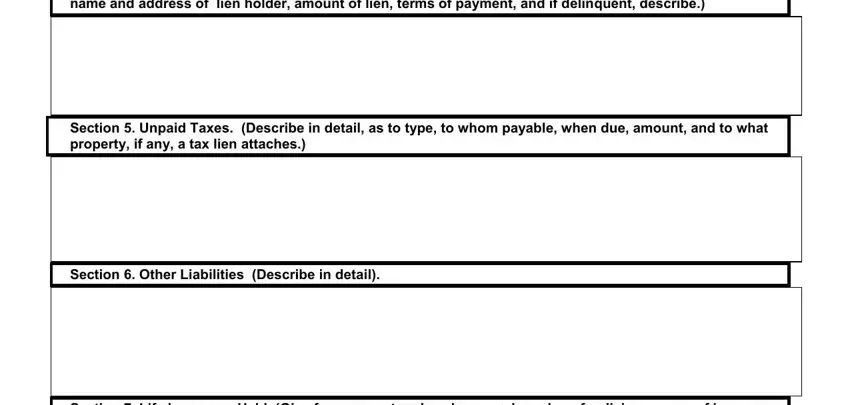

5. Because you get close to the completion of your document, there are actually a couple more things to do. Specifically, Section Other Personal Property, Section Unpaid Taxes Describe in, Section Other Liabilities, and Section Life Insurance Held Give should all be filled out.

Step 3: Immediately after double-checking the entries, press "Done" and you're good to go! Go for a free trial option at FormsPal and acquire instant access to personal networth statements - download or modify from your FormsPal account page. FormsPal is committed to the personal privacy of all our users; we make sure that all information processed by our system continues to be confidential.