Handling PDF documents online is actually very simple using our PDF editor. Anyone can fill out NONRESIDENT here and use many other functions available. The tool is consistently improved by our team, getting new awesome functions and growing to be better. Should you be seeking to get going, this is what it requires:

Step 1: Click the orange "Get Form" button above. It will open our tool so that you could start filling in your form.

Step 2: Using our online PDF editor, it is possible to accomplish more than just fill out blanks. Edit away and make your docs seem professional with custom text added in, or tweak the file's original content to perfection - all that backed up by the capability to insert stunning images and sign the file off.

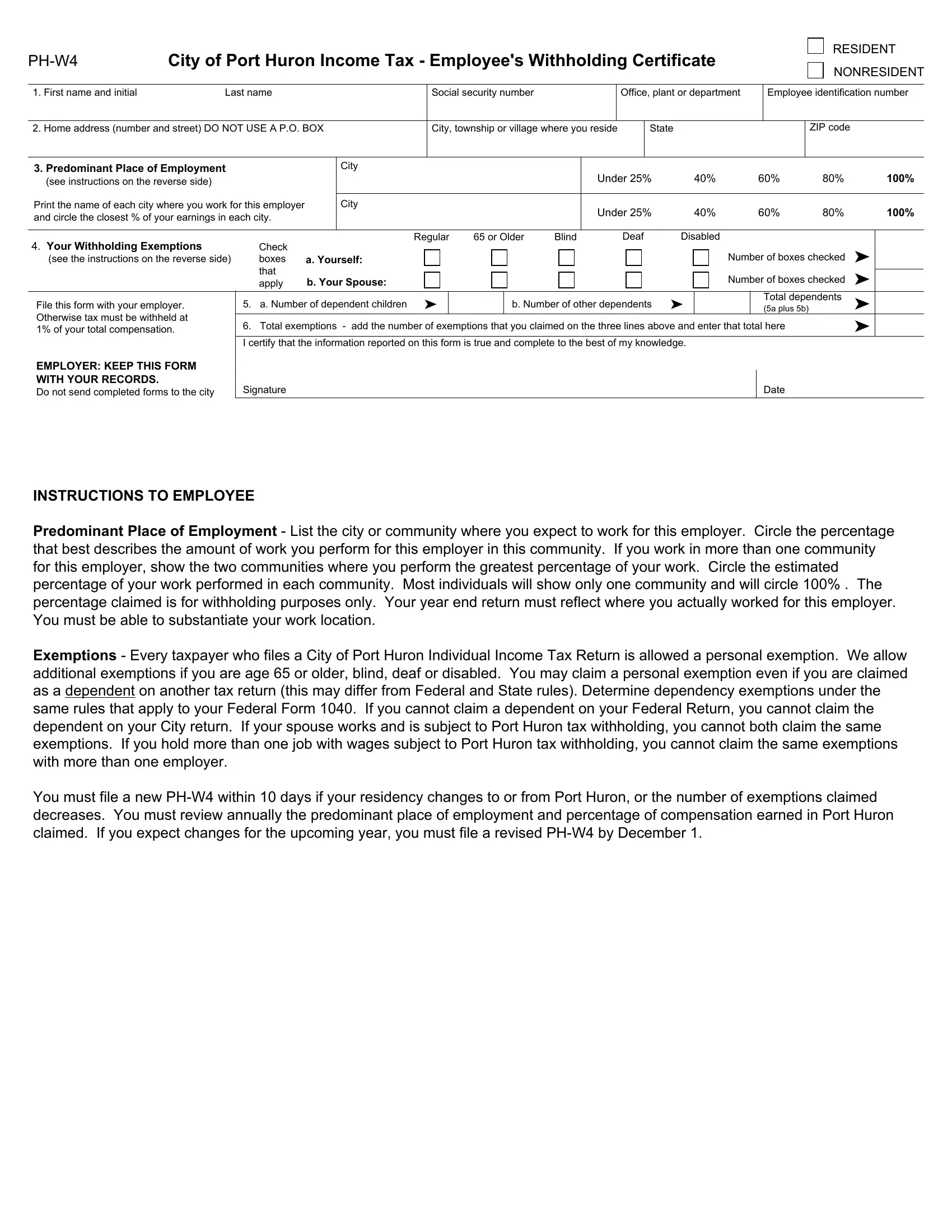

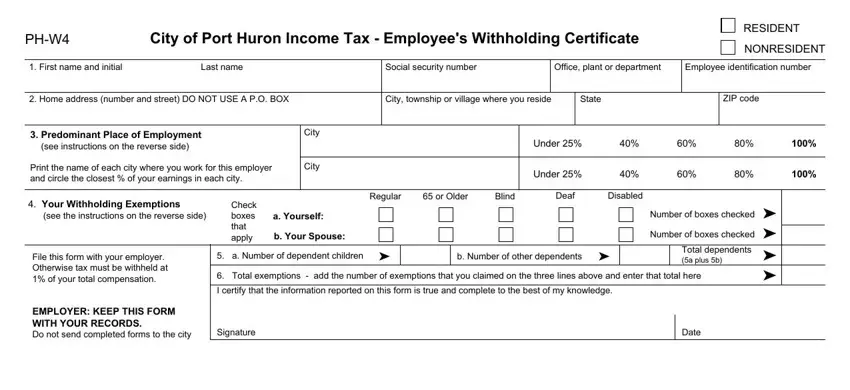

This PDF form will need particular information to be typed in, therefore ensure that you take your time to fill in what's asked:

1. It is important to fill out the NONRESIDENT properly, hence take care while filling in the sections including all of these fields:

Step 3: Once you've looked once more at the information entered, click on "Done" to conclude your document creation. Right after registering a7-day free trial account here, it will be possible to download NONRESIDENT or email it immediately. The file will also be readily accessible through your personal account page with your each and every change. At FormsPal, we do everything we can to ensure that your details are maintained secure.