Opening an account with Punjab National Bank (PNB) for Non-Resident Indians (NRIs) involves a comprehensive procedure detailed in their account opening form, designed to cater to single or joint account holders. This form captures essential information starting with personal details, including a recent photograph, the applicants' names, their father's or husband's name, and the type of account desired among options like Fixed Deposits, Non-Resident External (NRE), Non-Resident Ordinary (NRO), or Foreign Currency (Non-Resident) Accounts (FCNR). Applicants are also required to indicate their preference for auto-renewal of deposits, provide passport details, and clarify their status as a minor, if applicable, alongside providing guardian information. Further, it delves into the applicant's occupation, income, educational background, and detailed contact information across overseas and Indian addresses. The operation mode of the account, requests for a debit card, and internet banking services are also elaborated upon, ensuring applicants agree to terms including those related to information accuracy, compliance with Indian Income Tax Act residential status, and adherence to Foreign Exchange Management Act (FEMA) regulations. Additional provisions include nomination for the return of deposit funds, introduction by existing customers or through verification by recognized authorities, and specific instructions for transaction handling post-account opening. The form underscores PNB's commitment to regulatory compliance and customer-specific banking needs, facilitating a tailored banking experience for NRIs.

| Question | Answer |

|---|---|

| Form Name | Pnb Account Opening Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | pnb form fill up, pnb account opening form, online pnb account opening, pnb account opening form pdf |

PUNJAB NATIONAL BANK

ACCOUNT OPENING FORM

(For NRI Single/Joint Accounts)

(To be filled in by Bank)

Account No

Customer ID N0

Date / Month / Year

To,

PUNJAB NATIONAL BANK

Branch Office..……………

Dist. No……………………..

Please open an account as per details below: -

Photograph

Please affix a recent passport size photograph

Name of the |

1 |

st |

Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2nd Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

3rd Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name of |

1st Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Father/Husband |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2nd Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

3rd Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(To be filled in capital letters)

2.

Gender Male Female

3.

Identification Mark

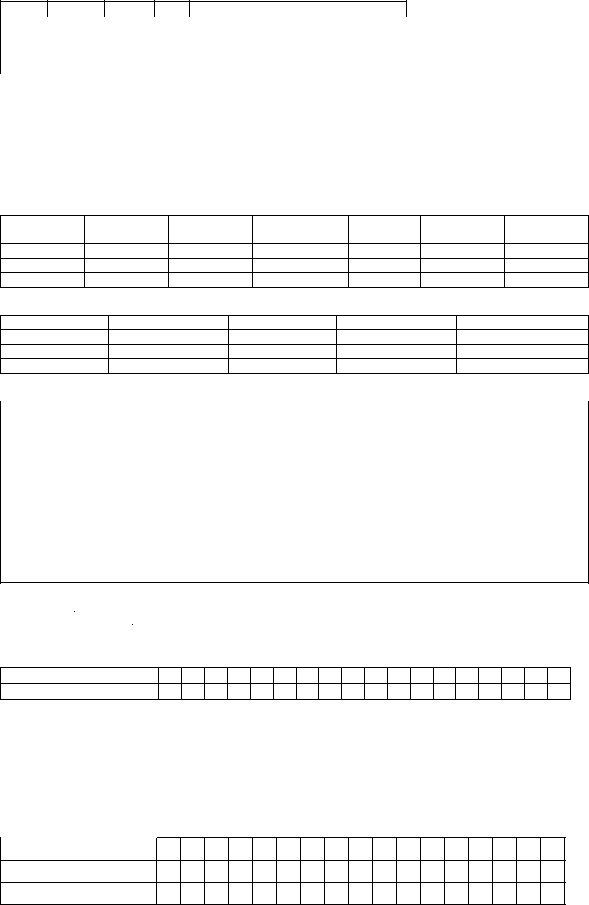

4.Type of Account (Please indicate by tick mark)

|

|

Nature of Deposit |

|

Type of deposit* |

|

|

Amount |

|

Period |

(For Fixed |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

(Specify Currency) |

|

Deposit) |

||

|

|

Foreign Currency |

|

|

|

|

|

|

|

|

|

|

||||

|

|

(Non- Resident) Account |

|

|

|

|

|

|

|

|

|

|

||||

|

|

(FCNR) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non |

|

|

|

|

|

|

|

|

|

|

||||

|

|

(External) Account |

|

|

|

|

|

|

|

|

|

|

||||

|

|

(NRE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Ordinary Account(NRO) |

|

|

|

|

|

|

|

|

|

|

||||

|

|

*Please specify the desired option such as Saving/Current/ Fixed Deposit |

|

|

|

|||||||||||

5. Instructions for auto renewal |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Auto Renewal Required |

|

If yes, number of times it is required………….. |

|

Period for which auto |

||||||||||

|

|

YES |

No |

|

Whether for entire proceeds / Principal only, |

|

renewal is required |

|||||||||

|

|

|

|

|

|

|

|

for Rs.………………….. |

|

|

|

|

||||

|

|

If no, payment instructions |

|

|

|

|

|

|

|

|

|

|

||||

|

|

are given at item No 14(c) |

|

|

|

|

|

|

|

|

|

|

||||

6. Passport Details |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

Passport No |

|

|

Date of |

|

Date of |

Place of Issue |

Nationality |

Date of |

|||

|

|

|

|

|

|

|

|

|

Issue |

|

Expiry |

|

|

|

Birth |

|

|

|

1st Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2nd Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3rd Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEX 111 – 59/07 – (100X2)SPP |

|

|

|

|

|

|

|

|

|

|

||||||

7.Minor Yes

No

If yes, furnish details of guardian

|

a. Relationship with Minor |

|

Father |

|

|

|

|

|

Mother |

|

|

|

|

|

|

Any other |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

b. Name of Guardian Mr/Ms |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c. Address of Guardian |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. Occupation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Salaried |

|

Business |

|

|

Self |

Retired |

House |

|

|

Student |

|

Other |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Employed |

|

|

|

|

|

|

|

wife |

|

|

|

|

|

|

|

|

Specify |

|||||||||||||

|

1st Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2nd Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3rd Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Please provide details of Name of employer / Line of business / Industry / profession etc.

9.Income per annum

Specify |

< Rs 60,000 |

Rs 60,000 |

Rs100000 |

Rs 500000 - |

Rs > |

Sources |

|

100000 |

500000 |

1500000 |

1500000 |

1st Applicant

2nd Applicant

3rd Applicant

10. Education

Under Graduate |

Graduate |

Post Graduate |

Professional |

1st Applicant

2nd Applicant

3rd Applicant

11.Communication Address (Please give all available details)

Overseas Office Address ( Land mark is compulsory) |

Overseas Residential Address |

…………………………….……………………………. |

………………………………………………………… |

…………………………………………………………… |

………………………………………………………… |

Country Name …………………Code ………………… |

Country Name………………….. Code …………… |

Phone No……… …………… Fax No……………… |

Phone No…….……………… Fax No……………. |

Indian Address (if any)

……………………………………………………………………………………………………………………………

Phone No ……………………………………………………………………………………………

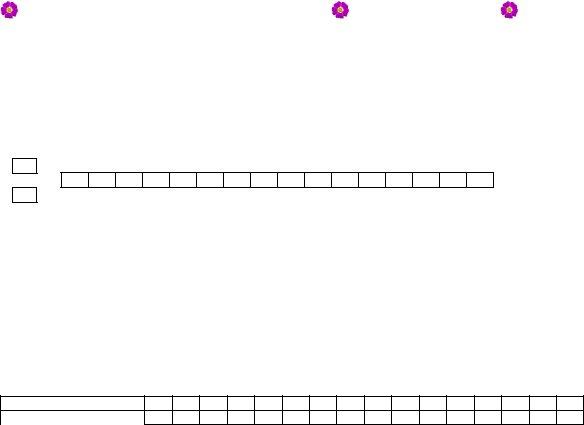

12.Mode of operation

Self |

|

|

Any of us or survivor(s) |

|

All of us jointly or survivor(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Either of us or survivor(s) |

|

Former or survivor |

|

|

|

|

13.Debit Card - Please issue Debit Card. I/We have read the terms and conditions governing the use of Debit Card

Name of 1st Card Holder Name of 2nd Card Holder

(i)Nomination For Card Holder Accident Insurance: - I/We hereby nominate Mr./Ms……………………………………………to receive money payable by the Insurance Company in the event of my / our death. I/We hereby declare that his/her receipt shall be sufficient discharge to the Bank.

(ii)As the nominee is minor on this date, I/We appoint Mr / Ms……………………son/daughter/wife of Mr

…………………… resident of ………………………………………. aged………years to receive money on behalf of nominee during his/her minority.

14.Internet Banking Services - I/We have gone through the Internet Banking Services guidelines and agree to abide by terms and conditions governing its use and availment by me / all of us. Please provide me / us this facility.

Facility to be provided to

15. Instructions/Declarations

.

I/We confirm that all the information given in this application form is true, correct, complete and uptodate in all respect and I/we have not withheld any information. I/We shall be held responsible for the same at all times if it is found incorrect. I/We confirm having read and understood the Rules and Regulations of the Bank including Bank’s tariff regarding the conduct of the account /deposits and pertaining to the phone banking, ATM, Debit Cards, Internet Banking and Electronic Banking facilities (collectively called the said banking facilities) and agree to be bound and abide by them / any other rules that may be in force from time to time. It is my/our responsibility to obtain the terms and conditions from your bank and read the same. I/We confirm my/our residential status as per Indian Income Tax Act 1962, is Non Resident Indian and I/We agree and undertake to inform the Bank in writing of any change in residential status. I/We undertake to operate and use the account /deposit as well as the said banking facilities strictly in accordance with the Exchange Control Regulation as laid down by the Reserve Bank of India from time to time.

Declaration under section 10(5) of FEMA 1999: I/We hereby declare that all foreign exchange transactions as are being entrusted and may be entrusted by me/us to the Bank from time to time do not/ will not involve and are not / will not be designed for the purpose of any contravention or evasion of the provisions of the aforesaid Act or of any rule, regulations, notification, direction or order made thereunder. I/We also hereby agree and undertake to give such information/documents as will reasonably satisfy you about the transaction in terms of above regulation. I/We also undertake that if I/We refuse to comply with any such requirement or make untenable complaint thereagainst, the Bank shall be within its right to refuse in writing or otherwise to undertake the transaction and shall, if it has reason to believe that any contravention /evasion is contemplated by me/us, report the matter to Reserve Bank of India.

(a)Please issue me / despatch a cheque book / Pass Book (in case of NRE / NRO account)

(b)Please credit interest to my NRE/NRO Account No …………………………………/or remit interest by DD/TT at my/our Indian/ overseas address /Bank account No………………………….. with…………………………………….after deducting remitting charges ,as may be applicable from time to time.

(c)Please credit proceeds on maturity to my/our Account No …………………with …. ………………….

Signature/thumb impressions of 1st applicant |

2nd applicant |

3rd applicant |

1.Mr/Ms………………………………………………… will sign as ………………………………………

2. Mr/Ms………………………………………………… |

will sign as ……………………………………… |

3. Mr/Ms………………………………………………… |

will sign as ……………………………………… |

16. Introduction |

|

Self (Existing Customer of the Bank – Please write your Account Number here

New Customers – Please enclose Copies of Passport and Resident Visa

I know Mr /Ms …………………………for the past ………years as a …………...(friend / relative / neighbour) and confirm his/her

occupation as a………………………

Signature of the Introducer ……………………………………. Rubber Stamp ……………….…………………

(Signatures of person known to the Bank / correspondent bank / Indian Embassy / High Commission / Consulate / Notary Public etc, along with Rubber Stamp, where applicable)

(i) In case, introducer is having account with the Bank

Name of the Introducer

Introducer’s Account No

(ii)In case of introduction, given by Indian Embassy/High Commission/Consulate/Notary Public etc, a communication (in duplicate) shall be sent thanking them for introducing the customer, and also for returning one copy of the communication, to ascertain the authenticity of the attestation of signatures.

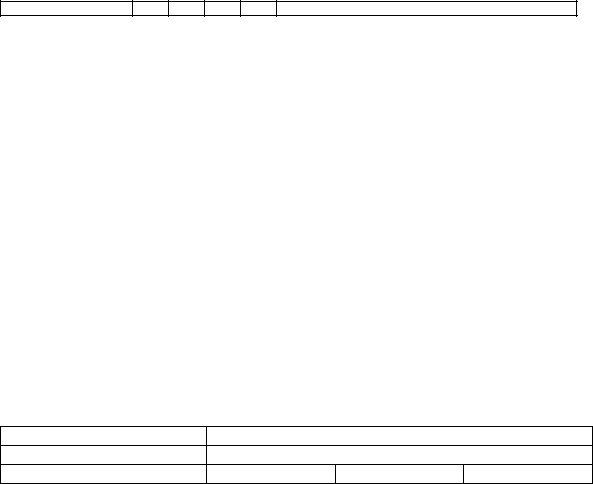

17. Nomination

Nomination required

Yes

No

If yes, please fill in the following particulars

FORM

I/We …………………………………………. (Name (s) and address (es), nominate the following person to whom, in the

event of my/our /minor’s death, the amount of deposit, particulars whereof, are given below, may be returned by ……

……………………….(name and address of branch / office in which deposit is held)

|

Deposit |

|

|

|

Nominee |

|

||

Nature |

Distinguis |

Addition |

|

Name |

Address |

Relationship |

Age |

If nominee |

of |

hing |

al |

|

|

|

With depositor, |

|

Is a minor, his |

|

No |

details, |

if |

|

|

if any |

|

date of birth |

|

|

any |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As the nominee is a minor on this date, I/We appoint Mr./Mrs./Ms…………………………………(name, address and age)

to receive the amount of deposit on behalf of the nominee in the event of my/our/minor’s death during the minority of the nominee.

Place……………

Date…………….

Signature(s)/thumb impression (s) of depositor(s)

Name (s), Signature (s), and Address (es) of witness (es)

18.FOR OFFICE USE

(i)

ATM CUM DEBIT CARD NO

Date of Issue

Customer’s Classification

(ii)

|

Introducer’s |

Customer’s |

Creation of |

Customer’s |

|

Signature Verified |

Signature |

Customer |

classification |

|

by |

attested by |

Master Data |

confirmed & |

|

|

|

Authorised by |

Account opened |

|

|

|

|

by |

Name |

|

|

|

|

|

|

|

|

|

GBPA No |

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|